The Buffett Indicator – which Warren Buffett himself calls “most likely the perfect single measure of the place valuations stand at any given second” – has surpassed 200% for the primary time in historical past.

To place this milestone in perspective: Throughout the notorious dot-com bubble, this indicator peaked at 159%. Throughout the 2008 monetary disaster, it reached 183%. In the present day’s studying of over 200% alerts unprecedented territory…

Buffett Indicator Shatters Earlier Data, Tops 200%

Whereas some analysts argue that fashionable components like world income streams and evolving company constructions could have an effect on the indicator’s accuracy, historical past suggests warning is warranted.

For traders, this unprecedented studying deserves critical consideration. Prudent portfolio safety methods may embrace:

- Reviewing asset allocation

- Including defensive positions

- Contemplating market hedges

- Sustaining sufficient money reserves

When this metric reaches excessive ranges, vital market changes typically comply with. In the meantime, treasured metals are making headlines with exceptional strikes.

Gold Breaks Via $2,750

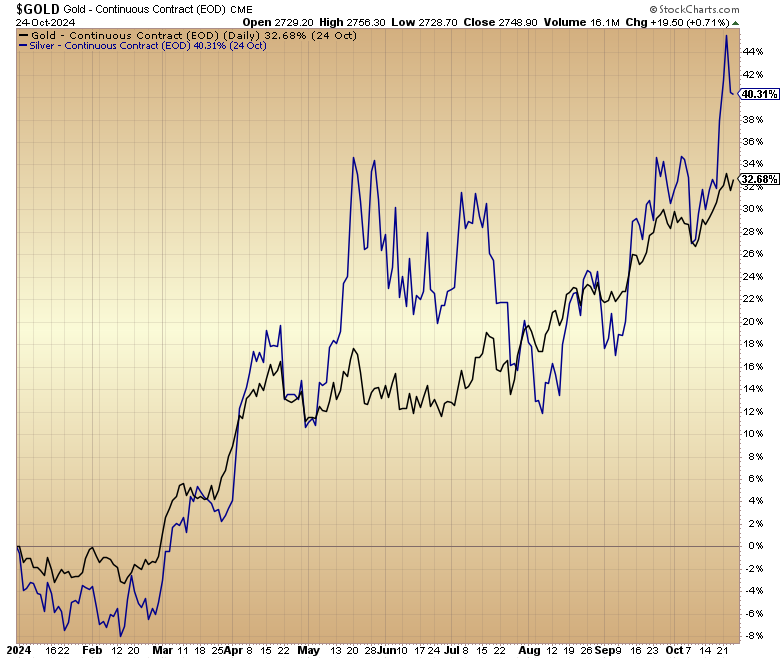

Gold’s surge reached new heights on Wednesday, October 23, touching an unprecedented $2,758 per ounce. The valuable steel continues to set contemporary information nearly day by day, with year-to-date positive aspects now exceeding 33%.

This momentum is more and more catching the eye of institutional traders, who’re including substantial gold positions to their portfolios.

In the meantime, Silver Soars to 12-12 months Highs

To not be outdone, silver has mounted a powerful rally of its personal, reaching almost $35 per ounce on Tuesday – ranges not seen since 2012. With year-to-date positive aspects surpassing 40%, silver’s advance is outpacing even gold’s robust efficiency.

This surge is supported by a singular mixture of rising funding demand and rising industrial utilization, highlighting silver’s twin position as each a treasured and industrial steel.

This highly effective efficiency in treasured metals comes at a vital time, as conventional market indicators (just like the Buffett Indicator) recommend elevated threat in equities.

Many traders are viewing these metals not simply as a hedge, however as a possibility to seize vital upside potential.

Gold Rush Paradox: Why Are Miners Struggling Throughout a Metals Increase?

Whereas gold and silver costs soar to new heights, an fascinating phenomenon is unfolding: many mining shares aren’t maintaining tempo. This disconnect highlights a vital lesson for treasured metals traders.

Take Newmont Corp., the world’s largest gold miner. Regardless of record-high gold costs, they’ve reported disappointing earnings and shrinking revenue margins, inflicting their inventory value to tumble.

And Newmont Mining just isn’t alone of their struggles. Rivals Barrick Gold Corp (GOLD) and Rio Tinto Group (RIO) have additionally underperformed gold’s returns yr up to now.

The Mining Inventory Dilemma: Excessive Danger, Excessive Reward

It is true: mining shares have produced legendary returns in previous bull markets. Tales of 10x, 20x, even 100x positive aspects have attracted many traders in search of to multiply their treasured metals publicity.

Nonetheless, these potential “lottery tickets” include advanced challenges that may rapidly erode income:

- Operational Prices: Rising labor, vitality, and gear bills eat into margins

- Regulatory Hurdles: Stricter environmental laws and sophisticated allowing processes

- Geographic Dangers: Political instability and ranging laws in mining areas

- Administration Challenges: Firm selections could make or break returns

- Geological Uncertainty: Every mine faces distinctive extraction challenges

- Leverage Danger: Whereas operational leverage can amplify positive aspects, it additionally magnifies losses

For traders seeking to capitalize on gold and silver’s highly effective momentum, bullion affords the purest, most safe type of publicity – with out the operational dangers and volatility of mining shares.

Prepared so as to add bodily treasured metals to your portfolio? At GoldSilver, we’re right here to assist:

- Browse our curated choice of premium gold and silver bullion

- Get aggressive pricing on the preferred merchandise

- Take pleasure in safe storage choices and insured delivery

- Entry our professional customer support group

Do not wait to safe your place in bodily treasured metals. Go to GoldSilver.com at this time to view our full choice of investment-grade bullion.

Greatest,

Brandon S.

Editor

GoldSilver