Each day Information Nuggets | Right now’s high tales for gold and silver buyers

October 23rd, 2025

Inflation Nonetheless Working Sizzling, However Fed Anticipated to Lower Anyway

Friday’s CPI report is more likely to present inflation stays uncomfortably elevated, with core costs forecast to rise 0.3% in September and maintain at 3.1% year-over-year — properly above the Federal Reserve’s 2% goal. That marks one other month of cussed value pressures that haven’t responded to increased charges as shortly as policymakers hoped.

But markets are pricing in a fee minimize subsequent week with close to certainty. JPMorgan’s buying and selling desk estimates a 65% likelihood shares rally after the info whatever the print. The rationale: buyers consider slowing development now trumps inflation issues within the Fed’s decision-making.

That’s a dangerous guess. Reducing charges whereas inflation runs sizzling has traditionally fueled forex weak spot and stored actual yields compressed — situations the place gold has persistently outperformed as each an inflation hedge and portfolio insurance coverage in opposition to coverage errors.

Individuals Aren’t Shopping for the “Inflation Is Fastened” Narrative

The White Home could also be able to declare victory, however American shoppers aren’t satisfied. On a regular basis prices — groceries, insurance coverage, housing — stay painfully excessive regardless of official assurances that inflation is underneath management. August’s CPI studying of two.9% reversed months of cooling, a reminder that tariffs and supply-chain pressures are nonetheless working via the system.

When the hole between political messaging and lived expertise widens, investor habits shifts. Individuals gravitate towards tangible shops of worth — actual property, commodities, and treasured metals — that may’t be devalued by central financial institution coverage or political guarantees. That sentiment tends to outlast the headlines, retaining demand for inflation hedges resilient at the same time as policymakers transfer on to the following disaster.

And people issues could also be extra justified than headline GDP numbers counsel.

