Fears of a slowdown amongst Chinese language customers have dogged the luxurious business for the higher a part of a yr. Final week the size of the issue hit residence for one among trend’s largest however most uncovered manufacturers, Gucci.

French group Kering SA noticed $9 billion wiped off its market worth after warning that gross sales of the Italian label’s merchandise in China have slumped this quarter. The slowdown can also be beginning to present up in different corners of the luxurious business.

A separate report confirmed Swiss watch exports to the nation — a number one vacation spot for high-end timepieces — tumbled final month. Analysts, in the meantime, are predicting China’s luxurious demand will cool additional this yr.

The spate of sobering information offers the most recent proof that an anticipated surge in spending by well-heeled Chinese language free of the world’s strictest Covid lockdowns is failing to materialize. Whereas some luxurious corporations are managing the fallout higher than others, the remainder might be compelled to rethink how they do enterprise in China — beginning with Kering.

“I haven’t purchased any Gucci baggage myself for years,” mentioned Wu Xiaofang, a 34-year-old banker residing in Shanghai who was as soon as so enamored with the model she purchased three baggage throughout a visit to Italy in 2016. “The brand new designs are dangerous.”

Wu is amongst a era of Chinese language luxurious customers that has grown extra selective about the place to spend its money. Rising unemployment and a property downturn have damage client confidence, whereas deflationary pressures are fueling concern about development in one of many world’s largest client markets.

The bar to entice Chinese language customers has due to this fact risen. Gucci has seen a major drop in Chinese language on-line gross sales in current months — together with from its official web site and e-commerce platform on Tmall, mentioned an individual accustomed to the scenario who requested to not be recognized discussing confidential issues.

Sabato De Sarno, who grew to become Gucci’s inventive director final yr, has adopted a extra minimalist aesthetic than the flamboyant designs of his predecessor, Alessandro Michele. It’s too quickly to say whether or not his sleeker and extra subdued fashions will resonate with Chinese language clients, as they’ve solely just lately appeared in shops.

But some customers might discover them much less distinctive than earlier than, mentioned trend marketing consultant Mark Liu, and too comparable in type to the likes of Valentino, Prada and Celine. Kering mentioned early ready-to-wear merchandise from the most recent Ancora assortment by De Sarno have been effectively acquired.

Gucci has lengthy been one of the vital risky of the main luxurious manufacturers, its fortunes rising and falling based mostly on buzz round designers like Michele and a predecessor, Tom Ford. That makes Kering extremely susceptible to shifts in style, particularly because the Italian model accounts for about half of its gross sales and greater than two-thirds of revenue.

Gucci “appeared to have turned itself right into a streetwear model for some time, then tried to shift again to a high-end model,” mentioned Wu. “Now I don’t know who it desires to focus on.”

Plunging Shares

Kering surprised traders with its March 19 announcement that Gucci gross sales have fallen practically 20% this quarter, led by the Asia-Pacific area. The share value fell essentially the most in three many years.

The group began taking motion to spice up its struggling label two years in the past when it named a brand new trend head for Gucci in China and Hong Kong. Gucci then parted methods with Michele and employed De Sarno, a lesser-known designer from Valentino. Subsequent, Kering changed Marco Bizzarri, who’d headed Gucci for about eight years, with Jean-Francois Palus, a longtime lieutenant of Pinault.

Extra adjustments might be wanted to reassure traders.

“Regardless of Kering’s insistence that Jean-Francois Palus is the correct interim CEO for Gucci, the market doesn’t agree,” wrote RBC Capital Markets analyst Piral Dadhania in a be aware Friday. “With monetary efficiency deteriorating, the case for appointing a brand new figurehead with a confirmed monitor document could be welcome in our view, as it could allow quicker tempo of change and new exterior concepts.”

Kering didn’t reply to a request for remark.

The slowdown in China is affecting manufacturers other than Gucci as effectively, if not as dramatically. Whereas prime luxurious homes akin to Rolex, Hermes, Chanel and Louis Vuitton noticed double-digit development in 2023 in Hong Kong — a well-liked vacation spot for Chinese language customers — these gross sales slowed as early as October, mentioned an individual accustomed to the matter, with second-hand costs for premium watches plunging 40% in January from the yr earlier than.

