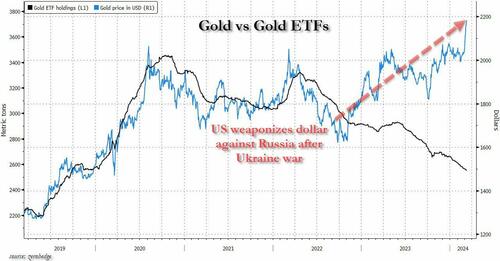

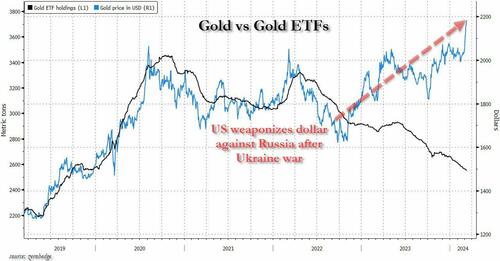

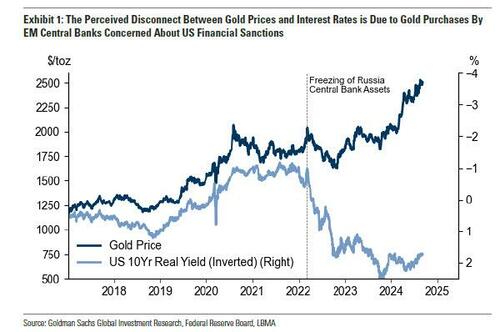

One thing outstanding occurred to the worth of gold again in early 2022 across the time of the Ukraine warfare: having beforehand tracked gold ETF inflows to the tick, the worth of gold instantly disconnected and exploded greater at the same time as “paper gold” as some name it, slumped. We confirmed this for the primary time again in April with the next chart which confirmed the clear decoupling between paper and bodily gold in 2022.

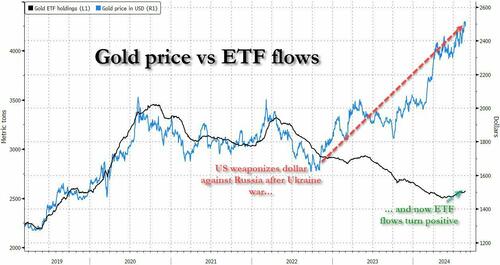

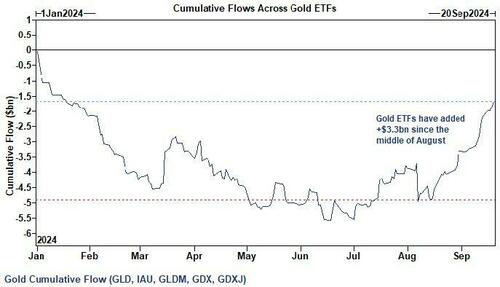

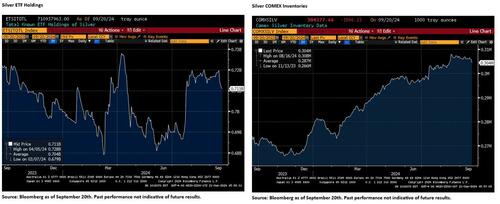

A number of months later, and two years after gold ETF holdings continued to drop at the same time as the worth of gold rose, it lastly occurred: makes an attempt at brute gold value manipulation through shifts in ETF holdings lastly ended, and with gold in any respect time highs, ETF flows lastly turned optimistic, a transfer which we famous would ship gold surging even greater (it did).

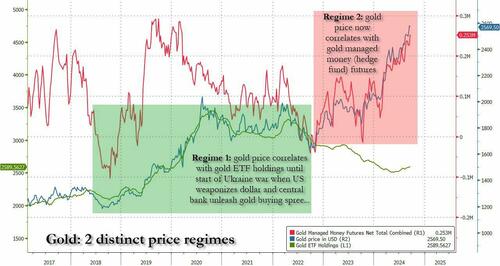

Which brings us to this weekend, and one more outstanding remark: whereas gold did correlate very intently with ETF holdings within the years previous to the Ukraine warfare (regime 1), since then gold has utterly misplaced all correlation with ETF holdings, and as an alternative has been correlating tightly with one other information collection: Managed Cash (i.e., hedge fund) web futures (regime 2).

