The Comex report for final month accurately recognized a possible huge transfer in silver whereas the identical report two months in the past preceded an enormous up transfer for the worth of gold. The information this month just isn’t as apparent or compelling, however it’s clear the stress on the Comex continues to construct.

The CME Comex is the Trade the place futures are traded for gold, silver, and different commodities. The CME additionally permits futures consumers to show their contracts into bodily steel by way of supply. You’ll find extra particulars on the CME right here (e.g., vault varieties, main/minor months, supply rationalization, historic information, and many others.).

The information beneath seems at contract supply the place the possession of bodily steel modifications fingers inside CME vaults. It additionally exhibits information that particulars the motion of steel out and in of CME vaults. It is vitally doable that if there’s a run on the greenback and a flight into gold, that is the information that can present early warning indicators.

Gold

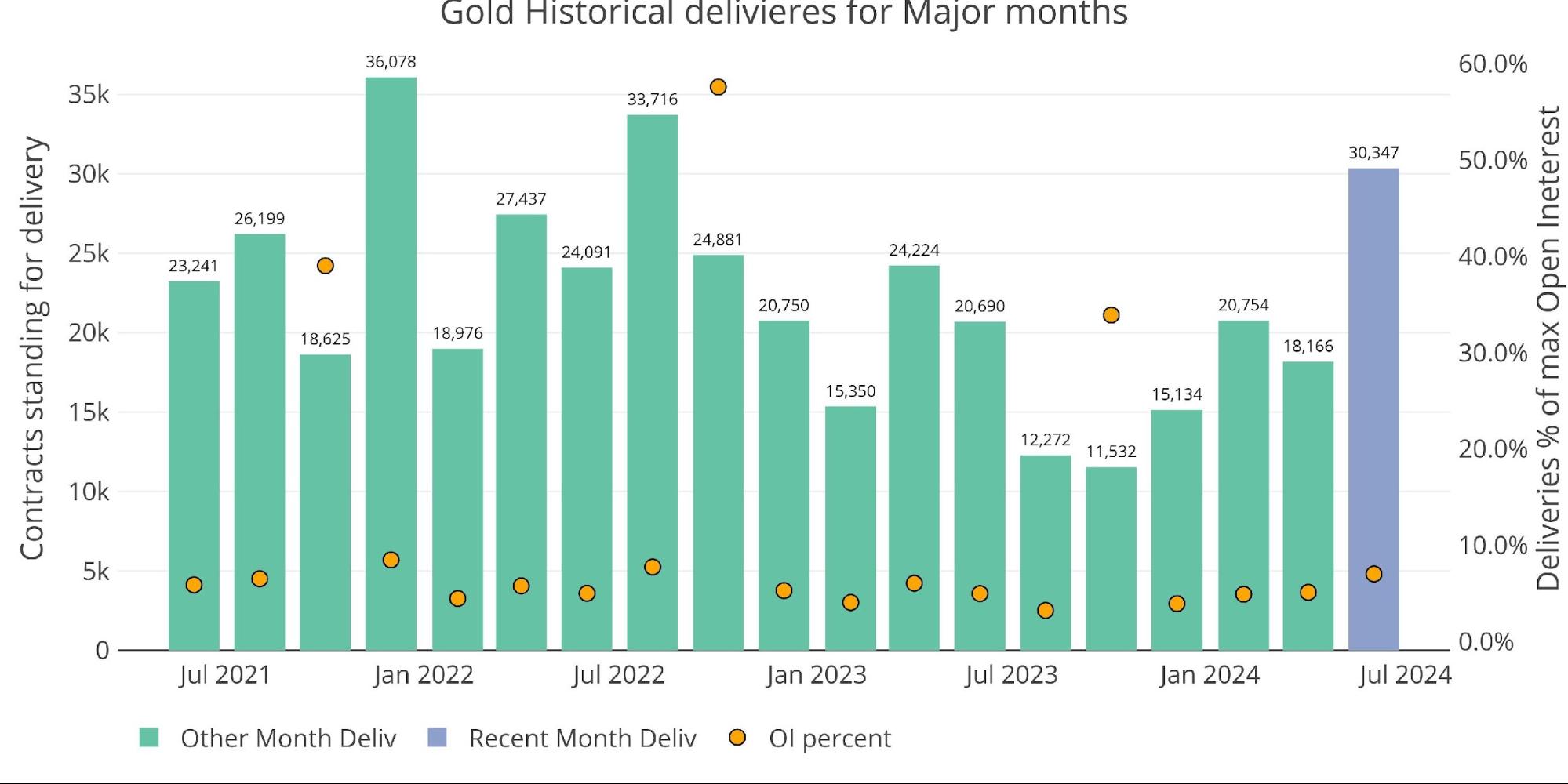

The evaluation final month confirmed open curiosity in gold at effectively above pattern. That pattern held into the supply interval. June is a serious supply month in gold and noticed greater than 30k contracts stand for supply. This was the biggest supply quantity since August 2022 by a large margin.

