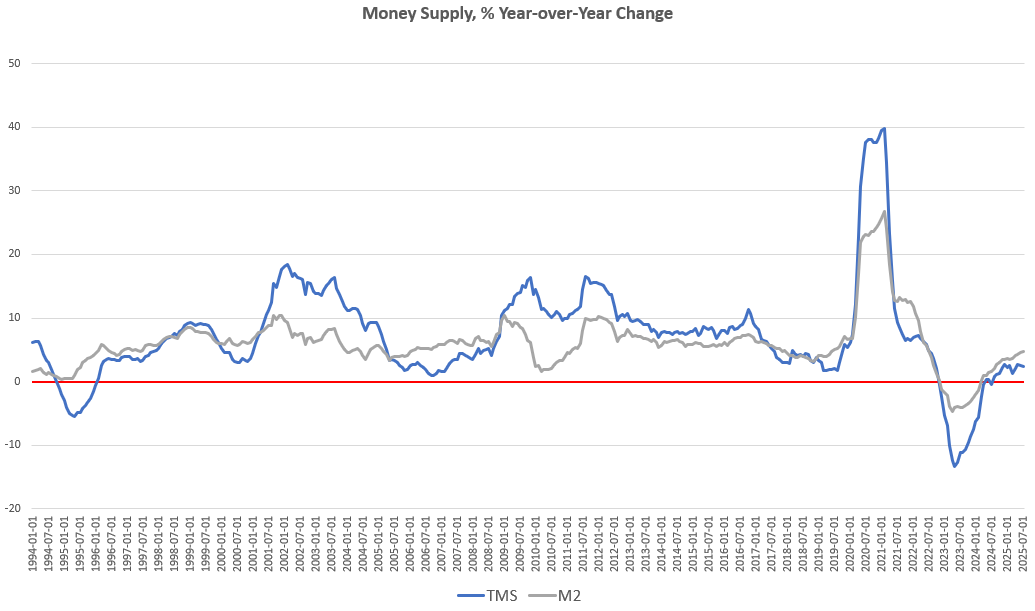

With latest financial information pointing to an unsure financial future, M2, a major measure of the cash provide, exhibits a flattening within the provide of cash. However, as extra exact measures of cash present us, this development might point out a latent recession within the dollar-fueled financial system.

The following article was initially revealed by the Mises Institute. The opinions expressed don’t essentially replicate these of Peter Schiff or SchiffGold.

The cash provide has almost flatlined in 2025, with July’s complete cash provide rising by solely $39 billion over the previous seven months. The entire dimension of the cash provide nonetheless stays greater than $5 trillion above its pre-covid complete—a rise of 35 %— however tendencies in delinquencies, employment, and residential gross sales have put downward strain on the cash provide all through a lot of 2025.

As of July, year-over-year progress within the cash provide was at 2.45 %. That’s down barely from June’s year-over-year improve of two.49 %. Cash provide progress can also be up in comparison with July of final yr when year-over-year progress was -0.43 %. The cash provide has now elevated, yr over yr, for twelve months in a row, following a really risky interval of immense progress within the cash provide—i.e., throughout 2020 and 2021—adopted by eighteen months of sizable declines within the cash provide throughout 2023 and 2024. Since then, nevertheless, cash provide tendencies have largely flattened.

This development has been very true within the first half of 2025. Month over month, the cash provide in July was up by 0.13 %, rising solely barely from June’s month-to-month progress charge -0.17 %. Throughout July of final yr, the month-to-month progress charge was 0.17 %.

The entire cash provide has hovered round $19.3 trillion for the previous three months, and is little modified from January of this yr, rising 0.2 %, or $39 billion since then.

This flattening of financial progress doubtless displays a number of tendencies we now see within the financial system. For instance, latest employment studies have proven that job progress has largely stalled, and July’s revisions to employment totals recommend that employment tendencies are worse than was beforehand thought. Furthermore, latest studies from the Federal Reserve Financial institution of New York exhibits that delinquencies on pupil loans, auto loans, and credit score cares are all at or above the degrees they have been through the Nice Recession. In the meantime, bankruptcies are up by greater than 11 % in 2025 in comparison with final yr, and pending residence gross sales proceed to fall.

