Over the previous few years, a quiet however highly effective shift has been unfolding within the international gold market. Central financial institution gold shopping for has surged to historic ranges — quietly reshaping how the world values financial belongings.

Central banks, not hedge funds or retail traders, at the moment are the most important marginal patrons of gold. This development isn’t a speculative blip; it’s a structural realignment which may be setting a brand new long-term worth ground for the yellow metallic.

Why Central Banks Are Shopping for Gold—Once more

Since 2018, international central financial institution gold demand has climbed to its highest stage in 5 many years. The motivation isn’t merely portfolio diversification — it’s self-preservation.

When the U.S. and its allies froze Russia’s foreign money reserves in 2022, policymakers throughout the creating world took observe. In case your reserves might be frozen with a keystroke, they’re not likely yours.

Gold, nonetheless, is completely different. It has no counterparty danger. It could actually’t be printed, devalued, or sanctioned. This realization has pushed international locations like China, India, Turkey, Poland, and Singapore to ramp up their gold holdings. In 2023 and 2024 alone, central banks added over 1,000 tonnes — a contemporary file in accordance with the World Gold Council.

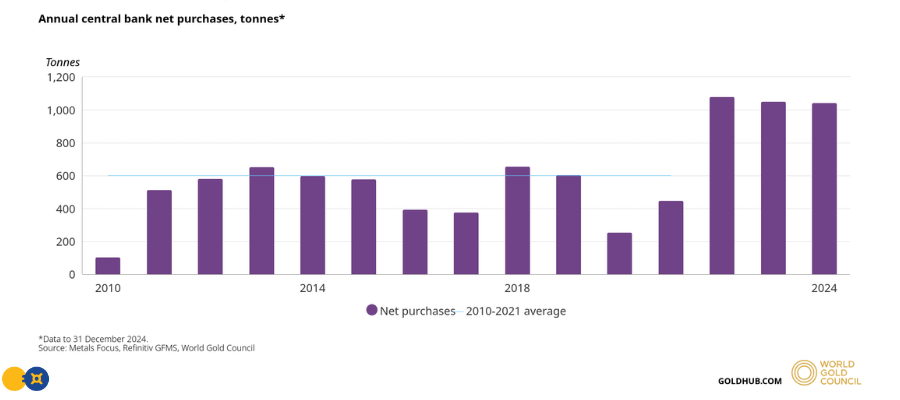

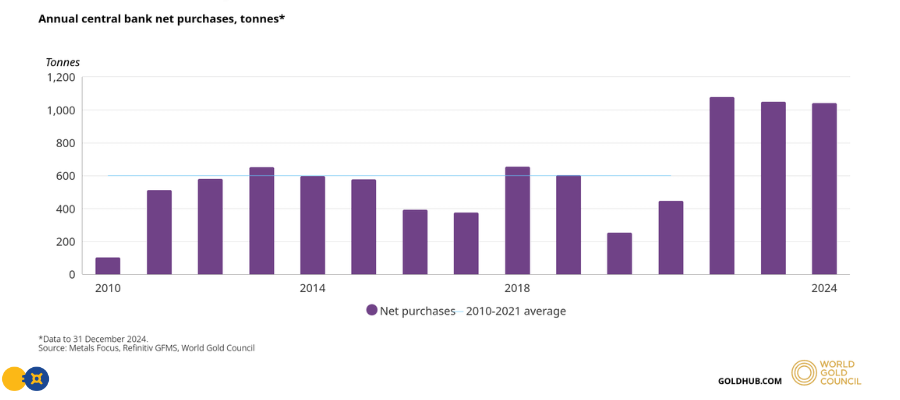

Central Banks Have Been Internet Patrons For 15 Consecutive Years

Because the chart reveals, international central financial institution accumulation has not solely surged properly above the 2010–2021 common — it has sustained at traditionally excessive ranges. This regular, institutional demand is reshaping gold’s long-term provide dynamics.

The East Is Main a Financial Shift

This surge in central financial institution gold shopping for additionally displays a broader international transition — from West to East. Whereas Western economies nonetheless rely closely on the dollar-based system, the BRICS nations (Brazil, Russia, India, China, South Africa — quickly joined by others) are exploring alternate options.

Gold is central to that effort.

China’s central financial institution has now reported greater than 18 consecutive months of gold accumulation, whereas nations like Turkey and Kazakhstan are reshaping their reserves to rely much less on the greenback.

In some ways, the present second mirrors the submit–World Warfare II period — besides this time, it’s rising markets, not the West, main the gold accumulation development.

A Structural Worth Flooring for Gold

What makes this motion so consequential is that central banks purchase in a different way than personal traders. They don’t speculate; they accumulate.

Their purchases are deliberate, strategic, and largely insensitive to cost — which means that even when gold dips, central banks maintain shopping for. That regular bid creates a structural worth ground, providing a type of financial “gravity” that helps gold during times of volatility.

As Western funding demand ebbs and flows, central banks have successfully grow to be the “robust fingers” of the gold market — quietly stabilizing it from beneath.

The Takeaway: Observe the Actual Cash

For traders asking “who’s shopping for gold?” the reply is obvious — and instructive. When central banks, the stewards of worldwide financial stability, are exchanging paper belongings for tangible metallic, it indicators a deeper realignment within the international monetary order.

Gold isn’t simply an inflation hedge anymore. It’s changing into a core reserve asset as soon as once more — the muse of belief in a world the place currencies are more and more political instruments.

And as central banks proceed to purchase, traders may do properly to observe their lead.

To construct your individual private gold reserve, go to GoldSilver.com to purchase gold and silver bullion and learn to safeguard your wealth with actual cash.

Folks Additionally Ask

Why are central banks shopping for a lot gold proper now?

Central banks are rising their gold reserves to cut back publicity to the U.S. greenback and safeguard towards monetary sanctions or inflation. Gold gives safety with out counterparty danger — it might’t be printed, frozen, or defaulted on.

Which international locations are main in central financial institution gold shopping for?

China, Turkey, India, and Poland are among the many most energetic patrons, with China reporting greater than 18 consecutive months of gold accumulation. These nations view gold as a core reserve asset and a hedge towards foreign money volatility.

How does central financial institution gold shopping for have an effect on the gold worth?

Constant central financial institution demand creates a structural worth ground for gold. As a result of central banks purchase steadily and maintain long-term, their purchases scale back volatility and assist help gold’s long-term upward trajectory.

What does central financial institution gold shopping for imply for the U.S. greenback?

As extra international locations diversify away from the greenback and into gold, international demand for U.S. debt and foreign money may step by step weaken. This “de-dollarization” development might strengthen gold’s position as a impartial international asset.

Is now a great time for traders to purchase gold like central banks?

With central banks rising reserves and inflation staying elevated, many traders are following go well with. Shopping for bodily gold and silver may help diversify and shield your wealth from systemic danger.