Introduction: Why Is Everybody Shopping for Gold from Costco?

In recent times, Costco has emerged as an surprising participant within the treasured metals market, with their gold bars changing into considered one of their fastest-selling gadgets. As financial uncertainty persists and inflation considerations mount, Individuals more and more view gold as a protected haven for his or her wealth. This pattern has propelled Costco—historically recognized for bulk groceries and family necessities—into the highlight as a gold retailer. However does buying gold from this warehouse big symbolize good worth? This evaluation examines the professionals and cons to assist potential traders make knowledgeable choices.

Why Costco Has Turn into a Gold-Promoting Powerhouse

Costco’s foray into treasured metals has garnered important consideration for a number of compelling causes:

Aggressive Pricing Construction

Costco sometimes provides gold bars at costs comparatively shut to identify, with markups which can be usually decrease than these of conventional jewelers or banking establishments. Nonetheless, they’re nonetheless increased than these of specialised sellers like BullionStar.

Established Belief and Fame

With many years of creating client belief by way of truthful pricing and high quality merchandise, Costco’s popularity provides consumers peace of thoughts; nevertheless, this common retail popularity doesn’t robotically suggest specialised experience in treasured metals.

| Unique Member Profit Gold purchases are restricted to Costco members solely, creating each a managed distribution channel and an extra perceived worth for membership holders, albeit with an annual membership price that provides to the full acquisition price. |

|

Streamlined On-line Buying

The simplicity of Costco’s on-line platform permits members to buy gold bars with the identical ease as ordering on a regular basis gadgets. The corporate discreetly ships gold bars on to their properties.

Vital Evaluation: Is Costco Gold Actually a Good Funding?

Whereas comfort and belief make Costco a horny choice, traders ought to weigh a number of necessary components:

Benefits of Buying Gold Via Costco

Clear Pricing

Not like some sellers who obscure precise prices with hidden charges, Costco clearly shows pricing that repeatedly updates to mirror market situations.

