Day by day Information Nuggets | Right this moment’s prime tales for gold and silver traders

September nineteenth, 2025

Gold Notches Fifth Straight Weekly Win

Gold is having fairly a run. The metallic is heading for its fifth consecutive weekly achieve, sitting fairly close to report highs after Wednesday’s Fed fee minimize. Up 39% this yr, gold has been the standout performer whereas shares and bonds wrestle with blended indicators.

Why the momentum? Simple arithmetic: when the Fed cuts charges, holding non-yielding gold turns into much less of a sacrifice. Merchants at the moment are watching to see how aggressive the Fed will get with future cuts. With recession fears rising and actual yields nonetheless detrimental, gold’s function as portfolio insurance coverage is trying like a sensible purchase.

The Triple Risk Pushing Gold to Information

Three forces are converging to ship gold costs skyward: escalating tariffs, cussed inflation, and an more and more dovish Fed. Commerce tensions are including gasoline to the inflation hearth simply because the Fed tries to assist a weakening economic system — creating what analysts name a “stagflation cocktail.”

It’s the form of setting the place conventional belongings wrestle however gold shines. The metallic has outperformed each shares and bonds this quarter, proving as soon as once more that when coverage makers are caught between a rock and a tough place, traders vote with their wallets for gold’s certainty.

India’s Marriage ceremony Season Sparks Gold Shopping for Spree

India’s gold market is buzzing because the pageant season approaches. Premiums simply hit a 10-month excessive as jewelers put together for Dussehra and Diwali — the nation’s peak gold-buying season. What’s attention-grabbing is the distinction with China, the place sellers are literally providing reductions. This break up between Asia’s two gold giants exhibits simply how highly effective cultural demand stays.

For the worldwide market, India’s seasonal urge for food couldn’t be higher timed. When the world’s second-largest gold client goes buying at already tight provide ranges, it tends to place a flooring beneath costs.

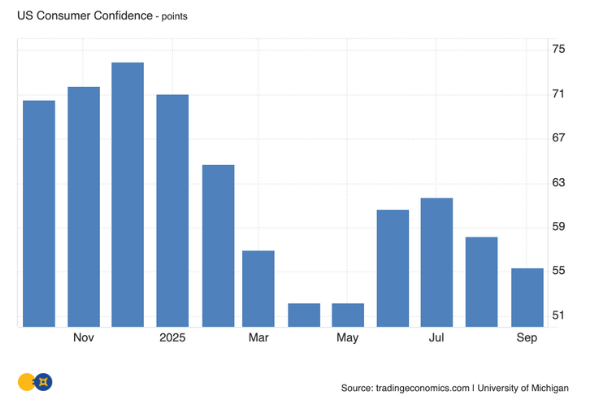

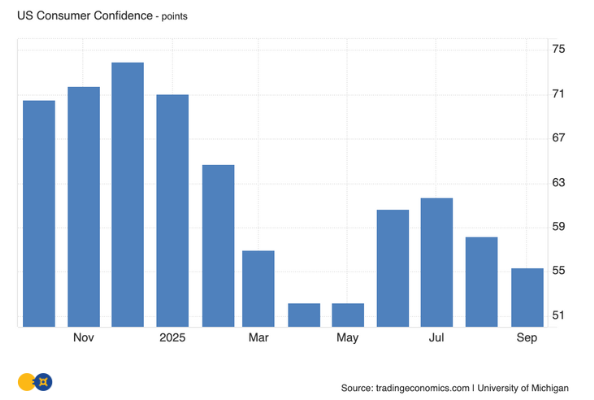

Client Confidence Takes a Dive

Primary Avenue isn’t shopping for the gentle touchdown story. Client sentiment dropped to 55.4 in September from 58.2 in August, catching economists off guard and highlighting the disconnect between Fed coverage and kitchen desk economics. The decline marks the bottom studying in six months, with middle-class Individuals particularly anxious about job safety and chronic inflation consuming into paychecks.

This pessimism issues for gold as a result of nervous shoppers typically develop into nervous traders. When religion within the economic system wobbles, the urge for food for “actual” belongings like gold and silver usually picks up. It’s a sample we’ve seen earlier than: Wall Avenue celebrates fee cuts whereas Primary Avenue buys safety.

Ray Dalio’s Gold Warning Goes Mainstream

Ray Dalio isn’t mincing phrases about America’s debt downside. The billionaire investor instructed CNBC that gold and different laborious belongings would be the clear winners because the U.S. debt burden turns into unsustainable. With nationwide debt topping $33 trillion and no spending restraint in sight, Dalio sees echoes of previous forex crises.

His level echoes GoldSilver’s long-held view: when governments print their means out of debt issues, good cash strikes into belongings they will’t print. Coming from the founding father of the world’s largest hedge fund, it’s a view that’s gaining critical traction amongst institutional traders who keep in mind what occurred to currencies all through historical past.