Gold hit a contemporary file excessive within the wake of Jerome Powell’s dovish feedback that the Fed will take into account reducing rates of interest at its upcoming September FOMC assembly. Because the Fed is pressured into accommodative coverage and presumably even eventual QE, prepare for much more file highs for the yellow metallic.

However simply don’t dance.

That’s a quote from a well-known scene in The Large Brief, when Brad Pitt’s character Ben Rickert sternly reminds his youthful investing companions that the success of their commerce is barely doable due to great struggling on the a part of Individuals who have been suckered into bogus mortgages. As they excitedly dance in anticipation of all the cash they’re about to make, Pitt’s character says:

“You simply guess in opposition to the American economic system…which implies if we’re proper, individuals lose properties, individuals lose jobs, individuals lose retirement financial savings, individuals lose pensions…each one % unemployment goes up, 40,000 individuals die, do you know that?”

Actual numbers might range. However the sentiment is a reminder of the significance of gratitude and humility. Gratitude since you noticed what was coming, and took the proper steps to guard your self, your funds, and your loved ones. Humility as a result of your guess was that financial debasement and an financial disaster have been inevitable.

When that disaster comes, crucial factor can be to determine how one can rebuild in a approach that applies the teachings taught by the inflationary horrors of central banking. Historical past reveals that, as soon as a central financial institution is established, these classes are normally discovered the onerous approach.

Made as a response to the 2008 monetary disaster, The Large Brief has a lesson to show Wall Avenue. However they didn’t be taught something from 2008. As a substitute of restructuring to cut back threat, policymakers and bankers doubled down on the identical behaviors that prompted the disaster. Threat wasn’t eradicated. It was repackaged and shifted to new corners of the market.

As a substitute of poisonous mortgage-backed securities, right now we have now mountains of company debt sliced into tranches, leveraged loans bought to yield-hungry traders, and full industries hooked on artificially low cost credit score. The labels have modified, however the underlying sport hasn’t.

Within the years after 2008, inventory buybacks exploded as firms borrowed file quantities of cash at near-zero rates of interest to repurchase their very own shares. This monetary engineering boosted govt bonuses and briefly propped up inventory costs, however it left company steadiness sheets dangerously uncovered. By 2020, U.S. company debt had swelled to greater than $10 trillion, a lot of it rated simply above junk. When the pandemic hit, it took one other wave of Federal Reserve intervention to maintain the home of playing cards from collapsing. Reasonably than permitting a reset, the Fed backstopped threat but once more, instructing Wall Avenue the identical lesson it discovered in 2008: regardless of how reckless you might be, the Fed will bail you out. When the system relies on criminality, you must normalize the criminality to keep away from the entire thing from collapsing.

Firms gorged on low cost cash over the past decade of near-zero charges, to not increase productiveness, however to purchase again their very own inventory. By 2020, company debt had ballooned previous $10 trillion, a lot of it within the lowest investment-grade tier, only a downgrade away from junk. This echoes the mortgage market pre-2008, the place trillions of subprime loans have been disguised as protected. The one distinction now could be that as a substitute of poisonous mortgages,it’s overleveraged companies whose steadiness sheets can’t survive greater borrowing prices.

As for the housing market itself, after the 2008 foreclosures wave, you’d assume the lesson could be that actual property markets shouldn’t be handled as a on line casino. As a substitute, massive personal fairness companies and hedge funds stepped in, shopping for up distressed properties in bulk and or throwing up low cost, hastily-constructed McRentals.

Right now, complete neighborhoods are owned not by households, however as a speculative asset class in a manipulated on line casino. The cycle of actual property financialization continues, with renters dealing with skyrocketing prices as a substitute of house owners with dangerous mortgages.

In the meantime, workplace towers in main US cities are sitting half-empty, their values plunging as distant work reshapes demand. Banks, particularly regional ones, are full of loans tied to those buildings. It’s the identical dynamic as 2008’s housing bust, solely this time the collateral isn’t suburban properties, however glass skyscrapers nobody desires to lease, particularly within the distant work established order. If property values fall far sufficient, lenders will face billions in losses, threatening the identical contagion that after unfold by means of mortgage-backed securities.

Then there are CLOs, or collateralized mortgage obligations. As a substitute of bundling dangerous mortgages, Wall Avenue slices up leveraged loans made to already-indebted firms. Demand for yield has made CLOs one of many fastest-growing corners of finance. They’re nothing new, however you typically see them touted as having excessive returns with out a lot point out of the dangers. Everybody insists the chance is “well-distributed,” identical to they mentioned about subprime mortgages in 2007.

