Day by day Information Nuggets | At this time’s prime tales for gold and silver traders

November 7th, 2025

Gold at $4,000, Silver Close to $49 — Momentum Holds

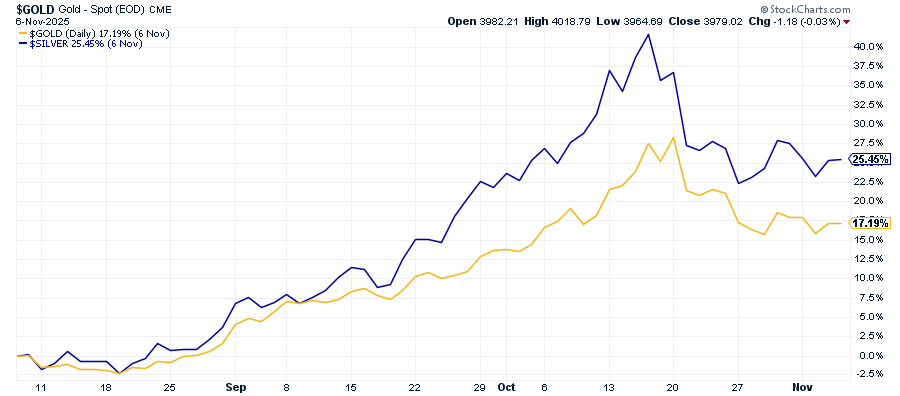

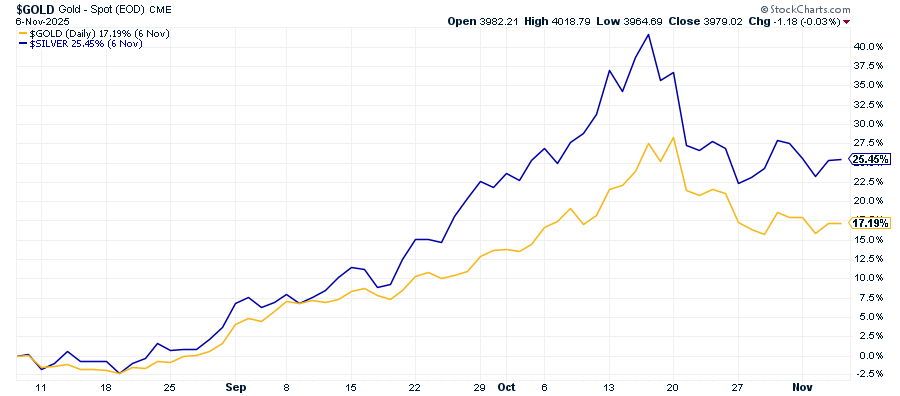

Gold climbed again over $4,000 per ounce this morning as traders weighed political gridlock, inflation considerations, and a weakening greenback. Silver rose to $48.58, rebounding from current losses however nonetheless nicely beneath final month’s document spike close to $54. Regardless of current volatility, each metals are on a tear. Over the previous three months, gold is up 17% and silver is up over 25%.

Take into consideration that for only a second. Each metals delivered what traders usually think about a robust 12 months — in a single quarter.

Beneath the hood, it’s the identical forces which were driving valuable metals all 12 months: regular central financial institution shopping for, considerations over U.S. fiscal stability, and a rotation towards laborious property. For silver, industrial demand from photo voltaic, EVs, and knowledge facilities is amplifying beneficial properties in an already tight market.

This isn’t simply an inflation commerce anymore. With coverage and financial uncertainty elevated, traders are reaching for property with out counterparty threat. A part of what’s driving that uncertainty? A authorities shutdown that’s left key financial knowledge at nighttime…

No Jobs Report, Huge Hypothesis

The October jobs report is lacking because of the federal government shutdown — however economists say it probably would’ve proven a cooling labor market. Estimates level to round 125,000 new jobs and unemployment ticking as much as 4.2%, marking the weakest job development since mid-2023.

Traders aren’t ready round for affirmation. Fewer jobs imply much less wage strain and extra room for the Fed to chop charges. That’s feeding expectations for simpler coverage forward, even because the central financial institution maintains its wait-and-see stance publicly. Gold’s push above $4,000 displays markets pricing in a softer path ahead — and a fragile economic system that will want it. When financial indicators weaken, even within the absence of laborious knowledge, safe-haven property have a tendency to learn. And it’s not simply the jobs knowledge that’s lacking.

Fed’s Knowledge Blind Spot Provides Danger to Inflation Outlook

Austan Goolsbee, President of the Federal Reserve Financial institution of Chicago, warned this week that the continuing delay in official inflation knowledge (brought on by the federal authorities shutdown) is forcing policymakers to “drive within the fog.” With no recent CPI or PCE releases, the Federal Reserve is relying more and more on personal‐sector indicators and inside surveys. Goolsbee famous that earlier than knowledge publication halted, inflation was displaying indicators of an uptick—elevating the danger that the true tempo of worth development is under-estimated.

With out the same old inflation barometer, the Fed might act extra cautiously, slowing anticipated charge cuts and even delaying them altogether. For gold and silver traders, this implies the “lighter financial coverage” situation could be postponed—and safe-haven valuable metals may profit from the uncertainty surrounding inflation and coverage.

The information blackout can also be hitting the actual economic system.

Airways Lower Flights as Shutdown Drags On

The partial authorities shutdown is beginning to hit vacationers. Airways are preemptively trimming flights amid staffing shortages and delayed FAA security inspections, with reductions probably throughout main hubs beginning Friday. The timing couldn’t be worse, with vacation journey season approaching and thousands and thousands of Individuals planning journeys.

Each extended shutdown carries a price. This one may shave 0.3% off GDP development this quarter — a notable drag on an already slowing economic system. Markets are responding with the same old playbook: decrease Treasury yields and better gold costs. When Washington gridlocks and financial uncertainty rises, traders attain for stability. It’s a sample that’s performed out in each main fiscal standoff over the previous decade.

Whereas short-term disruptions dominate headlines, longer-term coverage shifts are additionally in movement.

Silver Lands on U.S. Vital Minerals Record

The Trump administration simply expanded its listing of “important minerals” very important to U.S. financial and nationwide safety — including ten new entries, together with silver and copper. The designation acknowledges their important roles in electrical automobiles, knowledge facilities, and renewable vitality infrastructure.

It’s a coverage win for the mining sector and will unlock federal help for home manufacturing, allowing help, and provide chain improvement. The U.S. presently depends closely on imports for each metals, making home provide a strategic precedence. For silver, it’s official recognition of what the market already is aware of: it’s not only a valuable steel anymore — it’s important infrastructure. Anticipate this to gas dialog about reshoring mining operations and decreasing overseas dependency.