In fact, it is not likely simply hedge fund shopping for: as we first defined again in 2022, central financial institution – largely Chinese language central financial institution – shopping for was the most important driver behind gold’s (bodily) decoupling with paper holdings and costs (ETFs). However whereas many central banks preserve their purchases hidden from the general public and disclose solely what they wish to disclose, particularly within the case of the PBOC, right here hedge funds – maybe because of their capacity to gather and commerce on “private” central financial institution info – have develop into the barometer and real-time indicator of central financial institution buying. As such, spot gold costs at the moment are immediately correlating with web gold managed futures (Bloomberg ticker CFCDUMMN), as might be seen on the chart above.

However the place issues get attention-grabbing is that even ETF flows at the moment are turning optimistic, and when mixed with continued central financial institution shopping for, mixed with file Indian gold imports, mixed with unprecedented demand for bodily within the US, no surprise that gold is hitting new all time highs day after day.

However that is only the start, another excuse why gold is about to soar is the Fed’s current “recalibration”, whereby Powell launched the easing cycle with a jumbo fee reduce which gold clearly thought was pointless, therefore sending gold surging. That is how Rabobank’s Benjamin Picton put it this morning:

Gold costs traded at recent all-time highs on Friday, closing nicely above the $2600/oz barrier. The rally in gold appears unstoppable at this level and resets on the all-time-high have gotten a frequent prevalence. This maybe comes as no shock provided that the Fed wrong-footed many economists to begin the easing cycle with a supersized fee reduce at the same time as progress has remained sturdy, inflation above goal and the Federal deficit at eyewatering ranges.

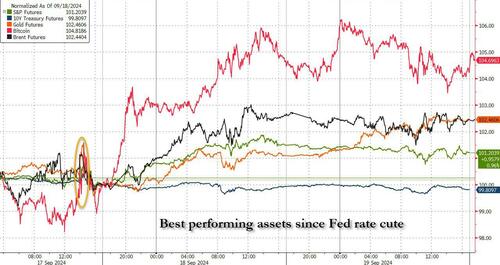

What was odd concerning the surge in gold, which has been the second finest performing property with simply Bitcoin outperforming since final week’s fee reduce…

… is that gold jumped at the same time as Treasuries sank. As Picton put it, “normally we’d anticipate a zero-yield asset that some disparagingly consult with as a “pet rock” to carry out poorly when market yields are rising. Fairness markets responded to the raise in long-end yields by closing the session flat within the case of the ‘cash right now’ Dow Jones, and down by 1/third of a share level within the case of the ‘cash tomorrow’ (we hope!) NASDAQ.”

“So why was gold insensitive to greater yields whereas equities weren’t”, the Rabobank strategist requested rhetorically? His reply…

Maybe markets merely picked up on Christine Lagarde’s feedback in Washington concerning the parallels between the 2020s and the Nineteen Twenties? Significantly the bit the place she cautioned that adherence to the gold commonplace within the Nineteen Twenties induced deflation (true) and contributed to the rise of financial nationalism.

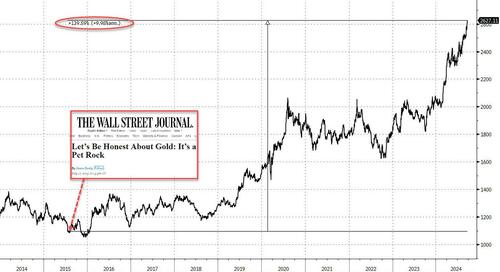

Lagarde’s level is that deflation is worse than the choice of inflation; so clearly it is smart to get lengthy “pet rock” whereas the world’s second strongest central banker is brazenly hinting that she views the erosion of your wage and financial savings because the lesser of two evils. And talking of pet rock, it’s up 140% because it was dubbed that by the WSJ’s Jason Zweig in 2015.

