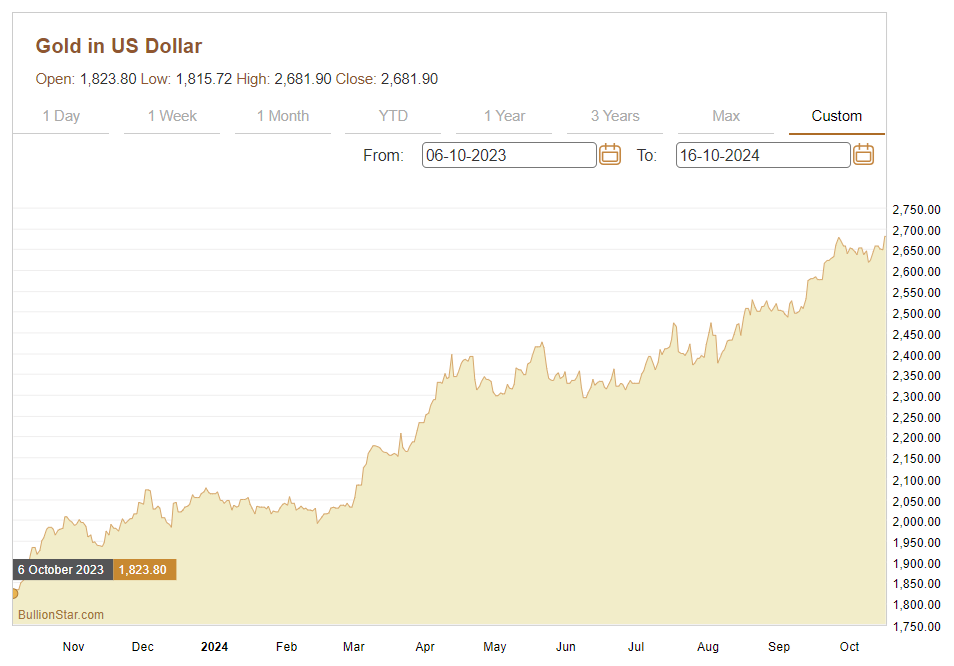

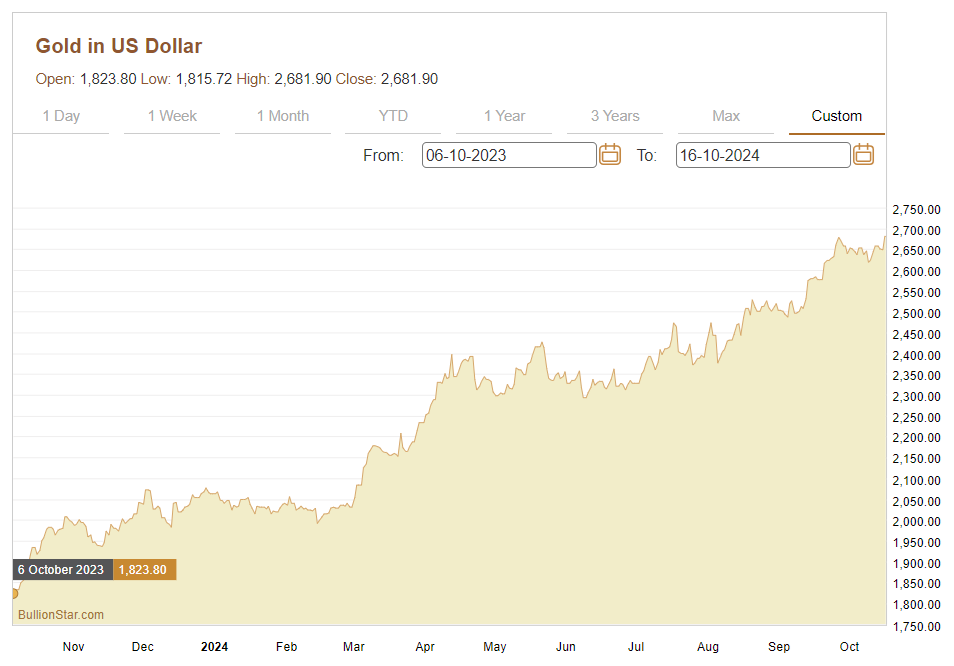

One of many standout tendencies in monetary markets this yr has been the fast appreciation within the worldwide gold value to constant new all-time highs above US$ 2680. 12 months-to-date, the USD spot value of gold is up 30% at $2681 on the time of writing, with most of this enhance occurring over a seven and a half month interval since early March after the value broke out of a buying and selling vary simply above US$ 2000.

