Unlock the White Home Watch publication without cost

Your information to what the 2024 US election means for Washington and the world

A surging US greenback and a “confluence of unhealthy information” have sparked the largest sell-off in rising market currencies because the early levels of the Federal Reserve’s aggressive rate-raising marketing campaign two years in the past.

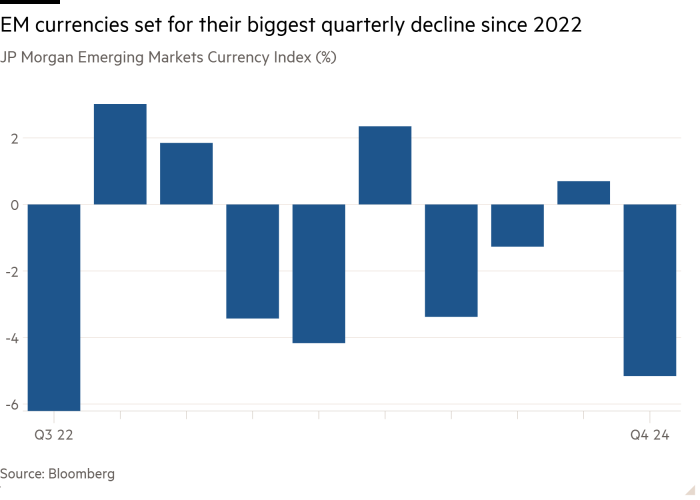

A JPMorgan index of EM currencies has fallen greater than 5 per cent over the previous two and a half months, placing it on track for its greatest quarterly decline since September 2022.

The decline has been broad, with no less than 23 currencies tracked by Bloomberg falling towards the greenback this quarter.

The buck has been on a tear since late September as some of the outstanding “Trump trades”, fuelled by expectations that US president-elect Donald Trump will impose sweeping commerce tariffs and loosen fiscal coverage when he takes workplace subsequent month.

“The greenback is totally entrance and centre” as the motive force of weak spot in EM currencies, stated Paul McNamara, lead supervisor on rising market bond and currencies at fund agency GAM.

Trump introduced final month he would impose levies of 25 per cent on all imports from Mexico and developed market peer Canada, together with an extra 10 per cent on Chinese language items. The Mexican peso has fallen 2.1 per cent this quarter, whereas China’s offshore renminbi is down 3.7 per cent.

Extra broadly, the South African rand — normally seen as a proxy for sentiment throughout EMs as a result of it’s simpler to commerce than different currencies — has fallen about 2.4 per cent because the finish of September.

Even when the curiosity earned from holding property in a neighborhood foreign money is factored into overseas change returns, solely the currencies of nations thought-about very dangerous by buyers, corresponding to Turkey and Argentina, had been within the inexperienced for buyers this quarter.

The breadth of the post-election sell-off has additionally hit so-called carry trades, when buyers borrow in decrease rate of interest currencies such because the greenback or yen to purchase the higher-yielding EM currencies.

A basket of standard EM carry trades tracked by Citi has returned only one.5 per cent this yr, or roughly its 10-year common, versus 7.5 per cent in 2023, the US financial institution stated.

EM currencies final posted a quarterly decline of this scale in 2022, when the US Federal Reserve turned the screws on financial coverage to curb runaway inflation. As US rates of interest leapt increased, the widening hole with charges in EMs piled stress on these international locations’ currencies.

The most recent fall places JPMorgan’s EM foreign money gauge on track for its seventh annual decline in a row.

Analysts stated weak spot within the Mexican peso could possibly be attributed largely to tariff developments. However the image is extra complicated for quite a few different EM currencies, with some additionally coming beneath stress from country-specific challenges, they added.

“There’s been a confluence of unhealthy information within the rising markets,” stated Thierry Wizman, world overseas change and charges strategist at Macquarie.

He highlighted China, noting “considerations concerning the stoop within the home economic system [and] the prospect that the central financial institution goes to proceed to ease coverage”, and Brazil, citing “considerations about deficits and debt sustainability”.

Yields on China’s benchmark 10-year bonds have fallen under 2 per cent to their lowest stage in 22 years, as merchants guess the central financial institution would minimize rates of interest additional to assist stimulate progress.

Brazil’s actual has additionally fallen to file lows in latest weeks, breaking via the brink of six to the greenback for the primary time as a brand new authorities promise to seek out R$70bn (US$12bn) in value financial savings did little to appease worries about its public funds.

“Brazil has a fiscal disaster on its fingers,” stated Ed Al-Hussainy, world charges strategist at Columbia Threadneedle Investments.

“Mexico has exceptionally low ranges of productiveness, progress and funding for an economic system that’s America’s largest buying and selling companion,” he stated, whereas there are additionally points with the standard of its structure and its establishments following latest judicial reforms.

Whereas noting EMs basically “haven’t been attracting capital flows”, he added that “all these international locations have some idiosyncratic points and what’s hanging could be very few of these idiosyncratic points are optimistic”.

In the meantime, South Korea’s received was hit after President Yoon Suk Yeol declared martial regulation — a call he later retracted.

The surging greenback has additionally pushed the euro decrease in latest months. This, in keeping with Mark McCormick, head of FX and EM methods at TD Securities, is unhealthy information for EM currencies that “orbit the euro”, together with the Polish zloty and the Hungarian forint.

Macquarie’s Wizman stated the sell-off in growing market currencies had helped revive the “Tina” funding narrative — that there isn’t a different to investing within the US.

“There aren’t any rising markets nowadays that stand out as having sturdy financial tales,” he added.

Extra reporting by Joseph Cotterill in London