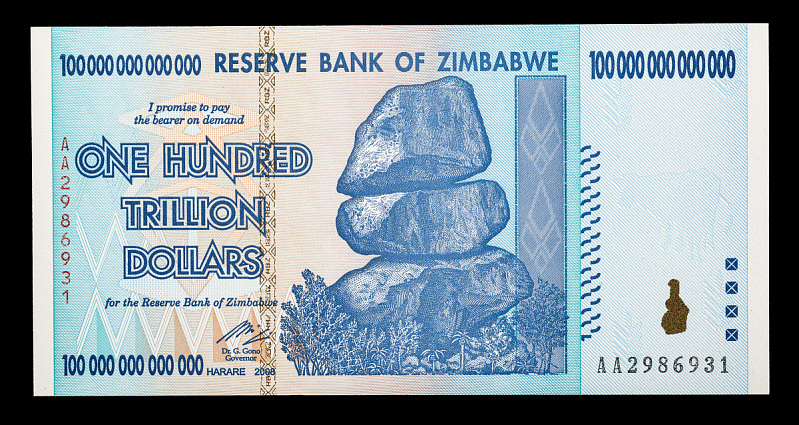

When the phrases ‘Zimbabwe’ and ‘currencies’ are talked about in the identical sentence, many individuals will call to mind the persistent hyperinflation interval that Zimbabwe skilled from the early 2000s to 2009, and the notorious 100 trillion Zimbabwean greenback observe which Zimbabwe’s central financial institution issued in a determined try to deal with that hyperinflation.

That hyperinflationary interval – which included Zimbabwe’s inflation charge peaking at an astronomical 89.7 sextillion % in November 2008 – was solely introduced below management when the nation deserted the then Zimbabwean greenback in 2009 and moved to a multi-currency system of formally utilizing the US greenback and different foreign exchange, a transfer which stabilised Zimbabwe’s inflation charges at extra ‘regular’ ranges between the years 2010 and 2018.

However then in 2019, Zimbabwe launched a brand new Zimbabwean greenback (ZWL), banned using foreign exchange, and commenced rampant ‘printing’ of the ZWL, a transfer which once more torpedoed confidence within the nation’s forex, destabilised the economic system, and created spiralling ranges of inflation from 2019 onwards, regardless of the backtracking reintroduction of foreign exchange such because the US greenback, as authorized tender.

Backed by a Basket of FX Reserves and Gold

Which is why it’s very fascinating that in early April 2024, Zimbabwe launched one more new circulating forex as authorized tender, its sixth try at creating a brand new forex since 2008, and the newest try to stabilise Zimbabwe’s economic system and take management of a persistent inflation which in March 2024 had reached an annual charge of 55%.

Nevertheless, this new forex, which is known as the ZiG and which is issued within the type of circulating notes and cash, is sort of completely different from preceeding forex makes an attempt, because it payments itself as a gold-backed forex.

Whereas colloquially being known as a gold-backed forex, the brand new ZiG (which stands for Zimbabwe Gold) is extra accurately, in response to the laws which launched it, a forex “backed by a basket of international forex reserves and treasured metals (primarily gold) and precious minerals held and maintained by the Reserve Financial institution [of Zimbabwe] in its vaults as a part of the in-kind royalties.”

The ZiG is also called a “structured” forex, which merely implies that that it’s backed or anchored by a basket of international change and gold, and linked to an change charge related to the worth of the backing. Underneath the foundations of the ZiG, the Reserve Financial institution of Zimbabwe (RBZ) can solely subject ZiG notes and cash towards the worth of the reserves property which the central financial institution holds (international forex reserves and gold / treasured metals held in its vaults).

At launch date on 5 April 2024, Zimbabwe’s industrial banks have been required to transform all present Zimbabwe greenback balances into the brand new ZiG forex, and as of that date, the ZiG grew to become Zimbabwe’s authorized tender (alongside the US greenback and different foreign exchange such because the South African rand, the Euro, and the pound sterling). Notice that as of early April, the US greenback nonetheless accounted for about 85% of all transactions in Zimbabwe.

At the moment, ZiG notes have been issued in denominations of 1, 2, 5, 10, 20. 50, 100 and 200 ZiG. On conversion date (5 April), 1 ZiG was deemed to have an equal worth of 1 milligram of 99% pure gold valued on the spot worth of gold on that day. The precise conversion (when banks transformed all outdated ZWL account balances to ZiG) was achieved on the charge of ZiG 1 = ZW$ 2498.72 (ZWL).