Even when this year-to-date efficiency is maintained and the value stays the place it’s now, it could imply that 2024 will document the very best annual calendar yr gold value return since 2007 (when the gold value rose by 30.9%), and could be the second finest performing yr for the reason that new millennium.

The US greenback gold value can be now up an astonishing 47.7% since 6 October 2023 when it lingered across the $1815 mark. What a distinction a yr makes!

Not solely has the gold value damaged out to all-time highs in US greenback phrases, it has additionally damaged out to all-time highs in each main fiat forex, together with the Euro, British pound, Japanese yen, Chinese language yuan, Swiss franc, Australian greenback, Singapore greenback, Hong Kong greenback and Canadian greenback.

The rapidity of the gold value rise since March 2024 has additionally been astounding, with the value surge having been pushed by a mix of things which have led traders to hunt out gold as a protected haven, as a retailer of worth and as an inflation hedge:

• Geopolitical uncertainty and battle (notably from conflicts in Ukraine/Russia and the Center East)

• A financial coverage shift by the Federal Reserve and different central banks from rate of interest tightening to an rate of interest slicing cycle

• Elevated inflation expectations and forex debasement fears

• Issues over renewed quantitative easing, accelerating cash provide development, and an ever rising US federal debt

Moreover, as a result of expectation of upper gold costs and the ensuing momentum, the gold value has seen speculative buying and selling exercise on derivatives exchanges in China (the Shanghai Futures Change – SHFE) and on the COMEX.

De-dollarisation themes are additionally turning into influential in shaping traders’ perceptions of gold as a result of hypothesis about gold’s function in a future BRICS financial system, in addition to the continuous strikes by central banks to extend the gold element of their reserve belongings, provided that bodily gold held in their very own vaults has no counterparty danger or sanctions danger.

Increasingly more individuals within the international monetary markets are thus flocking to acquire publicity to the gold value, in order to profit from the perennial protected haven and retailer of worth attributes which gold gives, and as a type of monetary insurance coverage and wealth preservation.

An Underneath-the-Radar Transfer

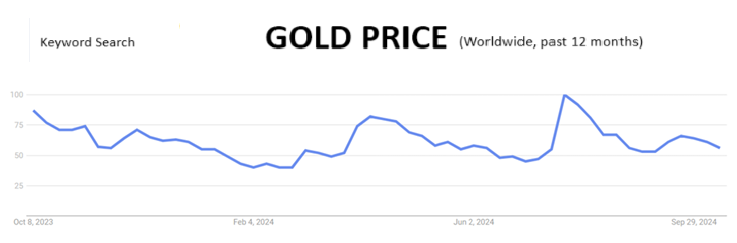

Nonetheless, this gold bull transfer continues to be in some methods an under-the-radar stealth rally, and has arguably not but gained common investor consideration.

Curiously, on a worldwide foundation, the search time period ‘Gold Value’ in Google Tendencies has truly been falling because it peaked at ‘100’ over the last week of July, and is now at ‘69’, which is even beneath a secondary peak which was recorded in mid April 2024 (which had a price of ‘82’). In reality, when it comes to search frequency, ‘Gold Value’ as a key phrase search time period is now beneath ranges recorded in early December 2023 (when it recorded a price of ‘71’).

