The gold-to-silver ratio has guided treasured metals traders for hundreds of years — however making use of it as a technique might be surprisingly easy. The 80/60 gold-silver rule helps traders determine when to favor one steel over the opposite utilizing information, not emotion.

Understanding the Gold-to-Silver Ratio

Earlier than diving into the 80/60 rule, it’s vital to grasp what the gold-to-silver ratio really measures. The ratio represents what number of ounces of silver it takes to buy one ounce of gold.

For instance, if gold trades at $4,000 per ounce and silver trades at $50 per ounce, the ratio can be 80:1. This quantity fluctuates continuously with market situations, financial information, and investor sentiment — making it a helpful sign for these monitoring relative worth in treasured metals.

The 80/60 Rule Defined

The 80/60 gold-silver rule is a tactical technique designed to assist traders make extra goal choices:

- When the ratio hits 80:1 or greater → silver is comparatively low-cost → think about shopping for silver or buying and selling some gold for silver.

- When the ratio falls to 60:1 or decrease → gold is comparatively low-cost → think about shifting towards gold or buying and selling silver for gold.

These thresholds are based mostly on many years of historic information exhibiting that the ratio tends to revert towards its long-term common of roughly 65-70:1. By utilizing that mean-reversion tendency, traders should buy the undervalued steel and progressively rebalance as situations change.

Why These Numbers Matter

The 80 and 60 ranges aren’t arbitrary. They mark statistical extremes the place the market has traditionally over- or under-valued one steel relative to the opposite.

In the course of the 2020 pandemic, for instance, the ratio spiked above 120:1 as silver lagged, then rapidly fell again towards 70:1 as silver costs surged 47.9% whereas gold gained 25.1%. That swing confirmed how rapidly alternatives can emerge when the ratio strikes too far in a single route.

The Ratio at Work

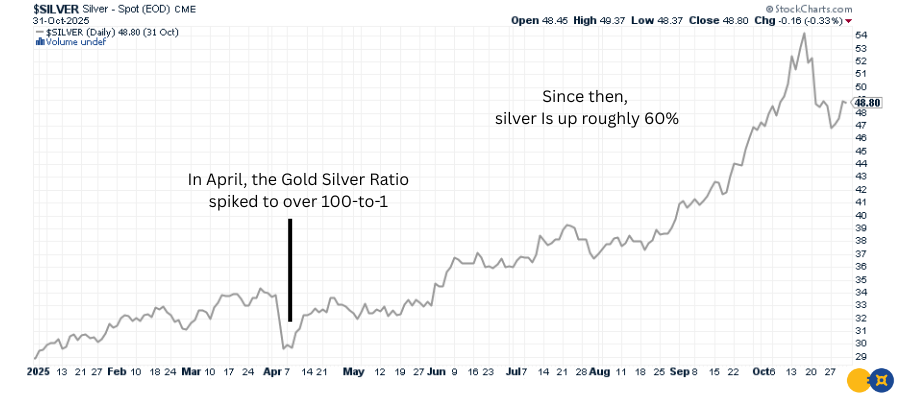

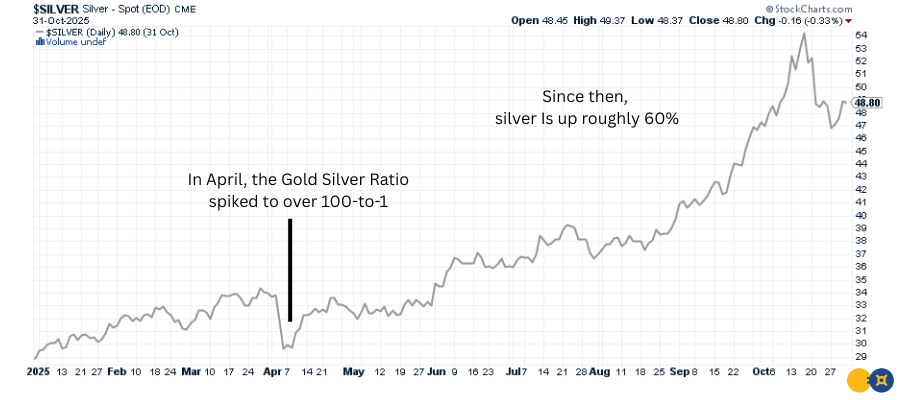

Again in April, GoldSilver highlighted that the gold-to-silver ratio had reached excessive ranges above 100:1 — a sign that silver was deeply undervalued relative to gold.

