Day by day Information Nuggets | In the present day’s high tales for gold and silver buyers

September tenth, 2025

Inflation Watch: All Eyes on This Week’s Stories

Key inflation knowledge dropping this week may present costs picked up pace in August, with economists anticipating 0.3% will increase throughout the board. However right here’s the twist: Even when inflation ticks larger, the Fed is prone to shrug it off and minimize charges anyway.

Why? The job market is weakening quick, and that’s change into the Fed’s larger fear. The central financial institution seems able to look previous any inflation bump and give attention to stopping a deeper financial slowdown when it meets September 16-17. Talking of the Fed, not everybody’s proud of the way it’s being run…

Trump vs. The Fed: Choose Blocks Presidential Energy Play

President Trump’s try to fireside Federal Reserve Governor Lisa Cook dinner simply hit a authorized wall. A federal decide quickly blocked the transfer, guaranteeing Cook dinner retains her seat — a minimum of by way of the essential September 16-17 Fed assembly the place she’ll vote on rates of interest.

Trump had tried to oust Cook dinner over mortgage fraud allegations, however the ruling underscores the Fed’s independence from presidential interference. It’s a major early victory for Cook dinner and a reminder that even presidents can’t merely dismiss Fed officers at will.

All this uncertainty is exhibiting up within the markets — and conventional secure havens proceed to win massive…

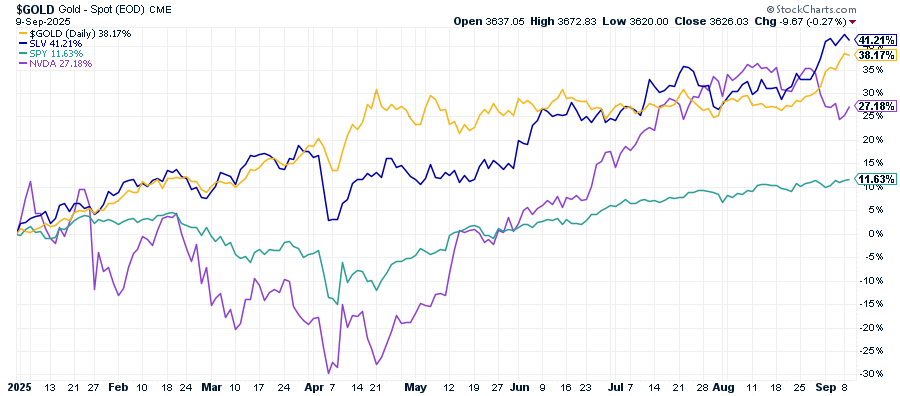

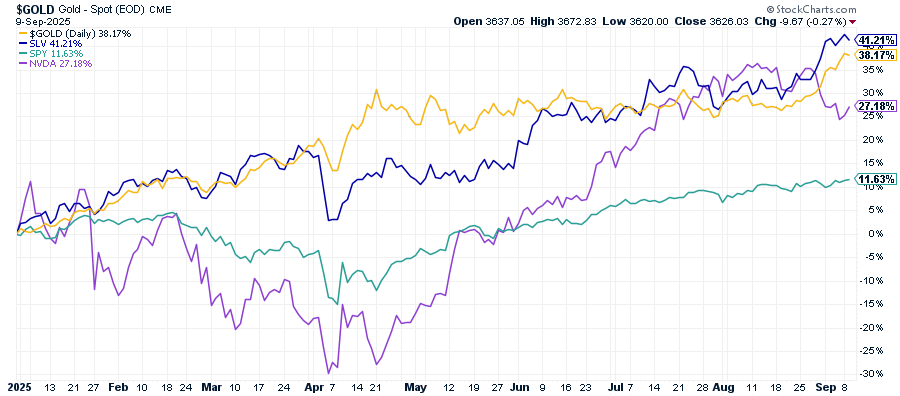

2025’s Shock Winners: Metals Triple S&P 500 Efficiency

Right here’s a stat that may shock you: Whereas everybody’s been obsessing over AI shares, gold and silver have quietly change into 2025’s runaway winners. Gold has surged 38%, silver a formidable 40% — each crushing the S&P 500’s modest 11.6% acquire.

Much more outstanding? Nvidia, regardless of dominating headlines and AI hype, sits at 27%—a full 11 factors behind gold.

It’s a story as outdated as markets themselves: When confidence wavers, buyers flee to what they will maintain. However this time, the flight to security is simply starting. Main banks are calling for a lot larger costs forward, with some focusing on ranges that may make at the moment’s beneficial properties look conservative.

ANZ Financial institution: $3,800 Gold by Yr-Finish

ANZ Group raised their gold forecast to $3,800 by December, with a possible peak close to $4,000 by mid-2026. The Australian financial institution cites “sturdy funding demand” because the driving power.

With gold already hitting a report $3,674 yesterday and up 38% this 12 months, their forecast doesn’t appear far-fetched. If gold does attain $3,800, that may imply 45% beneficial properties for 2025 — crushing almost each different asset class. The momentum exhibits no indicators of slowing as buyers search security from forex debasement and geopolitical tensions.

Goldman’s Name: $5,000 Gold “Highest Conviction” Commerce

Goldman Sachs simply made a daring name: gold is their high commodities decide, with potential to hit $5,000 by late 2026. The funding financial institution warns that threats to Fed independence may spark larger inflation, tank shares and bonds, and erode the greenback’s dominance.

Their message to buyers? Load up on gold as insurance coverage. With political uncertainty mounting and central banks worldwide already hoarding the steel, Goldman sees an ideal storm brewing for treasured metals.