Doing a fast spot examine, 1 gram of gold on the shut worth on 5 April was US$ 74.91, and 1 milligram was US$ 0.07491, and the ZWL/USD charge was about 30530 ZWL for 1 US greenback, so this offers a conversion charge of (0.07491 * 0.99 * 30530) = 2264, which is fairly close to the speed the financial institution used (and the FX charge was notoriously risky throughout that point anyway).

With 1 Zig = (0.07491 * 0.99 = 0.0741609), that meant that 1 US greenback = ZIG 13.48. That is very close to the ZiG 13.56 per US greenback quoted by Bloomberg in an article masking the topic on 5 April. However no matter means you take a look at it, you’ll be able to see that at launch date, the worth of the ZiG was related to the gold worth.

Going ahead, the worth of the ZiG is outlined as “the inflation differential between ZiG and US greenback inflation charges, and the motion within the worth of the basket of treasured metals (primarily gold) and precious minerals held as reserves by the Reserve Financial institution.” Once more, the continued worth of the ZiG is (not less than in idea), associated to the gold worth.

Onshore and Offshore Gold

The RBZ claims, as of 5 April, to have held “reserve property of USD 100 million in money and a couple of,522 kgs of Gold (US$185 million)”, i.e. in whole value US$ 285 million. This US$ 285 million, stated the RBZ, was greater than 3 instances cowl for the overall worth of all ZiG forex which was transformed and in subject at the moment.

However past the headline declare that the RBZ maintain 2,522 kilograms of gold (roughly 2.5 tonnes) in its vaults, that is in actual fact not completely correct. Because it seems, the RBZ vaults in Zimbabwe’s capital Harare, maintain 1.1 tonnes of gold. The RBZ additionally maintain different treasured metals together with diamonds, which the RBZ says has an equal worth of 0.4 tonnes of gold. That brings the overall to 1.5 tonnes (of gold and gold equivalents).

The RBZ additionally says it holds a further 1 tonne of gold ‘offshore’, however the location of this offshore gold has not been made public. This extar 1 tonne of offshore gold brings the overall to the claimed 2.5 tonnes of gold.

As per a assertion from the governor of the RBZ, John Mushayavanhu, on 5 April 2024:

“I can verify that we have now 1.1 tonnes of gold and different treasured minerals within the type of diamonds which, if transformed to gold, would equal 0.4 tonnes, making a complete of 1.5 tonnes in our possession. We even have one other tonne of gold held offshore. In whole, when contemplating our gold reserves, we’re speaking about 2.5 tonnes, valued at about US$225 million, together with US$100 million in money.”

In keeping with the foundations of the ZiG, the RBZ can solely subject ZiG notes (and sooner or later ZiG cash) as much as the worth of the reserve property which it holds, and the ZiG forex in circulation must be absolutely backed by these reserve property.

Inadequate Protection? Inadequate Auditing?

Critics of the ZiG say that the worth of the reserve property at US$ 285 million doesn’t present enough import cowl (being the equal of lower than 2 weeks’ import cowl for Zimbabwe’s imports). It is usually lower than 10% of the liquidity ranges really helpful by the South African Growth Group (SADC)).

Hasnain Malaik of UAE based mostly rising market analysis agency Tellimer, quoted by Reuters, stated that:

“Zimbabwe has an inadequate $285 million of laborious forex and gold reserves. To repair the economic system, Zimbabwe wants to deal with these root causes of its issues.”

The Institute of Safety Research (ISS) additionally has no confidence within the ZiG and thinks the ZiG is doomed to failure, like its predecessors:

“Financial mismanagement has stripped residents’ belief within the authorities and threatens the brand new forex’s viability. The lately launched forex, ZiG, appears destined to undergo the identical destiny because the 5 earlier makes an attempt to create a neighborhood forex.”