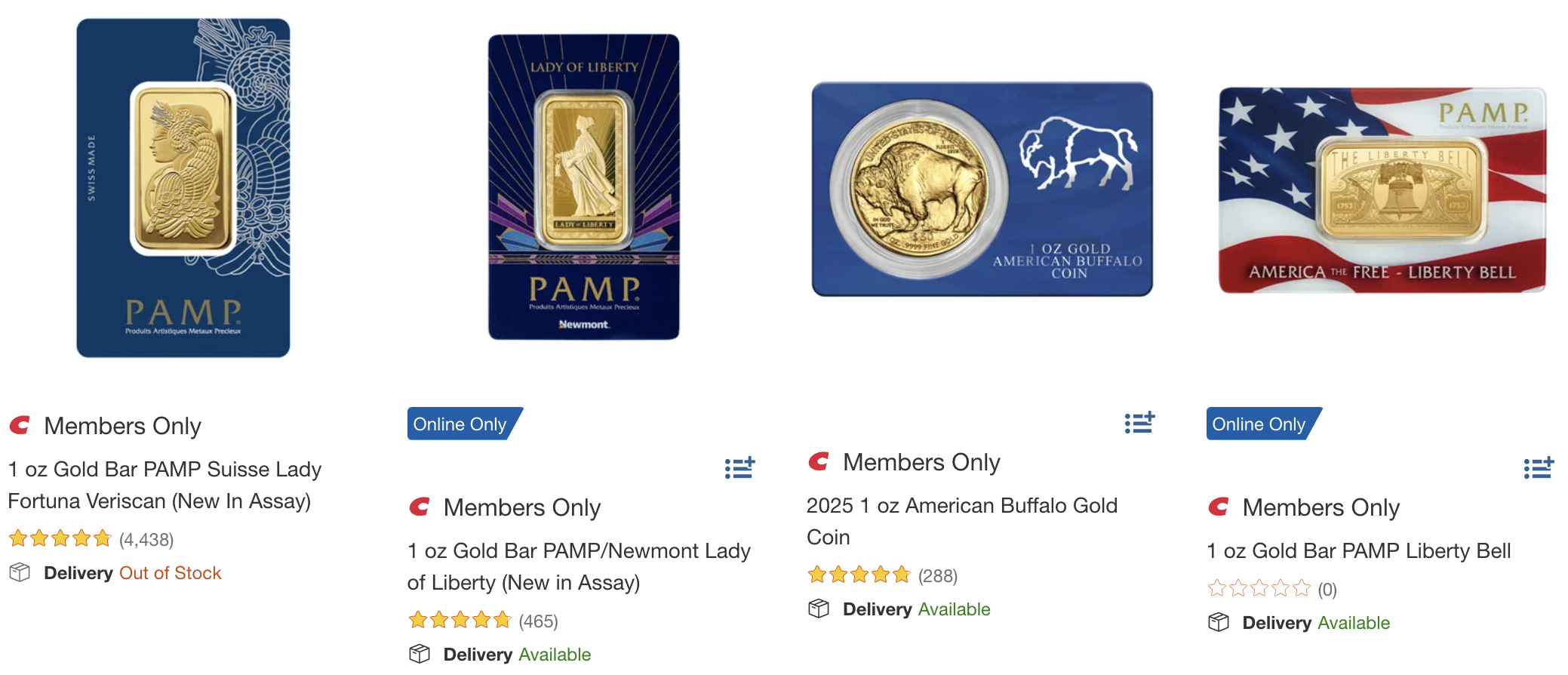

Assured Authenticity and High quality

Costco solely sells pure gold bars from internationally revered refiners corresponding to PAMP Suisse and The Royal Canadian Mint. Every bar comes correctly licensed with assay playing cards and tamper-evident packaging.

Buying Comfort

The power to purchase investment-grade gold by way of a well-recognized retail platform removes most of the intimidation components new gold traders usually expertise.

Important Limitations of the Costco Gold Program

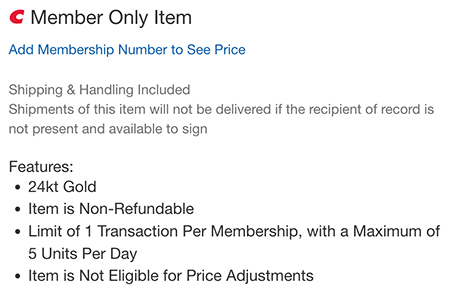

On-line-Solely Availability and Frequent Inventory Points

Regardless of being a bodily retailer, Costco doesn’t provide in-store gold purchases. All transactions should be accomplished on-line, with no choice for speedy possession. Extra problematically, their gold stock often sells out inside minutes of restocking, creating irritating experiences for potential consumers who might wait weeks for one more alternative.

Full Absence of Buyback Program

Considered one of Costco’s most critical disadvantages is the full lack of a repurchase choice. When traders determine to liquidate their gold holdings, they need to discover different consumers by way of bullion sellers or exchanges, probably incurring further transaction prices and going through value disparities that erode funding returns.

Severely Restricted Product Choice

Costco’s gold providing is remarkably restricted, focusing nearly solely on 1-ounce gold bars. This absence of fractional weights, cash, or different treasured metals creates important portfolio limitations and lacks the diversification choices critical traders require.

Premium Drawback

Whereas showing aggressive at first look, Costco’s premiums constantly exceed these provided by specialised bullion sellers like BullionStar, significantly for bigger purchases the place quantity reductions turn out to be important. The membership price additional will increase the efficient premium paid.

No Advisory Providers or Funding Steering

Gold IRAs: A Vital Choice Costco Can not Present

For retirement-focused traders, a major limitation of Costco’s gold program is the entire lack of ability to combine with treasured metals IRAs. Gold IRAs provide substantial tax benefits for retirement planning that bodily gold purchases from Costco can’t match:

Gold IRA Benefits

- Tax-deferred or tax-free development potential (relying on conventional or Roth construction)

- Specialised storage options assembly IRS necessities

- Safety from chapter and sure creditor claims

- Skilled portfolio administration with strategic treasured metals allocation

- Simplified required minimal distribution dealing with when reaching retirement age

