Brandon Sauerwein, Editor

Final week, gold made historical past. This week, it’s catching its breath.

After an explosive surge to an all-time excessive of $3,500 per ounce — one of many quickest bull runs in gold’s historical past — costs have pulled again to round $3,300. Some could marvel if the rally has peaked. However for seasoned buyers, this appears to be like much less like a prime… and extra like a textbook shopping for alternative.

As a result of the forces behind gold’s rise haven’t pale — they’re accelerating. Think about this:

- Gold continues to be up greater than 28% year-to-date

- Central banks proceed so as to add to reserves — significantly within the East

- International de-dollarization is accelerating amid geopolitical realignment

Mike Maloney believes we’re within the early levels of a large financial reset — and that gold is nowhere close to its ultimate vacation spot…

What If the Way forward for Cash Isn’t Digital — however Gold?

In his latest must-watch video, Mike Maloney presents his boldest argument but for a brand new gold-backed international financial system — and a possible gold worth of $10,000.

With Treasury Secretary Scott Bessent, international central banks, and main hedge funds like Bridgewater now overtly calling for financial reform, the indicators are in every single place:

- Mike believes a brand new Bretton Woods-style settlement could also be brewing

- China is stockpiling gold, whereas the U.S. quietly replenishes its personal reserves

- A $10,000 gold worth could not simply be attainable — it might be important after the financial reset on the horizon

“We’re not on the finish of this technique. We’re on the sting of the subsequent one. And gold shall be on the heart of it.” – Mike Maloney

For those who watch one video this week, make it this one.

Why This Pullback Might Be the Finest Entry Level All Yr

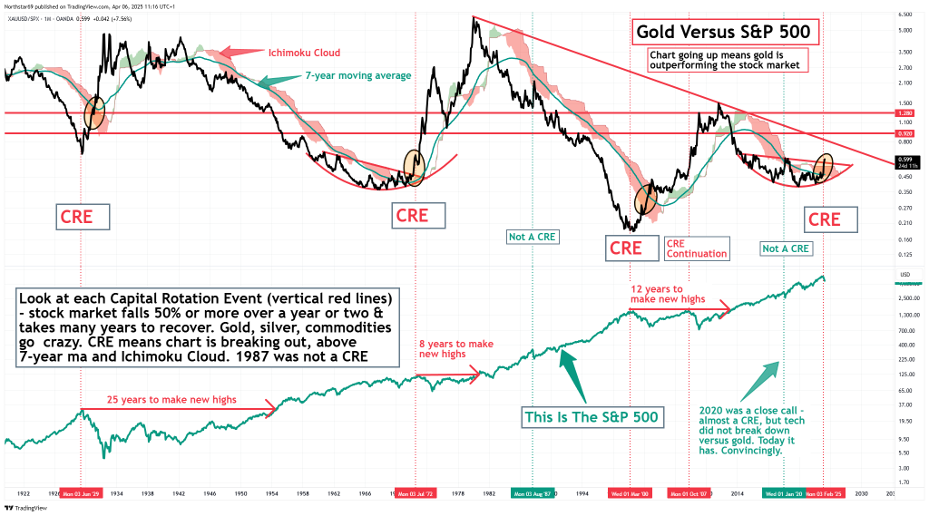

In a strong current panel, Alan Hibbard, Kevin Wadsworth, and Patrick Karim revealed why we could also be within the early levels of a uncommon and historic Capital Rotation Occasion — a shift of wealth from overvalued paper property into tangible shops of worth like gold and silver.

These rotations are uncommon. However after they occur, they reshape monetary markets. Think about:

- 1929: After the crash, it took 25 years for the S&P 500 to get well

- 1972: Publish-Nifty Fifty bubble, shares wanted 8 years to reclaim their highs

- 2000: After the tech bust, it took 12 years for the S&P to bounce again

Supply: Northstar Unhealthy Charts

In every case, capital fled shares and flowed into gold and silver. Those that moved early captured outsized beneficial properties.

Safe Bulk Pricing on Each Single Gold & Silver Buy

What Else is within the Information?

📉 Three-Yr Progress Streak Ends as US Financial system Shrinks in Early 2025

The US economic system shrank by 0.3% within the first quarter of 2025, marking the primary financial contraction in three years. This decline was barely worse than economists’ expectations of a 0.2% drop and represents a big slowdown from the two.4% development recorded in late 2024. The Bureau of Financial Evaluation says the contraction partly to a surge in imports — which subtract from GDP — as corporations rushed to safe items forward of latest tariffs.

Markets are reacting sharply to the information. On the time of writing, the Dow is down as a lot as 700 factors, as buyers digest the financial slowdown.

🚢 U.S. Provide Chains Brace for Influence as China Tariffs Start to Chew

President Trump’s 145% tariffs on Chinese language items have already prompted cargo shipments to plunge 60% since early April. The ripple results are imminent: main retailers like Walmart and Goal are warning of empty cabinets and rising costs by mid-Could as inventories skinny. Even when commerce talks resume quickly, restarting imports might overwhelm logistics networks — echoing the transport delays and value spikes seen through the pandemic.

💵 Trump Tariffs Slam the Greenback — Worst Drop Since 2002

The U.S. greenback is on monitor for its largest two-month decline in over 20 years, down 7.7% in March and April. The autumn was triggered by Germany’s stimulus plans (boosting the euro) and Trump’s tariff warfare (driving buyers into safe-haven currencies). Whereas stories of attainable tariff reduction gave the greenback a modest bounce on Tuesday, international buyers stay cautious of U.S. property amid the chaotic commerce negotiations.

💳 Credit score Disaster: Fed Warns of Highest Client Misery in 12 Years

Monetary pressure is constructing. The Federal Reserve Financial institution of Philadelphia stories 11.1% of Individuals at the moment are making solely minimal funds on their bank cards — the very best charge since 2012. Delinquencies are additionally surging, pushed by years of inflation and rising reliance on debt for necessities. With common bank card rates of interest now above 21%, households are feeling the squeeze.

📉 Gold Pulls Again After $3,500 Peak

After a record-breaking run — 28 new highs and a 28% YTD acquire — gold has cooled to round $3,300. For long-term buyers, this might be a wholesome reset — and probably a powerful entry level.

📊 Goldman Sachs Reaffirms $4,500 Gold Tail Danger

Goldman Sachs thinks this pullback might be momentary. They’ve simply raised their 2025 goal to $3,700 — and say gold might spike to $4,500 if markets face a Fed pivot or broader systemic stress. Of their view, the upside stays very a lot alive.

💬 What GoldSilver Buyers are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Buyer Service could be very useful!

“Travis was superb! I used to be having problem with a wire switch of my life’s financial savings, and I used to be very anxious that I may not be capable of obtain all of it. My husband simply handed away and I’ve been anxious about these funds together with grieving for 8 months. As quickly as I bought related with Travis, my considerations had been instantly addressed and he put me comfy. The difficulty was resolved inside days. He even known as me again with updates to maintain me within the loop about what was happening with the funds. I’m so grateful for a buyer consultant like Travis. He actually cares for his purchasers.” — A. Howard

Expertise the GoldSilver distinction:

- Obtain skilled steering from devoted valuable metals specialists

- Entry complete academic sources to grasp your funding technique

- Belief in our industry-leading customer support group that places you first

Able to get began?