However fundamentals apart, a much more proximal purpose to show bullish on gold has emerged, and it has to do with what we mentioned up prime: over the previous 2 years, gold ETF holdings had declined, at the same time as the worth of gold rose. Properly, not any extra.

As Goldman’s ETF desk wrote in its weekly rundown report (full report obtainable to professional subs) “the desk has been fielding elevated demand for spot gold publicity through ETFs like GLD, GLDM, and IAU, and gold miners publicity through GDX” and consequently, the Goldman desk has acted as a greater purchaser throughout the gold advanced, which aligns with broader market sentiment – each GLD & IAU haven’t witnessed an outflow in practically a month. Because the center of August, +$3.3bn has been added to Gold ETFs. In different phrases, it is not simply central banks and hedge funds which might be ravenously shopping for gold: the most important driver of gold upside within the decade previous to the Ukraine warfare, ETFs, are about to hitch the fray too!

After which there may be silver.

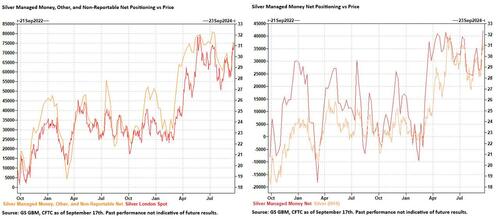

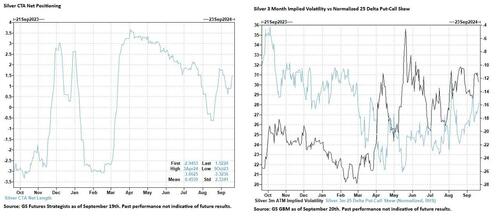

In keeping with Goldman Dealer Robert Quinn, whereas gold ETFs are lastly rising, silver managed cash longs (which recall have been the massive driver in gold costs previously two years) are hovering.

As Quinn observes, previous to the September Federal Reserve assembly, “speculative positioning in Silver futures surged, and Managed Cash dominated. With Producers reiterating a tighter bodily stability, decrease US actual charges and the Greenback served as incremental catalysts. After the Fed delivered a 50bps reduce, silver value prolonged greater nonetheless stream indicators have been extra blended.” Listed below are some extra observations from the Goldman dealer (full observe obtainable right here):

- Previous to the September Federal Reserve assembly, speculative positioning in Silver futures surged. Per Dedication of Merchants, mixed Managed Cash, Different, and Non-Reportable web size jumped $2.6bn from September tenth – seventeenth as value gained 8%. For context, the rise marked the 2nd largest over the previous 5 years. New longs have been the only driver.

- Managed Cash dominated. Managed Cash bought $2.3bn. Since late 2019, Managed Cash Silver shopping for exceeded $2bn in solely 3 different situations.

- With producers reiterating a tighter bodily stability, decrease US actual charges and the Greenback served as incremental catalysts. In a presentation, Fresnillo highlighted sturdy end-user demand because of 5G, photo voltaic, automotive, and nanotechnology. As well as, US 5 yr actual charges decreased 8bps and the Greenback Index misplaced -0.7%, sparking investor urge for food.

- After the Fed delivered, Silver value prolonged greater. Throughout September seventeenth – twentieth, Silver rose 1.7%.

- Nevertheless flows have been extra blended. GS Futures Strategists’ CTA mannequin exhibited lengthy augmentation. That mentioned, ETF Holders continued to promote into power, much like what they’ve been doing with gold till they lastly capitulated in current months. This, too, will not final. Furthermore, 3 month implied volatility cheapened whereas normalized 25 delta put-call skew richened. Name holders probably booked income.