Regardless of 15 years of supposed “reform,” banks have been nonetheless borrowing brief and lending lengthy, leaving themselves weak the second the Fed raised charges. As soon as once more, the federal government and the Fed needed to step in with emergency services to stop contagion. Wall Avenue’s tradition additionally hasn’t modified. In 2008, it was mortgage brokers pushing loans to unqualified patrons. Right now, it’s enterprise capital companies throwing billions at profitless tech startups, hole crypto firms, or personal funds inflating valuations with low cost cash.

The names of the belongings change, from subprime mortgages to crypto exchanges or AI unicorns, however the underlying dynamic continues to be simply hypothesis fueled by leverage. In the meantime, Individuals are indebted to the gills, don’t have any financial savings, and are seeing their retirements inflated away.

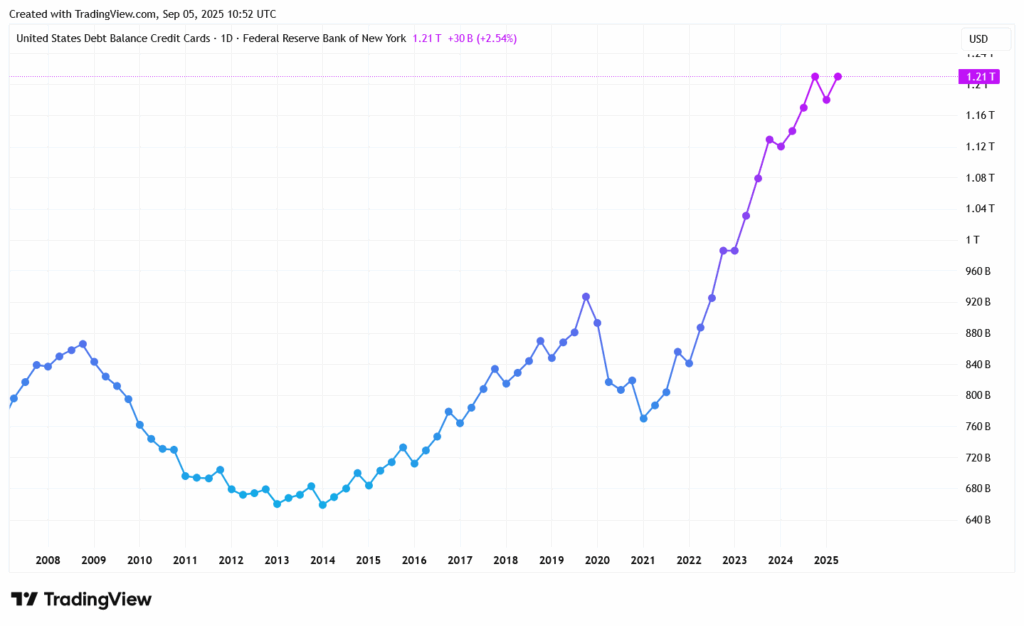

US Credit score Card Debt Balances

The “irrational exuberance” Alan Greenspan warned about within the Nineteen Nineties is again with a vengeance, solely this time fueled by trillions of {dollars} printed across the time of the pandemic. The names of the belongings are completely different, however the psychology is identical: everybody assumes the Fed will at all times trip to the rescue, regardless of how absurd the bubble.

As Peter Schiff not too long ago mentioned on QTR’s Fringe Finance:

“Identical to within the days and months main as much as the 2008 monetary disaster, nobody had a clue. However this time it’s greater — it’s a sovereign debt disaster, a foreign money disaster.”

However gold’s highs imply that traders are lastly dropping belief within the Fed, the rosy monetary knowledge, and Wall Avenue’s steadiness sheets. Rallying gold means skepticism in policymakers who preserve inflating new bubbles below the guise of preserving stability. The paper guarantees holding it collectively are solely nearly as good as the subsequent spherical of QE. Every new file excessive in gold is a vote of no confidence.

So long as chosen banks have the Fed as a purchaser of final resort, threat doesn’t matter. Perverse incentives result in perverse outcomes. The dancing continues, solely the music has modified. And gold’s rise is the reminder that this cycle, too, is heading towards a breaking level.

Financial crashes don’t simply erase paper wealth on Wall Avenue. They ripple out into jobs, financial savings, housing, and each different a part of the economic system. If the previous is any information, these on the prime will stroll away richer, whereas odd Individuals pay the worth. However some crashes are so huge that they name for a reset, and new financial paradigms are pressured to be born.

When this one occurs, and the powers that be clamor for CBDCs, crypto-dollars, and a system that offers them even better management, it will likely be as much as us to demand a tough cash commonplace that tethers our future to financial actuality fairly than the whims of central planners.

Name 1-888-GOLD-160 and converse with a Valuable Metals Specialist right now!