BullionStar is at present experiencing excessive demand and has raised worth premiums on sure merchandise.

We’re updating our web site to show real-time inventory ranges, permitting prospects to trace reside stock availability.

The net minimal order stays at SGD 99 (or equal in different currencies) for now however could also be adjusted if demand continues to rise.

Refineries Imposing Surcharges and Suspending Manufacturing

Metalor, one of many main Swiss refineries, has lately launched a per-oz surcharge on all its gold merchandise on account of shortages growing the gold lease fee, the widening unfold between spot and futures, and tariff-related components.

One other main Swiss refinery, Argor-Heraeus, has suspended orders for all 50-gram and 100-gram minted gold bars. Whereas BullionStar nonetheless has these things in inventory, replenishment will not be doable as soon as they’re bought out.

BullionStar Premiums & Minimal Orders

Given the rising demand, surcharges, and suspended manufacturing, we now have elevated premiums on sure merchandise.

For now, we’re sustaining the minimal on-line order of SGD 99 (or the equal in different currencies). Nonetheless, if order volumes turn into unsustainable, we might have to regulate this threshold.

Buyer promote costs have additionally been elevated.

BullionStar Inventory Stock Ranges

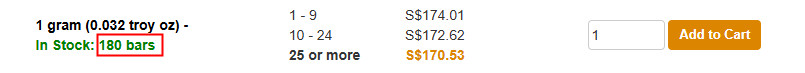

To reinforce transparency, we now have launched reside inventory ranges on our web site for all key merchandise. The amount at present obtainable for fast buy is displayed subsequent to the “In Inventory” label.

Due to this fact, prospects can now monitor our inventory ranges in actual time as potential shortages of bodily gold and silver loom.

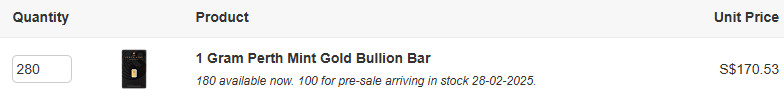

For some gadgets, we additionally settle for orders for merchandise at present in transit. That is listed as “Pre-Sale” with amount obtainable and the anticipated arrival date.

For gadgets labeled each “In Inventory” and “Pre-Sale,” the “In Inventory” amount is on the market for fast supply, whereas the “Pre-Sale” amount consists of further items which have already been ordered by us, are on the best way to our facility, and might be ordered by prospects

The completely different availability dates are additionally displayed at checkout when ordering past the in-stock amount.

Please be aware that every one pre-sale gadgets are confirmed with availability from our suppliers. We deal solely in bodily treasured metals and keep away from paper metallic guarantees.

Bodily Bullion and Refining Capability Shortages

Wholesale and retail bodily bullion shortages are rising in different areas as properly. In South Korea, for instance, banks have suspended gold and silver gross sales on account of surging demand.

Stories have additionally steered tightness of sure gold bar sizes on the financial institution retail stage in China. Nonetheless, with the Shanghai Gold Alternate (SGE) being primarily bodily—the place most contracts lead to bodily supply and withdrawals are doable for bars as small as 100 grams—China is well-positioned for a possible shift in worth discovery from paper gold to bodily gold.

Equally, within the West, US institutional demand has skyrocketed with COMEX gold deliveries for Feb25 exceeding 60,000 contracts or over 200 metric tons. This comes on the heels of an immense 498 metric tons delivered in simply the final two months. The sheer scale of those deliveries is overwhelming refineries and mints, stretching capability to its limits and inflicting extended delays for brand spanking new orders.