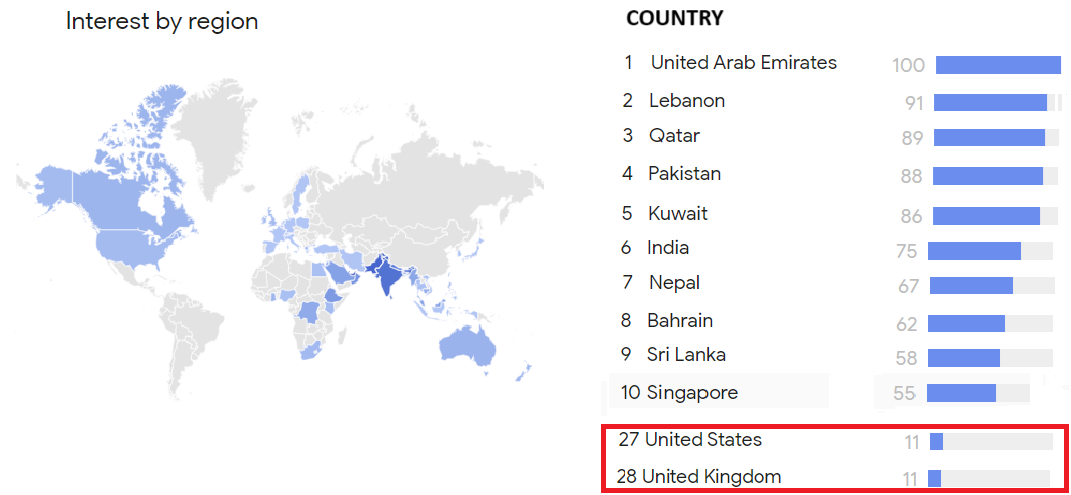

On a rustic foundation, the nations recording the very best search curiosity in ‘Gold Value’ are, not surprisingly, nations within the Center East and South Asia / South East Asia, such because the United Arab Emirates (with an ideal rating of ‘100’), Lebanon (with a rating of ‘91’), Qatar (‘89’), Kuwait (‘86’), and India (‘75’). These very excessive scores are as a result of these nations both being gold buying and selling hubs, and/or nations with conventional eager curiosity in gold, in addition to arguably a geopolitical danger premium as a result of conflicts within the Center East.

Notably, curiosity within the search time period ‘Gold Value’ continues to be anemic within the US and UK, with every having a paltry rating of ‘11’ a chunk, which is a helpful metric exhibiting that curiosity in gold in these Western nations continues to be nothing like a frenzy and has not been picked up by the mainstream funding neighborhood.

Speedy Gold Value Appreciation

There have solely been a handful of occasions since 2000 the place the gold value has risen with such rapidity over reminiscent of brief interval, and the March – October 2024 interval is certainly one of them.

The opposite time intervals included September 2007 – March 2008 (the worldwide monetary disaster as main monetary establishments collapsed), August 2010 – March 2011 (accelerated quantitative easing globally), February – August 2011 (European debt disaster and US credit standing downgrade), June 2019 – February 2020 (China – US commerce wars and the start of US rate of interest cuts), and March – August 2020 (Covid lockdowns and international stimulus).

However whereas in a lot of these time intervals, the rising gold value was signalling a response to a particular financial occasion that was bounded by time, the gold value bull market of 2024 is completely different as a result of it’s based mostly on a broad vary of drivers and considerations which can be unbounded by time. That’s the reason the present gold value rally might have endurance.

All-Time-Highs in all Main Currencies

One other key trait of the gold value rally of 2024 is that it has created constant new all time highs for the gold value in all main fiat currencies. Whichever main fiat forex you decide, the gold value has been making new all-time highs in that forex, a reality which highlights that this gold value bull market just isn’t based mostly on US greenback weak point.

For instance, in Euro phrases, the gold value has this week made an all time excessive above €2,455 per oz, and is up by greater than €575 for the reason that finish of February, a reality which won’t have gone unnoticed by the European Central Financial institution (ECB), nor by the thousands and thousands of bodily gold consumers all throughout Germany and the remainder of the Eurozone.

The Singapore greenback gold value has added almost SGD 750 since late February and this week hit a brand new all time excessive above SGD 3500, a improvement which will probably be welcomed by BullionStar’s in depth buyer base in Singapore and South East Asia.

From wanting on the US Greenback Index (DXY), it’s evident that each one of those continuous new all-time highs within the gold value throughout a number of main fiat currencies throughout 2024 should not as a result of US greenback weak point, as a result of throughout a few of 2024 bull run the gold value in US greenback phrases has been rising whereas the US greenback has been strengthening, for instance throughout March-April, and once more throughout the first two weeks of October.

The US Greenback Index (DXY) measures the worth of the US greenback relative to a weighted basket of the Euro, Japanese yen, British pound, Canadian greenback, Swedish krona, and Swiss franc, The DXY rises when the US greenback strengthens vs the element currencies, and vice versa.

US and International Curiosity Charge Cuts

A current shift within the US and different main central banks’ official rate of interest insurance policies to rate of interest slicing cycles has additionally had a considerable impression on the current power of the gold value.

Essentially the most influential shift in rate of interest coverage has come from the US, whereon 18 September, the US Federal Reserve’s FOMC lower the US benchmark rate of interest by a sizeable 0.5% to a variety of 4.75% – 5.00%, citing a taming inflation whereas conceding that the US unemployment price is simply too excessive.

This was the primary US Fed curiosity in over 4 years (since March 2020), and so it’s extremely important. It was a bigger lower than the market had been anticipating. For instance, one week earlier than the FOMC announcement, the market (based mostly on the CME FedWatch instrument) had been pricing in a 73% chance of a 25 foundation factors lower vs a 27% chance of a 50 foundation level lower.

The FOMC’s 19 members additionally signalled by way of their dot-plot predictions that there will probably be one other 0.5% discount in US benchmark rates of interest by the tip of 2024, which might be introduced in a single or each of the remaining FOMC conferences scheduled for this yr, 6-7 November and 17-18 December.

