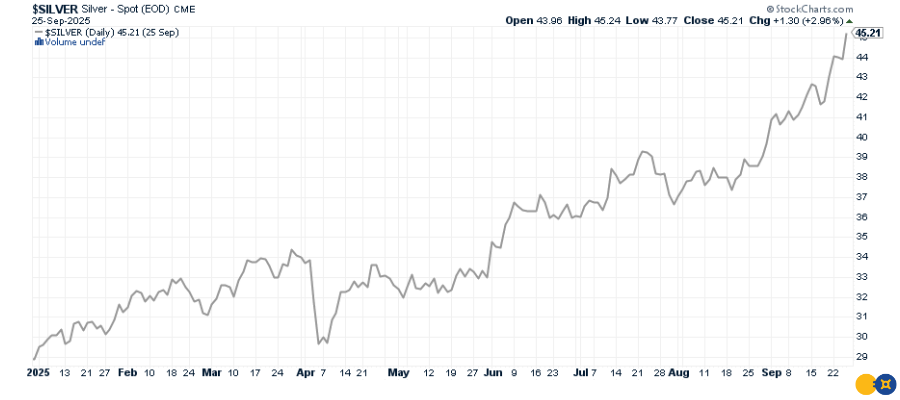

Silver costs have surged to $46.71 an oz., up a outstanding 61% year-to-date (see chart beneath). That’s the sharpest rally in a long time, pushing silver inside putting distance of its all-time excessive of $49.45 set in January 1980.

This run-up isn’t taking place in isolation. Silver has a historical past of explosive value strikes during times of financial stress, inflation, and monetary uncertainty. To higher perceive what may come subsequent, let’s look again on the final time silver neared $50 and evaluate it with at this time’s surroundings.

Silver’s Final Peak: Classes from 1980

In January 1980, silver costs spiked to almost $50 amid:

- Double-digit U.S. inflation (over 13%).

- Oil value shocks following the Iranian revolution.

- A weakening U.S. greenback that pushed buyers towards exhausting property.

- Speculative shopping for strain, most famously from the Hunt brothers.

Whereas that episode ended abruptly, the parallels with at this time — cussed inflation, rising geopolitical dangers, and rising mistrust in fiat currencies — can’t be ignored.

As we speak’s Macro Backdrop: Why Silver is Surging

1. Inflation Hedge: Regardless of fee hikes, inflation stays sticky. Silver, like gold, offers safety when buying energy erodes.

2. Industrial Demand: Silver is indispensable in photo voltaic panels, electrical automobiles, and electronics, inflicting demand to blow up worldwide. This twin function — as each financial and industrial steel — strengthens its long-term case greater than in 1980.

3. Forex & Geopolitical Dangers: From commerce wars to central financial institution disputes, at this time’s headlines are eroding confidence in fiat cash. Valuable metals are direct beneficiaries.

4. Gold Main the Manner: Gold’s rally above $3,700 has set the stage. Traditionally, silver follows gold’s trajectory — however with larger volatility and upside.

Will Silver Break $50?

Crossing the silver all-time excessive could be greater than symbolic. It might verify that buyers are piling into tangible property as a hedge in opposition to inflation, debt, and monetary instability.

Historical past exhibits that when silver strikes, it strikes quick. Through the well-known 1979–1980 spike, silver costs didn’t simply grind larger — they went parabolic:

- In late 1979, silver rocketed from round $30 to $40 in simply three weeks.

- Then, in January 1980, the climb accelerated — silver surged from $40 to $49.45 in a matter of days, an unprecedented 24% acquire in lower than two weeks.

To place that into perspective: buyers noticed practically a decade’s value of typical silver value appreciation compressed into a couple of buying and selling periods. That’s the character of silver bull markets — they are typically shorter, sharper, and extra dramatic than gold’s, rewarding those that place early.

We noticed echoes of this sample once more in 2011, when silver ran from $30 to $48 in simply three months earlier than briefly touching the high-$40s.

This historic explosiveness means that if silver breaks above $50, the transfer might be swift — and doubtlessly overshoot far larger earlier than settling.

The Subsequent Transfer in Silver

The silver value rally to over $46.50 displays greater than speculative momentum. It’s a convergence of commercial demand, inflation pressures, and geopolitical uncertainty.

Whether or not silver breaks its all-time excessive close to $50 within the coming months or consolidates first, the chance is evident: silver stays one of the uneven performs in at this time’s market — with draw back safety from its financial function and explosive upside from its industrial demand.

Silver is inside a couple of {dollars} of its historic peak. Be taught extra about proudly owning gold and silver with professional steerage at GoldSilver.com.

Individuals Additionally Ask

What’s the present silver value and the way shut is it to the all-time excessive?

As of September 26th, the silver value is round $46.71 per ounce, simply shy of its all-time excessive of $49.45 set in 1980. With silver up over 60% year-to-date, many buyers are looking forward to a breakout previous $50. You may monitor reside costs on GoldSilver Worth Charts.

When did silver hit $50 earlier than?

Silver has solely approached $50 an oz. twice — in January 1980 and once more in April 2011, when it reached $48. Each rallies have been pushed by inflation fears and monetary uncertainty. As we speak’s surroundings has most of the similar substances.

How briskly did silver rise in the course of the 1980 silver spike?

In late 1979, silver jumped from $30 to $40 in simply three weeks, and by January 1980 it surged from $40 to $49.45 in underneath two weeks. That explosive transfer exhibits how shortly silver can overshoot as soon as momentum builds.

What’s the gold-to-silver ratio and why does it matter?

The gold-to-silver ratio measures what number of ounces of silver equal the value of 1 ounce of gold. Traditionally, when the ratio is excessive, silver is taken into account undervalued relative to gold — usually signaling robust potential upside.

How can I put money into silver safely?

Traders can purchase bodily silver bars and cash, or use fashionable platforms that present safe, insured vault storage. GoldSilver provides each choices, with liquidity and professional steerage for critical buyers.