Gold Hits New All-Time Excessive at $3,559

Gold surged to an all-time excessive of $3,559 per ounce, extending its record-setting run as rate-cut expectations, greenback weak spot, and safe-haven demand gasoline investor urge for food. The steel is up greater than 5% over the past seven buying and selling days, making this one in every of its strongest weekly strikes of the 12 months. Analysts level to heightened volatility in international markets, considerations over central financial institution independence, and a rush into exhausting property as key drivers behind bullion’s momentum.

Gold’s sustained energy underscores its attraction as a hedge in unsure instances. With financial coverage in flux, momentum merchants and long-term allocators alike are including publicity.

BRICS Summit Looms Amid Gold-Fueled De-Dollarization Push

The upcoming BRICS+ summit, set for late October in Russia, may considerably reshape the worldwide financial order — and gold is on the heart of it. With new members like Egypt, Iran, and the UAE already in and heavyweight contenders like Saudi Arabia, Turkey, and Mexico ready within the wings, the bloc now represents greater than 43% of world oil manufacturing and a rising share of world GDP. As dollar-reliant commerce faces mounting skepticism, BRICS nations are quickly growing their gold reserves and exploring settlement programs impartial of Western banking rails.

The takeaway right here is: As geopolitical alliances shift and belief in fiat weakens, gold is rising because the reserve asset of selection. Central banks aren’t simply speaking — they’re backing their currencies with bullion, and that pattern is more likely to speed up after the BRICS summit.

World Gold Council to Check Blockchain Gold Buying and selling in London

The World Gold Council (WGC) is launching a pilot program to digitize gold buying and selling in London’s large $900 billion bullion market. The initiative would permit gold to be traded, settled, and used as collateral on a blockchain-based platform, doubtlessly slicing prices. Backers say it may assist bridge the hole between bodily and digital property, making gold extra accessible to a wider vary of buyers.

Whereas “digital gold” would possibly sound threatening to conventional bullion buyers, suppose greater image: thousands and thousands of recent buyers gaining quick access to gold possession may drive unprecedented demand for the bodily steel that backs all of it.

Digital gold buying and selling may very well be a game-changer for the dear metals market, bridging the hole between bodily property and the digital financial system whereas doubtlessly boosting demand from tech-savvy buyers.

The Quiet Outperformers: Gold and Silver Depart Shares within the Mud

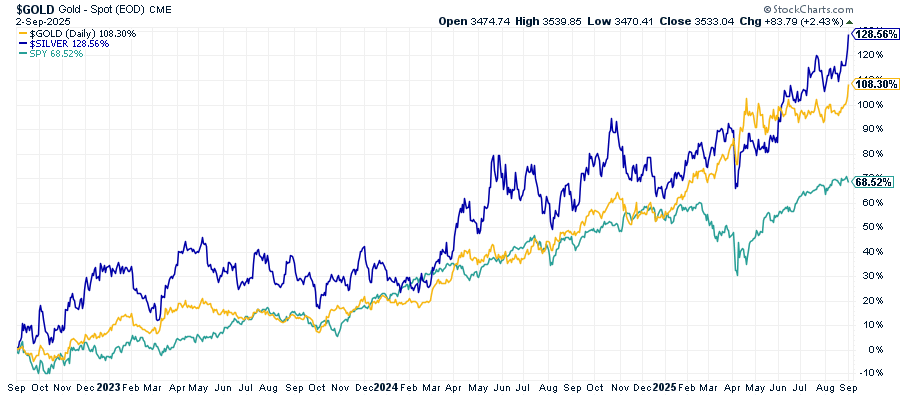

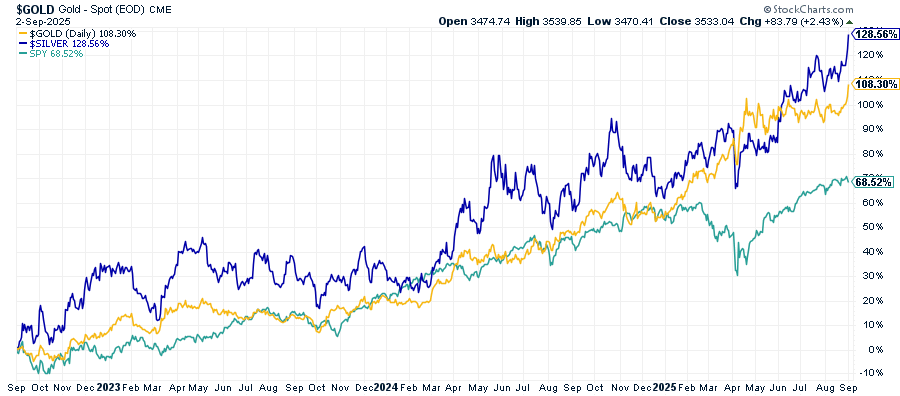

Whereas everybody’s been targeted on the inventory market’s current highs, valuable metals have been quietly crushing it. Over the previous three years, gold has surged 108% and silver an eye-popping 128%, whereas the S&P 500 (SPY) has gained a good however comparatively modest 68%. Regardless of the fixed headlines about inventory market information, it’s really been gold and silver delivering the true returns for affected person buyers.

Gold vs Silver vs SPY Over Previous 3 Years

Lengthy-Time period Bond Yields Surge, Signaling Hassle Forward

A pointy selloff in long-dated U.S. Treasuries has pushed yields to multi-year highs, rattling policymakers and buyers alike. Greater long-term yields improve borrowing prices for governments already working file deficits — they usually ripple outward, elevating financing prices for firms, mortgages, and customers. That may gradual progress and tighten monetary circumstances even with out Fed motion.

For markets, spiking yields additionally threat triggering volatility: fairness valuations come underneath stress as low cost charges rise, and extremely indebted sectors face refinancing dangers. Traditionally, such episodes usually feed safe-haven demand for gold, as buyers hedge in opposition to each inflationary financing and the danger of coverage missteps.

The takeaway right here is: Rising long-term yields are a double-edged sword — they spotlight market fears about debt sustainability and financial pressure, whereas additionally reinforcing gold’s position as a hedge when the bond market itself turns into a supply of instability.