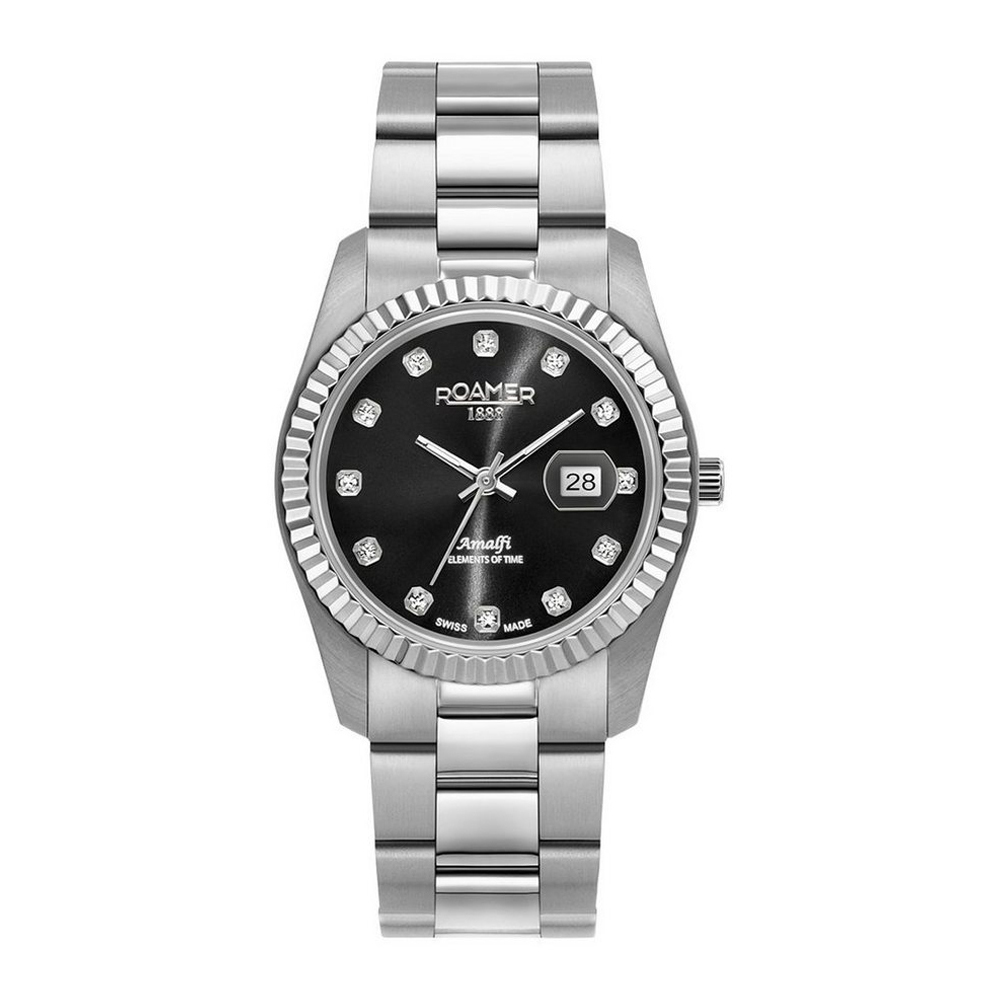

Few luxurious items are extra uncovered to adjustments in Chinese language client sentiment than Swiss watches. Exports to China plunged by 25% in February from the yr earlier than, the Federation of the Swiss Watch Trade mentioned final week, whereas shipments to Hong Kong dropped by 19%.

Collectively, exports to these two locations surpass the US, the most important single marketplace for Swiss timepieces.

“There’s a slowdown,” mentioned Nick Hayek, the chief government officer of Swatch Group AG, whose manufacturers embrace Omega and Tissot. China accounted for a 3rd of the corporate’s gross sales in 2023.

Buyers in China and Hong Kong are visiting Swatch Group model shops however they’re extra hesitant to tug the set off on a significant buy, the CEO mentioned. “They’ve the cash, however they’re extra essential on when to spend and methods to spend it.”

Representatives for Rolex and Chanel declined to remark, whereas LVMH and Hermes didn’t instantly reply to requests for remark.

Slowing Progress

The ills aren’t restricted to China. After a current two-week journey to Asia, HSBC luxurious analysts led by Erwan Rambourg mentioned in a be aware Friday that the demand scenario in China is “proving robust.” However disappointment additionally got here from lackluster traits in Hong Kong, Macau and Singapore as Chinese language vacationers, though coming in higher numbers, don’t appear to be spending a lot, they wrote.

Some manufacturers could also be compelled to seek out methods to scale back their reliance on China. Progress in luxurious gross sales there this yr is forecast to sluggish to the mid-single-digits, in contrast with 12% in 2023, in line with a report from Bain & Co., a consulting agency. However that development will probably be pushed by high-net-worth people, or these with investable belongings of greater than 10 million yuan ($1.4 million).

Some luxurious labels have bucked the slowing development. Prada SpA, which owns the model Miu Miu, noticed retail gross sales rise 32% within the Asia-Pacific area, excluding Japan, within the fourth quarter. Earlier this month, Andrea Guerra, the Italian group’s CEO, mentioned he was glad with traits in January and February. Hermes Worldwide SCA additionally noticed double-digit development charges within the fourth quarter.

In unsure occasions, Chinese language shoppers are inclined to desire luxurious gadgets which might be extra prone to preserve their worth over time, mentioned Bruno Lannes, a co-author of the Bain report. That’s why manufacturers with these merchandise fared higher than these rolling out seasonal items, he mentioned.

American cosmetics large Estee Lauder Cos., which owns labels together with La Mer and Tom Ford, is constant to wager large on China due to its long-term development prospects and to keep away from ceding floor to native upstarts. The volatility will ultimately ease because the growth of the Chinese language center class retains pushing per capita consumption greater over time. “That development shouldn’t be altering,” CEO Fabrizio Freda mentioned at a UBS convention in New York this month.

Some luxurious manufacturers, nevertheless, are reconsidering their Asia technique to look past China for future development, mentioned Angelito Perez Tan, Jr., co-founder and CEO of RTG Group Asia, which operates companies together with a luxurious consultancy. India, Southeast Asia and the Center East are seen as having nice potential in the long run, he mentioned.

“Executives have checked out it extra holistically by way of that there’s extra to Asia than simply China,” mentioned Tan. “Luxurious manufacturers generally have realized that a few of them have been too reliant on the Chinese language client. They realized that they’ll’t put all their eggs into one basket anymore.”

By Jennifer Creery, Shirley Zhao, and Andy Hoffman