We’re witnessing historical past within the making!

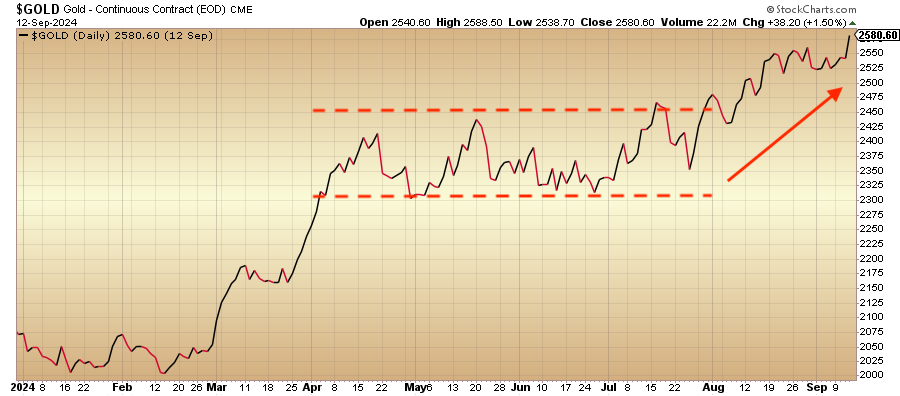

Gold has simply shattered its personal file, passing over $2,580 per ounce on Friday. This gold rush is being propelled skyward by mounting expectations of a Federal Reserve fee reduce at subsequent week’s essential assembly.

In a world fraught with financial query marks, rising world tensions, and political drama, gold is not only flexing its muscle tissue because the go-to protected haven – it is main the cost. With a formidable 25% achieve this yr, gold is outpacing many main asset lessons, proving as soon as once more why it is the cornerstone of good investing.

Your determination to spend money on gold has by no means appeared higher. As we eagerly await the Fed’s subsequent transfer, the case for gold grows stronger by the day.

Gold Worth Breaks Previous $2,500

After a quiet summer time, gold has damaged free from its $2,300-$2,450 vary, shattering the $2,500 barrier whereas constructing momentum.

Since August, we have witnessed a roughly 6% enhance, with new information set nearly every day. The yellow metallic’s efficiency has been notably sturdy:

- Friday, September 13, 2024: New all-time excessive of over $2,580/oz

- 2024 year-to-date achieve: Over +25%

- Since 2020: Roughly +67% enhance

Gold’s ascent is grabbing headlines, however silver may very well be the subsequent metallic to observe.

Silver: The Subsequent Huge Transfer in Metals?

Whereas gold reaches new highs and basks within the limelight, silver has been quietly constructing potential. Up 31.5% year-to-date, silver has truly outperformed gold in 2024.

Nonetheless, it is nonetheless buying and selling inside its summer time vary of $27.00 to $32.00.

Silver’s worth chart reveals a basic consolidation sample, suggesting pent-up market vitality. This section of consolidation, usually likened to a coiled spring, usually serves as a precursor to a serious worth motion.

With key financial occasions looming, significantly the Fed’s rate of interest determination, silver’s worth seems poised for a probably explosive upward transfer.

Silver’s Historic Outperformance

Silver’s market dynamics supply distinctive alternatives for traders. With a market measurement considerably smaller than gold’s, silver tends to be extra delicate to provide and demand shifts. This interprets to greater positive factors throughout bull markets:

- From 2008 to 2011, gold gained 166%, however silver skyrocketed by 448%.

- Whereas gold surged by an unimaginable 2,328% within the Nineteen Seventies bull market, silver’s worth soared even greater, climbing by as a lot as 4,000%.

In case you’re involved in studying extra about silver’s outstanding efficiency in the course of the Nineteen Seventies bull market, I extremely suggest testing Mike Maloney’s insightful video under. He supplies some nice historic context about what many think about the best metals bull market in historical past.

By diversifying your valuable metals holdings with silver, you are positioning your self to probably seize even larger returns as this bull market unfolds.

Bear in mind, whereas silver’s volatility can result in greater positive factors, it additionally comes with elevated threat. As all the time, it is essential to align your funding technique together with your private monetary targets and threat tolerance.

With rates of interest very possible being lowered subsequent week, now may very well be the right time to extend your gold or silver holdings – earlier than costs probably react to the information.

Purchase Gold or Silver At the moment

That’s it for this week’s GoldSilver Nuggets. We’ll be again subsequent week with extra information and updates.

Greatest,

Brandon S.

Editor

GoldSilver