As banking techniques falter, currencies devalue, and international conflicts escalate, thousands and thousands of People maintain financial savings and portfolios which are dangerously uncovered to systemic dangers—all as a result of monetary advisors deliberately exclude one essential asset class: bodily gold bullion.

This omission leaves hardworking savers only one market crash away from devastating losses whereas denying them the wealth preservation energy that has safeguarded households by wars, depressions, and forex collapses for over 5,000 years.

Regardless of gold’s 5,000-year historical past as a financial steel and retailer of worth, lower than 2% of People personal bodily gold as an funding, and even fewer have been suggested to take action by their monetary professionals.

This widespread omission isn’t merely coincidental. There are particular, structural the reason why the monetary advisory {industry} largely steers purchasers away from bodily treasured metals.

Immediately, we’ll discover what many monetary advisors aren’t telling you about gold bullion – and why this data hole may depart your financial savings and portfolio weak.

The Fee Battle: How Advisor Compensation Discourages Gold Suggestions

The trendy monetary advisory enterprise operates totally on both fee-based or commission-based fashions. Neither construction incentivizes the advice of bodily gold bullion.

Price-based advisors sometimes cost a proportion of property underneath administration (AUM), generally 1-1.5% yearly. Bodily gold saved outdoors the monetary system—whether or not in a personal vault or private secure—generates no ongoing charges for the advisor. Allocating $100,000 to bodily gold as a substitute of managed funds represents $1,000-1,500 in misplaced annual income per consumer.

Fee-based advisors face comparable disincentives. Whereas promoting mutual funds, annuities, and insurance coverage merchandise can generate as much as 6% commissions, the margins on bodily treasured metals sometimes vary from 1-3%, typically as one-time transactions quite than recurring income streams.

This compensation construction creates an inherent battle of curiosity. Even well-intentioned advisors working underneath fiduciary requirements face financial stress to advocate paper property over bodily bullion.

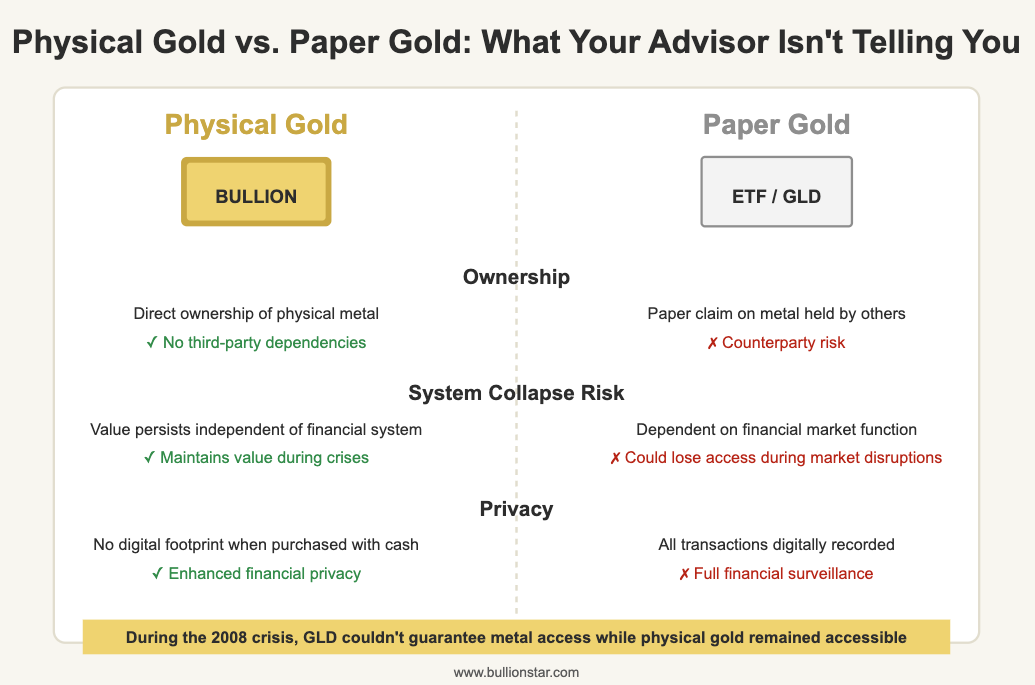

Bodily Gold vs. Paper Gold: A Essential Distinction Your Advisor Might Blur

When gold does enter the dialog with monetary advisors, the advice sometimes leans towards “paper gold” – monetary merchandise that observe the gold worth quite than present precise possession of the steel itself.

These embody:

Whereas these devices supply comfort and liquidity, they essentially differ from bodily gold bullion in a single essential respect: counterparty danger. Every paper gold car is determined by the continued solvency and honesty of a number of monetary intermediaries.