Determine: 1 Latest like-month supply quantity

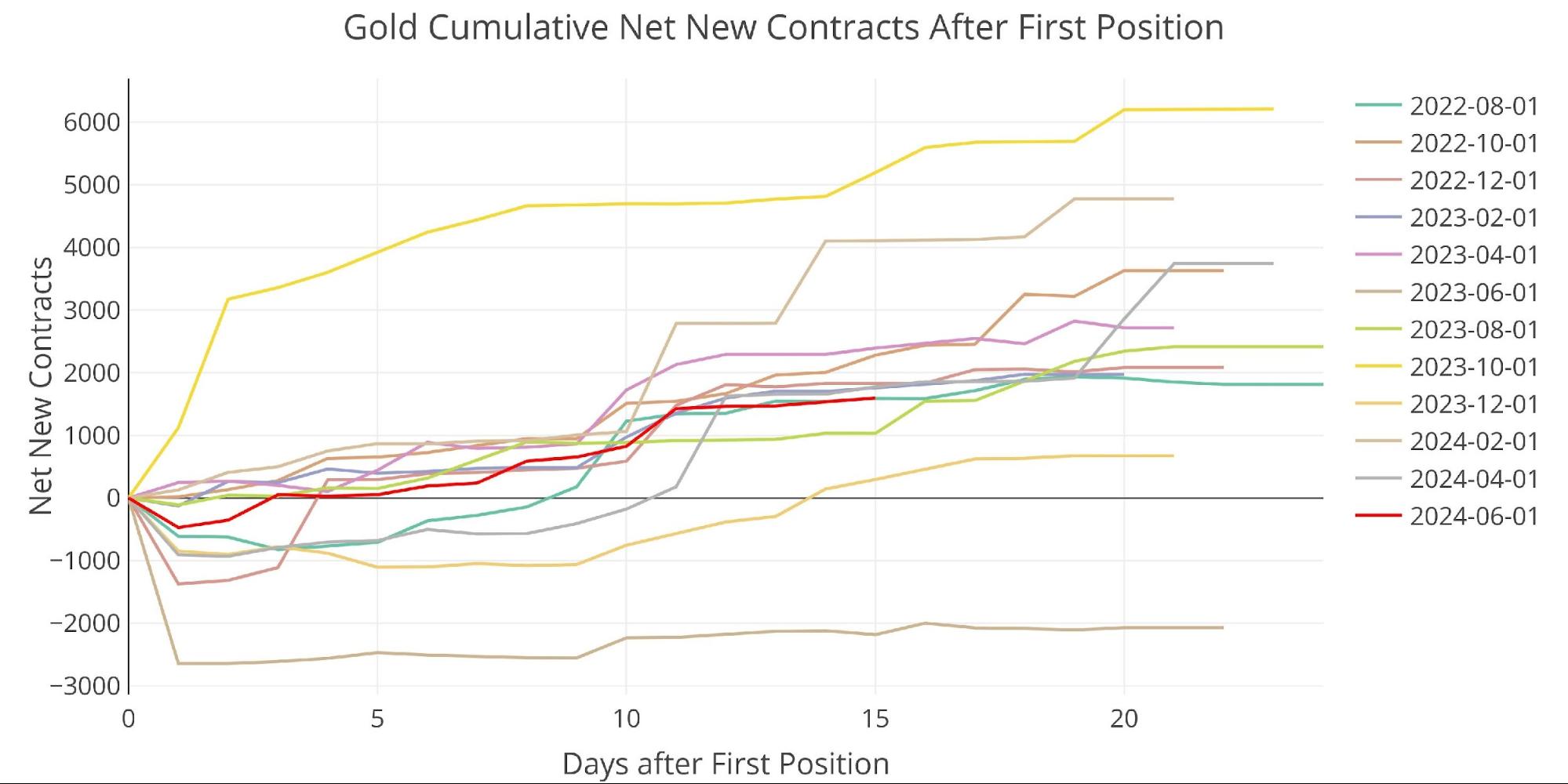

Not like most months, the large supply quantity was NOT pushed by web new contracts. June began out the gate with huge quantity and was solely considerably supplemented by about 1500 web new contracts.