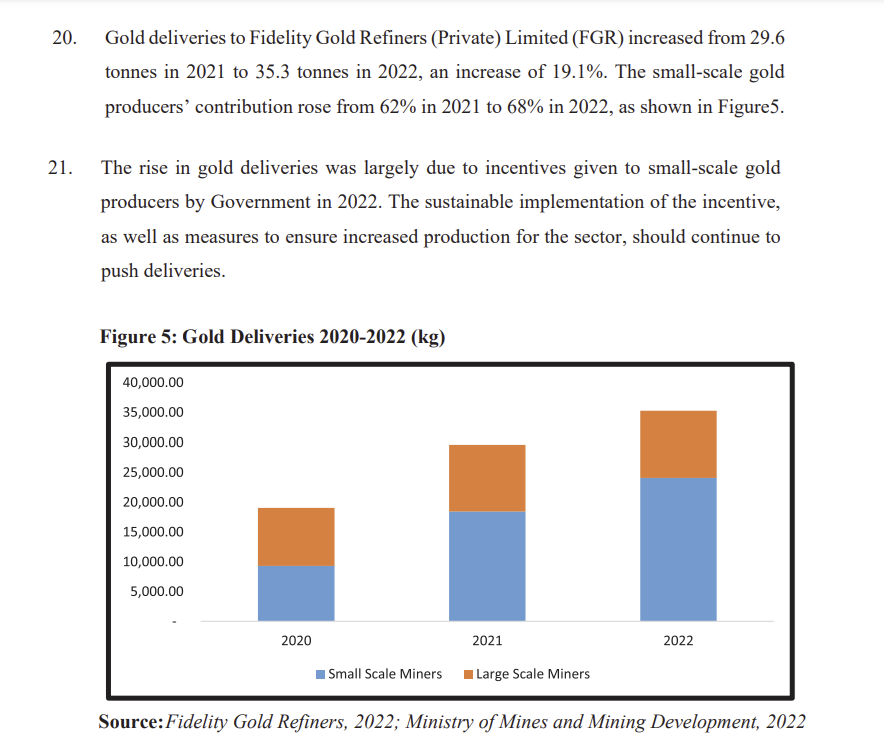

Admittedly, 2,522 kgs of gold (2.5 tonnes) doesn’t sound like so much, however Zimbabwe additionally goals to extend the nation’s gold manufacturing and channel a few of this gold to the central financial institution through in-kind royalties from mining firms. The RBZ additionally says that further in-kind royalties from different treasured metals and treasured stones mined in Zimbabwe (equivalent to platinum, lithium and diamonds) will be bought and reinvested into international change and gold. Whereas Zimbabwe is inside the checklist of prime 10 gold producing nations in Africa, it’s in about eighth place behind greater producers equivalent to Ghana, Mali, South Africa Sudan, and Guinea.

“The ZiG forex is anchored to gold reserves. It then turns into very important to make sure that we unlock the complete potential of our gold assets, and of our gold sector” stated Zimbabwean Mines and Mining Growth Minister Winston Chitando throughout Might. “Zimbabwe’s gold mining sector is focusing on to lift manufacturing to 40 metric tons this 12 months from 30.1 metric tons delivered final 12 months.”

As to verifying the existence of the gold that the central financial institution claims to carry as backing for the ZiG, the RBZ states that the reserve property:

“shall be topic to impartial audit not much less ceaselessly than as soon as in a calendar 12 months by exterior auditors particularly appointed for that objective, and the outcomes of the audit shall be revealed within the Annual Report of the Reserve Financial institution.”

Whether or not this comparatively rare system of auditing is clear sufficient to offer confidence within the ZiG stays to be seen.

Digital Forex and Gold Cash

This ZiG circulating forex will not be the primary time that Zimbabwe has experimented with a gold-backed forex to attempt to rein in inflation and stabilise the economic system. In Might 2023, Zimbabwe issued a gold-backed digital forex, which confusingly was additionally known as ZiG, and wherein the tokens of that digital forex could possibly be used to pay for native transactions and which have been “absolutely backed by bodily gold” held by the Reserve Financial institution of Zimbabwe.

Now that ZiG refers back to the new circulating forex launched in April 2024, the prevailing gold-backed digital forex have been rebranded as a Gold-backed Digital Token (GBDT).

Within the third quarter of 2022, the Reserve Financial institution of Zimbabwe started issuing 1 oz 91.67% pure gold (often called Mosi-oa-Tunya gold cash), bought to each the retail public and corporates, with the cash minted by Constancy Printers and Refiners, a safety printing and gold refinery owned by the RBZ. Subsequently, ½ oz, ¼ oz and 1/10 oz weights of those gold cash have been additionally minted. The rationale for issuing each the gold cash and gold-backed token was to offer Zimbabweans with a retailer of worth and an alternative choice to the eroding worth of the Zimbabwean greenback.

ZiG-Zagging and Flip Flopping

However on the bottom and in the true economic system in Zimbabwe, there may be confusion, and mistrust. This isn’t stunning as a consequence of a long time of expertise the inhabitants has needed to face with hyperinflation, political corruption, a murky line between central financial institution independence and authorities interference, and the collapsing values of all earlier Zimbabwean forex experiments. The expertise on the bottom appears to be yet one more of zig-zagging than ZiG. For instance:

• Will probably be compulsory for firms to settle not less than 50% of their tax obligations in ZiG, says the central financial institution.

