Final week, the Fed reduce rates of interest by 25 foundation factors, the primary reduce since December. Whereas it claims to be responding to financial situations, the Fed is basically simply catering to political and monetary elites, who’ve been pressuring the central financial institution for months.

The following article was initially revealed by the Mises Institute. The opinions expressed don’t essentially mirror these of Peter Schiff or SchiffGold.

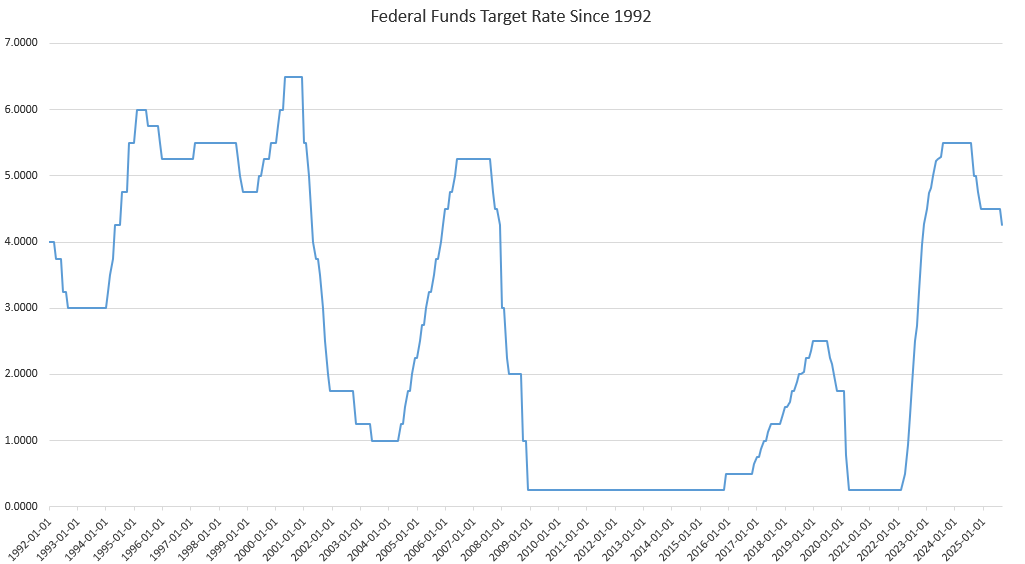

On Wednesday, the Federal Reserve’s Federal Open Market Committee reduce the goal coverage price by 0.25 %, bringing the goal all the way down to 4.25 %. This reduce is the primary for the reason that Fed carried out a reducing cycle final yr that diminished the goal price from 5.5 % to 4.5 %. That collection of cuts started with a 50 basis-point reduce in September of final yr, ending with a 25 basis-point reduce in December.

This month’s assembly is among the many most-watched conferences of latest years with the FOMC now being anticipated to “do one thing” in response to a transparent slowdown in job development in latest employment knowledge. Since January, the Fed has confronted immense public strain from the White Home, from Wall Avenue, and from many financial-sector pundits demanding that the Fed reduce the goal rate of interest and undertake an much more dovish stance. A frequent criticism of the Fed by this era—made by those that consider extra financial inflation can in some way strengthen an economic system—is that the Fed is “too late” in implementing extra price cuts to stimulate the economic system.

The strain to chop charges gained extra energy within the wake of latest jobs reviews, launched earlier this month, displaying that job development had considerably weakened throughout June, July, and August of this yr. Furthermore, the discharge of revised benchmark employment knowledge for a lot of 2024 and early 2025 confirmed that job development had not been almost as sturdy as beforehand reported.

These pushing for simpler cash used this jobs knowledge as a possibility to demand extra price cuts from the Fed. So, not surprisingly, Fed Chair Jerome Powell and the FOMC this week voted to decrease the goal price, and the Fed will speed up its open market operations, utilizing newly created cash, to intervene within the market to additional scale back short-term rates of interest.

On this, we additionally see what actually considerations the Fed. The Fed’s concern isn’t decreasing costs and bettering the price of dwelling for unusual folks. What actually considerations the Fed is guaranteeing rising asset costs for Wall Avenue whereas pushing low-cost credit score to finance federal deficits.

Does the Fed Care about Worth Inflation?

Usually, the mainstream narrative round Fed coverage works like this: when inflation is “too excessive”—as outlined by the Fed itself—then the Fed will enable rates of interest to rise. This can sluggish financial inflation and costs will stabilize. However, when employment isn’t sufficiently strong—once more, as outlined by the Fed itself—then the Fed will decrease the goal rate of interest. That may result in extra financial inflation which can “stimulate” job development. This narrative, nonetheless, depends upon the concept when employment development is weak, value inflation may even be weak, and vice versa.

