Brandon Sauerwein, Editor

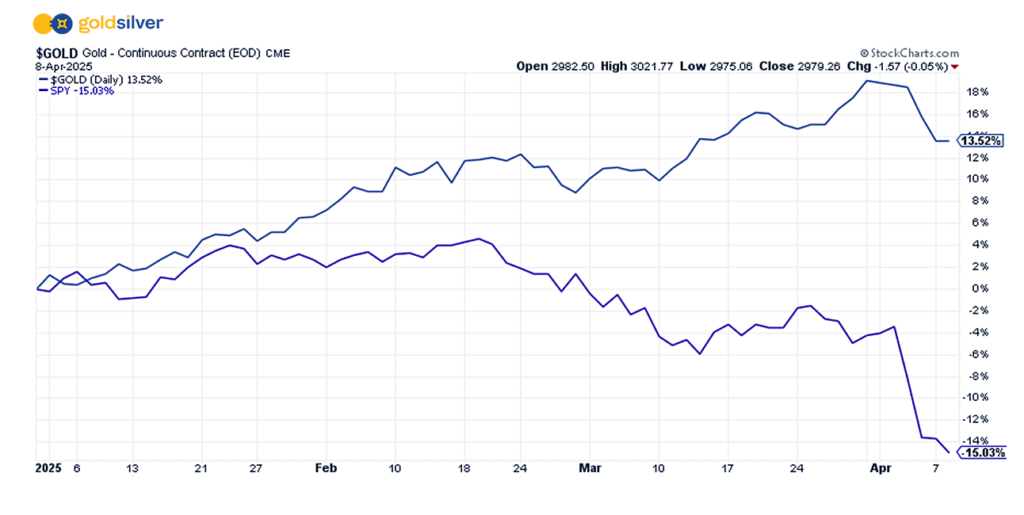

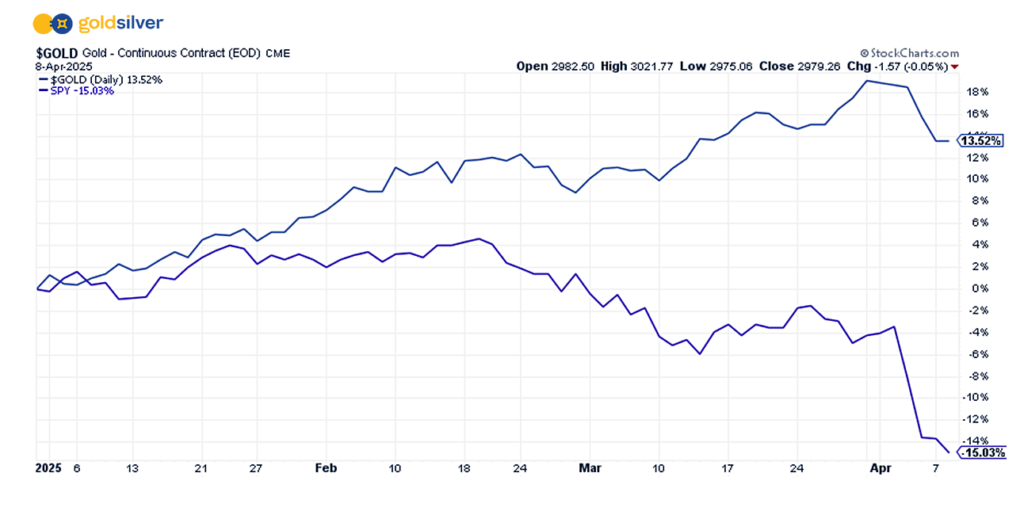

Whereas the inventory market whipsaws forwards and backwards, metals proceed to be a stabilizing power in monetary portfolios. In terms of gold vs S&P 500, the distinction is putting: year-to-date, gold has climbed +13.5% whereas the S&P 500 has tumbled -15%.

Many within the treasured metallic area are debating gold vs S&P 500 or buzzing about gold’s new document highs, however right here’s one thing which may shock you…

If you happen to rewind to January 1980, gold peaked at $850 per ounce. Adjusting for inflation, that’s equal to roughly $3,486 in at this time’s {dollars}.

