For a lot of buyers, evaluating gold vs money looks like a easy selection between security and alternative. Money is acquainted, it’s liquid, and it looks like the good place to attend out uncertainty. However in an inflationary world — and particularly within the financial panorama we’re getting into — money comes with a value most individuals by no means see.

In actual fact, the “most secure” asset in your portfolio could also be quietly eroding your wealth each single 12 months.

This information breaks down why money loses buying energy, how inflation alters long-term returns, and why gold has traditionally been probably the most dependable instruments for preserving actual wealth.

The Phantasm of Security: Why Money Isn’t What It Used to Be

Money feels secure as a result of the quantity in your checking account doesn’t change. However what that cash can purchase completely does.

Inflation isn’t at all times dramatic — typically it’s sluggish and quiet — however over time, its influence is devastating. (See present U.S. inflation knowledge from the Bureau of Labor Statistics). Even “reasonable” inflation, say 3% yearly, cuts your buying energy in half over 24 years.

To place that in perspective:

- $100,000 saved in money right this moment loses roughly $3,000 in actual worth yearly

- At a 7% inflation price (which we’ve seen in recent times), buying energy is lower in half in simply 10 years

- A retiree who retains a big money cushion could lose tens of 1000’s of {dollars} with out ever spending a dime

The greenback doesn’t collapse all of sudden — it wears down by means of sluggish, persistent erosion.

Gold, then again, traditionally strikes within the reverse course.

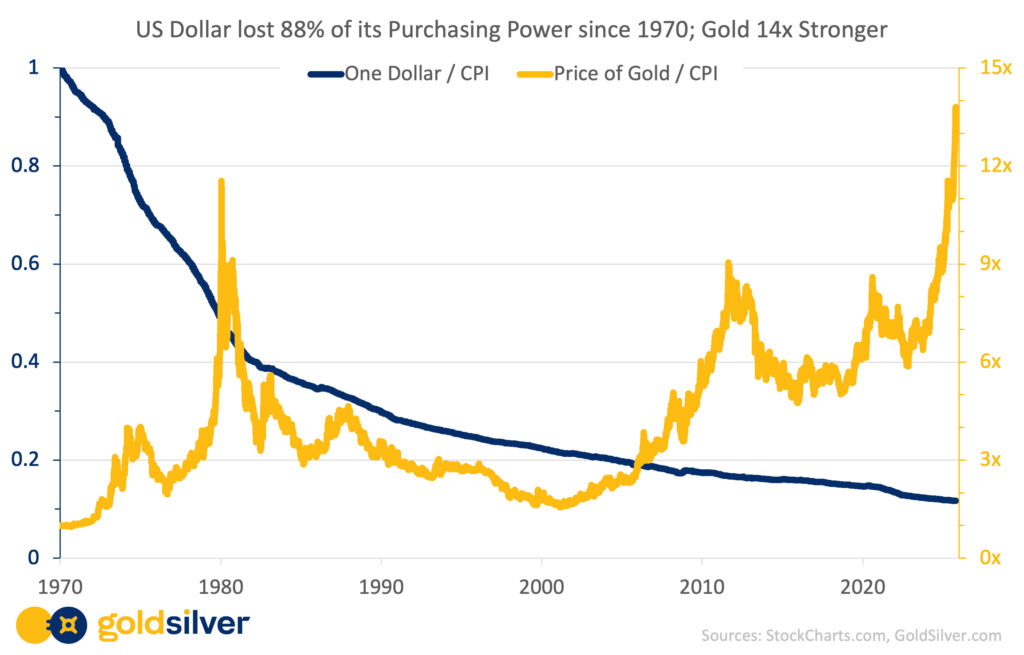

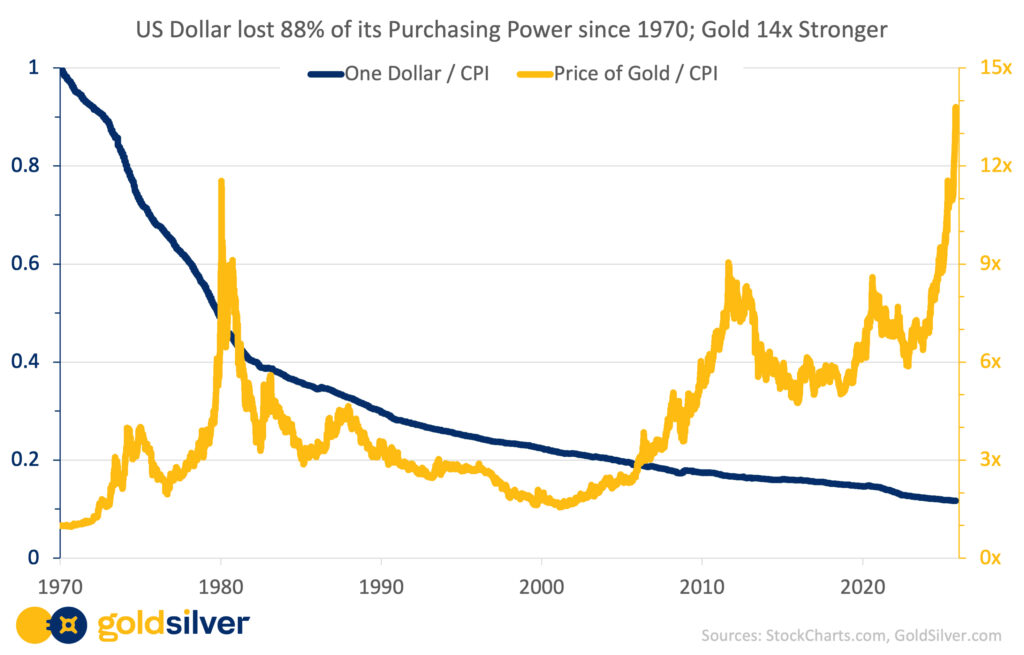

A 50-12 months View: Money Down, Gold Up

Should you evaluate gold vs money over any very long time interval, the sample is unmistakable:

The U.S. greenback has misplaced practically 90% of its buying energy because the early Seventies.