Determine: 2 Cumulative Web New Contracts

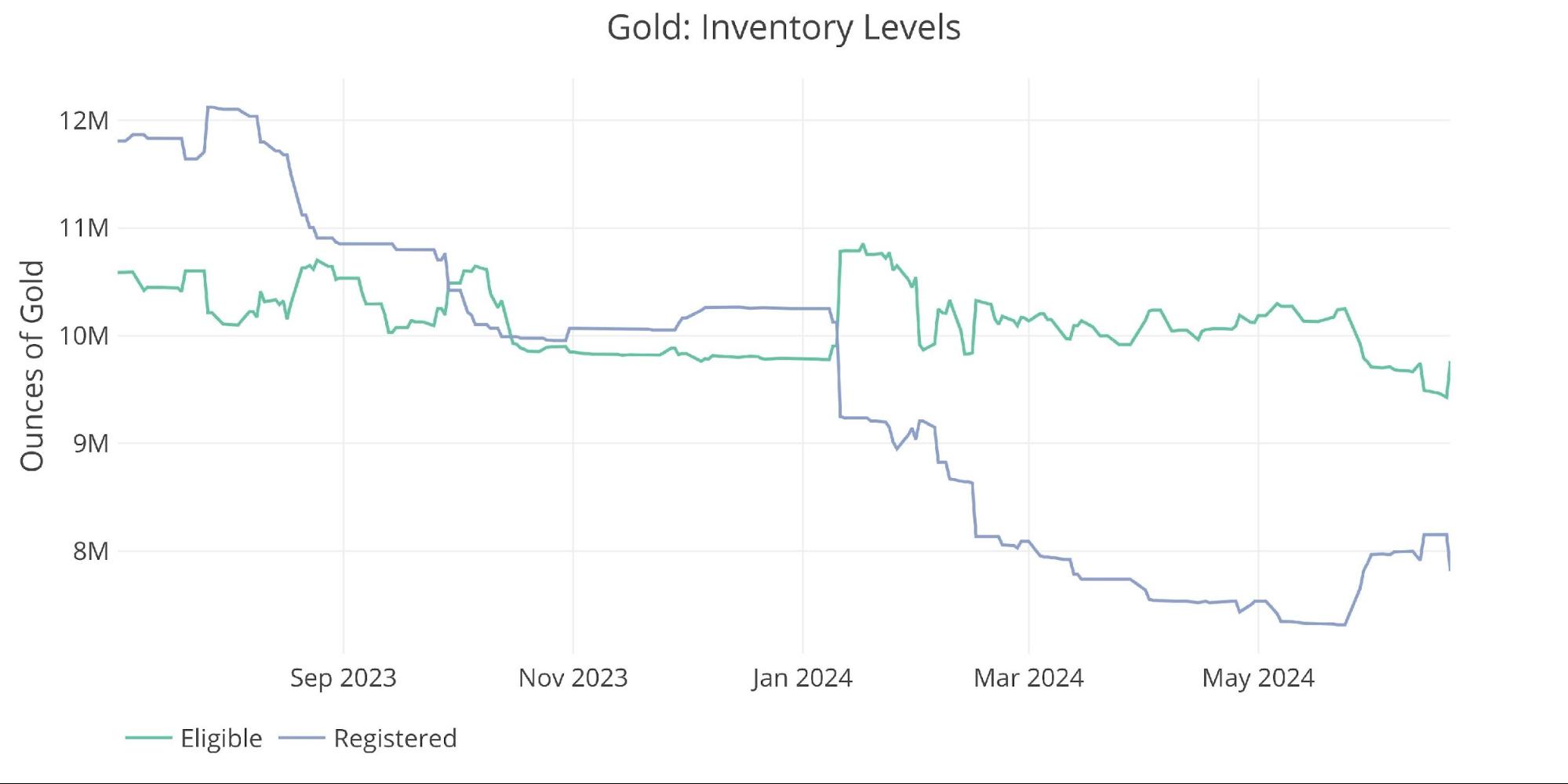

Yesterday additionally noticed a serious transfer from Registered again to Eligible. This strikes the steel out of the pool out there for supply.

