“LBMA ensures the very best ranges of management, integrity and transparency for the worldwide valuable metals trade by advancing requirements and creating market options.”

– LBMA Mission Assertion

When BullionStar repeatedly known as on the LBMA to uphold its personal mission – reforming for integrity and tranparency within the valuable metals market – how do you assume LBMA responded?

Did LBMA decide to clearer reporting of unencumbered gold? Did LBMA commit to finish the value manipulation?

No, as a substitute LBMA despatched an operative and his secretary to BullionStar’s Bullion Retail Heart in Singapore to tell us that there are inaccuracies in our protection. The secretary’s assigned process, we had been informed, was to learn our weblog posts as quickly as revealed!

Nonetheless, they kindly instructed an answer – if we despatched our weblog posts to the LBMA for evaluation earlier than publishing, they might ‘appropriate’ any inaccuracies for us!

We rejected LBMA’s provide to censor us.

BullionStar’s Critique of the LBMA

At BullionStar, we take delight in our independence and have been exposing the LBMA’s practices for years. My colleague Ronan Manly has written extensively on their opaque operations, conflicts of curiosity, and market manipulation. The extra we study the construction of the gold market, the extra evident it turns into that the LBMA is an impediment to free and honest buying and selling.

The LBMA positions itself as the worldwide authority on gold and silver buying and selling however overwhelmingly favors bullion banks and paper-based buying and selling over bodily metals.

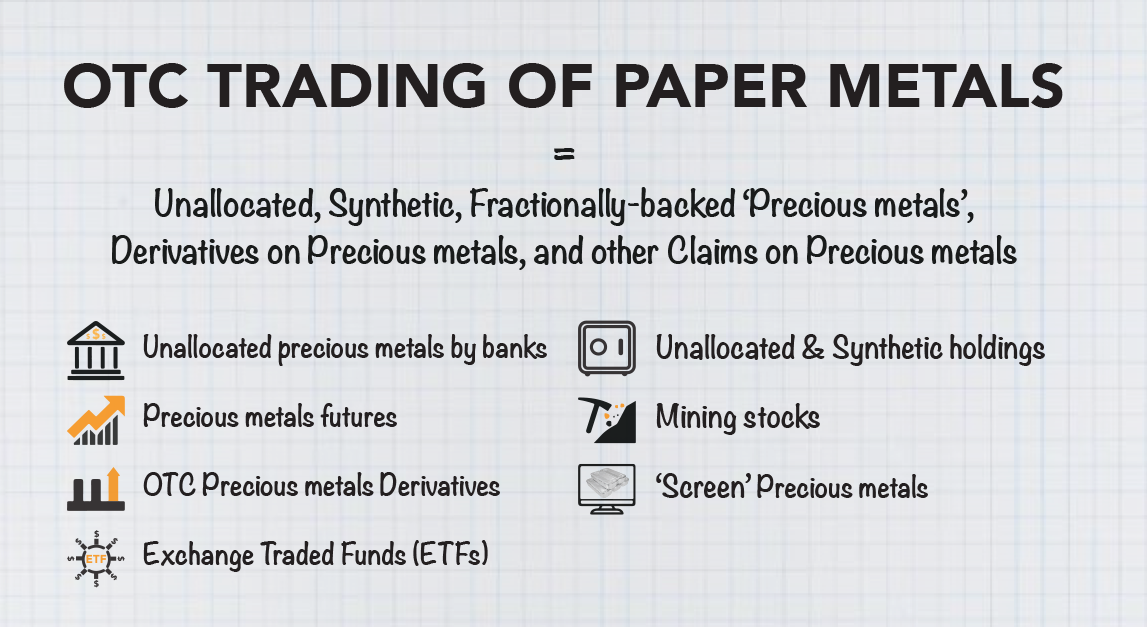

On the coronary heart of the difficulty is worth discovery. Quite than being pushed by provide and demand for precise bodily gold and silver, costs are influenced by opaque OTC buying and selling of paper metals. This distorts bodily market realities and creates alternatives for monetary establishments to govern costs, sidelining bodily traders and companies.

Tied intently to bullion banks and the Financial institution of England, the LBMA maintains an opaque system that advantages giant gamers whereas bodily traders face restricted transparency and equity.

Since bodily metals inherit costs from the OTC market, actual gold and silver holders lose by having the value of their metals suppressed.