In the meantime…

Gold has risen greater than 5,000% over the identical interval.

This doesn’t imply gold is “higher” in each market situation — or that it is best to abandon money completely. As an alternative, it underscores a easy reality:

Gold preserves what inflation destroys.

Each period of rising inflation — from the Seventies to the post-2019 interval — has seen gold outperform money dramatically. Not as a result of gold turns into extra worthwhile, however as a result of the greenback turns into weaker.

Why Money Burns Worth in an Inflationary Surroundings

Three forces work in opposition to money holders:

1. Inflation Reduces Actual Returns

Even high-yield financial savings or cash market accounts not often beat inflation over time.

A 5% financial savings account with 6% inflation continues to be a unfavorable actual return.

2. Forex Dilution

When governments borrow and print aggressively, like they’ve been for years, the availability of {dollars} will increase — and every greenback turns into price much less.

3. Zero Hedge In opposition to Systemic Danger

Geopolitical shocks, monetary crises, and financial instability don’t make money extra worthwhile — they sometimes make it much less.

That is why long-term savers, retirees, and conservative buyers are sometimes hit hardest.

Why Gold Holds Its Worth

Gold isn’t a promise from a financial institution or a authorities. It’s a tangible financial asset with:

- A 5,000-year monitor file

Gold doesn’t rely on a CEO, a quarterly earnings report, or a central financial institution coverage determination. It merely holds worth — particularly when currencies don’t.

Traditionally, gold has proven:

- Low correlation to shares and bonds

- Robust efficiency in inflationary durations

- Stability throughout systemic danger

- Resilience when actual rates of interest fall

In different phrases, gold tends to shine the brightest when currencies — together with the U.S. greenback — lose floor.

To be taught extra about all the properties of cash, try Alan Hibbard’s new Hidden Secrets and techniques of Worth collection, the place he particulars all 12 of the important properties of cash.

Actual-World Instance: A Cart Filled with Groceries

Think about you stroll right into a retailer with $20 in 1990. You might fill a basket.

Stroll in with $20 right this moment? Perhaps two or three gadgets.

Now think about as a substitute that you simply saved the worth of that $20 in gold.

You’ll have preserved practically the identical buying energy for 30 years.

That’s the essence of gold’s position: it’s not about getting wealthy — it’s about not getting poorer.

Why Extra Traders Are Shifting Out of Money Immediately

- Rising authorities debt.

- Unsure financial coverage.

- Geopolitical volatility.

- A weakening greenback development.

This mix has pushed buyers — particularly these nearing retirement — to rethink how a lot money they maintain. Money is critical for flexibility, emergencies, and alternative — however as a long-term retailer of worth, it’s traditionally one of many weakest choices.

Gold performs the alternative position: insurance coverage for buying energy, designed to carry worth by means of a long time of change.

So What’s the Proper Stability?

There’s no single reply for each investor. Most monetary professionals place gold as a part of a diversified technique — not a substitute for money, however a counterweight to inflation and financial danger.

The secret’s recognizing that:

In order for you your cash to stay helpful 10, 20, or 30 years from now, historical past strongly suggests you want greater than {dollars} working for you.

In an Inflationary World, Holding Solely Money Is the Actual Danger

Over any lengthy time period, inflation punishes money savers — and rewards those that maintain belongings that may’t be printed or diluted.

Gold has confirmed, for hundreds of years, to be probably the most dependable solutions to that drawback.

It’s not hypothesis.

It’s not hype.

It’s merely math, historical past, and financial actuality.

In case your aim is to protect your hard-earned buying energy — for your self, your loved ones, and your future — gold stays one of many few belongings constructed to do precisely that.

Folks Additionally Ask

Is gold higher than money throughout inflation?

Sure. Gold has traditionally held its buying energy throughout inflation, whereas money loses worth as costs rise. That’s why many buyers use gold as a long-term inflation hedge. You may discover how gold performs in numerous environments in Hidden Secrets and techniques of Worth Episode 2: Cash vs Forex.

Does money lose worth over time?

Sure. Even low inflation reduces the actual worth of money 12 months after 12 months, that means your {dollars} purchase much less over time. This erosion is why many savers diversify into belongings like gold that keep worth.

Why do buyers select gold as a substitute of holding {dollars}?

Traders flip to gold as a result of it’s a scarce, globally acknowledged asset that traditionally performs properly when the greenback weakens. Gold has no counterparty danger and protects wealth throughout inflation or monetary stress.

Is it dangerous to maintain an excessive amount of money in financial savings?

Holding money isn’t dangerous when it comes to volatility, however it’s dangerous when it comes to buying energy. Inflation quietly reduces what your financial savings can purchase, particularly over lengthy durations.

Ought to retirees maintain gold as a substitute of money?

Retirees usually maintain some money for liquidity however use gold to protect long-term worth and defend in opposition to inflation. Gold may also help offset the purchasing-power loss that fixed-income retirees face. Find out how retirees use valuable metals by means of a Gold IRA at GoldSilver.

Notice: This text is supplied for informational functions solely and shouldn’t be thought of funding recommendation. Previous efficiency is just not indicative of future outcomes. All the time conduct thorough analysis or seek the advice of with certified monetary professionals earlier than making funding choices.