On the time of writing, the CME FedWatch instrument (which makes use of the pricing of 30-day Fed Fund Futures contracts) was signalling that for the November FOMC assembly, there’s a 84% chance of a 0.25% lower and a 16% chance of no lower (with one other price lower implicitly put again to December).

Monetary markets due to this fact now have extra perception that the speed cuts which have began in September are the start of a US rate of interest slicing cycle. Which once more is all good for the gold value and explains a few of the current gold value appreciation.

Different main financial areas have additionally begun rate of interest slicing cycles with the European Central Financial institution (ECB) starting a brand new cycle of rate of interest cuts in June (citing that inflation was underneath management) and slicing the ECB deposit price from 4% to three.75%. This was adopted up in September by one other 0.25% lower, bringing the deposit price to three.5%. A third rate of interest lower is anticipated by the ECB later this week.

Within the UK, the Financial institution of England, for the primary time since March 2020, lower its benchmark rate of interest from 5.25% to five% in August, and the Financial institution of England governor Andrew Bailey now says that UK rate of interest cuts needs to be extra aggressive. This too means the UK is ready to embark on a price slicing cycle, all of which is gold constructive.

In China, authorities are additionally busy slicing rates of interest and flooding the financial system with liquidity in an try to spice up China’s ailing financial system. In late September, the Chinese language central financial institution introduced a sequence of rate of interest cuts and financial institution liquidity measures, and much more not too long ago, the Chinese language authorities introduced large fiscal stimulus of over $300 billion final week focused at bounce beginning China’s faltering property and shopper sectors.

With the world’s main central banks now embarking on rate of interest slicing cycles and financial stimulus, markets see this as gold constructive, taking the view that decrease rates of interest scale back the chance value of holding “non-yielding” gold. Nonetheless, there’s a extra vital element right here and that’s inflation expectations.

Whereas central banks declare that they’re now slicing rates of interest as a result of having succeeded in bringing inflation down, this seems to be like a smokescreen to hide the actual fact they they’re primarily slicing charges due to elevated considerations in regards to the danger of financial downturn and/or recession.

So in essence, central banks at the moment are strolling a wonderful line between juicing up financial development and retaining inflation underneath management whereas stopping stagflation (simultaneous financial stagnation and inflation). However provided that the gold value continues to rise and provided that gprevious acts as a hedge towards future inflation, a few of this gold value power seems to be to be signalling renewed future inflation and that larger inflation expectations are on the horizon.

Debt and Cash Provide Development

The strengthening gold value can be a mirrored image of the unsustainable and quickly deteriorating fiscal conditions on each US and International ranges and quickly increasing cash provide metrics, all of which level to continued fiat forex debasement.

