Brandon Sauerwein, Editor

In case you’ve ever questioned what runaway fiscal coverage appears like in actual time — that is it.

Again in Could, the Home narrowly handed President Trump’s “Massive Lovely Invoice,” a sweeping tax and spending package deal projected so as to add $2.8 trillion to the federal deficit over the subsequent decade. However the Senate simply upped the ante.

On July 1, the Senate handed an amended model of the invoice, which slashes federal revenues by $4.5 trillion whereas reducing solely $1.2 trillion in spending. The outcome? A $3.3 trillion enhance within the deficit — half a trillion {dollars} greater than the Home plan.

And whenever you issue within the further borrowing prices? We’re taking a look at practically $4 trillion in new debt this 12 months alone…

Is This the Breaking Level for the U.S. Greenback?

Because the nationwide debt barrels previous $37 trillion, it’s clear Washington has deserted any pretense of fiscal self-discipline. With elections behind them, lawmakers from each events have quietly shelved deficit considerations.

Trillions in new deficits are being waved by — as a result of kicking the can down the highway is less complicated than going through actuality. In the meantime, the markets are already reacting.

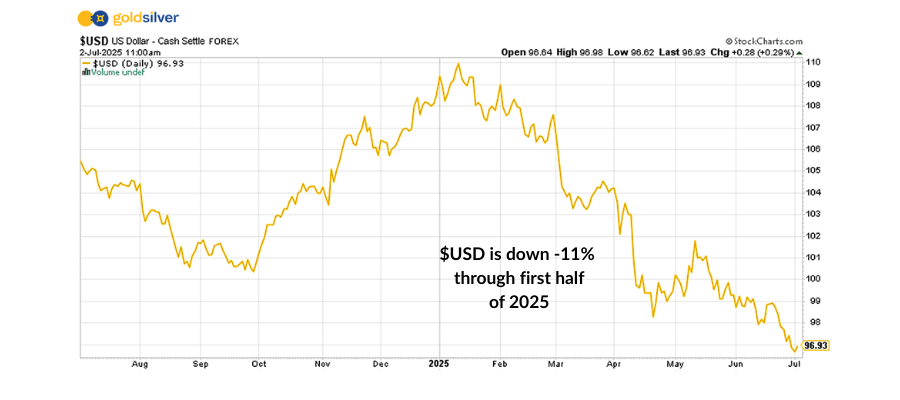

The U.S. greenback is having its worst begin to the 12 months in many years. The Greenback Index (DXY) — which tracks the dollar in opposition to a basket of main currencies — is down 11% by the primary half of 2025.

US Greenback Over Previous 12 Months

That’s the sharpest first-half decline for the greenback since 1973. Right here’s occurred to the value of gold by the remainder of the last decade:

- 1974: +58%

- 1975: +4.5%

- 1976: -22.5%

- 1977: +18.5%

- 1978: +31%

- 1979: +58%

- 1980: +101%

Seasoned buyers can see the writing on the wall: When politicians from each events agree that deficits don’t matter, currencies all the time pay the value.

For these targeted on preserving long-term wealth, this isn’t the time for wishful pondering. It’s time to place your self forward of the inevitable penalties.

In Case You Missed It:

💵 Central Banks Are Dumping {Dollars} at File Tempo

The greenback’s dominance simply dropped from 58% to 44% — and professional merchants haven’t shorted it this closely since 2005. In the meantime, central banks are shopping for gold at file tempo.

On this eye-opening episode, Mike reveals:

- Why Treasury’s “stablecoin repair” barely dents the debt

- The 2022 set off that flipped central banks from {dollars} to gold

- What the 30-year countdown means on your future

📈 The Portfolio Technique That Practically Doubles the 60/40 Portfolio

For years, monetary advisors pushed the 60% shares / 40% bonds mannequin because the gold customary. However what if you happen to may’ve practically doubled these returns?

Based on new Goldman Sachs analysis, including gold and silver to your portfolio would have completed precisely that — going again over 20 years.

On this episode, Mike and Alan break down:

- The danger-adjusted returns that obtained Wall Avenue’s consideration

- Why bonds are failing as a hedge (and what works as a substitute)

- Actual portfolio methods you should use right now

Current Articles

Market Pulse: This Week within the Information

💰 Minimal Wage Hikes Take Impact in 15 States and Cities

As of July 1, over 880,000 staff will see pay bumps in locations like Alaska, Oregon, and Washington D.C., including $397 million yearly to wages. Main cities together with Chicago, LA, and San Francisco are additionally elevating charges. In the meantime, lawmakers in states like Missouri are pushing to restrict voter-approved will increase.

📈 Client Confidence Hits 4-Month Excessive Regardless of Job Fears

June noticed client sentiment rise to 60.7 — the best since February — as inflation fears ease. Expectations for 1-year inflation dropped from 6.6% to five%, and long-term outlooks fell to 4%. Nonetheless, greater than half of customers anticipate unemployment to rise, and tariff considerations linger.

🏦 Trump Blasts Fed, Calls for Fast Fee Cuts

In a fiery interview, Trump slammed Fed Chair Jerome Powell as “silly,” demanding charges be slashed to 1–2%. With present charges at 4.25–4.5%, he warned no future Fed appointment can be made and not using a promise to chop. Treasury Secretary Bessent hinted a alternative could possibly be named by October.

🌐 Trump Holds Agency on July 9 Tariff Deadline

President Trump confirmed the 90-day world tariff pause will expire July 9, with no extensions deliberate. Nations will quickly obtain discover of recent tariffs — starting from 10% to 50% — primarily based on their commerce relations with the U.S. Negotiating 90 particular person offers stays an uphill battle.

🥈 The Silver Institute: Silver Faces Fifth Straight 12 months of Deficit

For the fifth 12 months in a row, the world used extra silver than it produced. The Silver Institute’s World Silver Survey 2025 reveals a 149M oz shortfall in 2024, pushed by file industrial demand. With one other 117.6M oz deficit anticipated this 12 months, provide stress on bodily silver is constructing — and sensible buyers are watching intently.

💬 Why Buyers Select GoldSilver

⭐ ⭐ ⭐ ⭐ ⭐ Extraordinarily Concise

“Extraordinarily concise, simple to learn, explains REAL issues vs. the continuing narrative of Central Banks & Govt.’s. Prompts one to develop agitation for having buried one’s head in sand for many years & empowers one to unfold Reality. And brings to mild “how” to capitalize on this harmful interval of historical past. A MUST learn if you happen to use Forex/or REAL Cash.” — John D.

Be a part of hundreds of sensible buyers who’ve found the GoldSilver distinction:

- Private steering from treasured metals specialists who truly reply the telephone

- Actual training that cuts by the noise — no fluff, simply information

- A crew that treats you want household, not a transaction quantity

Able to get began?