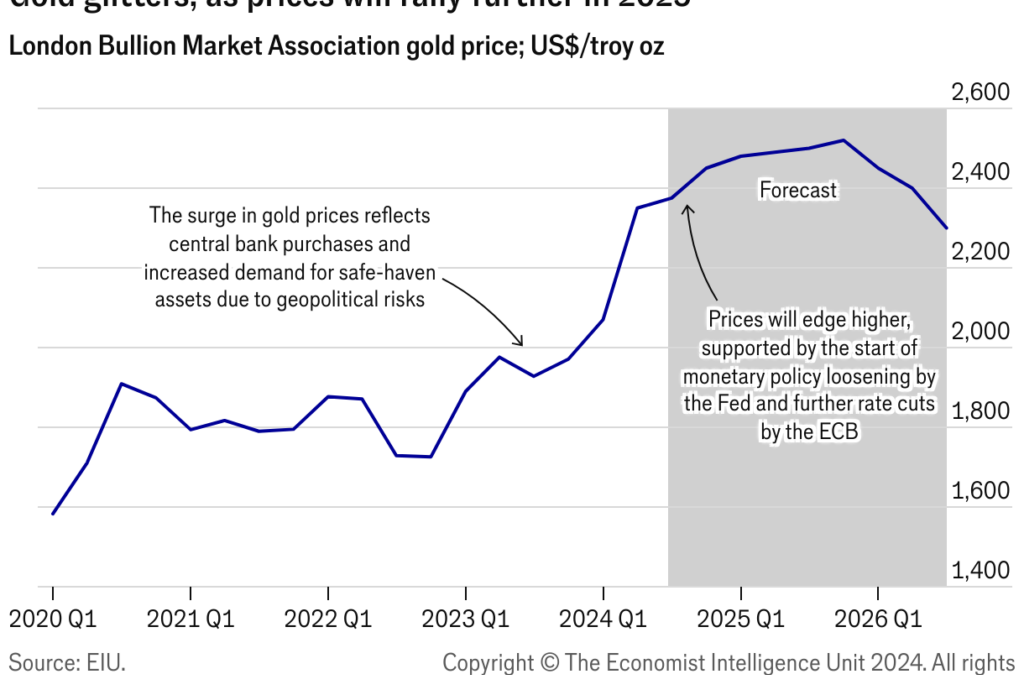

Gold has had a stellar yr thus far. After buying and selling at about US$2,000/troy ozfrom April 2023 to February 2024, gold costs have soared, reaching a file excessive of greater than US$2,420/troy ozin mid-Might, earlier than moderating to about US$2,350/troy ozin early June. Costs are holding close to that degree though macroeconomic and geopolitical uncertainties—together with Israel’s offensive in Gaza, Iran’s shadow struggle with Israel and rising US-China tensions—burnish gold’s attraction as a safe-haven asset. Central financial institution purchases and anticipated interest-rate cuts by the Federal Reserve (Fed, the US central financial institution) have additionally supported the rise within the metallic’s worth.

Though the value of gold has receded from its file excessive, it stays 10% larger than initially of the yr and is now buying and selling at about US$2,330/troy oz. Gold costs have traded larger this yr regardless of elevated rates of interest and a stronger greenback—components that sometimes don’t assist the metallic. Central financial institution purchases by rising nations, notably China, have additionally propelled gold’s rally. Central banks account for a few quarter of the demand for gold, with purchases anticipated to achieve a file 1,100 tonnes this yr.

Central banks in rising economies will in all probability proceed their purchases as they diversify their foreign-exchange holdings away from the greenback. For rising economies, particularly these not allied with the West like China and Turkey, sanctions towards Russia’s dollar-denominated belongings are a serious concern. These nations have accelerated the diversification of their reserves on account of the sanctions.

China’s central financial institution has been aggressive in its purchases of gold. The Folks’s Financial institution of China purchased gold for 18 consecutive months, earlier than halting purchases in Might after the metallic rallied to a file excessive. Retail and funding demand in China, the world’s largest client of gold, has additionally been resilient. Demand has been robust, because the property sector disaster has restricted funding choices for retail consumers. We count on consumption in China to elevate world demand for jewelry by 1.5% this yr, though record-high costs will reasonable purchases in different areas.

A softening in US inflation will enhance the metallic’s rally. The US headline client value index was flat month on month in Might, bolstering expectations that the Fed will reduce charges twice this yr, in September and December. The European Central Financial institution (ECB) has already reduce charges this yr.

What subsequent?

Costs will proceed to strengthen in 2024-25, because the Fed will begin to cut back its coverage charge and the ECB will reduce charges additional. We count on gold costs to stay elevated in 2024, with the value averaging US$2,312/troy oz, up by 19% from 2023. We forecast that the Fed and the ECB will proceed to decrease rates of interest subsequent yr, and due to this fact count on gold costs to extend additional to common US$2,498/troy ozin 2025. Demand will stay robust on the again of central financial institution and retail purchases.

Moreover, softer rates of interest and safe-haven demand will revive curiosity in exchange-traded funds (ETFs). We count on web investments in gold ETFs to show constructive this yr. Assuming that financial coverage easing continues in 2025, we count on gold ETF web inflows to achieve 200 tonnes that yr.

The evaluation and forecasts featured on this article are accessible via EIU’s Nation Evaluation service. This complete resolution offers unmatched world insights overlaying the political and financial outlook for almost 200 nations, enabling organisations to establish potential alternatives and dangers successfully.