For greater than 5,000 years, gold has stood as the final word image of wealth and stability. From historical Egyptian tombs to trendy central financial institution vaults, its shortage, sturdiness, and common recognition have made it a cornerstone of wealth preservation, notably in unsure occasions.

Quick ahead to the twenty first century, and a challenger has emerged: Bitcoin. In simply over a decade, Bitcoin has risen from an obscure digital experiment to a world monetary phenomenon, usually heralded because the “digital gold” of the trendy period. With its finite provide of 21 million cash, decentralized framework, and talent to function exterior conventional monetary techniques, Bitcoin has gained traction – particularly in occasions of financial instability.

The controversy between gold and Bitcoin as the final word wealth protector has by no means been extra related than in 2025. The world is grappling with persistent inflation, rising geopolitical tensions, and a shift towards digital-first economies. Buyers are pressured to confront essential questions: Do you have to depend on the timeless safety of gold, or place your religion within the innovation and potential of Bitcoin? Which asset will finest defend your wealth in opposition to the storms of financial uncertainty?

Relatively than pitting these two belongings in opposition to one another, this weblog publish explores how gold and Bitcoin serve distinct functions. We’ll delve into their distinctive worth propositions and present how they’ll complement one another in as we speak’s funding panorama. Moreover, we’ll spotlight how BullionStar is ready to facilitate seamless buying and selling between gold and Bitcoin, empowering traders to leverage the strengths of each.

By understanding these two belongings and their use instances, you’ll see why constructing bridges between conventional and digital belongings isn’t just sensible but additionally extremely strategic in 2025.

Gold: The Timeless Protector

Gold has stood the take a look at of time as the final word retailer of worth, incomes its fame over 5,000 years as a logo of stability, wealth, and energy. Its shortage, common recognition, and resilience have made it a go-to asset for traders, governments, and civilizations during times of uncertainty. Whereas economies and fiat currencies have crumbled, gold’s worth has endured – Solidifying its position as a confirmed hedge in opposition to monetary instability, together with in 2025.

1. Gold’s Legacy Throughout Civilizations

Gold’s position as a retailer of worth started as early as 4,000 BCE with the traditional Egyptians, who used it as a type of foreign money and a logo of divinity. By the point of the Roman Empire, gold had advanced into the spine of world commerce and commerce. All through historical past, numerous civilizations have accrued gold to show wealth and energy. This observe persists, with trendy central banks holding substantial gold reserves. Right this moment, central banks world wide collectively maintain over 35,000 metric tons of gold of their reserves, valued at over $3 trillion.

Notably:

- The US holds the most important reserves at over 8,000 metric tons

- Germany ranks second with over 3,000 metric tons, adopted by Italy and France, every with greater than 2,400 metric tons.

- Rising economies resembling China and Russia have been steadily rising their gold holdings. China, for instance, added over 200 metric tons to its reserves in 2023 alone, bringing its complete to greater than 2,000 metric tons.

This widespread reliance on gold by each developed and rising economies underscores its enduring significance within the international monetary system.

2. Stability and Tangibility in a Digital Age

Gold’s intrinsic worth comes from its bodily properties: it’s uncommon, sturdy, and can’t be artificially created. In contrast to digital belongings resembling Bitcoin, gold’s tangibility offers traders with a novel sense of safety. You may maintain it, retailer it, and commerce it globally with out counting on expertise or web entry.

Gold has additionally confirmed to be a secure retailer of worth over the long run. Whereas short-term fluctuations happen, its historic value developments show constant development:

- 1971: When the U.S. deserted the gold customary, gold was priced at $35 per ounce.

- 1980: Amid excessive inflation and geopolitical tensions, gold surged to $850 per ounce.

- 2008: Through the monetary disaster, gold rose practically 25%, reaching $870 per ounce, as inventory markets collapsed.

- 2020: Amid the COVID-19 pandemic, gold hit an all-time excessive of $2,075 per ounce, reaffirming its safe-haven standing.

- 2025: As of early 2025, the value of gold is hovering round 2,793 USD per oz, hitting a brand new all-time-high, additional solidifying it’s fame as a secure retailer of worth and development over time.

3. A confirmed performer in Crises

Gold has a observe document of outperforming different belongings throughout occasions of financial turmoil. Its capability to retain worth – and even admire – makes it a cornerstone for wealth safety. Contemplate these historic examples:

- The Nineteen Thirties Nice Melancholy : Whereas the worldwide economic system contracted, gold costs remained secure beneath the gold customary, and its buying energy elevated as deflation set in.

