Tucked away within the rolling hills of Kentucky stands an imposing construction that has captured the creativeness of generations: the USA Bullion Depository at Fort Knox. This fortress of concrete and metal is alleged to accommodate most of America’s gold reserves.

After many years of hypothesis and advocacy, we stand at a historic turning level, with unprecedented alternatives for transparency on this legendary facility.

The Lengthy Highway to Transparency

The Fort Knox depository, accomplished in 1936, was designed to safe America’s financial gold reserves throughout a turbulent interval in monetary historical past. The power’s development adopted Government Order 6102, which required Americans to give up their gold holdings to the Federal Reserve in alternate for paper forex.

Whereas the power’s safety measures are legendary—with partitions of concrete-encased granite, a bombproof roof, and a 22-ton vault door—the true fortress lies within the wall of secrecy surrounding its contents. The final complete audit of Fort Knox gold occurred in 1953, through the Eisenhower administration. Since then, solely partial inspections have been carried out, and none have met the rigorous requirements anticipated in fashionable monetary auditing.

From Fringe Motion to Mainstream Coverage

The journey towards transparency has not been easy. Within the early 2000s, Congressman Ron Paul emerged as a distinguished advocate for accountability, making the audit of Fort Knox a central challenge in discussions about financial coverage. Though these preliminary efforts confronted vital resistance, they set the stage for at this time’s groundbreaking developments.

When advocates began calling for higher transparency in 2008, these requests had been typically dismissed as fringe points. Immediately, we’re witnessing not solely the potential for a Fort Knox audit but additionally broader initiatives, together with:

- Complete Federal Reserve transparency measures

- Discussions about gold’s position in financial coverage

- Declassification of key monetary paperwork

- Reform initiatives for main authorities establishments

The Trump Administration’s Dedication to Transparency

The present administration’s dedication to audit Fort Knox signifies a big step towards enhanced authorities accountability. Whereas the audit particulars stay unclear, I’m cautiously hopeful that this transfer will result in higher transparency.

Vital Questions That Demand Reply

Regardless of this progress, a number of crucial issues stay relating to Fort Knox’s gold reserves:

Bodily Verification: No impartial auditors have been permitted to conduct an entire bodily stock and assay of the gold, elevating questions on its precise presence and purity.

Encumbrances: Little transparency exists about whether or not gold has been leased, swapped, or in any other case encumbered by way of monetary preparations with overseas entities or banks.

High quality Assurance: Fort Knox gold was final high quality examined many years in the past, elevating issues about its purity and consistency.

Why This Issues Extra Than Ever

The importance of Fort Knox’s transparency extends far past mere curiosity. The gold held in its vaults represents a considerable portion of America’s financial reserves, which subsequently impacts international monetary stability.

For American Residents

The gold at Fort Knox finally belongs to the American folks. As taxpayers and stakeholders within the nation’s monetary system, residents have a proper to know the precise standing of their nationwide treasures. This transparency is much more important as Individuals more and more acknowledge the significance of together with treasured metals of their funding portfolios.

Why Particular person Gold Possession Issues

The rationale for holding gold extends past mere portfolio diversification:

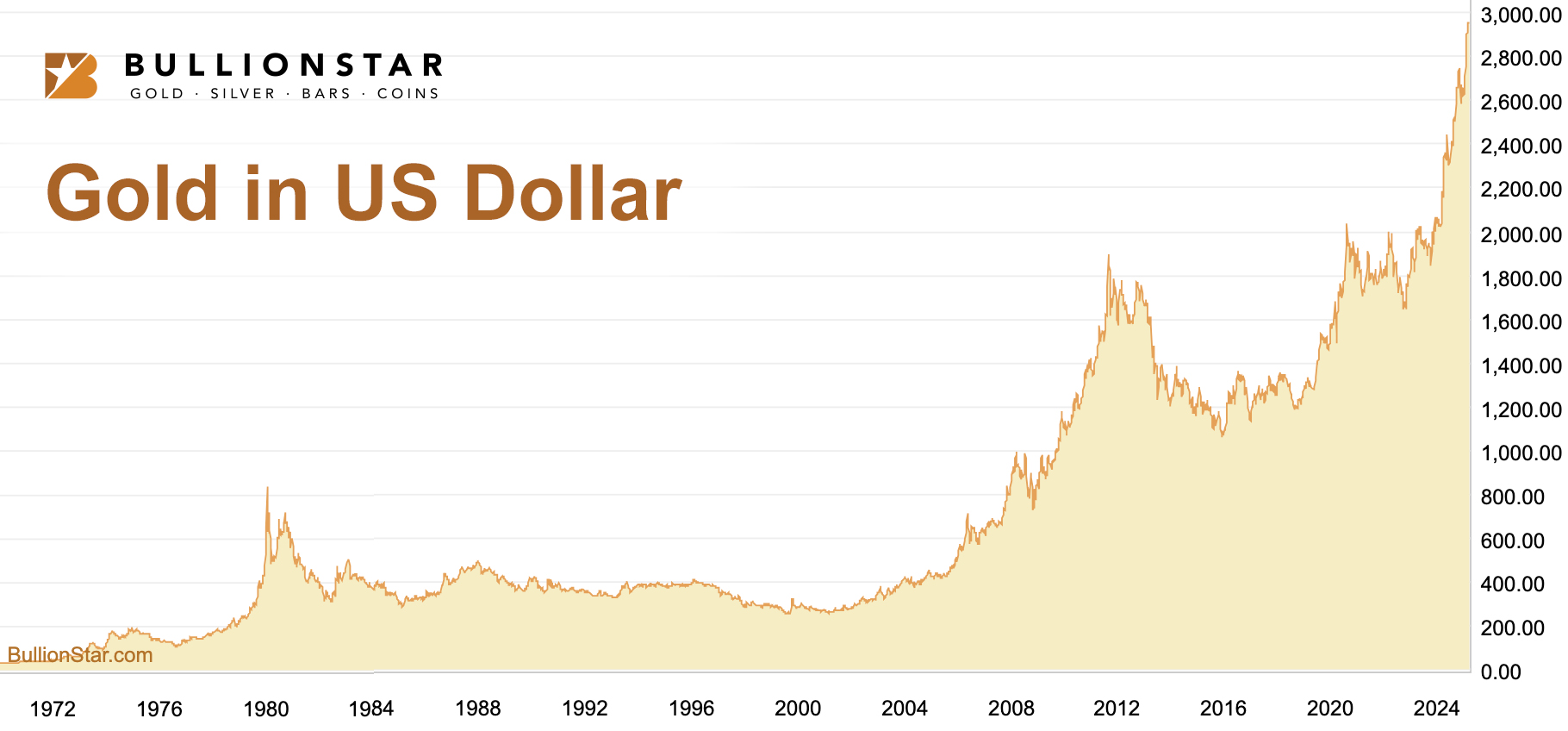

Wealth Preservation: All through historical past, gold has maintained its buying energy over centuries, defending towards forex devaluation and financial uncertainty. Whereas paper currencies have repeatedly misplaced worth resulting from inflation and financial coverage modifications, gold has persistently preserved wealth throughout generations.

Monetary Independence: By proudly owning bodily gold, people scale back their dependence on the normal banking system and government-controlled financial coverage. This independence turns into particularly vital during times of monetary stress or systemic banking points.

Portfolio Safety: Gold sometimes strikes inversely to conventional monetary property like shares and bonds, offering essential safety throughout market downturns. For instance, through the 2008 monetary disaster, gold considerably protected buyers whereas many different property declined sharply.

Inflation Protection: As governments world wide have interaction in unprecedented financial growth, gold serves as a confirmed hedge towards inflation. In contrast to fiat currencies, which may be created at will, the availability of gold will increase at a predictable and restricted price.

It’s necessary to acknowledge that gold isn’t merely an ‘funding’ to be allotted alongside shares and bonds however reasonably the inspiration of sound cash itself.

All through historical past, gold has served as the final word unit of measurement towards which all different property are valued. After we converse of ‘buying’ gold with fiat forex, we’re truly changing unstable government-issued forex again into actual cash. This attitude shifts all the paradigm – reasonably than asking how a lot gold one ought to add to a portfolio, the wiser query turns into how a lot fiat forex and different property one ought to briefly maintain alongside their core gold financial savings.

Gold represents the inspiration of monetary safety reasonably than a mere diversification instrument, with bodily possession serving as true financial sovereignty in an more and more unsure world. This understanding transforms how people method wealth preservation, shifting past standard portfolio concept to acknowledge gold’s rightful place as cash itself.

Implementing Private Gold Possession

Efficient gold possession requires cautious consideration of a number of elements:

Storage Choices

Product Choice

Buy Technique

Documentation and Insurance coverage

The Connection to Fort Knox

The transparency of Fort Knox’s gold holdings immediately impacts citizen confidence within the broader financial system. When residents comprehend the precise situation of nationwide gold reserves, they’ll make extra knowledgeable selections relating to their monetary safety. This consists of:

- Evaluating the precise backing of the U.S. greenback

- Understanding the nation’s capability to reply to monetary crises

- Assessing the necessity for private gold holdings as a complement to nationwide reserves

- Making knowledgeable selections about portfolio allocation to treasured metals

For International Markets

Fort Knox’s gold holdings are important to worldwide monetary confidence. The uncertainty surrounding these reserves can affect:

- International gold costs and market stability

- Worldwide confidence within the U.S. greenback

- The credibility of American monetary establishments

- The broader worldwide financial system

For Future Generations

Transparency in authorities holdings is crucial for sustaining belief in monetary establishments and guaranteeing accountable stewardship of nationwide property.