Determine: 3 Stock Knowledge

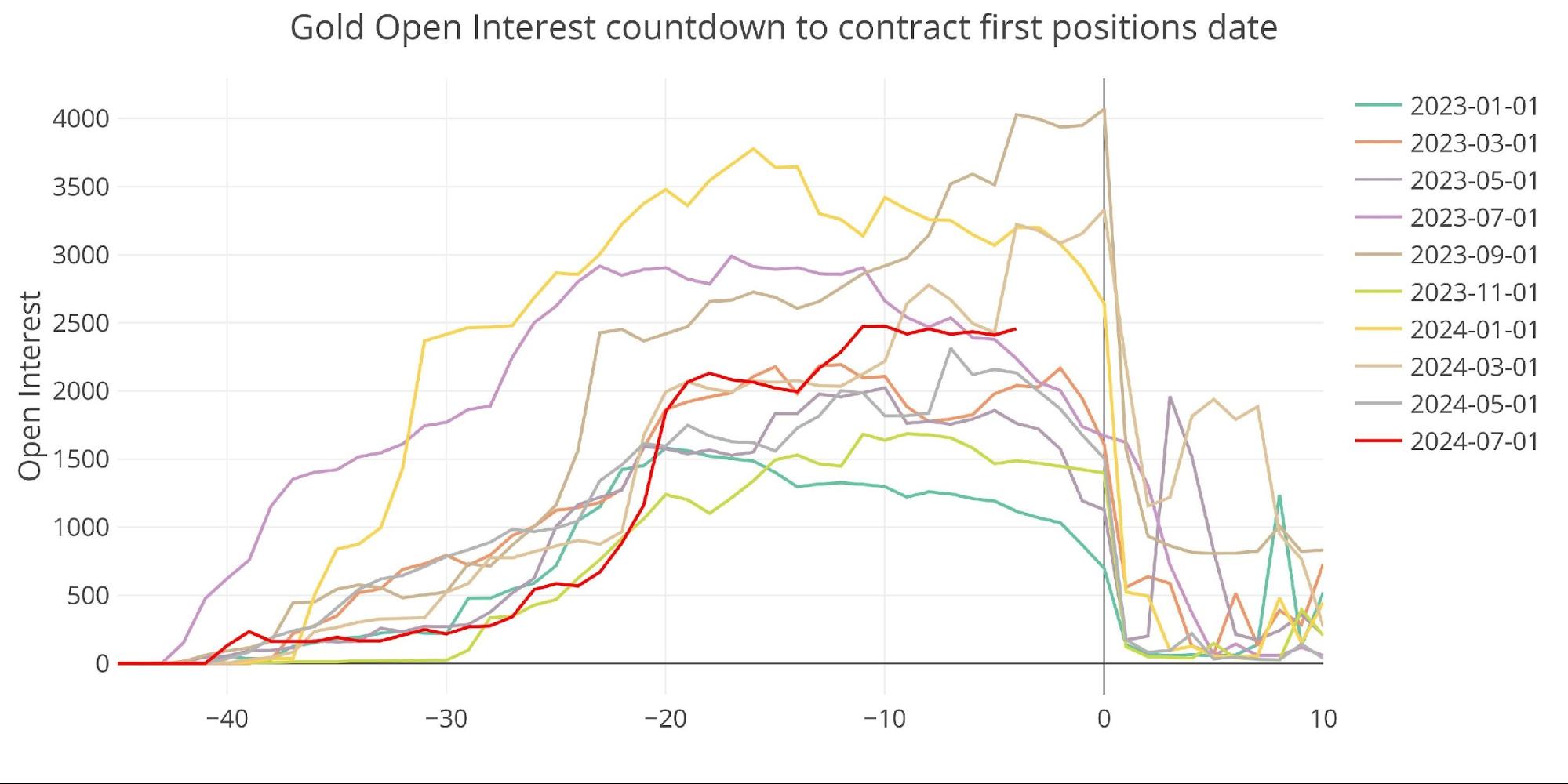

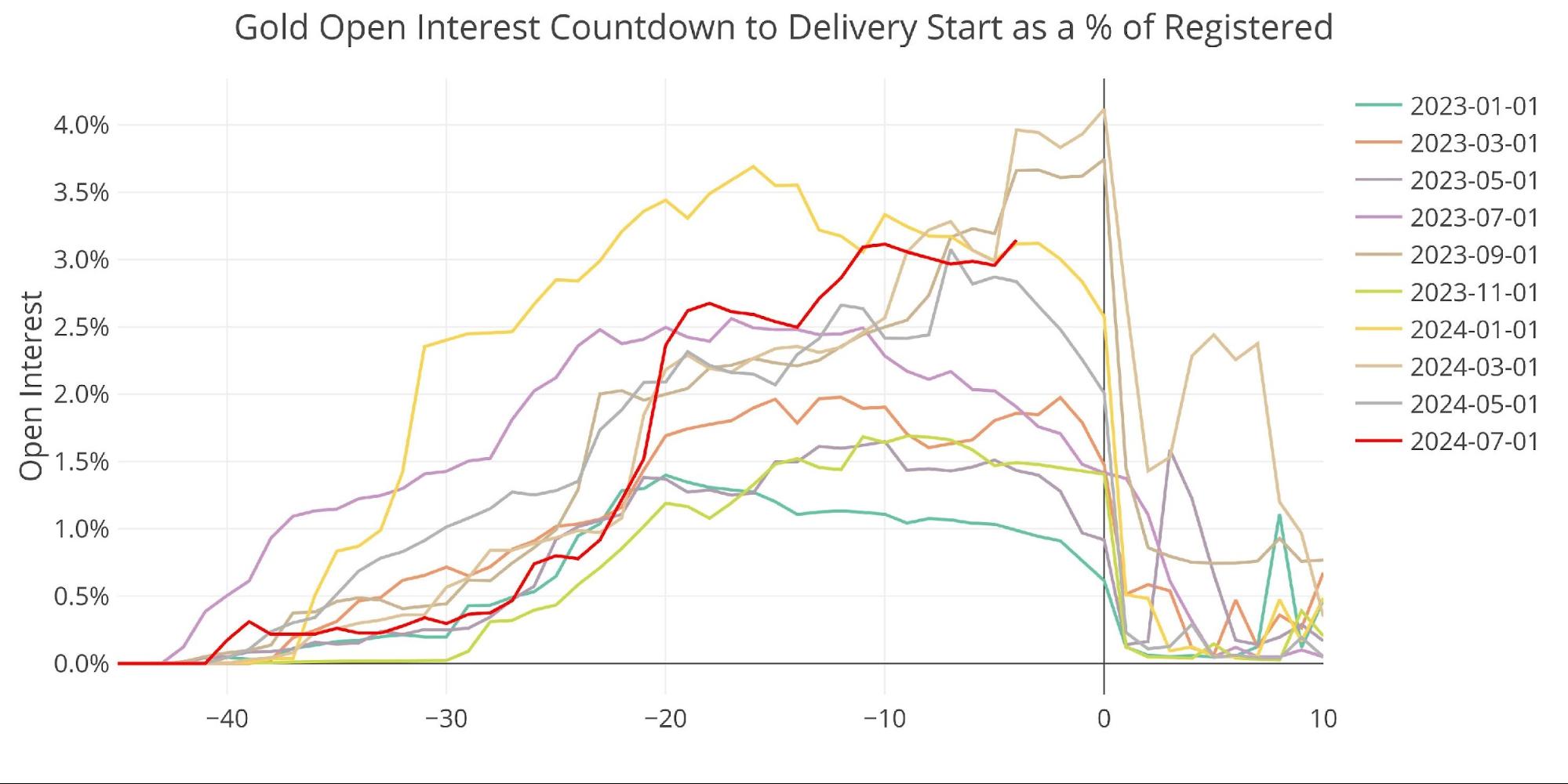

Heading into the minor supply month of July exhibits Open Curiosity is trending upwards into the shut.

Determine: 4 Open Curiosity Countdown

On a relative foundation, the open curiosity nonetheless stays elevated in comparison with current historical past.