The favored SPDR Gold Belief (GLD) prospectus spans 40 pages of authorized disclaimers and danger elements. Few advisors direct purchasers to learn this doc, which explicitly states: “The Belief could not have ample sources of restoration if its gold is misplaced, broken, stolen or destroyed.”

Throughout the 2008 monetary disaster, many gold ETF holders had been stunned to be taught their “gold funding” didn’t assure entry to precise steel throughout a liquidity crunch. Related issues emerged in 2020 when the unfold between paper and bodily gold costs quickly widened to unprecedented ranges as demand for actual steel surged.

Bodily gold bullion, against this, carries no counterparty danger when straight owned and adequately saved. This basic benefit not often options in typical monetary advisory conversations.

Financial savings & Portfolio Safety: From Market Crashes to Regime Modifications

Financial savings & Portfolio Safety Past Correlation Statistics

When gold is mentioned in mainstream monetary planning, it’s sometimes framed when it comes to its correlation (or lack thereof) with different asset lessons. Whereas this statistical strategy has advantage, it drastically undersells gold’s main perform: financial insurance coverage towards each quick market dangers and long-term systemic challenges.

Historic knowledge demonstrates gold’s distinctive efficiency during times of monetary stress:

-

- Throughout the 2008 monetary disaster, gold rose 25% whereas the S&P 500 fell 38%

- In 2020’s pandemic market shock, gold dropped simply 3% in the course of the preliminary selloff in comparison with the S&P 500’s 34% plunge

- Throughout the regional banking disaster of March 2023, gold surged whereas financial institution shares collapsed

- Immediately, as we confront unprecedented commerce wars, gold has achieved new heights.

This efficiency sample isn’t coincidental. Gold serves as a hedge towards the monetary system’s foundations: forex debasement, banking system fragility, and counterparty danger.

Normal financial savings and portfolio modeling instruments don’t adequately seize these systemic dangers, specializing in historic correlations throughout regular market situations.

Wealth Preservation Via Generations and Regime Modifications

Whereas standard advisors deal with quarterly efficiency metrics, gold’s strongest property extends far past short-term market actions. All through historical past, gold has preserved wealth throughout generations, political upheavals, and full financial system resets.

Normal monetary planning operates inside assumptions of political and financial stability. Historical past suggests such stability isn’t assured throughout generational timeframes.

All through the twentieth century, quite a few nations skilled forex collapses, asset confiscations, banking system failures, and political revolutions that decimated paper wealth. From the German hyperinflation of the Twenties to the Argentine forex crises of the early 2000s, from the Cyprus financial institution deposit confiscation of 2013 to the continued Venezuelan financial collapse – monetary system failures recur with shocking regularity..

In every case, bodily gold saved outdoors the banking system preserved buying energy whereas locally-denominated monetary property evaporated.

The identical properties that make gold carry out effectively throughout market crashes – its standing outdoors the monetary system and common recognition of worth – additionally make it distinctive throughout extra excessive situations that few advisors are snug discussing with purchasers, regardless of their historic frequency.

Few advisors think about gold insurance coverage quite than merely one other asset class, maybe as a result of doing so would require acknowledging systemic vulnerabilities within the monetary system from which they derive their livelihood.

The Privateness Benefit in an Age of Monetary Surveillance

Bodily gold affords a degree of monetary privateness more and more uncommon in immediately’s world – a profit seldom talked about in standard monetary planning discussions.

In contrast to just about all monetary property, bodily gold:

-

- Requires no private data to buy (under-reporting thresholds)

- Creates no digital transaction document when purchased with money

- Generates no statements, 1099s, or automated reporting

- In lots of circumstances, gold may be transported throughout nationwide borders with out third-party permission (topic to customs declarations)

Authorized privateness is a respectable proper that bodily gold uniquely preserves. As banking privateness continues to erode worldwide, this function of bodily gold turns into more and more useful but stays undiscussed primarily in mainstream monetary planning.

Gold’s Worldwide Liquidity: The Common Asset

One other underappreciated facet of bodily gold is its common recognition and liquidity. In contrast to most jurisdictionally sure monetary property, gold is a world forex acknowledged throughout borders and cultures.

This attribute turns into invaluable during times of capital controls or banking restrictions.

When Cyprus froze financial institution accounts in 2013, Greece restricted ATM withdrawals in 2015, and Lebanon enacted casual capital controls in 2019, these holding bodily gold retained entry to their wealth, whereas these with solely financial institution deposits encountered important restrictions.

Bodily gold may be bought for native forex in just about any nation, making it an distinctive asset for these dealing with geopolitical uncertainty or the potential for relocation. These advantages are not often mentioned in normal monetary planning frameworks.

Storage Options and Safety Myths

When bodily gold does enter monetary planning conversations, the dialogue of storage typically focuses solely on safety issues whereas ignoring fashionable storage options.