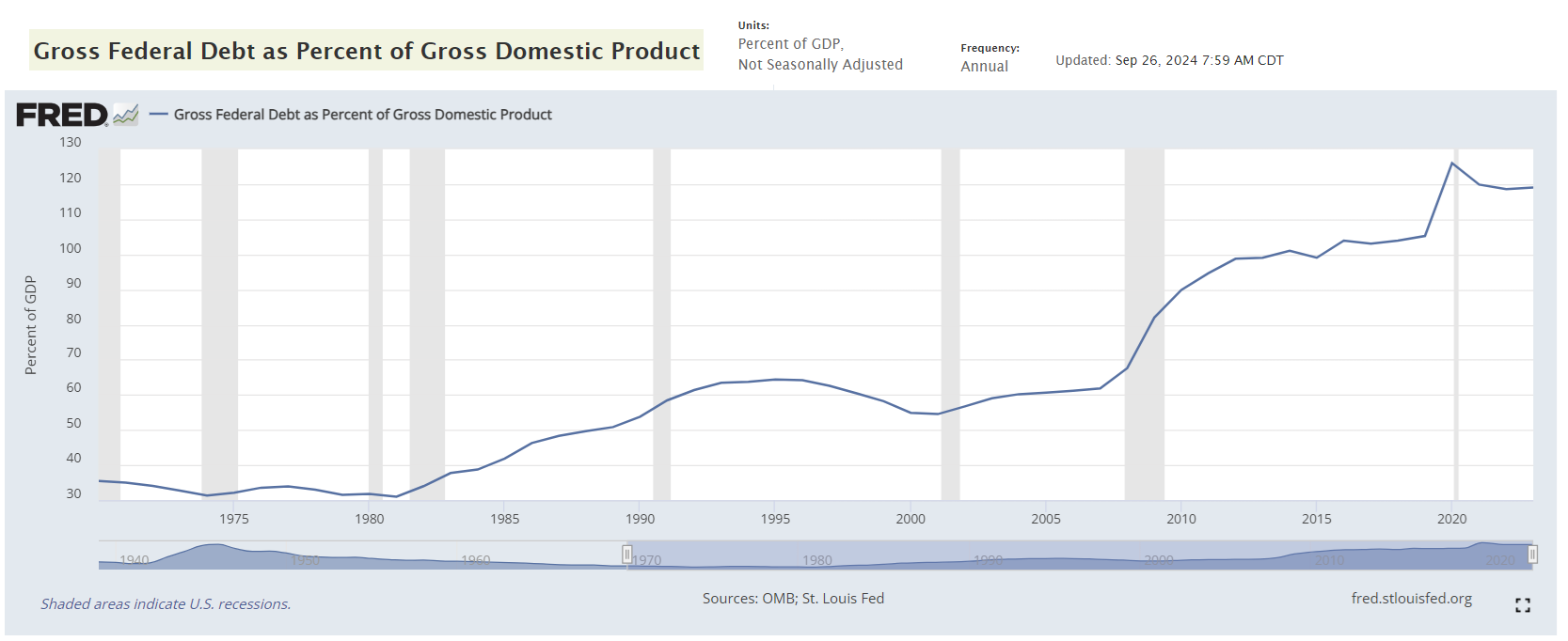

The US nationwide debt (federal debt) continues to spin uncontrolled and has now hit an unprecedented US$ 35.7 trillion, whereas the US federal debt to GDP ratio is now 124%. The US federal funds deficit is now at a staggering $ 2.2 trillion. See the USDebtClock right here. And now, for the primary time ever, curiosity funds on US federal debt have hit greater than US$ 1 trillion per yr.

This enormous federal debt will in some unspecified time in the future turn out to be unsustainable, and even now it has no probability of being lowered by tax will increase or spending cuts, and its fixed development will increase the chance of a US debt default in some unspecified time in the future sooner or later, except the US Authorities makes an attempt to inflate the debt away by creating extra inflation, a state of affairs which once more could be very gold constructive.

International debt ranges are additionally more and more regarding. In accordance with the Institute of Worldwide Finance (IIF) International Debt Monitor, whole international debt (as of Might 2024) reached a document US$ 315 trillion. And the Worldwide Financial Fund (IMF) has simply printed it’s Fiscal Monitor for October 2024, saying that ‘international public debt’ (of governments) is anticipated to exceed US$100 trillion in 2024.

In addition to the US, different main economies are exhibiting extraordinarily excessive debt-to-GDP ratios; reminiscent of Japan with a public debt to GDP ratio of 302%, Italy (174%), France (130%), Spain (136%) and the UK (110%). See World Debt Clock right here.

International Debt Hits a New Excessive of $315 Trillion 💸

📲 Need extra content material like this with day by day insights from the world’s prime creators? See it first on the @VoronoiApp.https://t.co/ThNsVM3QRN pic.twitter.com/SAxkLnKaQO

— Visible Capitalist (@VisualCap) August 23, 2024

International cash provide can be accelerating quickly as a result of central financial institution ‘cash creation’ out of skinny air, and is now over $107 trillion. Over the long run, as gold retains its buying energy, the worth of above floor gold will regulate to mirror this enormous enhance in fiat forex cash provide.

Nonetheless, with international debt of over $315 trillion, and international cash provide of $107 trillion, the full market worth of all above above floor gold is tiny as compared at roughly US$ 18.42 trillion.

This $18.42 trillion relies on World Gold Council knowledge, and is calculated as “whole above-ground inventory (end-2023)” of 212,600 tonnes + “estimated 2024 gold mine manufacturing” of 3600 tonnes = 216,200 tonnes * 32150.7 troy ozs per tonne * present gold value of $2650 per troy oz = US$ 18.42 trillion.

In different phrases, international debt is 17 occasions bigger than the present market worth of all identified above floor gold inventories, and international M3 cash provide is 5.8 occasions bigger than the present market worth of all identified above floor gold inventories. For the full worth of above floor gold to converge in direction of the greenback worth of this unprecedented debt and cash provide development, the gold value due to this fact has plenty of catching as much as do.

International Cash Provide hits all-time excessive of $107 Trillion pic.twitter.com/ArrFcaQPbU

— Win Sensible, CFA (@WinfieldSmart) October 10, 2024

Inflation-Adjusted Costs of Gold

Whereas there may be plenty of pleasure within the gold world as a result of ‘new all-time-highs‘ within the gold value, there is a vital caveat to recollect – these all time highs are solely true in a nominal sense, and don’t mirror cumulative inflation over time.

Whenever you regulate the gold value by previous inflation, be it the official US Shopper Value Inflation (CPI) knowledge of the Bureau of Labor Statistics (BLS), or by the arguably much more real looking and better inflation measurements produced by ShadowStats (i.e. the ShadowStats Alternate CPI (1980 Base)), the gold value is the truth is far lower than inflation-adjusted all time highs, and within the case of the ShadowStats measurement, an enormous quantity lower than the inflation-adjusted excessive.