Determine: 5 Open Curiosity Countdown P.c

Silver

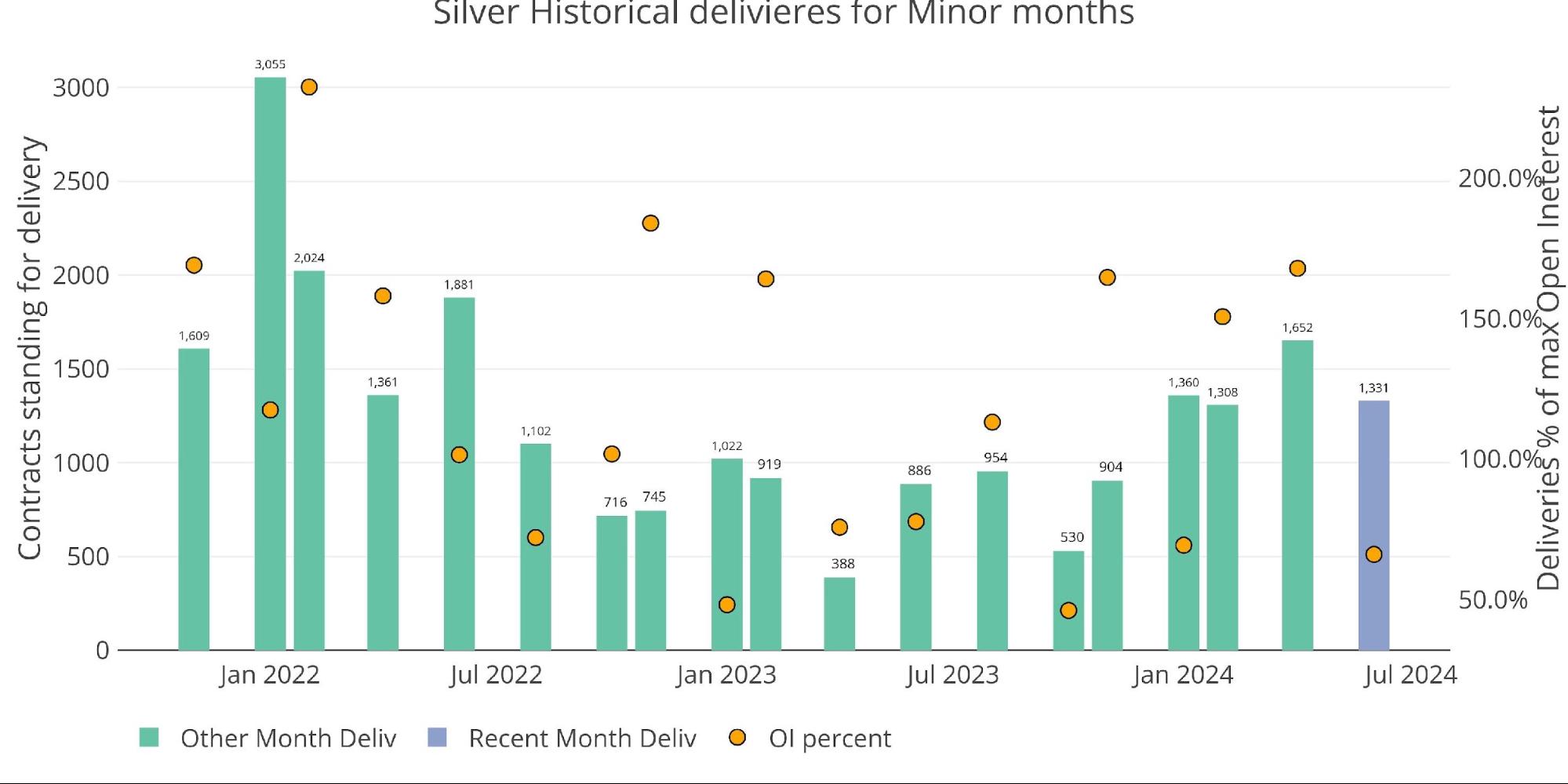

June silver noticed a modest 1,331 contracts stand for supply. June is a minor month in silver, however the chart beneath exhibits how exercise in silver has undoubtedly