At the moment, silver was buying and selling round $30 per ounce. Buyers who acknowledged the chance and elevated their silver publicity have since been rewarded: silver not too long ago reached about $48 per ounce, a acquire of roughly 60% in just some months.

That highly effective transfer exhibits the precept behind the 80/60 gold-silver rule: when the ratio stretches to extremes, it typically indicators alternative.

As the ratio started to maneuver again towards its long-term common, silver costs surged, rewarding those that acted when sentiment was most lopsided.

In different phrases, traders who adopted the info relatively than emotion — shopping for silver when the gold-silver ratio topped 100 — noticed vital outperformance because the market corrected that imbalance.

Tips on how to Apply the Technique

1. Monitor the Ratio

Examine the gold-to-silver ratio recurrently utilizing dependable monetary sources resembling MarketWatch or main bullion sellers. Many traders monitor it month-to-month as a part of their portfolio evaluate.

2. Determine Entry Factors

- Above 80: Silver could also be undervalued. Think about rising silver positions or including silver bars and cash.

- Under 60: Gold could also be undervalued. Concentrate on buying gold cash or bars.

3. Transfer Regularly

Keep away from giant, sudden shifts. Use dollar-cost averaging to regulate your holdings over time, decreasing timing danger and smoothing out volatility.

Historic Validation

The gold-to-silver ratio has fluctuated dramatically all through historical past — generally topping 100:1, different occasions falling under 40:1. In keeping with Investopedia, the ratio has served as a dependable gauge of relative worth between the metals for hundreds of years.

- In 2018-2019 the ratio climbed above 85:1 — a powerful silver-buying alternative.

- Silver went on to considerably outperform gold in 2020 because the ratio normalized round 70:1.

These examples spotlight why the 80/60 framework stays a invaluable, repeatable information for traders at the moment.

Advantages of the 80/60 Gold-Silver Rule

1. Goal Selections: By following clear ratio thresholds, traders depend on information as an alternative of feelings or market headlines.

2. Improved Efficiency Potential: Shopping for the undervalued steel and rebalancing towards the imply can improve long-term returns inside a diversified metals portfolio.

3. Constructed-In Danger Administration: The technique naturally promotes diversification, balancing publicity between gold and silver based mostly on relative worth relatively than arbitrary percentages.

Limitations to Preserve in Thoughts

- It’s Not a Crystal Ball. The ratio reveals relative worth, not precise worth timing. Extremes can persist for months or years.

- Requires Monitoring. The 80/60 strategy is extra hands-on than a easy buy-and-hold technique.

- Prices Matter. Every commerce might contain seller spreads, transport, and storage charges — components that may have an effect on web efficiency.

The Backside Line: A Device, Not a Rule

The 80/60 gold-silver rule is a sensible, time-tested approach to information precious-metals allocation utilizing goal market information. Whereas not good, it helps traders make smarter, extra disciplined choices inside a broader, diversified funding plan.

Whether or not you’re new to metals or a seasoned investor, understanding how the gold-to-silver ratio works — and methods to use it strategically — will help you seize alternatives and construct long-term wealth.

Individuals Additionally Ask

What’s the 80/60 gold-silver rule?

The 80/60 gold-silver rule is a straightforward technique that helps traders determine when to favor gold or silver based mostly on their worth ratio. When the ratio is above 80:1, silver is taken into account undervalued; when it falls to 60:1 or under, gold might provide higher relative worth. Be taught extra about how the ratio works at GoldSilver.com.

How does the gold-to-silver ratio have an effect on funding choices?

The gold-to-silver ratio exhibits what number of ounces of silver equal the worth of 1 ounce of gold. Monitoring it helps traders determine when one steel is traditionally low-cost or costly relative to the opposite — creating potential alternatives to purchase low and promote excessive.

Why did the gold-silver ratio matter when it was over 100 to 1?

A ratio above 100:1 suggests silver is extraordinarily undervalued in comparison with gold. When GoldSilver famous this in April, silver was round $30 per ounce — since then it’s climbed to about $48, proving how highly effective ratio-based timing might be.

Is the 80/60 gold-silver rule nonetheless related at the moment?

Sure. Whereas the ratio adjustments over time, the precept of imply reversion nonetheless applies. Utilizing the 80/60 thresholds provides traders a disciplined, data-driven approach to stability their treasured metals holdings in altering markets.

How typically ought to I verify the gold-to-silver ratio?

Most traders monitor the ratio month-to-month or quarterly, just like reviewing portfolio efficiency. It’s a easy but efficient indicator to incorporate in your common investing routine — websites like GoldSilver.com monitor it in actual time.