So, regardless of all of the champagne popping over latest value motion, gold truly hasn’t but reclaimed its true historic peak in actual buying energy. We’re witnessing historical past within the making, however essentially the most fascinating chapter may nonetheless be forward.

This “hidden low cost” raises an intriguing query: What occurs when gold lastly breaks above its inflation-adjusted 1980 excessive? If historic patterns supply any clues, the momentum might be extraordinary…

Mike Shares New Silver Forecast at Uncommon Stay Occasion

Mike Maloney simply made a uncommon public look on the Secrets and techniques of Syndication Convention, and his forecast for gold and silver could be a very powerful one he’s made in years.

On this uncommon reside presentation, Mike shares:

- Proof of over $500 billion in fraud throughout the U.S. Treasury

- Why somebody simply took supply of almost half a billion {dollars} in bodily silver

- His daring prediction for silver costs to surge into triple digits ($150-$500 per ounce)

- Important warning indicators of an imminent recession that might devastate inventory portfolios

- Why gold inflows to the U.S. are elevating critical questions on Fort Knox reserves

Mike hardly ever makes public appearances anymore, making this presentation notably beneficial. Watch his most present pondering earlier than these market-moving insights turn out to be frequent information.

Safe Bulk Pricing on Each Single Gold & Silver Buy

What Else is within the Information?

⏰ 24 HOUR PRICE UPDATE | As of 9:00 AM, Wednesday, April ninth:

- Gold is up roughly +2.6%

- And silver is up +1.9%

📊 Secure Haven Debate: Gold Steady, Bitcoin Down

The long-running correlation between gold and Bitcoin has damaged in 2025, with the valuable metallic up roughly +14% whereas Bitcoin has fallen -18% throughout the identical span. Since 2020, China, India, and Russia are collectively buying over 1,000 metric tons of gold yearly, serving to drive gold’s rise. In the meantime, Bitcoin’s value motion matches extra speculative property than protected haven.

⚔️ China Pledges to “Battle to the Finish” In Commerce Battle

President Trump’s reciprocal tariff plan has formally gone into impact, with U.S. Customs and Border Safety starting to gather country-specific tariffs from 86 U.S. commerce companions beginning at 12:01 a.m. ET. The plan features a substantial 104% tariff on Chinese language items, intensifying commerce tensions between the world’s two largest economies. China has pledged to “battle to the top” by imposing sturdy countermeasures.

This commerce struggle comes at a precarious time for US fiscal well being. With a deteriorating fiscal place, ballooning curiosity bills, and financial weak point, the credit score outlook for US authorities debt seems more and more susceptible.

🏛️ US Treasuries: Secure Haven Standing at Threat?

The longstanding place of US Treasuries because the world’s premier safe-haven funding might be in danger. Trump’s tariff insurance policies could also be accelerating world diversification away from US property, with Deutsche Financial institution warning of a possible “confidence disaster” within the greenback and UBS suggesting the euro may strengthen as a substitute reserve forex.

As we speak, international buyers personal roughly one-third of the US Treasury market. Any vital discount in worldwide demand would create substantial funding challenges exactly when fiscal calls for are escalating. — doubtlessly threatening the greenback’s reserve forex standing.

🔄 Trump Uncertainty Isn’t Going Away

One of many key repercussions of the commerce struggle is heightened financial uncertainty. Tariffs swing wildly — 10% sooner or later, 104% the subsequent — creating an unpredictable surroundings for companies and buyers alike.

Even when tariffs had been out of the blue eradicated, belief with our buying and selling companions has already been broken. The worldwide financial system is getting into an period of instability that exhibits no indicators of abating quickly.

On this local weather of uncertainty, defending your hard-earned wealth with time-tested protected havens isn’t simply prudent — it’s important.

💬 What GoldSilver Traders are Saying

⭐ ⭐ ⭐ ⭐ ⭐ At all times Nice

“At all times nice. Thanks GoldSilver for serving to me protect wealth, and thanks Travis for assiduous persistence in serving to us with serving to my daughter log in to my account invite.” — J. Grimes

Expertise the GoldSilver distinction:

- Obtain skilled steering from devoted treasured metals specialists

- Entry complete instructional assets to grasp your funding technique

- Belief in our industry-leading customer support workforce that places you first

Able to get began?