Gold and silver delivered extraordinary performances in 2024. It was a record-breaking yr as gold climbed to a number of new all-time highs all through the yr. Gold’s outstanding ascent to a brand new file above $2,700 an oz was pushed by a number of components together with central financial institution shopping for, geopolitical tensions, financial coverage easing, persistent inflation, and elevated safe-haven demand from buyers.

yr. Gold’s outstanding ascent to a brand new file above $2,700 an oz was pushed by a number of components together with central financial institution shopping for, geopolitical tensions, financial coverage easing, persistent inflation, and elevated safe-haven demand from buyers.

Treasured metals outpaced returns in most different asset courses. Gold climbed as a lot as 33% yearly by means of the fourth quarter, whereas silver gained 29%.

Key Bullion Traits in 2024

A number of components contributed to gold’s stellar efficiency in 2024 together with aggressive central financial institution shopping for, geopolitical tensions across the globe, cussed inflation and financial easing.

- De-Dollarization: The geopolitical panorama, significantly actions such because the freezing of Russia’s greenback belongings by the Biden administration, prompted nations to rethink the quantity of their reserves held in {dollars}. This contributed to the elevated demand for gold as a safe, long-term reserve internationally.

- Lengthy-term Place Constructing: Central banks are shopping for and stockpiling gold, and these are long run positions. This development emerged amid a basic shift in how central banks handle the composition of their reserves. Notably, they’re reducing their U.S. greenback reserves and rising their gold reserves. Central banks like Russia, together with rising markets like China, India, and Turkey, have been vital consumers of gold lately. This enhance in central financial institution gold holdings has created a powerful secure base for gold costs at these greater costs ranges. Central banks are the final word purchase and maintain buyers, and have a tendency to carry their belongings for many years.

- Geopolitical Tensions: Ongoing conflicts in Ukraine and the Center East, coupled with broader international uncertainties, heightened gold’s enchantment as a safe-haven asset.

- Financial Coverage Shifts: Federal Reserve and different central financial institution’s rate of interest cuts in 2024 boosted gold’s attractiveness. As rates of interest lower, non-yielding belongings like gold change into extra interesting to buyers.

- Inflation Considerations: Persistent inflationary pressures in lots of economies, together with the US, elevated investor curiosity in gold as a technique to guard and protect the buying energy of their wealth.

- Sturdy Investor Demand: The record-breaking efficiency of gold in 2024 attracted extra buyers into bullion, making a self-reinforcing cycle of demand. As costs climbed, extra buyers entered the market, additional driving up costs.

Investor Habits: Fractional Gold Emerged As a Well-liked Bullion Technique in 2024

Over the previous yr, new and seasoned buyers actively amassed fractional gold in a long-term wealth constructing technique. There was vital deal with fractional gold, which is seen as a sensible, inexpensive, and the right emergency-use foreign money.

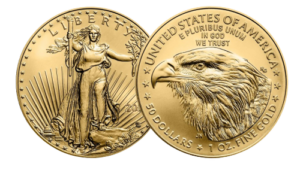

These smaller denominations of gold, sometimes weighing lower than one ounce, present a extra accessible entry level into the dear metals market. One of many advantages of fractional gold is its affordability. With choices like 1/10 oz, 1/4 oz, and 1/2 oz cash buyers can construct their bullion portfolios on an on-going foundation, over time, utilizing a method referred to as dollar-cost averaging.

One other profit to fractional gold is elevated liquidity—as smaller denominations are seen as simpler to promote or commerce in comparison with bigger cash or bars. This liquidity is a invaluable hedge in opposition to intervals of financial uncertainty or panic—particularly as quite a lot of American states advance laws to acknowledge gold and silver as authorized tender. Already, 12 states have legal guidelines on the books that make gold and silver authorized tender. Moreover, different states are exploring comparable initiatives.

The push for legalizing gold and silver as foreign money is pushed by a number of components. Advocates argue that treasured metals supply stability in worth in comparison with fiat currencies, that are topic to inflation and financial fluctuations. The rising curiosity amongst states means that this development may broaden within the coming years as extra lawmakers think about alternate options to conventional fiat techniques amid financial uncertainties.

Investor Confidence and Wealth Constructing

Profitable wealth constructing contains taking a long-term view to your investments. As Wall Road legend Ben Graham suggested: “The person investor ought to act persistently as an investor and never as a speculator.”

Traders are more and more assured within the stability, peace of thoughts and wealth preservation alternatives that treasured metals supply. Traders view these investments as a part of a gradual, long-term wealth-building technique, including to their portfolios at any time when attainable. Regular accumulation of bullion has confirmed to be probably the most profitable strategy to constructing wealth over the long run.

Treasured metals have stood the take a look at of time, offering folks for 1000’s of years a retailer of worth that not solely protects and preserves wealth, however helps to develop it. The nice gold rally is much from over. Gold broke information this yr and is predicted to set new information in 2025.

In the event you need to construct wealth for your self and future generations, Blanchard will help you obtain your objectives. Over the previous 50 years, now we have helped purchasers put money into American numismatic rarities and funding grade silver, gold, platinum and palladium bullion to guard and develop their wealth. We will help you too.