All of those tendencies are more likely to affect cash provide progress. As Frank Shostak has defined, the cash provide will typically develop together with mortgage exercise at business banks, and will increase in mortgage exercise requires an abundance of credit-worthy debtors. As delinquencies and bankruptcies rise—a development made worse by stagnating employment—the variety of accessible debtors falls. Fewer loans will then be made and the cash provide will develop much less swiftly. On the opposite finish, a rising variety of defaulting debtors means beforehand lent {dollars} will “disappear” as these loans are by no means paid again, placing downward strain on the general cash provide. As home-sale totals fall, this additionally tends to imply fewer newly lent {dollars} getting into the financial system.

All of this collectively is a recipe for diminishing progress within the cash provide. When mixed with the Fed’s latest reluctance to decrease the goal coverage rate of interest—which has meant fewer financial injections from the Fed’s open market operations— we’re now seeing a flattening within the general cash provide.

The cash provide metric used right here—the “true,” or Rothbard-Salerno, cash provide measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to supply a greater measure of cash provide fluctuations than M2. (The Mises Institute now presents common updates on this metric and its progress.)

Traditionally, M2 progress charges have typically adopted a comparable course to TMS progress charges, however M2 is now rising significantly sooner than TMS, and a niche between the 2 measures has step by step widened. In July, the M2 progress charge, yr over yr, was 4.79 %. That’s up from June’s progress charge of 4.51 %. July’s progress charge was additionally up from July 2024’s charge of 1.54 %. Month over month, M2 has additionally grown sooner than TMS, rising by 0.33 % from June to July.

Though year-over-year and month-to-month progress charges could also be moderating, money-supply totals stay far above what they have been earlier than 2020 and the covid panic. From 2020 to 2022, the Federal Reserve’s easy-money insurance policies resulted in roughly 6.4 trillion {dollars} being added to the financial system. This was completed to assist to finance the federal authorities’s huge deficits pushed by runaway covid stimulus packages. Though the entire dimension of the cash provide has fallen since mid 2022, it has definitely not fallen sufficient to return cash provide progress to the pre-covid development, and the entire cash provide as of July stays 5 trillion above the place it was firstly of 2020.

Since 2009, the TMS cash provide is now up by almost 194 %. (M2 has grown by almost 156 % in that interval.) Out of the present cash provide of $19.3 trillion, almost 26 % of that has been created since January 2020. Since 2009, within the wake of the worldwide monetary disaster, greater than $12 trillion of the present cash provide has been created. In different phrases, almost two-thirds of the entire present cash provide have been created simply prior to now 13 years.

In consequence money-supply is now nicely above the previous development that was in place earlier than 2020. For instance, simply to get to again to the money-creation development that existed in 2019 earlier than the “nice covid inflation,” complete cash provide would want to fall by at the least three trillion {dollars}.

Why Is There a Rising Hole Between M2 and TMS?

However why is there a rising hole between M2 and TMS, and does it imply something? To reply the primary a part of this query we have to think about how M2 is calculated in another way from TMS. First, TMS contains Treasury deposits at Federal Reserve banks, whereas M2 doesn’t. These deposits have fallen by almost $200 billion since January. This has introduced down TMS totals, however has in a roundabout way diminished M2. Furthermore, M2 does embody retail cash funds whereas TMS does not embody these funds as cash. So, with retail cash funds rising by greater than $100 billion since January we’re seeing extra upward strain on M2 than on TMS. These are simply two elements which can be serving to to kind an ongoing hole between M2 and TMS.

Does this hole matter? Traditionally, a big and rising hole between M2 and TMS has prompt in a number of circumstances that the US financial system has already entered a recession. Trying again to the months earlier than the onset of recession in 1990, 2001, and 2007, we discover that the hole between TMS and M2 was close to a brand new peak in every case. An analogous phenomenon occurred in late 2019 together with the repo disaster of that yr. This was doubtless a prelude to a 2020 recession that would have occurred had the central financial institution not intervened to push excessive ranges of recent liquidity through the covid panic. Now, in mid 2025, this hole is now the most important it has been in many years—and presumably ever.

This doesn’t show that the US is within the midst of a recession in the meanwhile, however the rising hole between M2 and TMS means that the US is, at the least, getting into a interval of great financial weak point.

Obtain SchiffGold’s key information tales in your inbox each week – click on right here – for a free subscription to his unique weekly e mail updates.

Curious about studying easy methods to purchase gold and purchase silver?

Name 1-888-GOLD-160 and converse with a Valuable Metals Specialist at the moment!