Analysis Briefing

| Jul 22, 2024

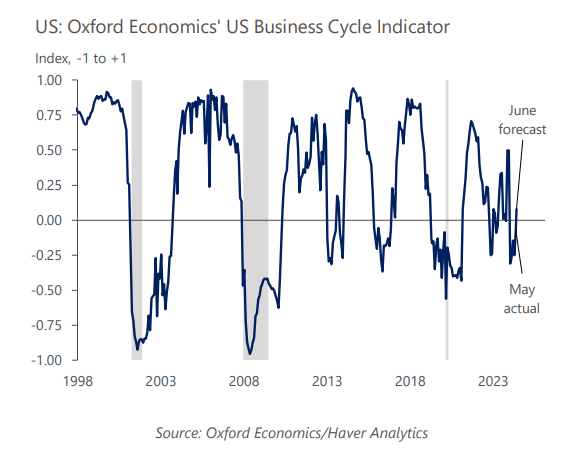

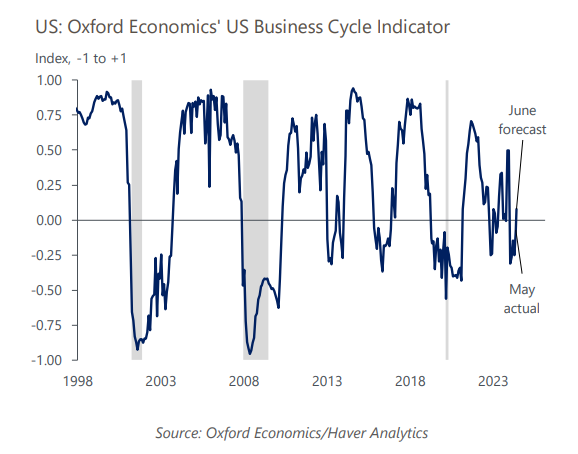

The economic system underwhelmed within the first half of the 12 months whereas it transitioned to a extra sustainable tempo of progress, which frequently consists of bumps and jitters. Our enterprise cycle index weakened however shouldn’t be in line with an economic system in recession, and the incoming information for June factors towards a noticeable enchancment.

What you’ll study:

- There are elements of the economic system struggling, together with manufacturing and housing. Worries concerning the client are overdone, however there are some vulnerabilities. A deceleration in inflation will assist positive aspects in actual disposable revenue and, by extension, consumption whereas lowering the percentages of a major rise in delinquency charges.

- The current rise within the unemployment fee shouldn’t be sending warning indicators, with greater than half of the rise because the begin of the 12 months attributed to a rising labor provide whereas job losers have declined. Labor demand is slowing, however firms aren’t shedding employees in giant numbers, which reduces the percentages of a detrimental suggestions loop of rising unemployment resulting in revenue loss, discount in spending, and extra layoffs.

- Close to-term recession dangers didn’t change markedly in June from their lows final month. Weak point stays concentrated in client sentiment and constructing permits, and neither must be a trigger for concern of an impending recession.

Associated Providers

Service

US Forecasting Service

Entry to short- and long-term evaluation, eventualities and forecasts for the US economic system.

Service

US States and Metro Service

Forecasts, eventualities and evaluation for US states, metropolitan statistical areas and counties.

Service

US Trade Service

Outlook for 261 detailed sectors within the NAICS classification.

Share