We’re experiencing unprecedented demand for bodily valuable metals at BullionStar. Final week, we noticed file demand each when it comes to gross sales income and variety of orders.

Regardless of our current counter enlargement within the Bullion Heart, permitting us to serve as much as ten clients concurrently, the file demand has resulted in substantial queuing instances. A number of days final week, we had greater than 100 clients in queue, with ready instances reaching as much as 5 hours regardless of all counters being open.

Our philosophy has all the time been to top off aggressively throughout the board on the first signal of bodily scarcity. This method has as soon as once more confirmed worthwhile, permitting us to keep up obtainable stock for much longer than most of our rivals.

Whereas we’re presently dealing with challenges in replenishing and sourcing metals from a number of suppliers, we nonetheless have ample inventory ranges for many merchandise. A number of suppliers are reporting bodily steel shortages and refining capability limitations.

Examples embody Heraeus, which is presently non-committal on new silver orders with supply instances exceeding three months. Nadir has added a spot value premium for silver of as much as USD 3 per ounce, citing bodily silver shortages. PAMP has raised wholesale silver premiums by 33 %, and The Royal Mint has introduced measures for restricted allocation.

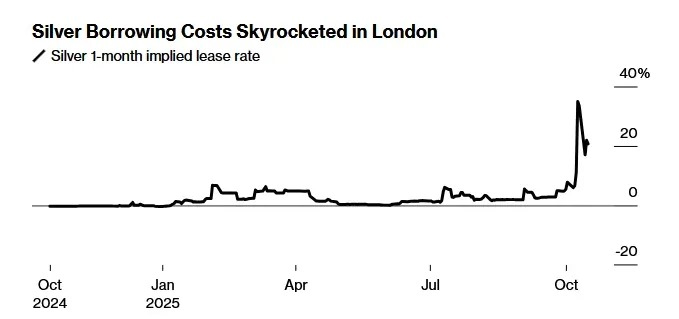

Moreover, silver lease charges have reached as excessive as one hundred pc, indicating bodily silver shortages, significantly within the London spot market. BullionStar has for years highlighted that the paper silver market is tons of of instances bigger than the quantity of bodily silver really obtainable. Evidently the London paper silver charade is lastly coming to an finish as extra folks notice that the emperor has no garments and no bodily silver.

Picture supply: Bloomberg, CME

Picture supply: Bloomberg, CME

It is a reminder that imaginary gold and silver haven’t any inherent worth. It has by no means been extra vital to avoid paper gold and silver in all their kinds. Many have been defrauded into shopping for paper gold and silver, however when gold and silver reprice exponentially, solely bodily steel will matter, not unbacked digital liabilities.

What We Are Doing

Free Insured Supply Throughout Singapore – Trackable and Discreet

Keep away from the Bullion Heart queue and revel in quick, safe, and discreet supply. All deliveries are absolutely insured and trackable. Orders are shipped inside two enterprise days (Monday to Friday) after fee is acquired. We additionally supply worldwide delivery.

Alternatively, you may retailer your metals with BullionStar. Your holdings are absolutely insured, saved below your authorized possession and might be audited, bought, or bodily withdrawn at any time.

Specific Precedence Queue for Pre-paid Orders

Order at BullionStar.com and pre-pay (we settle for PayNow, Financial institution Switch, Crypto Cost and Card Cost) to take pleasure in our precedence queue when amassing your gadgets at our Bullion Heart.

Premium Will increase

We’ve needed to enhance premiums and lift the no-spread quantity threshold for No-Unfold BullionStar Gold and BullionStar Silver Bars. Whereas that is regrettable, it’s unavoidable after we face wholesale premium will increase or outright incapability to restock gold and silver from our suppliers, whereas most rivals are utterly bought out.

Minimal Order Quantity of S$2,500

We’ve launched a minimal order quantity of S$2,500 or equal in different currencies. We’ve all the time been proud to welcome everybody to BullionStar, whether or not you’re a seasoned investor or a small-time saver simply beginning your valuable metals journey.

This measure pains us. It’s heartwarming to see grandparents shopping for a silver coin for his or her grandchildren or somebody with restricted assets starting to save lots of in valuable metals, and that’s one thing we wish to help. Nevertheless, with our workers working a number of hours of time beyond regulation on daily basis, dealing with 1000’s of help tickets and lengthy in-store ready instances, we have now little alternative however to introduce this measure.

If demand continues to develop on the present tempo, we could have to boost the minimal order additional.

Hiring and Capability Enhancements

We’ve just lately prolonged our opening hours and at the moment are open Monday to Saturday from 11 am to 7 pm. We’ve additionally expanded our counters in order that we will serve as much as ten clients concurrently at our Bullion Heart at 45 New Bridge Street in Singapore.

Even so, we’re scaling up capability in each space of the enterprise as rapidly as potential. We’re hiring throughout nearly all departments, together with store bullion executives, vault workers, buyer help, accounting, authorized, and compliance.

Apply right now for those who share our ardour for sound cash and our dedication to transparency and repair.