picked up after a reasonably quiet 2023.

Determine: 6 Latest like-month supply quantity

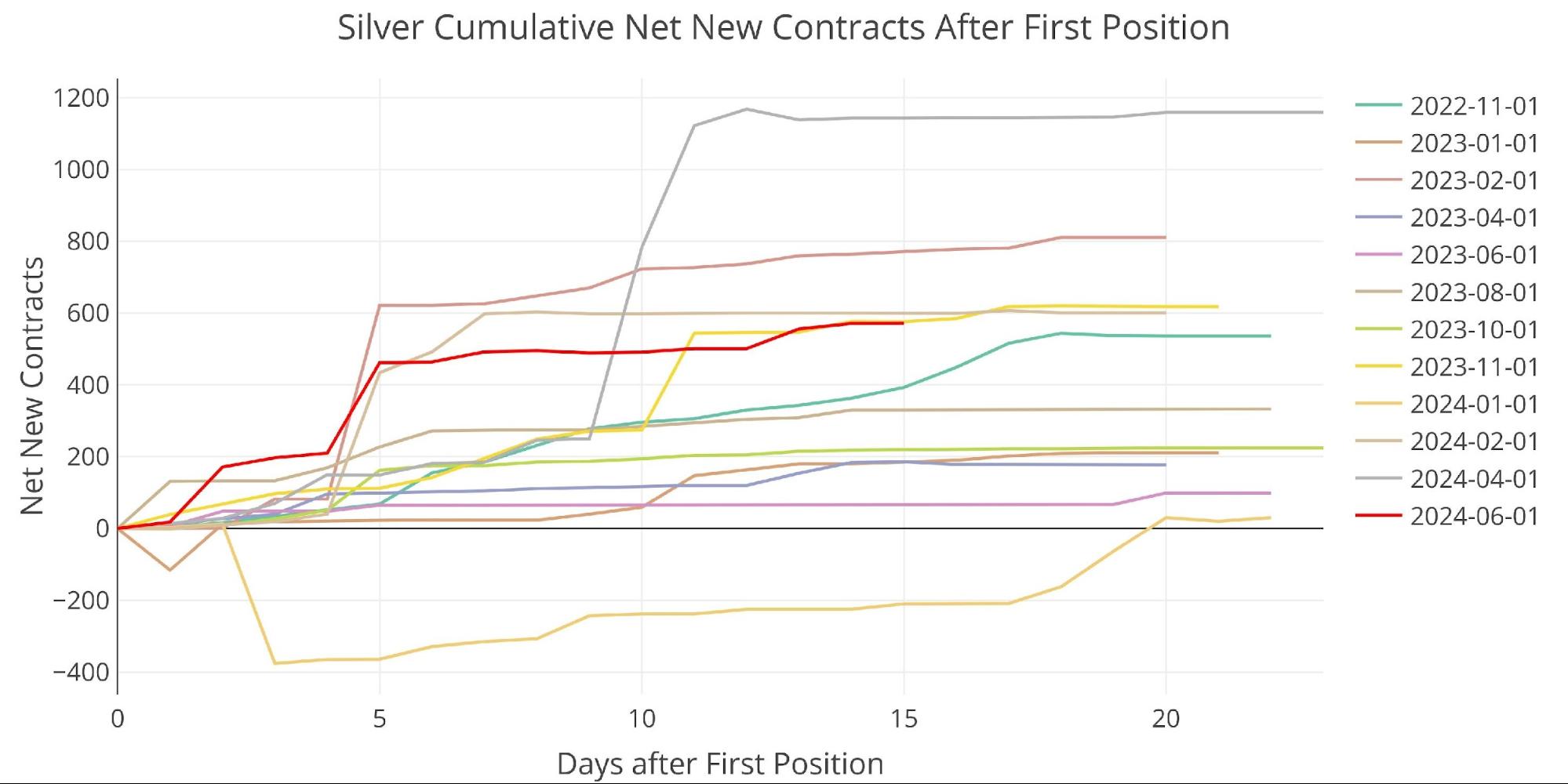

The supply quantity was partially pushed by web new contracts which represented about 572 of the entire contracts delivered.