Fashionable Options for Fashionable Challenges

Expertise gives many options for performing complete audits whereas guaranteeing safety:

- Non-invasive testing strategies for verifying gold purity

- Blockchain-based stock techniques for clear trackin

- Impartial auditing protocols utilized by main personal vault

- Actual-time monitoring techniques for ongoing verification

BullionStar’s Management in Transparency

At BullionStar, we’ve got lengthy proven that full transparency in treasured metals storage is just not solely achievable however essential. Our practices embody:

- Full allocation and segregation of saved metals

- Common third-party audits

- Detailed documentation of all holdings

- Buyer entry for bodily verification

- Public reporting of audit outcomes

These requirements have helped set up benchmarks for what is feasible in fashionable bullion storage and verified that safety and transparency can coexist successfully.

At BullionStar, we’ve got been asking robust questions for over a decade. We proceed to advocate for transparency in auditing gold reserves and are proud to be leaders on this dialogue.

Addressing Skepticism Whereas Embracing Progress

Whereas some long-time advocates specific skepticism about potential audit findings, particularly regarding gold encumbrance, it’s important to acknowledge the historic nature of this second. The mere undeniable fact that we’re discussing an official audit signifies unprecedented progress in authorities transparency.

The Path Ahead

The dedication to audit Fort Knox represents greater than only a single coverage resolution; it’s a victory for many years of advocacy and a testomony to the facility of persistent requires accountability. Shifting ahead requires:

-

- Establishing an impartial auditing fee

- Implementing fashionable verification applied sciences

- Creating clear reporting mechanisms

- Growing ongoing monitoring protocols

- Constructing everlasting oversight mechanisms

Conclusion

At this pivotal second, we are able to acknowledge how far the motion for monetary transparency has progressed. What was as soon as seen as a fringe concern has remodeled into mainstream coverage, illustrating the impression of relentless advocacy and shifting public expectations.

At BullionStar, we take delight in our position within the journey in the direction of higher transparency in treasured metals storage. Our long-standing dedication to full accountability and buyer accessibility highlights what may be achieved in fashionable bullion storage. Each ounce of gold in our custody is absolutely allotted, segregated, and uniquely identifiable. Clients can bodily examine their treasured metals at any time, and we keep detailed information of all bars and cash, together with specs, serial numbers, and pictures.

The upcoming Fort Knox audit and broader transparency initiatives signify not an endpoint however a brand new starting. They current a chance to ascertain new authorities accountability and monetary transparency requirements that may profit future generations. By sustaining acceptable skepticism and a spotlight to element, we are able to rejoice this historic progress whereas persevering with to advocate for even higher openness in our monetary techniques.

This thorough audit of Fort Knox’s gold reserves is fascinating and essential for market stability, public belief, and monetary accountability. As private-sector leaders in bullion storage have proven, the know-how and procedures are already in place.

It’s a matter of political will and public demand for accountability. The trail forward presents challenges, however the route is unequivocal—towards higher openness, accountability, and belief in our monetary establishments.

Take Motion: Safe Your Wealth in Unsure Occasions

Whereas we look ahead to higher transparency in nationwide gold reserves, there’s no purpose to delay securing your monetary future. BullionStar gives a seamless connection between the digital and bodily realms of sound cash, enabling shoppers to effortlessly alternate cryptocurrencies and bodily gold with only a few clicks.

This flexibility has confirmed to be extremely priceless for our forward-thinking shoppers. In latest months, a number of BullionStar clients efficiently hedged their publicity by changing Bitcoin on the USD 100,000+ stage into bodily gold earlier than the numerous crypto pullback—a call that significantly preserved and enhanced their wealth.

This real-world instance highlights the sensible advantages of getting environment friendly pathways between varied types of sound cash. Whether or not you’re aiming to diversify cryptocurrency good points, construct a basis of bodily gold financial savings, or just decrease publicity to fiat forex dangers, BullionStar affords the safe infrastructure and experience to implement your technique successfully.

Discover our web site at this time to find how our clear, fully-allocated storage options and cryptocurrency alternate companies will help you confidently navigate at this time’s advanced financial panorama.