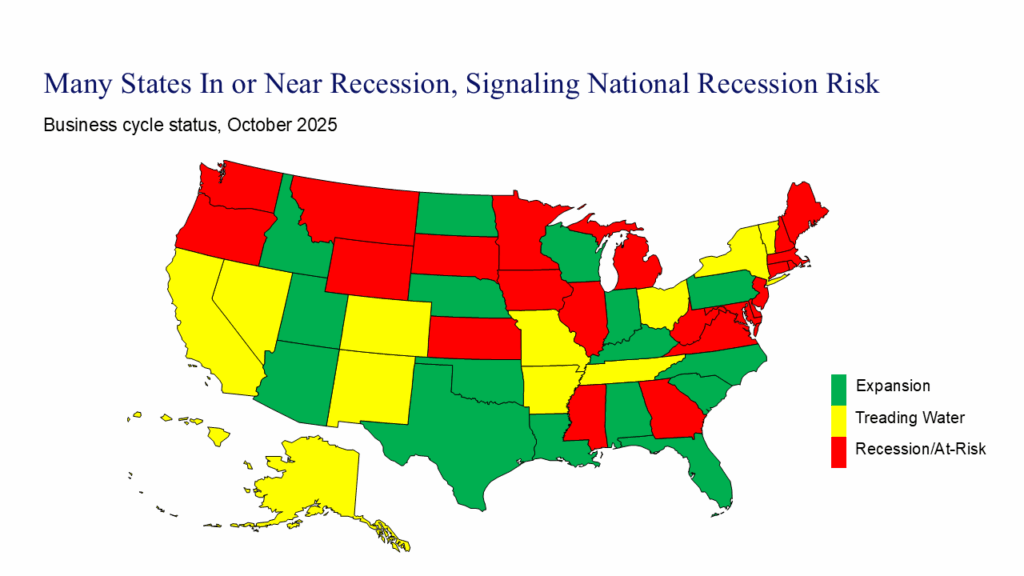

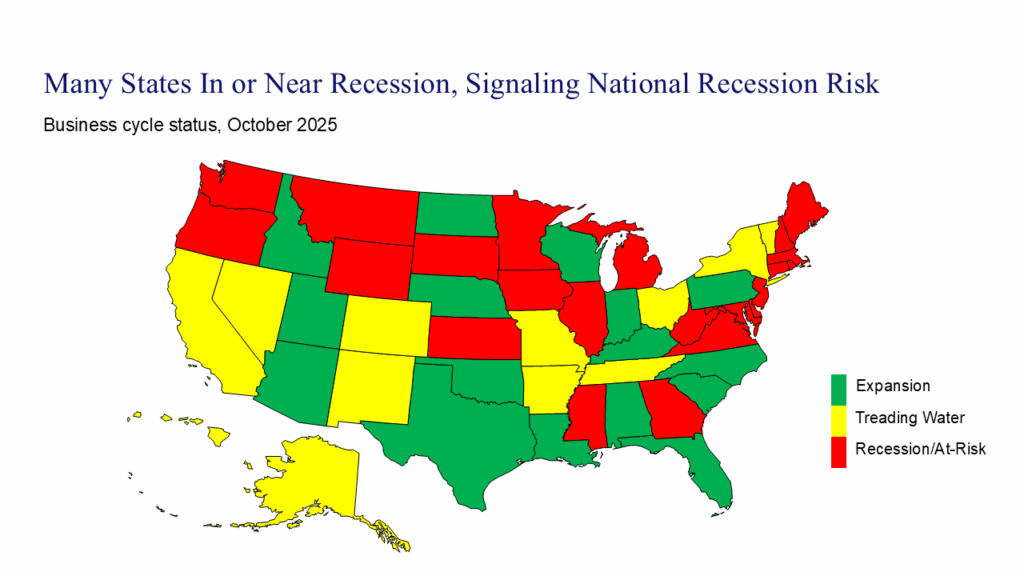

Practically a Third of U.S. Financial system Now at Recession Danger

The nationwide GDP numbers look wholesome, however zoom in and the image fractures. Moody’s Analytics experiences that 22 states and Washington, D.C. are at present in or close to recession. That’s a jarring disconnect from the strong development figures policymakers hold citing.

Chief economist Mark Zandi’s breakdown reveals the harm isn’t confined to rural states. Texas continues increasing, however financial heavyweights like California and New York are barely treading water. Extra regarding: Michigan, an industrial bellwether, has deteriorated from secure to distressed in current months, becoming a member of 21 different states exhibiting severe pressure.

Right here’s why that issues: when a 3rd of the financial system is cracking whereas the S&P 500 sits close to document highs, markets are seemingly underpricing draw back threat. Historical past reveals this type of fragmentation usually precedes broader weak spot—the type that reveals up in employment knowledge and company earnings earlier than Wall Road adjusts. That’s exactly when defensive property like gold are inclined to validate their function as portfolio insurance coverage.

And the dangers don’t cease at state strains.

U.S. Nationwide Debt Crosses $38 Trillion

The U.S. nationwide debt simply breached $38 trillion — up $2 trillion since January alone. The newest trillion was added in roughly eight weeks, the quickest tempo outdoors pandemic-era emergency spending. However in contrast to 2020, there’s no disaster to justify it. Simply persistent deficits and an curiosity invoice that now exceeds $1.2 trillion yearly, consuming an ever-larger slice of federal income.

Wall Road is more and more frightened concerning the endgame. Sustained deficits of this magnitude can erode confidence within the greenback, particularly if overseas collectors — already holding document Treasury positions — develop reluctant to finance America’s spending behavior. When fiat forex credibility weakens, arduous property traditionally fill the void. Gold thrives in that atmosphere exactly as a result of it’s nobody’s legal responsibility and might’t be printed away.

Mix persistent inflation, regional financial cracks, and runaway fiscal coverage, and you’ve got the sort of macro backdrop the place treasured metals aren’t only a hedge — they’re more and more a core allocation.

J.P. Morgan Predicts Gold Above $5,000 by Late 2026

J.P. Morgan’s commodities desk simply launched some of the bullish gold forecasts on document, projecting costs will common $5,055 per ounce by the tip of 2026 — roughly 20% above present ranges. The financial institution cites three converging forces: slowing international development, a weakening greenback, and aggressive central financial institution accumulation, notably from China and rising markets racing to scale back greenback dependency.

Analysts are drawing parallels to the early 2000s, when related situations sparked a decade-long rally that noticed gold surge from underneath $300 to over $1,900. The widespread thread: detrimental actual rates of interest, forex issues, and geopolitical instability creating sustained demand for financial alternate options.

If inflation stays elevated whereas the Fed pivots to fee cuts — compressing actual yields additional — gold isn’t only a tactical commerce. It’s more and more positioning itself as a structural portfolio holding for an period of fiscal extra and financial uncertainty.