As we shut out 2024, silver has confirmed itself the standout performer in valuable metals.

Beginning the 12 months at roughly $23 per ounce, it surged to almost $35 in October earlier than settling round $30-$32 with two weeks left to go within the 12 months – a exceptional run that left most market predictions within the mud.

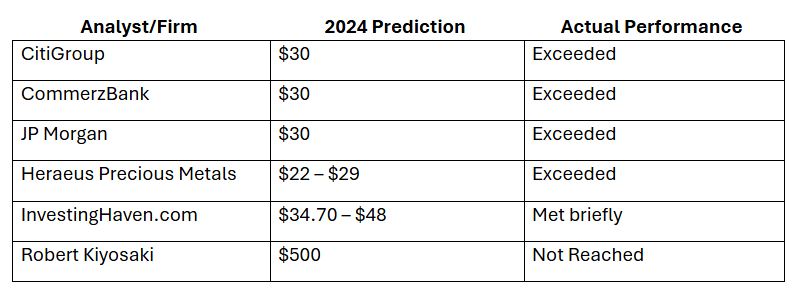

Let’s have a look at how the specialists’ forecasts measured up in opposition to actuality.

Silver Outperforms Most Main Forecasts

Most analysts considerably underestimated silver’s potential, with the steel reaching their $30 goal earlier than June.

What drove this spectacular run? Past the Federal Reserve’s Q3 rate of interest cuts that lifted all valuable metals, silver benefited from three highly effective drivers:

1. Industrial Demand Hits New Heights

Industrial demand for silver reached an unprecedented 700 million ounces in 2024. This milestone was primarily pushed by inexperienced financial system functions, notably within the photovoltaic sector.

2. Photo voltaic’s Rising Silver Urge for food

Silver’s use in photo voltaic panels has greater than doubled up to now 5 years. The photovoltaic business consumed an estimated 232 million ounces in 2024 – a 20% improve from 2023. India’s speedy photo voltaic capability growth performed a big position on this progress.

3. Electrical Automobiles: Silver’s New Frontier

Bear in mind once you hardly ever noticed an EV on the street? Now they’re in all places – and each is a small however vital silver story. Fashionable electrical automobiles use as much as 50 grams of silver every, greater than twice what conventional vehicles require. With EV manufacturing accelerating, automotive silver demand is rising to 90 million ounces by 2025.

Silver Demand Outpaces Provide

Including to those demand components, 2024 marked the fourth consecutive 12 months of bodily provide deficit, with a shortfall of round 182 million ounces. This persistent deficit continues to assist costs and creates what seems to be a bullish setup for 2025.

Silver’s Subsequent Chapter

Wish to know what’s in retailer for silver in 2025? We have simply revealed our complete evaluation analyzing provide constraints, industrial demand forecasts, and financial components that would affect costs within the 12 months forward.

Learn the Full 2025 Silver Evaluation

Keep tuned for extra market insights,

Brandon S.

Editor

GoldSilver