A surge in demand amongst Indian shoppers for gold jewelry and bars after a current minimize to tariffs helps to drive world bullion costs to a sequence of contemporary highs.

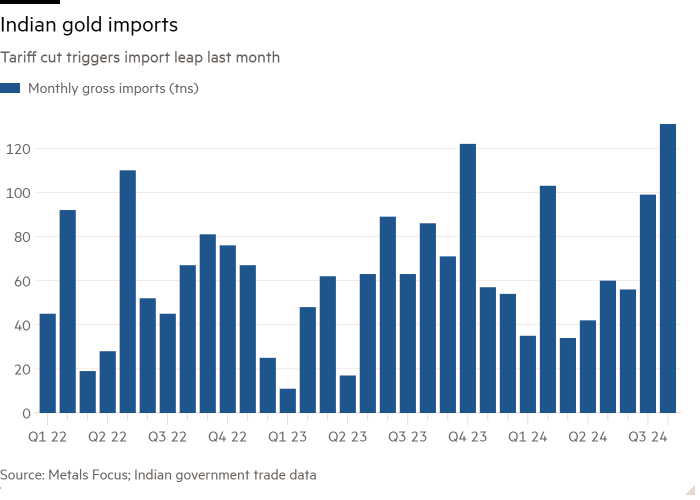

India’s gold imports hit their highest degree on report by greenback worth in August at $10.06bn, in accordance with authorities information launched Tuesday. That means roughly 131 tonnes of bullion imports, the sixth-highest whole on report by quantity, in accordance with a preliminary estimate from consultancy Metals Focus.

The excessive gold value — which is up by one-quarter because the begin of the yr — has historically deterred price-sensitive Asian consumers, with Indians lowering demand for gold jewelry in response.

However the Indian authorities minimize import duties on gold by 9 share factors on the finish of July, triggering a renewed surge in demand on the earth’s second-largest purchaser of gold.

“The influence of the obligation minimize was unprecedented, it was unimaginable,” mentioned Philip Newman, managing director of Metals Focus in London. “It actually introduced shoppers in.”

The tariff minimize has been a boon for Indian jewelry shops akin to MK Jewels within the upmarket Mumbai suburb of Bandra West, the place director Ram Raimalani mentioned “demand has been unbelievable”.

Clients have been packed into the shop shopping for necklaces and bangles on a current afternoon, and Raimalani is anticipating an annual gross sales increase of as a lot as 40 per cent through the multi-month competition and marriage ceremony season that runs from September to February.

Raimalani praised India’s authorities and “Modi ji”, an honorific for Prime Minister Narendra Modi, for lowering gold duties.

Expectations of fast rate of interest cuts by the US Federal Reserve have been the principle driver of gold’s enormous rally this yr, in accordance with analysts. Decrease borrowing prices enhance the attraction of property with no yield, akin to bullion, and are additionally more likely to weigh on the greenback, through which gold is denominated.

The Fed minimize charges by half a per cent on Wednesday, pushing gold to one more report excessive, just under $2,600.

However robust demand for gold jewelry and bars, in addition to shopping for by central banks, have additionally helped buoy costs.

India accounted for a few third of gold jewelry demand final yr, and has change into the world’s second-largest bar and coin market, in accordance with information from the World Gold Council, an trade physique.

Nevertheless, that demand has meant that home gold costs in India are rapidly catching as much as the extent they have been at earlier than the tariff obligation minimize, in accordance with Harshal Barot, senior analysis guide at Metals Focus.

“That complete profit [of the tariff cut] has form of vanished,” mentioned Barot. “Now that costs are going up once more, we should see if shoppers nonetheless purchase as common.”

Jewelry shopping for had been flagging earlier than the minimize in import obligation, with demand in India within the first half of 2024 at its lowest degree since 2020, in accordance with the World Gold Council.

India’s central financial institution has additionally been on a gold shopping for spree, including 42 tonnes of gold to its reserves through the first seven months of the yr — greater than double its purchases for the entire of 2023.

An individual acquainted with the Reserve Financial institution of India’s pondering referred to as the gold purchases a “routine” a part of its overseas change reserve and forex stability administration.

In China, the world’s greatest bodily purchaser of gold, excessive costs have meant fewer jewelry gross sales, however extra gross sales of gold bars and cash, which surged 62 per cent within the second quarter in contrast with a yr earlier.

“We noticed robust optimistic correlation between gold funding demand and the gold value,” wrote the World Gold Council, referring to China.

All of this has helped assist the bodily market and mitigate the influence that prime costs can have in eroding demand.

“It acts as a steady basis for demand,” mentioned Paul Wong, a market strategist at Sprott Asset Administration. “In elements of Asia, gold is quickly convertible into forex,” making it standard for financial savings, he mentioned.

Western investor demand has additionally been an enormous think about bullion’s rally, with a web $7.6bn flowing into gold-backed change traded funds over the previous 4 months.

After hitting a contemporary excessive on Wednesday, analysts warn there could possibly be a correction within the gold value.

“When you will have this scale of anticipation [of rate cuts], for this lengthy, there’s room for disappointment,” mentioned Adrian Ash, London-based director of analysis at BullionVault, a web based gold market. “I believe there’s scope for a pullback in valuable alongside different property.”

Whether or not or not gold pulls again from its report highs, Indian jewelry demand appears set to stay robust by the approaching marriage ceremony season, in accordance with MK Jewels’ Raimalani.

Hovering costs of bullion have been no deterrent to his prospects, he added. “Indians are the happiest when costs go excessive as a result of they already personal a lot gold. It’s like an funding.”