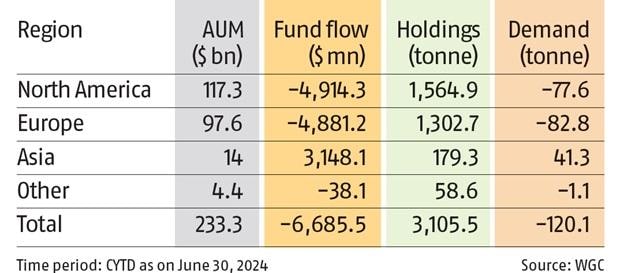

International bodily backed gold trade traded funds (ETFs) have misplaced $6.7 billion within the first half of calendar 12 months 2024 (H1-CY24), struggling their worst first half in a calendar 12 months since 2013, stated a current be aware by World Gold Council (WGC). Whole holdings, the report stated, have dropped by 120 tonnes (-3.9 per cent) to three,105 tonnes throughout this era.

Western gold ETF buyers, in keeping with the report, didn’t react as anticipated to the rise within the gold value – which generally drives up funding flows – amidst a excessive degree of rates of interest and a extra risk-on sentiment generated by the AI growth.

“In distinction, Asian flows rhymed with the worth energy – weaknesses in non-dollar currencies and gold’s staggering efficiency in these currencies attracted buyers within the area,” WGC stated.

Gold ETF property are tracked by WGC in two methods – the amount of gold they maintain (usually measured in tonnes), and the equal worth of these holdings in US {dollars} (AUM). Additionally they monitor how these fund property change via time by two key metrics – demand and fund flows.

Asia an outlier

Area-wise, Asia, in keeping with WGC, was an outlier that registered inflows of $3.1 billion in H1-CY24, considerably outpacing all different markets and the one area witnessing optimistic flows.

“This represents the strongest ever H1 for Asian funds, primarily pushed by record-level inflows into China and Japan. Supported by record-breaking inflows and a better gold value, the whole AUM of Asian funds reached $14 billion, the very best ever, whereas collective holdings elevated by 41 tonnes,” WGC stated.

European funds, too, noticed their worst present since 2013 (-$8 billion). Regardless of a 6 per cent fall in holdings, WGC stated, the whole AUM of European funds noticed a 6.3 per cent rise throughout the first half, because of the upper gold value.

Two in a row

In June, world bodily backed gold ETFs witnessed their second consecutive month-to-month influx and attracted $1.4 billion, WGC stated. All areas noticed features besides North America, which skilled delicate losses ($573 million) for the second consecutive month.

“On the whole, decrease yields in key areas and non-dollar forex weaknesses elevated gold’s attract to native buyers,” WGC stated.

As an illustration, in June, the European Central Financial institution (ECB) delivered its first charge reduce for nearly 5 years, while the Swiss Nationwide Financial institution lowered charges for the second time in 2024. Within the UK, the Financial institution of England (BoE) hinted {that a} potential reduce was on the playing cards, however left charges unchanged following a shock common election announcement.

First Revealed: Jul 10 2024 | 10:51 AM IST