Skilled allotted storage affords most safety with recognized bars in your identify, segregated from different purchasers’ holdings, and totally insured. Trendy dwelling safety options have made personal storage significantly extra viable than in earlier eras for these preferring private possession.

The narrative that bodily gold is essentially troublesome or harmful to personal serves monetary pursuits that profit from maintaining consumer property throughout the financial system. Safe, insured storage options exist at affordable prices – sometimes 0.5-0.7% yearly, lower than half the price most monetary advisors cost.

At BullionStar, we provide US clients one 12 months of complimentary safe treasured steel storage

Many wealth administration corporations cost as much as 1% in charges, not together with hidden prices. Take note of buying and selling charges, fund expense ratios, and custodial charges. This context reveals that storage charges for treasured metals are extremely aggressive.

A Balanced Strategy to Gold Allocation

Somewhat than accepting the industry-standard dismissal of bodily gold, think about asking your monetary advisor these questions:

-

- “What particular allocation to bodily gold bullion (not ETFs or mining shares) do you advocate, and why?”

- “How would you examine the counterparty dangers of gold ETFs versus allotted bodily gold?”

- “What historic examples are you able to present the place bodily gold did not protect buying energy throughout forex crises?”

Their solutions–or lack thereof–could reveal the restrictions of standard monetary advisors’ knowledge concerning this historic however enduringly related financial steel. It’s little marvel many People flip to Costco to purchase gold.

Taking Motion: First Steps Towards Bodily Gold Possession

If you happen to’re contemplating including bodily gold to your financial savings and portfolio, begin with these steps:

-

- Schooling: Be taught the basics of gold as financial insurance coverage quite than merely one other funding

- Product choice: Perceive the variations between cash, bars, and numerous types of bullion

- Authentication: Buy solely from respected sellers with established observe information

- Storage: Consider skilled storage, financial institution secure deposit bins, and residential storage choices primarily based in your scenario

- Documentation: Keep acceptable information for potential future sale or inheritance functions

Whereas the monetary advisory {industry} could have structural causes to downplay bodily gold possession, an knowledgeable investor could make unbiased selections about this distinctive asset class.

Gold has preserved wealth for 1000’s of years earlier than fashionable monetary planning existed—and will proceed to take action lengthy after immediately’s funding automobiles have been forgotten.

BullionStar: A Premium Resolution for Bodily Gold Possession

For US buyers searching for a trusted companion in bodily gold possession, BullionStar affords a complete resolution that addresses the issues outlined on this article. In contrast to many home sellers who merely facilitate transactions, BullionStar supplies an built-in strategy to treasured metals possession with a number of distinct benefits.

Offshore Storage for Enhanced Safety and Privateness

Maybe BullionStar’s most vital differentiator is their worldwide vault choices. Positioned in Singapore, one of many world’s most secure and revered monetary jurisdictions, BullionStar’s vault services supply US buyers a degree of geographical diversification unavailable by home suppliers.

Singapore maintains strict banking secrecy legal guidelines and has no reporting necessities to overseas tax authorities past established tax treaties. This creates a authorized and safe setting for asset safety that operates outdoors the US monetary system’s more and more complicated net of rules and reporting necessities.

BullionStar’s allotted storage means your treasured metals are held in your identify, segregated from others’ holdings, totally insured, and audited by revered third events. This association supplies the final word mixture of safety, privateness, and authorized compliance, addressing a number of key issues that conventional monetary advisors not often focus on.

Vertically Built-in Enterprise Mannequin

In contrast to many bullion sellers who function primarily as middlemen, BullionStar’s vertically built-in strategy encompasses:

-

- Direct bullion sourcing from main refineries and mints

- Rigorous authentication processes with state-of-the-art verification gear

- Safe showroom services for bodily inspection of merchandise

- Proprietary storage vault operations underneath their direct administration

- Built-in buy-back program with clear pricing

This end-to-end management of the provision chain ensures authenticity, aggressive pricing, and repair continuity that fragmented supplier preparations can not match.

Taking the Subsequent Step

For US buyers able to discover bodily gold possession past the restrictions of standard monetary recommendation, BullionStar affords free sources, market insights, and schooling.

Our worldwide perspective and deep experience in bodily treasured metals present a useful counterpoint to home monetary advisory companies that usually overlook or misunderstand this essential asset class.

Go to BullionStar’s web site to be taught extra about our offshore vault choices, the place you’ll be able to globally diversify your treasured metals, discover a complete product choice, and find out how we’re serving to People safe their wealth preservation methods past the standard monetary system.

You may additionally be eager about what the new US tariffs imply in your wealth.

Disclaimer: This text is for informational functions solely and shouldn’t be construed as monetary recommendation. Seek the advice of with certified professionals concerning your particular scenario earlier than making funding selections.