If a weakening employment state of affairs had been the one factor happening proper now, then it might be very simple for the Fed to say proper now—utilizing the popularly accepted narrative—that it’s crucial for the Fed to chop the goal price to stimulate employment. However, the Fed face a complicating issue proper now in that value inflation has been rising in latest months, and reveals no indicators of returning to the Fed’s arbitrary two-percent inflation goal.

Particularly, core CPI in August rose 3.1 %, effectively in extra of the two-percent goal. Furthermore, the Fed’s most popular inflation measure, private consumption expenditures, rose by 2.9 % in July. Powell latest acknowledged that their estimate for PCE development in August can be 2.9 %. In different phrases, value inflation isn’t going away, and by decreasing the goal price, the Fed is pushing extra financial inflation which can put additional upward strain on costs.

Moreove,r the FOMC’s members now don’t anticipate the Fed to hit its goal price-inflation price till 2027. At the least, that’s what the members are saying in line with the Fed’s abstract of financial projections (SEP). The SEP, nonetheless, can all the time be counted on the painting the economic system as secure and customarily bettering. It’s the perfect state of affairs that Fed voting members assume they’ll get away with predicting. So, if the SEP is telling us that value inflation is not going to fall to 2 % till 2027, we are able to anticipate that there’s loads of financial inflation within the works.

The state of affairs projected by the SEP is that this: that the Fed will correctly handle the economic system again to a state of rising employment and moderating value inflation, because the Fed threads the needle of discovering simply the appropriate goal rate of interest to optimize financial situations. That’s what they need the general public to consider.

If value inflation does are available coming months and years, the extra seemingly state of affairs is that this: the economic system will weaken, simply as is now prompt by recessionary tendencies within the index of main financial indicators, in new dwelling development, in stagnating job development, and in delinquency charges. Costs will fall as demand collapses within the face of rising unemployment, falling actual wages, and overindebtedness.

The draw back of a recession, after all, is short-term unemployment. However the upside—within the absence of central-bank meddling—is that the various inflationary bubbles which have grown because of financial inflation lastly pop and costs fall. Zombie corporations that solely existed because of low-cost credit score go bankrupt and extra environment friendly house owners take over and construct a extra productive economic system out of the rubble of the previous Fed-created inflationary economic system. That is all to the great by way of the price of dwelling as a result of the bubble economic system has change into unaffordable for unusual people who find themselves compelled to cope with incessantly rising costs and unaffordable properties.

That’s what would occur if the Fed truly cared about decreasing value inflation. Sadly, the Fed isn’t going to let that occur. Fairly than enable costs to fall considerably, and permit for a brand new, much less wasteful, much less frothy and bubbly economic system to come up, the Fed will as an alternative proceed to pressure down rates of interest and push extra financial inflation because the economic system slows. This can forestall a reset in costs, and it’ll assist be sure that the identical, wasteful bubble enterprises proceed to dominate the economic system.

The Fed will say, as it’s already now saying, that it should “stability” its efforts to fight inflation in opposition to the necessity to stimulate employment.

In different phrases, because the economic system slows, American policymakers have the chance to permit dwelling costs to fall and to make properties accessible to tens of millions of Individuals who’ve been priced out because of a long time of easy-money-fueled asset value development. Individuals policymakers have a possibility to permit a flowering of latest competitors and new effectivity within the economic system because the previous incumbent corporations that now subsist on debt and speculative manias truly make manner for brand spanking new entrepreneurs and new dynamic economic system.

However, as we noticed this week, the Fed will do the whole lot it could to cease that from taking place. Whilst value inflation continues to develop, the Fed is telling us it has to print extra money to make sure that “quantity go up” by way of asset costs and GDP.

Positive, the Fed will body all this as a service to unusual folks, and as a prudent technique of guaranteeing a vibrant job market. In fact, the central financial institution is serving its most necessary shoppers: Wall Avenue and the US regime. On the one hand, the Fed is intervening to guarantee that asset costs—i.e., shares—proceed to rise for the advantage of current rich asset owns. However, the Fed is decreasing rates of interest to make sure the Treasury can borrow at low rates of interest because the federal debt continues to climb to $40 trillion.

In distinction to all this central planning from the central financial institution, what the Fed must be doing proper now’s nothing. The Fed might merely chorus from taking any motion towards meddling within the personal economic system in any respect. The Fed might finish its open market operations which make use of financial inflation to govern rates of interest. The Fed might enable markets to perform, and will enable the economic system to heal. Sadly, the Fed was created to do something however enable the personal economic system to perform. It has all the time been an instrument of central planning, and we must always not anticipate something totally different from it now.

Name 1-888-GOLD-160 and communicate with a Valuable Metals Specialist immediately!