Gold demand simply hit a brand new report excessive for the third quarter at 1,313 metric tons, the very best quarterly quantity on report, the World Gold Council stated. Demand for gold is rising simply because the U.S. paper cash provide reaches a brand new report excessive.

Whole funding demand for gold climbed 47%, demand for gold bars and cash surged 17% totaling 315.5 tons, and central financial institution shopping for jumped 10% to 219.9 tons within the third quarter.

So, who’s shopping for up all this gold?

It seems it’s a mixture of traders—from central banks beefing up their reserves to institutional traders trying to shield their portfolios, and on a regular basis People shopping for gold as a haven towards rising inflation, forex devaluation, and issues over rising authorities debt ranges.

Gold is the most secure cash

Ray Dalio, billionaire investor and founding father of Bridgewater Associates, shared an essay on Oct. 30 known as “Gold is the Most secure Cash.” Dalio believes that gold is the “most elementary cash over time, with one of the best monitor report of getting its worth monitor the price of dwelling over very lengthy intervals of time.”

Dalio factors to the best way currencies are structured as the important thing motive that gold has stood the check of time and stays the most secure type of cash.

All through historical past, currencies have both been “hard-backed” currencies or “fiat” currencies. Exhausting-backed currencies have been traditionally linked to bodily gold or to one thing equally restricted in provide and globally valued, like silver.

Individuals with hard-backed currencies may trade their paper cash for bodily gold or silver at a set trade fee. That compares to fiat currencies, which aren’t backed by something and aren’t restricted in provide.

The U.S. greenback is a fiat forex.

At present, the U.S. authorities debt continues to barrel greater, lately climbing above $38 trillion—a report excessive in October 2025, and on the similar time our fiat cash provide is increasing.

What’s the connection between fiat currencies and authorities debt?

Dalio studied previous fiat forex techniques when there was an excessive amount of debt relative to the sum of money that was wanted to pay it. Identical to what we’re seeing in America right now.

To fight the rising debt ranges, central bankers created some huge cash and credit score, which usually led to greater inflation and better gold costs. That is what we’re seeing right now as effectively.

U.S. cash provide hits report excessive: simple cash is again

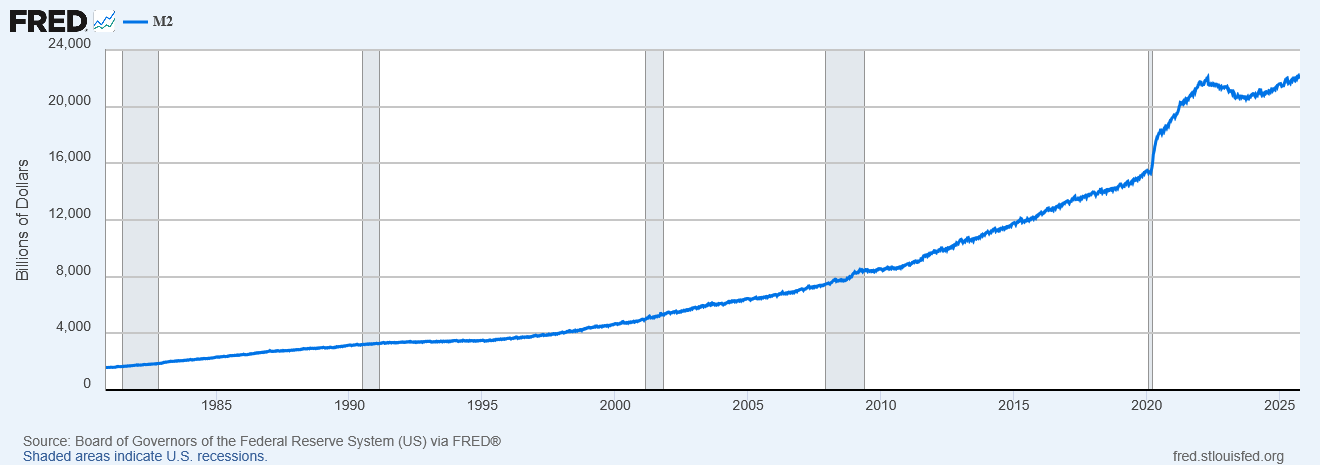

Cash provide accelerated in 2025 and lately hit a report excessive above $22.2 trillion, as proven within the chart by the St. Louis Federal Reserve. Cash provide refers back to the whole quantity in circulation, together with cash, money, and bank-account balances.

Gold holds Its buying energy

As central banks create extra fiat forex, it loses worth.

Dalio discovered that all through historical past when governments with fiat currencies took on unsustainable debt ranges, gold carried out effectively. In truth, he discovered that over lengthy intervals of time, gold was the cash with one of the best monitor report of holding its buying energy. That is why it’s now the second-largest reserve forex held by central banks right now.

Gold pattern nonetheless factors greater

As central banks purchase extra bodily gold so as to add to their reserves and the U.S. authorities prints extra money and expands our fiat cash provide, the place does true worth lie? Dalio says gold. That is simply one of many many causes traders are turning to gold to protect and shield their wealth and buying energy right now.

Traders are shopping for closely this 12 months because the sturdy uptrend for gold continues. Spot gold is up over 50% this 12 months, after hitting a report excessive at $4,373.20 on Oct. 16. You might be asking, can this rally in gold proceed? Most say sure.

“The outlook for gold stays optimistic, as continued U.S. greenback weak point, decrease rate of interest expectations, and the specter of stagflation may additional propel funding demand,” stated Louise Avenue, senior markets analyst on the World Gold Council. “Our analysis signifies the market will not be but saturated.”

As authorities debt ranges rise, fiat forex expands, and inflation will increase—the worth of your U.S. greenback is falling. Gold is a forex with a 5,000-year monitor report. The time is ripe to commerce a few of your paper {dollars} which might be reducing in worth for gold. All through historical past gold has confirmed to be the most secure cash of all. Do you personal sufficient?