Adjusting for inflation by the present BLS US Shopper Value Index (CPI), the actual all-time-high of the US greenback gold value was in January 1980 at US$ 3680 per troy ounce.

Nonetheless, there’s a broadly held view that the CPI calculations of the US Bureau of Labor Statistics intentionally underestimate shopper value inflation. Aside from the proof obtainable to the particular person on the road that precise value will increase (or actual inflation) is way larger than the BLS says it’s, there’s a motivation for the US authorities (and all governments) to underestimate inflation charges in order to make economies seem wholesome and in order that inflation-linked authorities payouts reminiscent of pensions, social safety, and inflation-linked debt will probably be minimised. Subsequently the BLS (and all governments) consistently change the methodology of calculating official inflation in order to minimise the inflation charges

Because of this different inflation price suppliers reminiscent of ShadowStats, with its Alternate CPI have emerged to push again towards this authorities manipulation and to offer extra correct inflation calculations.

Aa such, the “Alternate CPI” from ShadowStats is an estimate of inflation up till right now as if it had been calculated utilizing the methodologies that the Bureau of Labor Statistics utilized in 1980 once they had been much less corrupted. As ShadowStats explains:

“The Alternate CPI displays the CPI as if it had been calculated utilizing the methodologies in place in 1980.

Typically phrases, methodological shifts in authorities reporting have depressed reported inflation, shifting the idea of the CPI away from being a measure of the price of residing wanted to keep up a continuing way of life.”

ShadowStats additionally says that:

“The ShadowStats Different CPI-U measures are makes an attempt at adjusting reported CPI-U inflation for the impression of methodological change of current many years”

In an article explaining the Bureau of Labor Statistics flaws, Shadowstats additionally says that:

“the Shopper Value Index has been reconfigured for the reason that early-Nineteen Eighties in order to understate inflation versus frequent expertise”.

When adjusted utilizing the Different CPI-U (which bear in mind is only a former CPI methodology of the Bureau of Labor Statistics), the actual inflation-adjusted all-time-high for the gold value is an enormous US$ 29,170 per oz (based mostly on the January 1980 nominal gold value excessive).

Underneath this revision, there may be nonetheless an terrible lot of room for the present gold value to rise (greater than 11 fold) earlier than it approaches the actual 1980 BLS methodology inflation-adjusted all-time-high. Fairly a staggering quantity to consider.

For extra background in regards to the methodologies used to create these charts, see BullionStar article “The Staggering ranges of inflation-adjusted costs of gold and silver“.

ES >5800

China melting up

Japan melting up

US melting up… as all central banks interact in coordinated, international easing pic.twitter.com/GIO49Jp0R5

— zerohedge (@zerohedge) October 4, 2024

Gold value fuelled by derivatives – Sure, as All the time

For the reason that worldwide gold value broke out and started earnestly shifting above the $2000 buying and selling vary beginning in March this yr, varied commentators within the London monetary media have tried to elucidate the fast value rise, and have come spherical to the view that it has been gold derivatives, and never the bodily gold market, which have been the driving force behind value will increase.

For instance, in a 23 April Monetary Occasions (FT) article written by Harry Dempsey and Cheng Leng, titled “Chinese language speculators super-charge gold rally”, at which period the gold value had reached $2400, the FT acknowledged its perception that Chinese language speculators on the Shanghai Futures Change (SHFE) had performed a big function in driving this gold value rise.

This was, stated the FT, as a result of “lengthy gold positions held by futures merchants on the SHFE”, positions which by then had surged nearly 50% since late September 2023 to almost 300,000 contracts (equal to 300 tonnes of gold), pushed by what the FT put right down to geopolitical tensions within the Center East, and home Chinese language crises within the property sector and inventory market.

This speculative exercise, says the FT, was led by Chinese language futures buying and selling corporations reminiscent of Zhongcai Futures, Citic Futures and Guotai Junan Futures.

Extra not too long ago on 26 September this yr (by which period the gold value had reached $2670), Ross Norman CEO of Metals Every day (and previously of Sharps Pixley, Credit score Suisse and N.M. Rothschild) in an article titled “Gold – The derivatives tail wagging the golden canine?” , additionally subscribed to the Chinese language specs principle, saying that from earlier this yr “the Chinese language specs caught their oar in, shopping for on alternate and OTC forwards, futures and choices. And so they purchased in large measurement” both as a result of expectations of US Fed rate of interest cuts or considerations over the Chinese language property sector.

