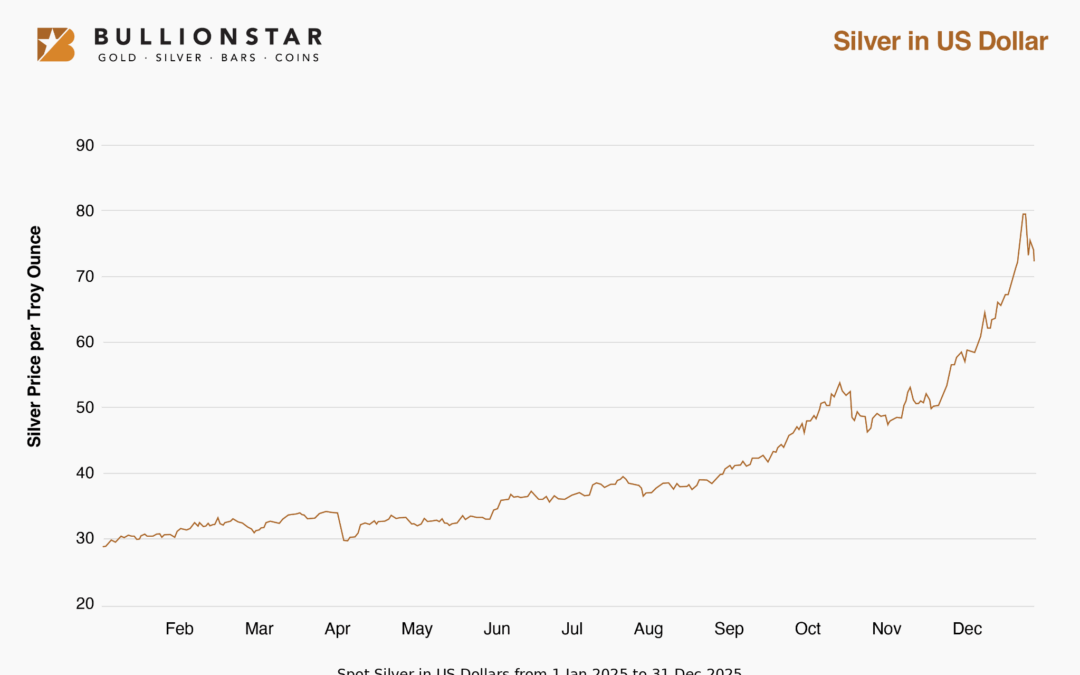

As we step into 2026, the silver market is capturing international consideration like by no means earlier than. After surging greater than 150 % in 2025, costs are hovering round USD 73 per ounce in early January. What traders at the moment are witnessing is just not a typical cyclical rally, however what more and more resembles a elementary repricing of silver as each an industrial necessity and a financial steel.

At BullionStar, we have now lengthy advocated bodily valuable metals as a cornerstone of wealth preservation. The present dynamics in silver spotlight exactly why possession of actual, deliverable steel issues greater than ever.

On this publish, we look at the important thing forces behind silver’s surge, with specific deal with the escalating market squeeze, the widening disconnect between paper and bodily markets, regional premiums signaling acute shortages, and the rising systemic dangers embedded in paper silver devices equivalent to ETFs.

China on the Epicenter of the Paper–Bodily Breakdown

Probably the most putting sign in at the moment’s silver market is coming from China. Bodily silver pricing on the Shanghai Gold Trade has decisively damaged away from Western paper benchmarks, with premiums reaching roughly 12 to 13 % above LBMA spot and COMEX futures costs.

A premium of this magnitude is exceptionally excessive by historic requirements and locations present situations among the many most excessive divergences noticed within the trendy silver market. Bodily silver is thus thought to be way more invaluable than what the Western paper costs at present replicate.

In impact, the bodily market is asserting worth management over the paper market.

International Premiums Verify Bodily Stress

China is just not alone. Related pressures are seen throughout a number of areas, albeit at various intensities.

In Japan, premiums on secondary market platforms equivalent to Mercari have at instances surged to round 60 %, reflecting intense retail demand amid restricted availability. Within the UAE, notably Dubai, premiums are at present round 40 %, pushed by funding demand, jewellery consumption, and the area’s function as a bodily bullion hub.

