On October 19, 1987, the monetary world stood nonetheless as markets throughout the globe skilled an unprecedented meltdown. This present day, now etched in historical past as “Black Monday,” noticed the Dow Jones Industrial Common (DJIA) plummet by an astonishing 22.6% – a record-breaking single-day drop that also stands 37 years later.

The crash despatched shockwaves by world monetary programs, wiping out billions in market worth and leaving buyers scrambling for solutions. It wasn’t simply Wall Avenue that felt the affect; from Tokyo to London, markets tumbled in a domino impact that highlighted the interconnectedness of the worldwide financial system.

Black Monday served as a stark reminder of the market’s volatility and the potential for fast, widespread losses. It challenged long-held assumptions about market conduct and threat administration, in the end reshaping monetary laws and buying and selling practices for many years to come back.

On this article, we’ll dive deep into the occasions main as much as Black Monday, look at its speedy affect, and discover the lasting modifications it delivered to the monetary world. We’ll additionally take a look at how completely different belongings, notably gold, carried out throughout and after this disaster, providing worthwhile insights for at the moment’s buyers.

So, what precisely led to this historic crash, and what classes can we draw from it in at the moment’s ever-evolving monetary panorama?

The Markets Earlier than the Crash

The mid-80s noticed inventory markets hovering. From August 1982 to August 1987, the DJIA surged from 776 to a peak of two,722. By August 1987, it had rocketed up by 44% in simply seven months. The euphoria was palpable, however beneath the floor, whispers of a bursting bubble grew louder.

By mid-October, a sequence of unsettling information studies start to shake investor confidence. The U.S. authorities reveals a commerce deficit that is bigger than anybody anticipated, and the greenback’s worth took a giant hit.

All of this directly was an excessive amount of and the markets started to falter, hinting on the chaos that is about to unfold. Then, on October 16, amidst this turmoil, we hit “triple witching” – a day when inventory choices, inventory index futures, and inventory index choices all expire on the identical day.

Triple witching days can see elevated buying and selling exercise as merchants shut, roll out, or offset their expiring positions, notably within the closing hour of buying and selling. This will typically result in elevated volatility within the markets. The stage was set for Black Monday.

Black Monday: The Day Darkness Descended

On Black Monday, a mixture of automated buying and selling programs, panic promoting, and world contagion led to a market meltdown. It was like watching dominos topple, however on a worldwide scale. The world watched in horror as inventory markets crashed in all places.

Because the massacre in shares occurred on Black Monday, gold initially climbed $19.90, or 4.2%, to a excessive for the day of $491.50. However then the steel turned south and settled at $481.70 and the following day slid to $463.20, which was a lack of $28.30, or 5.8%, from Monday’s peak.

It seems that folks had been busy liquidating something, together with gold, to boost money. Throughout any disaster, there’s a likelihood that gold goes down for this very motive.

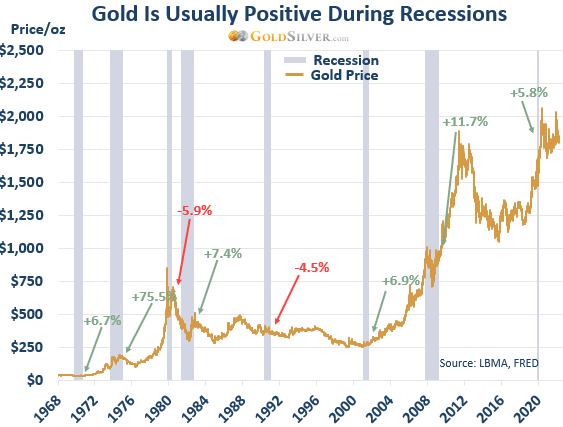

However traditionally gold has a robust observe report of performing effectively after a disaster. The next graph exhibits the 9 greatest crashes within the S&P 500 because the mid-Seventies, when the “gold window” was closed and the worth was not pegged to the U.S. greenback.

Restoration: The Put up-Crash Panorama

Put up Black Monday, there was a scramble to make sure such a disaster would not repeat. Regulators revamped buying and selling protocols and launched “circuit breakers” to pause buying and selling throughout excessive market dips, giving buyers a breather and an opportunity to regroup.

Apparently, whereas the markets had been in chaos, the Federal Reserve and different central banks jumped into motion. Because of their intervention, the Dow bounced again from its 22% drop comparatively shortly.

As Black Monday exhibits, gold gained’t robotically rise with each downtick within the inventory market. Typically throughout the chaos, buyers could must promote no matter belongings they’ve, together with gold, for money.

But, historical past has persistently proven gold’s resilience as a protected haven throughout crises. Whereas many view gold merely as a hedge, its potential as a strong asset throughout affluent occasions is usually missed.

Many individuals consider gold solely has a hedge and underestimate gold’s energy as an asset throughout good occasions. Because the U.S. departed from the Bretton Woods system and the gold customary within the early Seventies, gold has appreciated roughly 50-fold.

Furthermore, since 2000, gold is quietly up over 800%, outshining standard belongings like shares, bonds, and actual property by a large margin.

Your Path to Monetary Stability Begins with Gold

Within the ever-shifting panorama of worldwide finance, gold stays a beacon of stability. Allow us to allow you to harness its enduring worth.

In the event you’ve but to incorporate gold in your funding portfolio, take into account this your wake-up name. In the event you don’t safe your monetary future with actual belongings, nobody else will.

And for these already invested in gold, keep in mind: we’re right here to help you in increasing and optimizing your holdings.

Do not watch for the following market shakeup. Safe your monetary future with gold at the moment.

ADD GOLD TO YOUR PORTFOLIO TODAY

Till subsequent time!

Finest,

Brandon S.

GoldSilver