Brandon Sauerwein, Editor

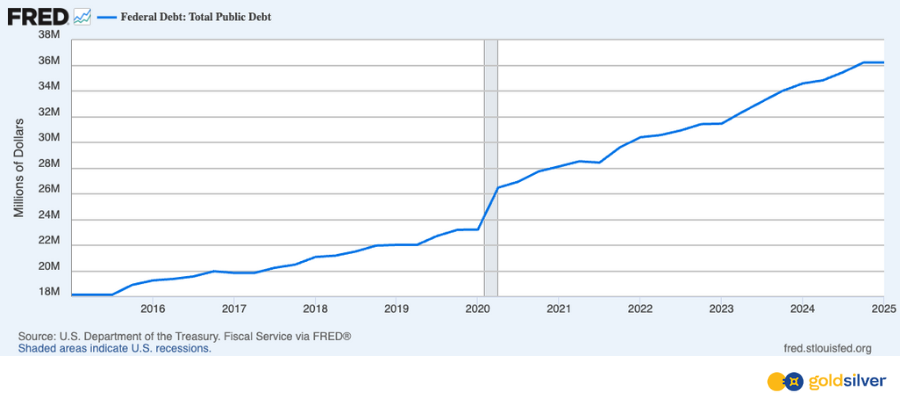

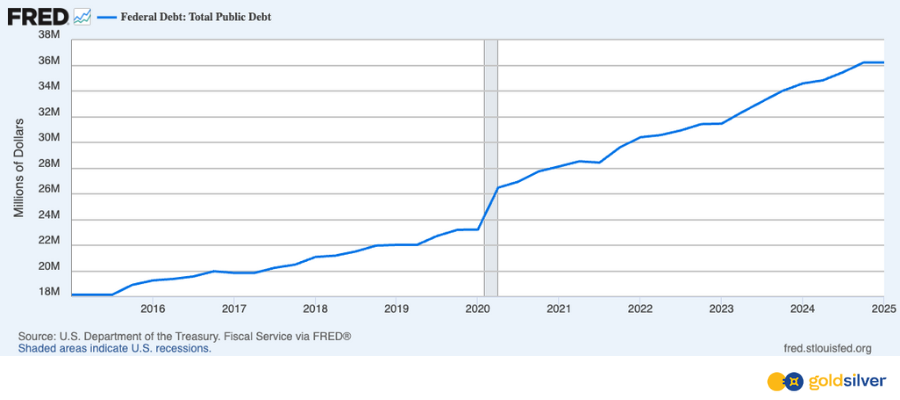

One other trillion in debt — in roughly 211 days.

The U.S. nationwide debt has climbed from $36 trillion to over $37 trillion in roughly seven months. That’s about $4.7 billion added each single day.

The final time America had a federal funds surplus? That was again in 2001.

Since then, 12 months after 12 months of unchecked spending and mounting deficits precipitated the nationwide debt to double over the previous decade. As of 2024, our nationwide debt has grown to 124% of GDP.

And the price of servicing this debt? Curiosity funds account for 10.7% of all federal spending in 2023 — a burden persevering with to develop heavier as charges keep elevated…

The place Does It Finish?

Trump’s proposed tax-and-spending invoice, which may add trillions in deficits, will solely worsen the scenario. An increasing number of People are waking as much as the truth that this path is unsustainable.

All through historical past, nations have tried to spend their means out of bother — funding limitless wars whereas on a regular basis savers foot the invoice. The sample is predictable: currencies debase, buying energy erodes, and those that trusted paper guarantees lose.

That’s why now — greater than ever — it’s essential to take proactive steps to safeguard what you’ve labored so onerous to construct. Bodily treasured metals stay one of many few property with no counterparty threat, no printing press, and no political agenda.

Tangible, time-tested, and trusted — actual property for unsure instances.

In Case You Missed It:

The Demise of Wall Road? Why Good Cash Is Going Native

There’s a quiet revolution unfolding — one you received’t hear a lot about within the headlines.

Centralized management is breaking down. And as a replacement, Fundamental Road capitalism is making a comeback — fueled by those that perceive actual cash (gold, Bitcoin) and community-first companies.

Should you’ve sensed a significant shift underway, this dialog connects the dots — and exhibits how sensible traders are already positioning themselves.

Gold and Greenback Rising Collectively? Right here’s Why It’s Taking place

Most traders imagine it’s both/or: gold rises when the greenback falls, and vice versa.

However what if each may rise concurrently?

Mike Maloney sat down with Brent Johnson at Insurgent Capitalist Reside to unpack precisely that — and the way it suits into the Greenback Milkshake Principle that’s gaining traction quick.

If you wish to perceive what’s driving capital flows right this moment — and learn how to place your self neatly — don’t miss this one.

Reduce By the Mainstream Noise

The MacroButler breaks down what’s actually driving gold, silver, and the worldwide economic system — so you can also make smarter choices along with your cash. Learn his newest article Why Gold, Not Fashions, Will Ship in 2025 – MacroButler

Latest Articles

Market Pulse: This Week in Metals

🚀 Gold and Silver on Observe for Large 2025 Good points

Gold is up 29% to date this 12 months, with silver shut behind at 25.5%. If this tempo continues by means of year-end, gold may notch a 58% achieve in 2025, with silver hitting 51% — staggering good points that might mark one of many strongest years for treasured metals in fashionable historical past.

🕊️ Iran-Israel Truce Calms Metals Markets

Gold steadied this week following experiences of a truce between Israel and Iran, easing geopolitical tensions and threat urge for food. Costs have hovered between $3,300–$3,400 as markets shift focus to approaching U.S. financial information.

⏱️ Powell: No Rush to Reduce Charges Regardless of Political Stress

Fed Chair Jerome Powell advised Congress the central financial institution will look ahead to extra financial information earlier than contemplating fee cuts — a stance that contrasts with President Trump’s requires speedy easing. Powell emphasised the Fed stays “well-positioned to attend.”

📊 Fed Eyes Tariff Impression Earlier than Coverage Shift

Minneapolis Fed President Neel Kashkari echoed warning, noting latest inflation information has improved however warning that tariffs may nonetheless drive costs greater. Whereas some Fed officers favor fee cuts this summer time, the committee stays divided.

📈 BofA: Ballooning US Debt Will Drive Gold to $4,000

Financial institution of America forecasts gold may hit $4,000/oz inside a 12 months. Whereas previous good points have been fueled by geopolitical tensions, BofA says exploding U.S. deficits would be the major driver going ahead. Central banks are more and more dumping Treasuries in favor of gold, a pattern accelerating as international debt soars.

💬 What GoldSilver Buyers are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Jenelle in Buyer Help – Excellent Woman!

“Jenelle helped me to replace my particulars at Gold and Silver in addition to explaining quite a few issues that I didn’t absolutely perceive together with making a Roth IRA. She very patiently took me by means of the whole lot I wanted for over half an hour -she was so useful,very nice and if I may fee her over 5 stars, I’d-she is an absolute gem and ask you to please share this with Mike directly-she is a tribute to your Firm-thank you. Gwyn Elias-a buyer of yours since 2016” — Gwyn E.

Expertise the GoldSilver distinction:

- Obtain professional steerage from devoted treasured metals specialists

- Entry complete instructional assets to grasp your funding technique

- Belief in our industry-leading customer support group that places you first

Able to get began?