- That mentioned, the time period construction has but to replicate a confused system. All through the aforementioned value power, December-March Silver truly declined. This appeared according to a number of indicators. First, Producer, Processor, Service provider, and Consumer shorts resided under common on September seventeenth. Secondly, COMEX inventories solely just lately retraced from a 1 yr peak. Thus regardless of Fresnillo’s rhetoric, bodily individuals possess capability to facilitate extra speculative longs.

In fact, identical to with the gold meltup, there may be solely a lot bodily that sellers and shorts can unload, reducing the worth, earlier than silver too explodes greater, and since its convexity is far higher than that of gold, it would not be stunning to see silver outperform gold considerably within the coming yr.

Lastly, these curious what Goldman’s commodity analysis desk thinks, here’s a hyperlink to the workforce’s newest observe “Fed Assist to Gold Costs; The Charges Relationship Is not Damaged” by which they make two factors which ZH readers have identified for a very long time: “first frequent argument towards Fed assist to gold costs is that the standard relationship between rates of interest and gold costs would have damaged down, as instructed by the divergence of their ranges since 2022…

… the perceived disconnect between gold costs and rates of interest is definitely because of elevated gold purchases by EM central banks involved about US monetary sanctions and rising US debt. This surge in central financial institution demand has elevated gold costs and reset the connection between gold costs and absolute rate of interest ranges.”

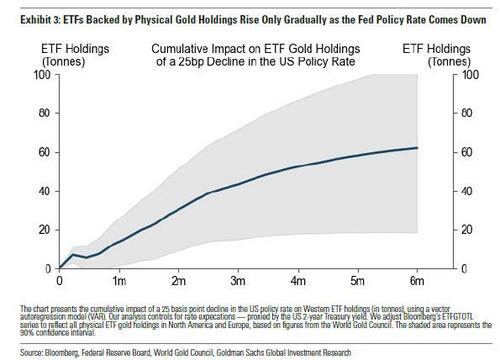

They then go on with the second frequent argument towards gold which is that “the gold market would have already got absolutely priced within the Fed rate of interest slicing cycle. Whereas the bond market has priced in additional rate of interest cuts than our economists’ baseline forecast (for 3 consecutive cuts in 2024, and an eventual terminal fee of three.25-35%), we discover that ETFs backed by bodily gold holdings rise solely steadily because the Fed coverage fee comes down. Particularly, we discover that the increase to ETF holdings from a coverage fee reduce rises steadily for about six months utilizing a statistical mannequin, which additionally controls for coverage fee expectations proxied with the US 2-year Treasury fee.1 Will increase in ETF holdings matter for gold costs.”

And here’s a beautiful admission from Goldman gold analyst Lina Thomas, which till a couple of years in the past might be heard solely among the many “tinfoil” gold bug blogosphere: “gold ETFs are absolutely backed by “allotted” bodily gold, rising ETF holdings cut back the bodily provide of gold obtainable to the market (in distinction to paper gold, which is usually not backed by bodily gold).”

Translation: the surge in gold ETF shopping for is just getting began.

So, in gentle of the above, Goldman’s commodity workforce reiterates its “lengthy gold buying and selling suggestion and our value goal of $2,700/toz by early 2025” for 3 causes:

- We consider that the tripling in central financial institution purchases since mid-2022 on fears about US monetary sanctions and US sovereign debt is structural and can proceed, reported or unreported.

- Fed fee cuts are poised to deliver Western capital again into gold ETFs, a element largely absent of the sharp gold rally noticed within the final two years. Since ETF holdings solely enhance steadily because the Fed cuts, this upside isn’t but absolutely priced in.

- Gold gives vital hedging worth to portfolios towards geopolitical shocks together with tariffs, Fed subordination threat, debt fears, and recessionary dangers. Our evaluation suggests a further upside of 15% in gold costs underneath a hypothetical rise in monetary sanctions equal to the rise seen since 2021 and an analogous upside if US CDS spreads widen by 1 commonplace deviation (13bps) amid rising debt issues.

Add to this the technicals and stream points described above and the transfer in gold is simply getting began.

Extra within the full notes obtainable to professional subs right here, right here and right here.

Loading…