There was then a“second part to the Chinese language specs – and that’s the US specs … they’ve joined the occasion late … with futures longs now at a close to 4 yr excessive”. Norman says that “the concept that the market is derivatives lead is sensible in some ways” provided that the gold value nonetheless rose concurrently official US inflation charges fell, the greenback rose and treasury yields rose.

Whereas these observations from the FT and Ross Norman concede the function of gold derivatives in driving the gold value in these current situations, they fail to spotlight that the worldwide gold value is all the time and solely set by paper gold markets, and never by non-physical gold markets, a theme which BullionStar has been on the forefront of explaining for a few years.

The gold value is established in derivatives markets, primarily the London OTC gold market, the COMEX paper gold futures market, and extra not too long ago the Chinese language SHFE. The London OTC gold market being a venue the place unallocated gold, which is a by-product and a type of artificial gold or gold credit score or fractionally backed gold, is traded. These are the value making venues.

Provide of and demand for bodily gold performs no function in setting the worldwide gold value. Bodily gold transactions in all different gold markets (value takers) simply inherit the gold costs which can be found in these by-product gold buying and selling markets (value makers).

See BullionStar article “What Units the Gold Value – the Paper or Bodily Market?” and BullionStar Gold College primer “Bullion Banking Mechanics”.

The gold value feeds that you simply see in your display from CNBC, Bloomberg, Reuters and many others are simply feeds that soak up ‘display gold’ XAU/USD quotes based mostly on the buying and selling of LBMA bullion financial institution buying and selling desks and the buying and selling of interdealer brokers and sellers reminiscent of LBMA members TP ICAP, Marex Spectron, BGC Companions, GFI Group, Sucden Monetary, and Triland Metals.

Central Banks shopping for doesn’t transfer the Gold Value

Which brings us to an vital level. Almost all mainstream monetary media commentators and plenty of gold sector commentators nonetheless keep that the gold value bull run is being pushed by amongst different components, central financial institution gold shopping for of bodily gold. You’ll be conversant in many gold articles with titles reminiscent of “Gold pushed to new excessive as a result of document central financial institution gold shopping for” and many others.

However in actuality, central banks don’t want their gold shopping for transactions to affect the gold value. They need the alternative. That’s the reason central banks purchase and promote gold (and lease and swap gold) in secret in London, coordinated by the Financial institution of England and by way of the Financial institution for Worldwide Settlements (BIS) buying and selling desk, the place they web off consumers and sellers in order to minimise value impression. The Financial institution of England and BIS could even use a queueing or rationing system for bodily gold, permitting some central banks to purchase some gold from different central banks after which some from annual new provide / recycling. This could clarify why solely a handful of central banks ever appear to be shopping for gold in anyone month.

No central financial institution desires the gold value to interrupt out in an uncontrolled method, as all of them wish to shield their fiat currencies. Do not forget that gold to central bankers is just like the solar to vampires. The secrecy round central financial institution gold transactions and the London gold lending market exists in order that central financial institution gold transactions don’t have an effect on the market value of gold.

Some could discover it shocking that even the Folks’s Financial institution of China (PBoC) and the Central Financial institution of the Russian Federation are central financial institution members of the BIS, together with 61 different central banks.

China has even gone on document saying that it doesn’t wish to affect the gold value with its gold shopping for. In 2010 “an official from the China Gold Affiliation (CGA)” informed China Every day that:

“Opposite to a lot hypothesis China could not purchase the Worldwide Financial Fund’s (IMF) remaining 191.3 tons of gold which is up on the market as it doesn’t wish to upset the market.”

“It isn’t possible for China to purchase the IMF bullion, as any buy and even intent to take action would set off market hypothesis and volatility”.

Regardless of this denial, China is definitely a first-rate candidate for having bought this 191.3 tonnes of IMF gold again in 2010. That’s the reason particulars on the IMF on-market gross sales of gold in 2010 stay ‘extremely confidential’, and the IMF has determined “to not declassify these paperwork due to the sensitivity of the subject material”. For particulars see BullionStar article “IMF Gold Gross sales: The place ‘Transparency’ Means ‘Secrecy’”.

Additionally in March 2013, Yi Gang, deputy governor of the Chinese language central financial institution, offered additional proof that central banks don’t want their gold shopping for to maneuver the gold value:

“We may also consider a secure gold market. If the Chinese language authorities had been to purchase an excessive amount of gold, gold costs would surge, a state of affairs that may damage Chinese language customers. We will solely make investments about 1-2 % of the overseas alternate reserves into gold as a result of the market is simply too small”.

See BullionStar article “Chinese language Central Financial institution Gold Guying – On a Must Know Foundation”.