The Paper Gold Shell Sport

LBMA oversees the paper gold and silver market – an elaborate system of unallocated accounts and derivatives that give the phantasm of liquidity whereas masking the truth that there’s far much less bodily gold than their contracts signify.

This technique permits the banks to broaden the availability of “gold” far past the obtainable bodily provide, suppressing costs and defending their fiat pursuits.

The complete system is constructed on the idea that almost all merchants won’t ever take supply, permitting the bullion banks to have interaction in fractional reserve gold buying and selling with impunity.

Convicted Gold Manipulators Run the LBMA

In 2020, JP Morgan admitted wrongdoing and agreed to pay over $920 million to settle U.S. probes into its manipulation of valuable metals. The scheme concerned hundreds of misleading trades over an 8-year interval. A number of merchants, together with Gregg Smith and Michael Nowak (a former LBMA board member), had been later convicted of fraud, worth manipulation, and spoofing and despatched to jail.

In 2020, JP Morgan admitted wrongdoing and agreed to pay over $920 million to settle U.S. probes into its manipulation of valuable metals. The scheme concerned hundreds of misleading trades over an 8-year interval. A number of merchants, together with Gregg Smith and Michael Nowak (a former LBMA board member), had been later convicted of fraud, worth manipulation, and spoofing and despatched to jail.

Regardless of this, JP Morgan stays a key participant within the LBMA, retaining its standing as a market-making member and participant within the each day gold and silver worth auctions.

How can an organisation declare to make sure the very best ranges of integrity, transparency, and governance whereas having JP Morgan as one among its most influential members?

Market manipulation fines are handled as simply one other value of doing enterprise, and banks proceed working with the identical privileges, making certain that the cycle of manipulation persists.

Murky LBMA Vaults

Whereas the LBMA releases month-to-month information on whole metallic saved in London vaults, these figures masks important particulars. How a lot of that is actually unencumbered, free-floating metallic obtainable for market use? The LBMA received’t say.

A lot of the vaulted gold is tied up – custodied by the Financial institution of England for central banks or backing ETFs like SPDR Gold Belief leaving solely a fraction as obtainable for commerce or buy. BullionStar has beforehand estimated that the free float of London gold, excluding ETF holdings, is at most 800 tonnes – 1,200 tonnes. This estimate excludes personal holdings, corresponding to these held by bullion banks and different entities, additional lowering the obtainable provide.

A lot of the vaulted gold is tied up – custodied by the Financial institution of England for central banks or backing ETFs like SPDR Gold Belief leaving solely a fraction as obtainable for commerce or buy. BullionStar has beforehand estimated that the free float of London gold, excluding ETF holdings, is at most 800 tonnes – 1,200 tonnes. This estimate excludes personal holdings, corresponding to these held by bullion banks and different entities, additional lowering the obtainable provide.

With 500 tonnes of gold already moved from London to New York previously couple of months—and extra on the way in which—it’s apparent that the LBMA is operating out of bodily gold. However slightly than admitting it, what’s their excuse? A scarcity of males and vans to move it… as a result of gold is heavy.

LBMA & COMEX Collusion Break Ranks

For years, the LBMA and COMEX have labored collectively to shore up the gold market throughout crises, scrambling to safe sufficient bodily gold to keep up confidence within the paper commerce. This was evident in 2020-2021, when panic almost broke the system, but they managed to carry it collectively.

Now the tide is popping. The U.S. appears more and more uninterested about defending the LBMA exhibiting little concern for the widening hole between spot and futures costs or the spot worth’s fading relevance as a benchmark for bodily gold.

The main focus has shifted to a determined race to personal bodily gold earlier than the inevitable paper market collapse.

Central banks, establishments and rich traders are amassing actual bodily bullion, signaling mistrust within the LBMA paper markets. The as soon as dominant LBMA is dropping affect as tangible gold overtakes paper guarantees because the true measure of wealth and affect.

Is the LBMA Coming to an Finish?

LBMA member banks will not be within the enterprise of contributing to actual worth discovery for valuable metals. Quite the opposite, the temptation to govern costs by spoofing and different ways—driving quantity and exercise for revenue—is simply too nice to withstand. With a keystroke, they will broaden unallocated positions, successfully injecting “limitless credit score” into the system.

However this large Ponzi scheme is coming to an finish as extra rich nations and people get up to the reality – the self-proclaimed LBMA emperor has no garments. There isn’t sufficient gold to again up even a fraction of the paper guarantees and the run on bodily gold has begun.