These premiums are the pure consequence of a market the place bodily provide is constrained and paper costs fail to clear real-world demand.

BullionStar Premiums and Stock Positioning

BullionStar has additionally skilled record-breaking demand for silver, as reported right here.

Our technique has been to construct substantial bodily stock on the earliest indicators of tightening within the bodily market. This strategy has allowed us to take care of availability of each silver bars and silver cash at a time when many rivals are both utterly offered out or working with severely restricted inventory. We nonetheless have a comparatively wide selection of silver bars and silver cash obtainable, with further shipments already in transit.

That mentioned, replenishing silver has develop into more and more difficult. Rising acquisition premiums and longer supply lead instances from suppliers have made it vital to regulate our pricing.

From a world perspective, nonetheless, we consider our premiums stay extremely aggressive. Our present indicative premiums are as follows:

Good Supply roughly 1,000 oz silver bars at spot +5.99%

100 oz, 5 kg and 15 kg silver bars at spot +10% to 12%

1 kg silver bars from spot +14%

1 oz silver cash from spot +12%

Structural Provide Deficits and Inelastic Industrial Demand

The bodily squeeze in silver is underpinned by years of structural deficits. International mine manufacturing peaked round 2016 and has since declined, whereas demand has continued to rise. With roughly 70 % of silver produced as a byproduct of base steel mining, increased costs alone can’t rapidly deliver new provide on-line.

Industrial demand now consumes greater than half of annual silver provide, and far of this demand is very inelastic. Photo voltaic power, electrical autos, AI infrastructure, information facilities, and superior electronics all require silver no matter worth. A lot of this steel is consumed and successfully faraway from circulation, not like gold which is never destroyed.

This creates a persistent drawdown of obtainable above-ground inventories.

The ETF Fragility Drawback

Maybe probably the most underappreciated danger within the present market lies inside paper silver devices, notably ETFs.

Most silver ETFs don’t function like easy vaults holding unencumbered steel for shareholders. They depend on a posh construction involving approved individuals, custodians, sub-custodians, leasing preparations, and unallocated steel. Underneath regular situations, this method capabilities easily.

Underneath bodily stress, it doesn’t.

When bodily silver turns into scarce and lease charges rise, approved individuals could also be unwilling or unable to supply steel for ETF creation or redemption. In such eventualities, ETFs can start buying and selling at persistent reductions or premiums to web asset worth, droop redemptions, or be compelled into money settlement.

In an excessive squeeze, ETF shares might proceed buying and selling whereas the underlying steel successfully disappears from the market. Traders consider they personal silver, however in actuality maintain a paper declare with rising counterparty danger.

That is how paper markets break. Not via a single dramatic default, however via gradual lack of credibility as bodily steel flows out of Western vaults and into areas prepared to pay actual premiums.

Lease Charges and Backwardation Sign Escalating Stress

One other reinforcing sign comes from lease charges within the bodily silver market. Rising short-term lease charges point out that holders of steel are more and more unwilling to lend silver even quickly.

When elevated lease charges coincide with backwardation, it alerts acute tightness. Instant supply instructions a premium over future supply. Traditionally, such situations have usually preceded sharp upward repricing as paper markets are compelled to converge towards bodily actuality.

What This Means for Savers and Traders

Taken collectively, the surge in Chinese language premiums, elevated regional premiums elsewhere, rising lease charges, persistent provide deficits, and mounting ETF fragility level to a silver market underneath extreme pressure.

What we’re witnessing is a credibility take a look at for paper silver markets.

For savers and traders, the implications are clear. Bodily possession is non-negotiable. Counterparty danger for paper silver is increased than ever.

In a fragmented market the place bodily steel more and more dictates worth, counting on paper claims introduces dangers that many traders haven’t absolutely thought-about.

With industrial demand accelerating, financial pressures intensifying, and bodily provide constrained, silver’s repricing should be in its early phases. Many now view costs above USD 100 per ounce in 2026 as more and more believable, not as hypothesis, however as a consequence of structural realities.