Comparative Evaluation: Costco vs. BullionStar and Different Specialised Bullion Sellers

| Characteristic | Costco | BullionStar |

| Product Choice | Severely restricted (primarily 1 oz bars) | In depth (cash, bars, numerous weights, a number of metals) |

| Pricing Construction | Greater premiums with further membership prices | Decrease premiums, clear pricing, quantity reductions |

| Liquidity Choices | No buyback program | Established buyback choices with aggressive charges |

| Authentication | Fundamental certification | Complete authentication together with superior testing capabilities |

| Stock Reliability | Continuously offered out for prolonged durations | Constant inventory availability |

| Advisory Providers | None | Knowledgeable market steerage |

| Storage Options | No choices offered | Safe vault storage with insurance coverage and audit verification |

| Gold IRA Assist | None | IRA, Superannuation or Retirement Accounts. |

| Instructional Sources | Minimal product descriptions | In depth market evaluation, funding guides, and historic context |

| Worldwide Delivery | Restricted | World attain with safe supply choices |

Why BullionStar Outperforms Costco for Critical Gold Traders

BullionStar represents a superior different to Costco for treasured metals acquisition attributable to a number of essential benefits:

True Market Experience

Not like Costco’s common retail strategy, BullionStar specializes solely in treasured metals, using analysts and specialists who perceive market dynamics, present precious insights, and information funding choices based mostly on present financial situations.

| Complete Product Ecosystem BullionStar provides a whole vary of investment-grade treasured metals, from fractional gold and silver cash to massive bars, enabling traders to construct strategically diversified portfolios tailor-made to particular targets. |

|

| Superior Buyback Program Maybe probably the most important benefit over Costco is BullionStar’s established buyback program, providing clear pricing and speedy liquidity—a crucial consideration for any critical investor. |

|

| Safe Storage Options BullionStar’s safe vault storage choices present traders with insurance-backed, audited storage amenities that eradicate the safety considerations of self-custody whereas sustaining direct possession and entry. |

|

Instructional Basis

BullionStar’s intensive market evaluation, analysis publications, and academic assets create knowledgeable traders who perceive not simply what to purchase, however why and when—a stark distinction to Costco’s minimal product info.

Making the Proper Gold Buy Determination

For Informal or First-Time Gold Patrons

Even for newcomers, Costco’s limitations current important drawbacks. Whereas the acquainted model may present preliminary consolation, the restricted choices, frequent stock shortages, and full absence of buyback provisions create potential issues that specialised sellers like BullionStar keep away from by way of complete service choices.

For Critical Valuable Metals Traders

Traders with significant allocation plans or particular strategic targets would considerably profit from establishing relationships with respected bullion sellers like BullionStar, getting access to:

- Considerably extra aggressive pricing on all buy volumes

- Complete product variety for portfolio optimization

- Established buyback applications making certain speedy liquidity

- Knowledgeable steerage on market situations and acquisition timing

- Safe storage choices with insurance coverage and verification

- Tax-advantaged funding constructions together with Gold IRAs

Important Issues Earlier than Any Gold Buy

Whether or not selecting a specialised supplier like BullionStar or a mass retailer like Costco, prudent traders ought to observe these elementary rules:

Conduct Thorough Value Comparisons

All the time test present spot costs and evaluate premiums throughout a number of distributors earlier than finalizing any buy. Even small proportion variations can symbolize important sums on precious commodities.

Set up Safe Storage Options

Bodily gold requires acceptable safety measures. Decide whether or not you’ll use house storage (requiring safe safes and probably further insurance coverage) or skilled vault companies earlier than acquisition.

Think about Future Liquidity Necessities

The power to effectively convert gold again to foreign money is an important facet of any treasured metals technique. Distributors providing assured buyback applications present important benefits when market situations shift.

Perceive Tax Implications

For retirement planning, discover Gold IRA choices with specialised sellers somewhat than easy bodily acquisition by way of retailers like Costco.

Conclusion: Strategic Method to Gold Funding

Whereas Costco gold represents real investment-grade treasured metallic, its extreme limitations in product choice, frequent availability points, full lack of buyback provisions, and lack of ability to help tax-advantaged constructions like Gold IRAs make it a basically compromised choice for critical traders.

Specialised sellers like BullionStar present a complete ecosystem for treasured metals possession—from acquisition by way of storage to eventual liquidation—with pricing benefits, market experience, and funding steerage that mass retailers merely can’t match.

The elemental precept stays fixed: knowledgeable traders evaluate choices completely, perceive the entire possession lifecycle, and make choices based mostly on whole price of acquisition and eventual liquidation somewhat than preliminary buy value alone. By these requirements, specialised bullion sellers constantly outperform common retailers in delivering superior worth and repair to treasured metals traders.