• The federal government has ordered some authorities departments to solely use the ZiG (and never US {dollars}), however different departments, equivalent to Zimbabwe’s passport issuing workplace, will solely settle for US {dollars}.

• Nevertheless, the federal government has granted exceptions to some personal companies, equivalent to fuel stations, permitting them to refuse to simply accept ZiG and solely settle for US {dollars}.

• In the meantime, different personal companies are being pressured to simply accept ZiG, and face fines is that they don’t settle for it.

• There may be additionally an absence of public confidence within the ZiG. Some retailers refuse to simply accept it. Many individuals after they obtain funds in ZiG instantly convert the ZiG to US {dollars} on the black market.

• Within the first two weeks after the ZiG’s launch, the ZiG misplaced 50% of its worth on the black market, falling from 1 US greenback = 13.56 ZiG to 1 US greenback being transformed for greater than 20 ZiG. This triggered Zimbabwe’s authorities to conduct mass arrests of black market cash changers on the streets of Harare, with 65 sellers arrested. Unofficial forex sellers from now moved underground and conduct their enterprise through Whatsapp.

Conclusion – Blame the World Financial institution

The rationale for introducing the ‘reserve asset’-backed ZiG has been to revive confidence in Zimbabwe’s forex, and in so doing, rein in excessive inflation and the earlier depreciation of the Zimbabwean forex towards main currencies such because the US greenback.

The selection of bodily gold as a major a part of this reserve backing is comprehensible as a result of gold is a steady retailer of worth and wealth preservation, and the world’s pre-eminent financial asset.

However like every forex, confidence is essential, and whereas Zimbabwe’s authorities / central financial institution claims it is not going to finance authorities spending by printing cash, in the event that they break this promise and start to print forex in extra of the worth of the reserve property backing the ZiG, confidence will evaporate, and the worth of the ZiG will go the best way of all earlier Zimbabwean currencies, in direction of zero.

And using coercion in forcing Zimbabwe’s inhabitants to make use of the ZiG and never use the opposite ‘more durable’ currencies just like the US greenback, is an anti market competitors tactic which is able to solely push individuals additional into utilizing the FX black market.

On the floor this new ZiG forex seems like a home Zimbabwean invention, however there may be proof that worldwide worldwide establishments such because the Worldwide Financial Fund (IMF) and World Financial institution are protecting a detailed eye, and have even been concerned in its creation.

In Might, the IMF stated that “the introduction of ZiG represents an necessary coverage motion accompanied by a number of complementary coverage adjustments — together with financial, change charge, and financial coverage measures”, and this month in June 2024, the IMF is conducting an (Article IV) evaluation of Zimbabwe’s economic system the place it hopes to “assess the complete economic system as we all the time do, but additionally we might be trying on the new forex association, the ZiG“.

In keeping with an IMF spokesperson:

“Zimbabwe launched a brand new forex backed by a basket of foreign exchange and different property, together with gold and naturally we stand prepared to debate these with the authorities and to help their efforts to revive macroeconomic stability“.

Nevertheless it’s the IMF’s sister organisation the World Financial institution, the place issues actually get fascinating, for astonishingly, the Reserve Financial institution of Zimbabwe governor John Mushayavanhu, has even pre-emptively laid the blame on the World Financial institution if the ZiG finally ends up failing, in April saying that:

“We didn’t know a lot a few structured forex. We received a marketing consultant from the World Financial institution. Loads of the stuff you’re seeing concerning the structured forex really got here from the World Financial institution.”

“So, if you happen to’re going responsible me, you’re really blaming the World Financial institution. Possibly they didn’t advise us correctly. And if they didn’t advise us correctly, it’s positive. Let’s refine it.”

Not very inspiring phrases from a central financial institution head, are they?

In idea, the introduction of the ZiG is an fascinating experiment in anchoring its worth to a steady basis of gold and international forex reserves. However with deep-rooted scepticism amongst Zimbabwe’s inhabitants in accepting the ZiG and a insecurity within the authorities’s transparency and financial administration expertise, the jury continues to be out on whether or not the ZiG might be a future case research of a profitable new gold-backed forex, or a future case research of one other basket-case so as to add to Zimbabwe’s lengthy checklist of failed currencies.