The Biden Administration’s Client Monetary Safety Bureau (CFPB) simply issued a proposal to ban medical debt from factoring into your credit score rating. However for free-money socialists and their Keynesian bedfellows, this doesn’t go almost far sufficient: wanting canceling medical debt solely, nothing else is suitable.

The proposal addresses a loophole in order that Individuals with medical debt aren’t prevented from getting loans and even shedding their residence on account of unpaid medical payments. The announcement has set a refrain into movement from those that consider cash grows on bushes, and debt could be magically erased. For economically-illiterate, quixotic activists who assume cash can (and may) be printed out of skinny air, lots of of billions of {dollars} in debt can simply as simply be made to vanish with out financial penalties.

Medical debt shouldn’t present up on credit score reviews. But in addition, medical debt shouldn’t exist.

In search of medical remedy in America mustn’t saddle folks with debt.

It’s time to cancel medical debt and go Medicare for all.

— Nina Turner (@ninaturner) June 13, 2024

Even simply banning medical debt from credit score scores may probably gasoline inflation and result in larger medical prices — however the one factor the free cash advocates have proper is that healthcare is just too costly in America. The system is in dire want of reform. However we now have a really giant nation with low homogeneity the place the socialized healthcare methods of high-trust societies, like some Nordic nations, could be unattainable — not solely economically, however culturally as properly.

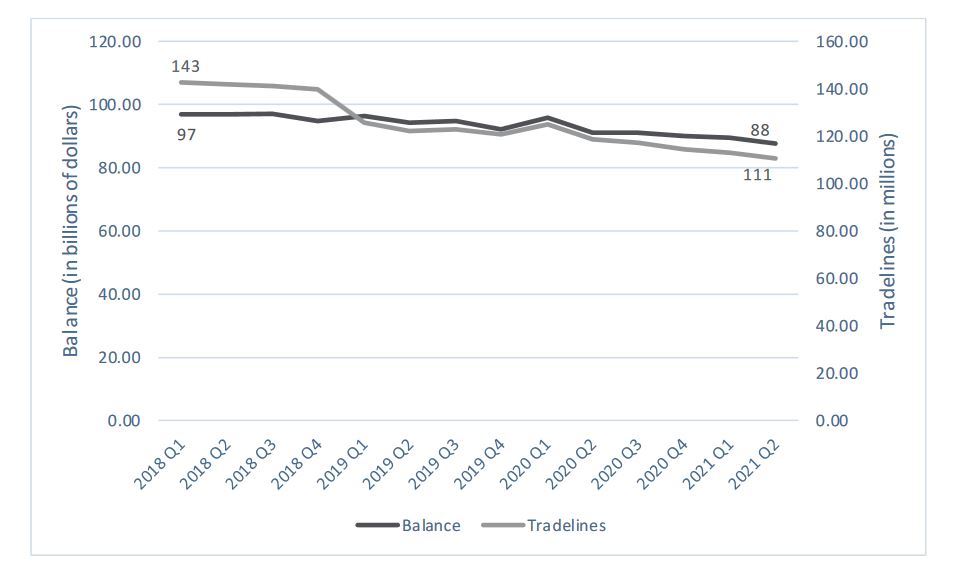

CFPB Information: Medical Debt Collections in Client Credit score Panel, 2018 – 2021

Medical debt whole stability and whole tradelines from the CFPB’s Client Credit score Panel, a 1-in-48 pattern of de-identified credit score data from one of many three main nationwide client reporting businesses

Supply: US Client Finance Safety Bureau, Medical Debt Burden in america. February 2022. Accessed June 2024

We even have an out-of-shape populace locked in a vicious downward cycle of atrocious diet, deteriorating well being, and compounding pharmaceutical interventions. A “Medicare For All” scheme would inevitably translate to the fixed and astronomical (lifestyle-induced) medical prices of the morbidly unhealthy being handed onto Individuals who take affordable steps to remain in first rate well being. Someplace round half of grownup Individuals have completely preventable power ailments, and worth inflation solely worsens this sample as folks flip to cheaper and lower-quality meals to maintain their households.

However in its present kind, the system itself is principally devoid of any actual free market worth discovery mechanism. There’s cartel-ized healthcare pricing the place the full in your invoice has as a lot to do with the dynamics of company and State monopolies than the price of the service, supplies, and medicines. There isn’t sufficient competitors between big healthcare suppliers, and the FDA has created a revolving door system for rubber-stamping merchandise from pharmaceutical giants at the price of innovation.

There’s little to no incentive to decrease prices. Authorities intervention abounds greater than ever with Obama’s Reasonably priced Care Act, and whereas some are getting reasonably priced insurance coverage who couldn’t earlier than the ACA, it has solely achieved this by shoving these prices onto different folks.

State intervention, assured loans, and “debt aid” applications in medication, schooling, and different industries push up costs for customers needlessly and arbitrarily by reducing out free market mechanisms, shifting the burden to the remainder of us. It’s a political ploy to curry favor to the indebted by promoting out the following technology. We’d like the federal government concerned much less, no more, besides to the extent that Individuals have to be shielded from entrenched company monopolies and public-private cartels. Let the free market converse, let it set the fairest-possible costs by means of real competitors, and let it self-regulate.

However a deeper root of the issue is the US greenback itself. Issues ripple outward from this widespread denominator — when a central financial institution can set financial coverage and print cash on a whim, inflation is inevitable, and prices will go up. For those who don’t repair the cash, you may’t repair the opposite points — and makes an attempt to take action are inevitably attempting to handle signs with out addressing foundational causes. From the central financial institution to the healthcare system, cartels and monopolies and walled gardens abound. It’s Individuals who pay the value.

Passing present debt alongside to the remainder of the nation isn’t the reply, and to actually repair healthcare in a long-lasting means, we should first abolish fiat cash.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist at present!