Determine: 7 Cumulative Web New Contracts

Registered and Eligible have been plotted individually to make the charts extra readable. Eligible was pretty flat in June.

Determine: 8 Stock Knowledge

Registered additionally remained pretty flat after the massive improve in Could. That is the best stage of Registered in a number of years (steel out there for supply).

Determine: 9 Stock Knowledge

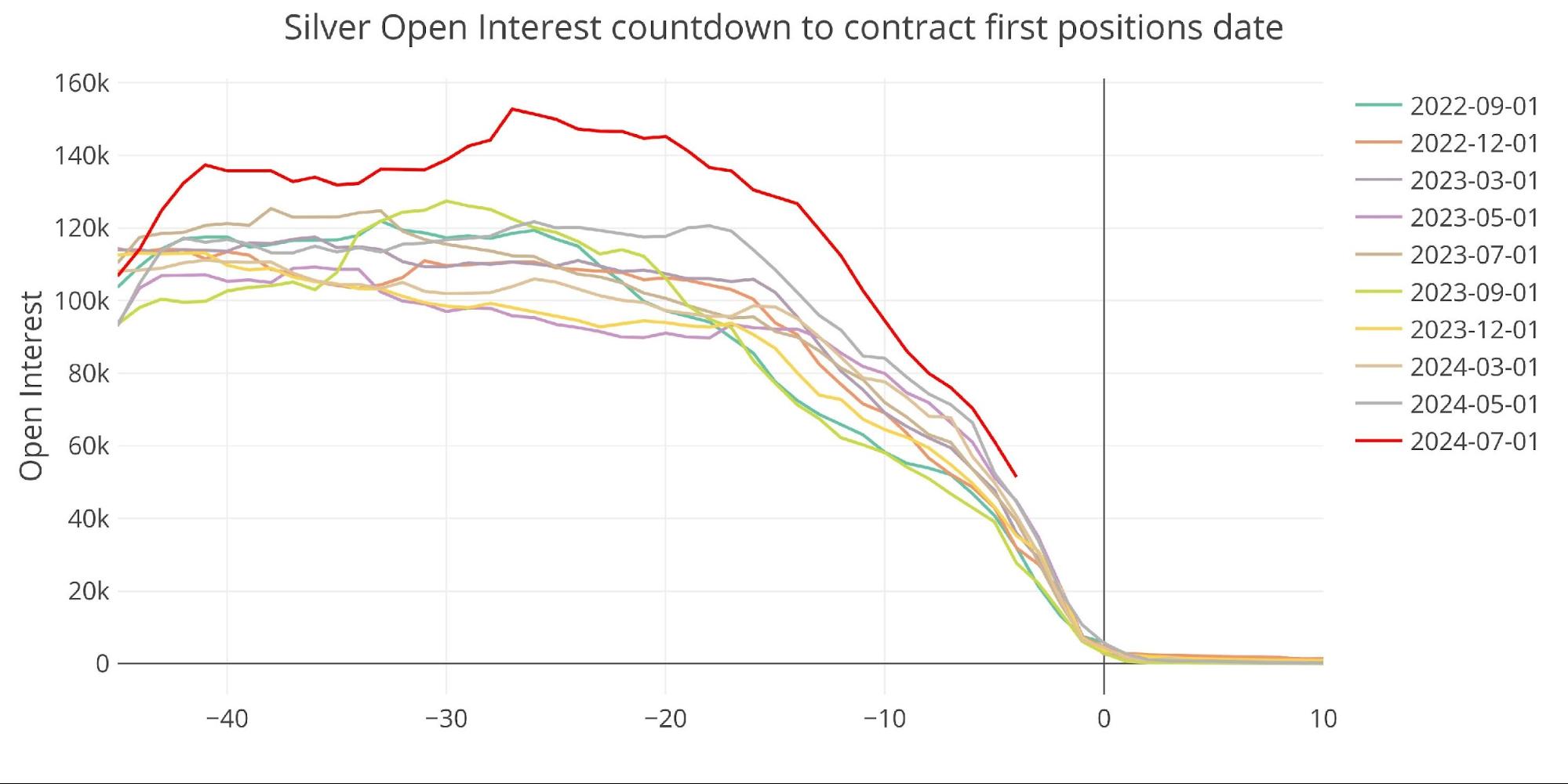

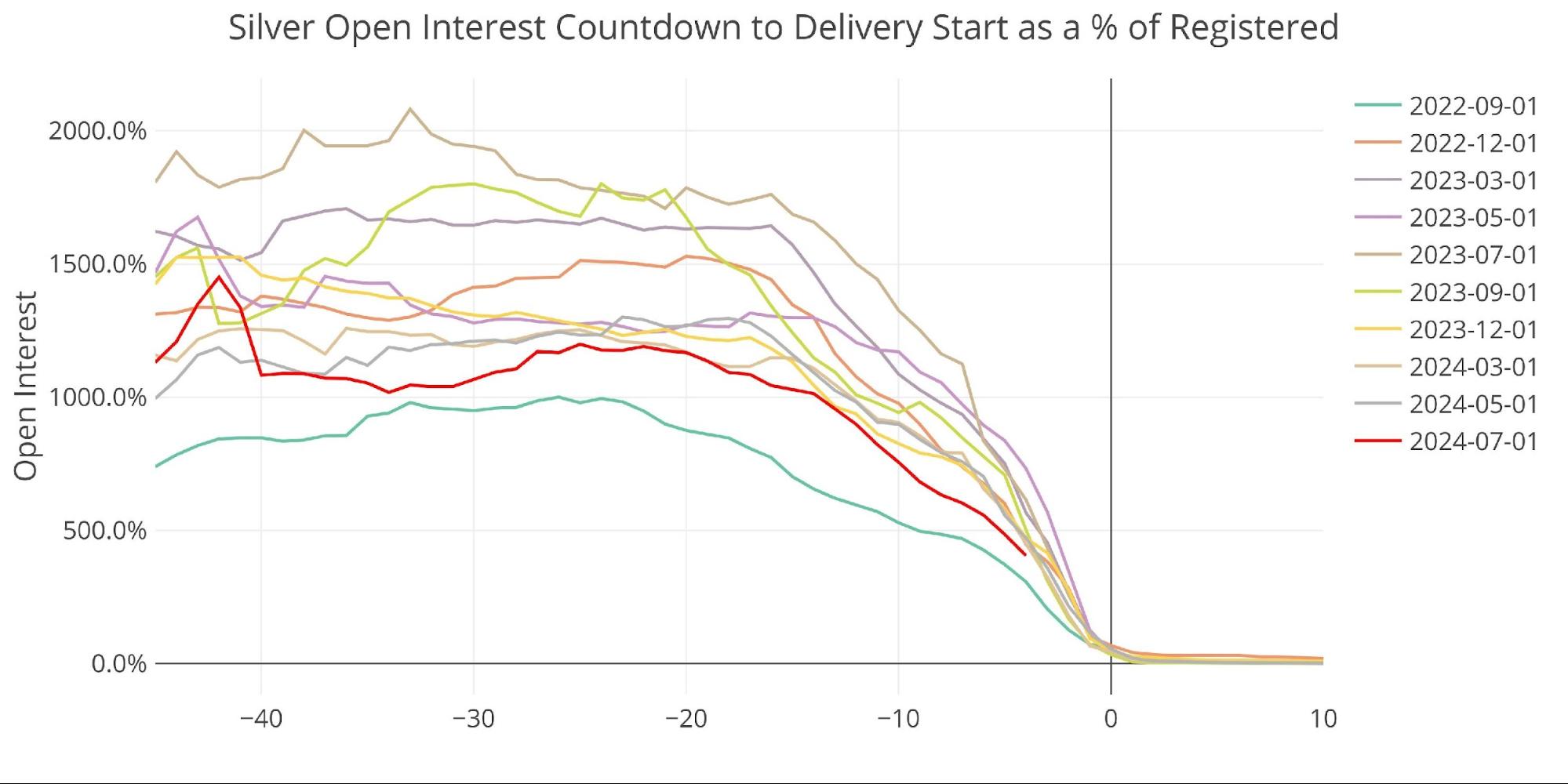

As we method the supply interval for July, you possibly can see that the silver contract is definitely effectively above the previous couple of months. This is similar motion we noticed in gold final month which turned out to be an early signal for large supply quantity.

Determine: 10 Open Curiosity Countdown

On a relative foundation, it’s truly effectively beneath pattern due to the large inflow of steel into Registered that occurred in Could.

Determine: 11 Open Curiosity Countdown P.c

Conclusion

With gold seeing huge supply quantity, and silver poised to do the identical, it seems that extra persons are taking supply of bodily steel regardless of the upper costs. This exhibits a whole lot of sturdy demand in each gold and silver which ought to hold costs elevated and could be the basis for the subsequent huge transfer increased.

Knowledge Supply: https://www.cmegroup.com/

Knowledge Up to date: Nightly round 11PM Japanese

Final Up to date: Jun 21, 2024

Gold and Silver interactive charts and graphs could be discovered on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Name 1-888-GOLD-160 and communicate with a Treasured Metals Specialist at this time!