Brandon Sauerwein, Editor

What do 89% of hedge fund managers, Warren Buffett, and the Atlanta Fed all have in frequent proper now?

They’re positioning for an financial storm. Fund managers overwhelmingly report overvalued markets, Buffett holds file money ranges, and the Atlanta Fed now initiatives a 2.8% GDP contraction in Q1 2025.

As Mike explains in his newest evaluation, as soon as this recession begins, the financial dominoes will fall quickly. The query isn’t if it’s coming, however the way you’ll climate it…

“They Can‘t Stop the Crash That’s Going to Occur” Mike Maloney

On this crucial replace, Mike reveals:

- Why the Atlanta Fed’s 2.8% GDP contraction forecast alerts the start, not the tip

- How Warren Buffett’s file money place mirrors earlier pre-crash behaviors

- The domino impact that may cascade by markets as soon as the recession formally begins

- Why typical monetary recommendation will fail within the coming setting

As Mike exhibits, these aren’t remoted occasions — they’re the primary seen cracks in a dam that’s about to interrupt.

Are you ready for what comes subsequent?

Gold Stands Alone

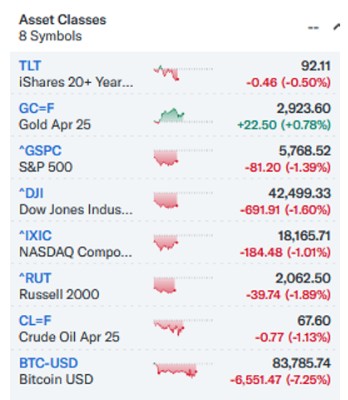

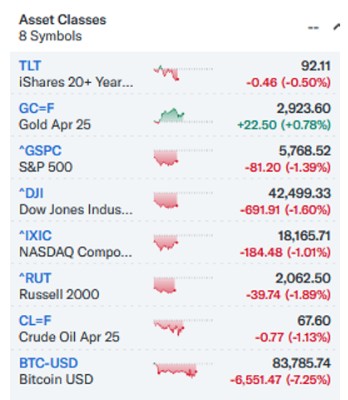

They are saying an image is price a thousand phrases. At the moment’s market efficiency tells a compelling story:

Chart courtesy of Yahoo Finance at midday 2/4/2025.

What you see is not only a dreadful day within the markets. It’s a clear illustration of what occurs when coverage shifts create uncertainty throughout the funding panorama. As new tariffs take impact at the moment, we’re seeing market-wide turbulence with each main U.S. asset class in damaging territory.

Besides one: Gold.

Whereas shares tumble, bonds wrestle, oil retreats and bitcoin proceed to disclose itself as a hypothesis that draws all kinds of unhealthy behaviors, gold continues to show why it has endured as a compelling monetary asset. At the moment’s value motion reinforces what now we have lengthy maintained: geopolitical tensions, commerce realignments and feckless fiscal and financial insurance policies are accelerating the pattern towards gold as impartial, accountable, and apolitical cash.

This isn’t about politics — it’s about arithmetic. When insurance policies of any stripe introduce uncertainty, gold’s everlasting properties change into much more priceless. In a world of accelerating complexity, gold continues to be refreshingly easy.

For individuals who have stored correct gold allocation of their portfolios, at the moment serves as validation. For individuals who haven’t, it gives a transparent sign that now’s the time to rethink including ballast to their funding portfolio.

Keep secure.

What Else is within the Information?

📊 TRADE WAR ESCALATES

President Trump has imposed sweeping 25% tariffs on Canadian and Mexican imports whereas elevating China’s to twenty%, affecting $1.5 trillion in annual commerce. Canada has retaliated with phased levies on $107 billion of US items, whereas China has applied its personal countermeasures. Economists warn these tensions may increase family prices and gradual financial progress throughout an already susceptible interval.

📉 RAY DALIO WARNS OF US DEBT “HEART ATTACK”

Billionaire Ray Dalio predicts a serious US debt disaster inside three years with out quick deficit discount. The Bridgewater founder factors to the harmful mixture of a $1.8 trillion annual deficit, continued tax breaks, and retreating Treasury consumers as creating an unsustainable fiscal scenario. He urges chopping the deficit to three% of GDP to forestall what he describes as an approaching financial “coronary heart assault.”

🏦 CENTRAL BANKS ACCELERATE GOLD BUYING

Central banks added 18 tons of gold to official reserves in January 2025, with Uzbekistan, China, and Kazakhstan main purchases. Poland and India every contributed 3 tons as rising markets proceed to dominate gold accumulation methods. This persistent shopping for pattern underscores gold’s strategic significance as a hedge towards rising financial and geopolitical uncertainties.

📈 $3,100 GOLD PRICE TARGET FROM GOLDMAN

Goldman Sachs has raised its gold forecast to $3,100 per ounce by end-2025, projecting one other 8% achieve on prime of this yr’s 40% rally. The bullish outlook is pushed by sturdy central financial institution demand following the 2022 freezing of Russian property and anticipated investor curiosity as rates of interest fall. Below continued world uncertainty, Goldman suggests costs may climb even increased to $3,300.

💬 What GoldSilver Traders are Saying

⭐ ⭐ ⭐ ⭐ ⭐ At all times Nice

“At all times nice. Thanks GoldSilver for serving to me protect wealth, and thanks Travis for assiduous persistence in serving to us with serving to my daughter log in to my account invite.” — J. Grimes

Expertise the GoldSilver distinction:

- Obtain professional steerage from devoted valuable metals specialists

- Entry complete instructional assets to grasp your funding technique

- Belief in our industry-leading customer support crew that places you first

Able to get began?