- The Nineteen Seventies Inflation Disaster: Gold costs skyrocketed by over 2,000% from $35 per ounce in 1971 to $850 per ounce in 1980, offering a dependable hedge as inflation soared to double digits.

- The 2008 Monetary Disaster: Gold rose by about 25% in 2008, reaching $870 per ounce. Its main rally occurred post-crisis, peaking at $1,900 per ounce in 2011 as central banks pursued free financial insurance policies.

- The 2020 COVID-19 Pandemic: Amid widespread uncertainty, gold rose by 36% between 2019 and its peak in 2020, outpacing most different asset courses.

These occasions spotlight gold’s capability to thrive in situations the place different belongings – resembling shares or fiat currencies – falter.

4. Central Banks’ Continued Confidence in Gold

Gold’s significance extends past particular person traders; it’s a essential a part of the worldwide monetary system. Central banks collectively personal over 17% of all above-ground gold, underscoring their belief in its worth. In recent times, central banks have elevated their gold holdings considerably:

- Since 2010, central banks have been web patrons of gold, buying a mean of 450 metric tons per yr.

- In 2022, central banks purchased a document 1,136 metric tons, the best stage since 1967.

- This development continues into 2025. Nations resembling Turkey, India, and Brazil search to diversify away from the U.S. greenback and safeguard in opposition to foreign money volatility.

Gold’s capability to behave as a hedge in opposition to foreign money devaluation and geopolitical dangers ensures its ongoing relevance in central financial institution methods.

5. The Psychological Consolation of Gold

Gold is extra than simply an funding – it’s a image of stability and prosperity. The tactile nature of gold, whether or not within the type of bars, cash, or jewellery, offers traders with a tangible sense of safety that no digital asset can replicate. In an more and more digital world, the place belongings exist as mere entries on a display screen, gold provides peace of thoughts as a bodily, enduring asset.

Even throughout occasions of maximum market volatility, the sight of gold in a secure deposit field or vault reassures traders, reinforcing its position as a psychological anchor in unsure occasions.

Gold’s Enduring Relevance

For over 5 millennia, gold has preserved wealth by wars, recessions, and inflationary intervals. In 2025, as the worldwide economic system faces rising uncertainty, gold continues to shine as a beacon of stability. Its confirmed observe document, institutional backing, and psychological reassurance make it the final word selection for these searching for a dependable retailer of worth. Whereas Bitcoin might supply speculative alternatives, gold’s enduring legacy cements its standing because the final wealth protector.

Bitcoin: The Digital Innovator

Bitcoin has revolutionized the idea of cash and worth in our digitized world. In simply over a decade, it has advanced right into a viable asset class for tech-savvy and forward-looking traders.

1. Decentralization and Shortage

Bitcoin’s provide is capped at 21 million cash, mimicking gold’s shortage. Its decentralized framework permits customers to transact with out intermediaries, interesting to these searching for monetary autonomy.

2. Excessive Development Potential

Bitcoin’s value trajectory has been meteoric, albeit unstable. From lower than $1 in 2009 to over $100,000 in 2025, it has delivered substantial returns for early adopters and continues to draw speculative curiosity.

3. A New-Age Inflation Hedge

Bitcoin’s mounted provide positions it as a possible hedge in opposition to inflation. Nonetheless, its quick historical past makes its effectiveness on this position much less sure in comparison with gold’s centuries-long observe document.

Bridging Gold and Bitcoin: A Holistic Strategy

Whereas gold and Bitcoin might look like opposites, they’re extra complementary than aggressive. Each belongings have distinctive strengths that cater to totally different funding objectives:

- Gold provides stability, tangibility, and a confirmed observe document throughout financial downturns.

- Bitcoin offers excessive development potential, technological innovation, and decentralized monetary freedom.

Sensible Suggestions for Investing in Gold

In Might 2014, BullionStar turned one of many first bullion sellers globally to facilitate seamless buying and selling between gold and Bitcoin, providing traders the flexibility to diversify effortlessly.

Investing in gold is among the most dependable methods to guard and develop wealth, notably in unsure financial occasions. Whether or not you’re a seasoned investor or simply beginning, it’s vital to decide on the best funding method and work with a trusted supplier to make sure the security, authenticity, and comfort of your gold holdings. Right here’s a information to getting began, that includes services from BullionStar, a number one identify within the gold funding business.

