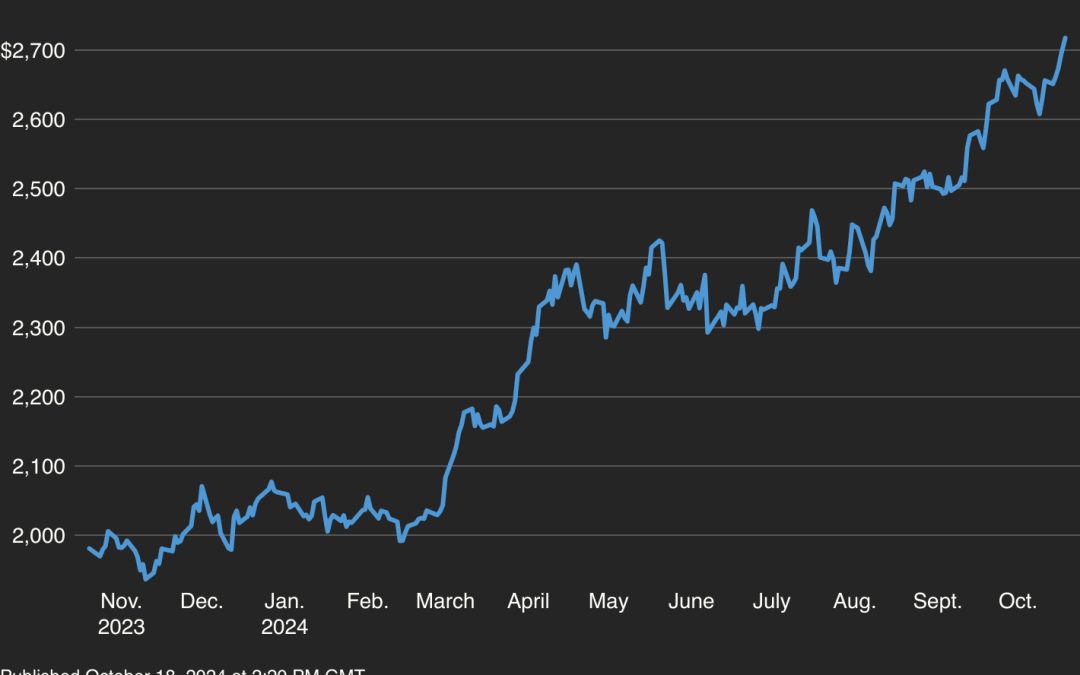

Oct 18 (Reuters) – Gold surged above the historic threshold of $2,700-per-ounce on Friday, powered by escalating tensions within the Center East, uncertainties across the U.S. elections and relaxed financial coverage expectations that pushed the steel into uncharted territory.

Spot gold was up 1% at $2,720.05 per ounce by 02:58 p.m. ET (1858 GMT) and has risen 2.4% thus far this week.

U.S. gold futures settled 0.8% greater to $2,730.

“With the battle intensifying – significantly following Hezbollah’s announcement to escalate the battle with Israel – traders are flocking to gold, a conventional safe-haven asset,” stated Alexander Zumpfe, a valuable metals dealer at Heraeus Metals Germany.

Rising geopolitical tensions immediate traders to hunt safe-haven belongings like gold, pushed by threat aversion and issues over international market instability.

“Including to the momentum, issues across the U.S. presidential election and anticipation of looser financial insurance policies have additional fuelled the rally,” Zumpfe added.

Gold shattered data a number of occasions this 12 months as expectations of extra price cuts by central banks and geopolitical uncertainties boosted costs by greater than 30% thus far this 12 months, its finest annual development since 1979, as per LSEG knowledge.

Decrease charges improve the enchantment of bullion, which yields no curiosity by itself.

Sources instructed Reuters the ECB was more likely to minimize once more in December except financial knowledge suggests in any other case. Merchants are additionally pricing in a 92% probability of a Federal Reserve price minimize in November, in keeping with the CME Fedwatch device.

Max Layton, international head of commodities analysis at Citi, sees gold costs reaching $3,000/oz over the following 6-12 months, as a retailer of wealth in a time of excessive U.S. and European financial uncertainty, driving up ETF and funding demand.

Silver is predicted to carry out strongly to $35/oz over the following three months, Layton added.

Spot silver rose 6% to $33.58. Platinum added 2.4% to $1,016.25 and palladium gained about 4% to $1,083.25.

Enroll right here.

Reporting by Anushree Mukherjee, Swati Verma and Anjana Anil in Bengaluru; Enhancing by Shailesh Kuber and Shreya Biswas

Our Requirements: The Thomson Reuters Belief Rules.