BRICS 2024 Summit – Kazan

All eyes may also be on the upcoming sixteenth BRICS annual summit, which this yr, as a result of Russia holding the BRICS Chairmanship, takes place between 22 – 24 October within the Russian metropolis of Kazan.

Kazan is an historic metropolis within the Republic of Tatarstan roughly 500 miles east of Moscow, and 1.5 hours flight time from Moscow.

The Enormous BRICS summit in Russia’s Kazan is gearing up and can start on Oct twenty second.

It’ll be attended by Presidents and Prime Minister’s from dozens of nations, together with:

🇹🇷 President of Turkiye Recep Tayyip Erdogan

🇨🇳 President of China Xi Jinping

🇧🇾 President of Belarus… pic.twitter.com/vXRnW6Vghs

— Yunus Arslan (@yunus_arslan_ya) October 12, 2024

This will probably be an intriguing BRICS summit for quite a lot of causes. Not solely will it’s the primary annual BRICS summit through which the 5 new BRICS member nations of Saudi Arabia, the United Arab Emirates (UAE), Iran, Egypt and Ethiopia will probably be attending as full members alongside Brazil, Russia, India, China and South Africa, however additionally it is anticipated that this summit might see an announcement about using gold as a part of a world settlement mechanism in a standard unit of account referred to as (UNIT).

The UNIT will probably be a world unit of account, 40% pegged to the worth of gold, and 60% to a basket of BRIC nation nationwide currencies.

Andrey Mikhailishin, head of economic providers activity drive of the BRICS Enterprise Council, informed TASS information company in September that quite a lot of BRICS monetary system initiatives are being developed and may very well be introduced on the summit, together with not solely the UNIT, but in addition a world settlements for BRICS digital currencies (Bridge), a fee system (Pay), and a settlement depository (Clear).

It seems to be like this BRICS UNIT will draw closely on the gold-backed models which have already been studied and deliberate in depth by Russia and the Eurasian Financial Union (EAEU), as its proposed construction is much like different gold, forex basket and commodity basket worldwide fee and settlement devices which have in recent times been designed for the EAEU by Russian politician and economist Sergei Glazyev (at present Commissioner for Integration and Macroeconomics of the fee which oversees the EAEU), and Sergei Silvestrov of the Russian Safety Council’s scientific council. See BullionStar article “Moscow World Customary to Destroy LBMA’s Gold Monopoly” for additional particulars.

Conclusion

The spot gold value has skilled fast and noteworthy will increase since March 2024, and has recorded constant new all-time highs throughout all main fiat currencies.

This gold value bull market of 2024 is being pushed by a broad and different array of things, and is now ‘firing on all cylinders’. Particularly, the surge in gold costs is being pushed by a mix of elevated geopolitical considerations, battle within the center east and Ukraine/Russia, a shift in central financial institution financial coverage to a price slicing cycle, rising inflation fears, a de-dollarisation pattern, and speculative exercise on gold derivatives exchanges.

The breadth of contributing components and the truth that most of those components are non-temporary provides credence to the argument that this gold value rally just isn’t momentary, however that it’s simply starting.

Moreover, with international debt 17 occasions bigger than the worth of all identified above floor gold shares, and international cash provide 5.8 occasions bigger than worth of all identified above floor gold shares, the gold value must rally multiples from right here to even partially again international debt or international cash provide. To not overlook that the inflation-adjusted value of gold (as calculated by ShadowStats CPI methodologies) places the actual inflation adjusted value of gold at $29,170, which is 11 occasions larger than the present spot value of gold.

Regardless of the numerous rise within the gold value from $ 2000 to over $ 2650 since early March, this gold value rally stays underneath the radar for a lot of traders, notably in Western markets. As to how sturdy and chronic this gold value rally may very well be, maybe the very best comparability is the Nineteen Seventies, as the set of things influencing this present gold value bull market are much like the set of things which created a multi-year gold bull market in gold throughout the 1970 and into Nineteen Eighties.

On that event, much like now, there was heightened geopolitical and battle (such because the Vietnam struggle, Iranian revolution, and Afghan struggle), excessive inflation and excessive inflation expectations, a lack of confidence in fiat currencies, and speculative exercise in gold futures markets. There’s additionally now the chance {that a} wider struggle within the Center East might ship the oil value far larger (bear in mind the oil value inflation of the Nineteen Seventies). Most of the years throughout the Nineteen Seventies noticed the gold value rise by massive double digits, reminiscent of over the 1972-1974 interval, and notably over the 1977 – 1980 interval, which included 1979, when the gold value rose in a single yr by a staggering 133%.

Whereas the evolution of asset costs, together with gold costs, don’t all the time repeat themselves, they will, as within the case of historical past, usually rhyme.