1. Select the Proper Type of Gold Funding

Gold is available in numerous kinds, every with distinctive benefits relying in your funding objectives. BullionStar provides a variety of choices to go well with totally different wants:

- Gold Bars: For traders who prioritize maximizing worth, gold bars are a wonderful selection resulting from their decrease premiums over the spot value. BullionStar provides a wide range of gold bars in numerous sizes, from 1 gram bars for entry-level traders to 1-kilogram bars for these making bigger purchases.

- Gold Cash: Gold cash mix worth with historic and aesthetic enchantment. BullionStar shares an intensive choice of globally acknowledged cash, such because the United Kingdom Gold Britannia, Canadian Gold Maple Leaf, and Austrian Philharmonic. These cash are extremely liquid and broadly accepted worldwide.

- Gold Jewelry: For individuals who need to mix funding with practicality, BullionStar additionally provides investment-grade gold jewellery in addition to refurbished pre-loved jewelry, which retains worth whereas serving as a wearable asset.

- Bullion Financial savings Program: BullionStar provides a bullion financial savings program, the place you should purchase valuable metals in as little as 1 Gram! They are often transformed into bodily bullion bars at any time.

- No-Unfold Gold and Silver Bars: BullionStar business main No-Unfold Gold and Silver Bars can be one other avenue the place you should buy Gold or Silver at No Unfold!

2. Prioritize Safe Storage

Storing bodily gold safely is important. BullionStar offers a state-of-the-art vault storage answer situated in Singapore, New Zealand and the United States. Right here’s why it’s an ideal selection:

- Absolutely Allotted Storage: Your gold is saved individually beneath your identify, making certain you keep full possession.

- Aggressive Storage Charges: BullionStar provides aggressive storage charges amongst bullion sellers.

- 24/7 Entry: You may entry your account on-line anytime to view your holdings or request bodily supply.

- No Gross sales Tax: This makes buy and storing valuable metals an economical train.

For individuals who desire to retailer gold at house or at your personal secure deposit field, BullionStar additionally provides discreet packaging and absolutely insured supply companies.

3. Timing Your Gold Purchases

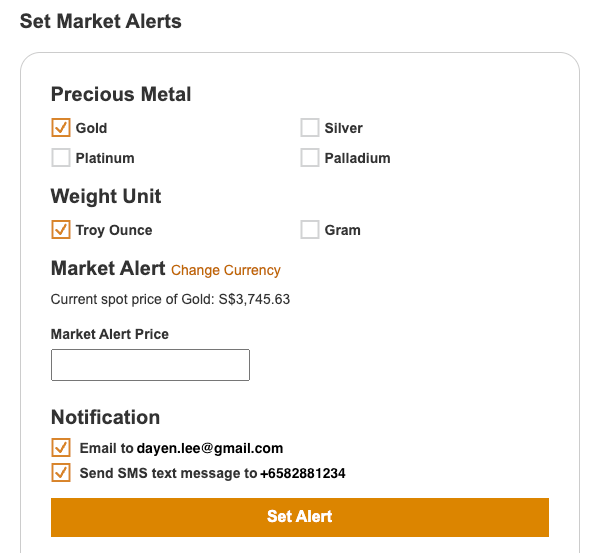

Whereas gold is finest seen as a long-term funding, shopping for throughout value dips will help maximize returns. BullionStar’s dwell spot value charts and market insights make it simple to observe gold costs and make knowledgeable selections. Additionally they supply Value Alerts. Set alerts to inform you when gold reaches your required value level.

4. Diversify Your Gold Portfolio

Diversification inside gold investments can cut back danger and improve liquidity. Contemplate holding a mixture of: Bars for bulk worth, Cash for liquidity & Bullion Financial savings Program.

BullionStar’s broad product vary ensures you possibly can construct a balanced portfolio with ease.

Conclusion

In 2025, Gold and Bitcoin will not be adversaries however allies in wealth preservation and development. Gold’s timeless stability and Bitcoin’s progressive potential make them highly effective instruments when used collectively. By embracing platforms that allow seamless buying and selling between these belongings, traders can get pleasure from the most effective of each worlds.

So, whether or not you’re a gold fanatic, a crypto believer, or someplace in between, the way forward for wealth safety lies in stability and flexibility. Why select one when you possibly can harness the strengths of each?

Tell us: How are you integrating gold and Bitcoin into your funding technique? Share your ideas under!