FY 2024 (July 1, 2023 – June 30, 2024) was one other sturdy 12 months for BullionStar. Gross sales income reached SGD 423.5 million, a 6.76% enhance in comparison with FY 2023.

Gold Value

- Spot Gold: Closed FY 2024 at USD 2,326, up from USD 1,919 on July 1, 2023—a 21.2% acquire.

- Gold briefly surpassed its all-time excessive of USD 2,075 per troy ounce on December 4, 2023. Nevertheless, on March 1, 2024, it broke by means of this degree and continued transferring increased.

Silver Value

- Spot Silver: Closed FY 2024 at USD 29.15, up from USD 22.73 on July 1, 2023—a 28.2% acquire.

- Silver traded between USD 20.75 and USD 25.60 for many of the 12 months earlier than breaking out in April 2024 and ultimately peaking at USD 32.50 on Could 20, 2024.

The sell-to-buy ratio reached 0.94—the very best lately—twice throughout FY 2024:

November 2023: Important promoting occurred as gold neared its all-time excessive, and silver approached an higher resistance degree, although neither steel broke out then.

March 2024: Gold decisively surpassed its earlier report excessive, pushing silver to observe swimsuit and get away of its buying and selling vary.

By way of our seamless on-line platform, prospects can rapidly promote bullion. Prospects who use our safe, absolutely audited, and insured vault can promote orders on-line.

Our clear pricing and instantaneous settlement present a protected and environment friendly promoting expertise.

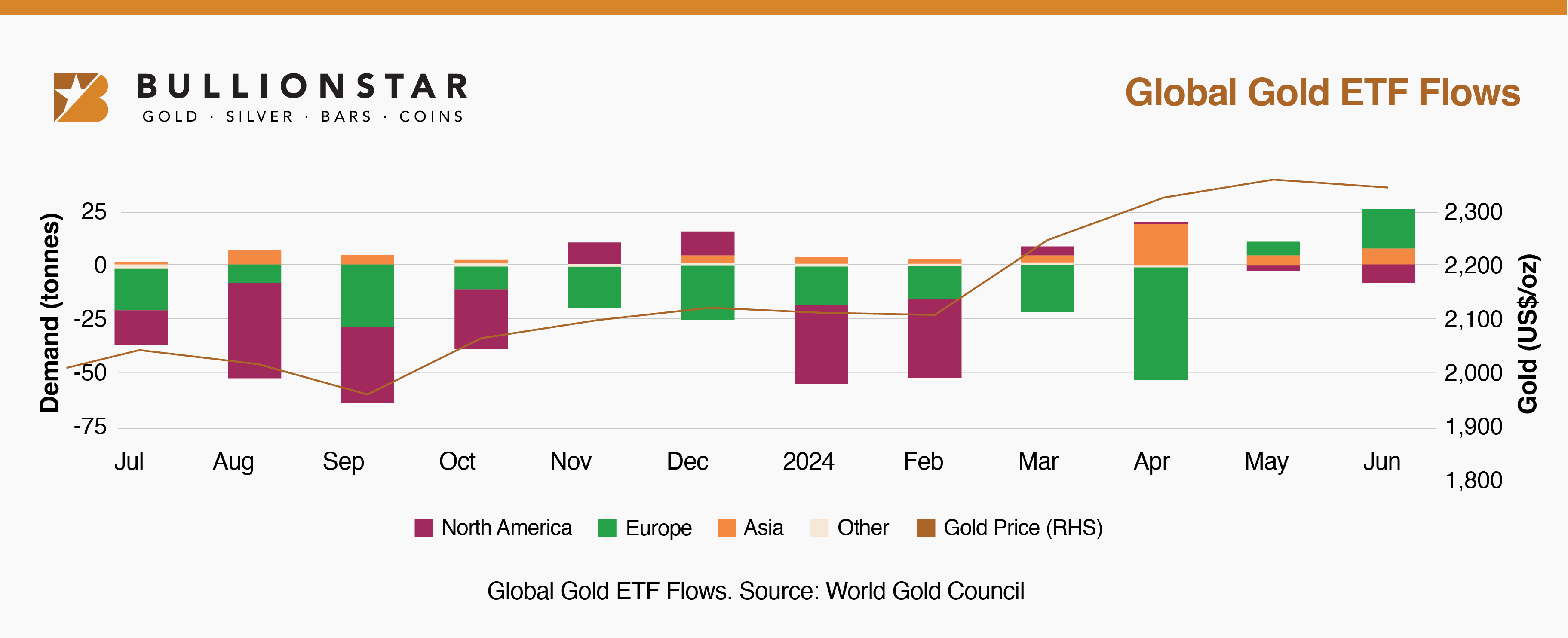

Regardless of rising gold costs, international gold ETFs noticed their internet positions decreased through the first three quarters of FY 2024. When seen as a proxy for Gold ETF investor sentiment, it may be inferred that Gold ETF shareholders missed a sizeable portion of the gold rally.

After gold’s decisive breakout in March 2024, Gold ETF investor sentiment shifted course, leading to internet inflows – a sign of trend-following behaviour.

April 2024 & October 2023 Led the Surge

- April 2024:

3,963 purchase orders, pushed by gold’s historic breakout above its earlier all-time excessive in USD and silver’s substantial rise out of its buying and selling channel.

- October 2023:

3,584 purchase orders had been positioned, spurred by geopolitical tensions following the Hamas-led assault on Israel on October 7, 2023. The ensuing uncertainty elevated gold by round 7.3%, growing demand as traders sought safe-haven property.

These months underscore the affect of worldwide occasions and market actions on investor conduct.

- Gold gained 21.2% in FY 2024, capturing widespread media consideration for hitting new report highs.

- Silver gained 28.2% in the identical interval but attracted far much less media protection.

- Silver largely remained below the radar regardless of overshadowing gold in proportion phrases, presenting vital alternatives for individuals who tracked its efficiency.

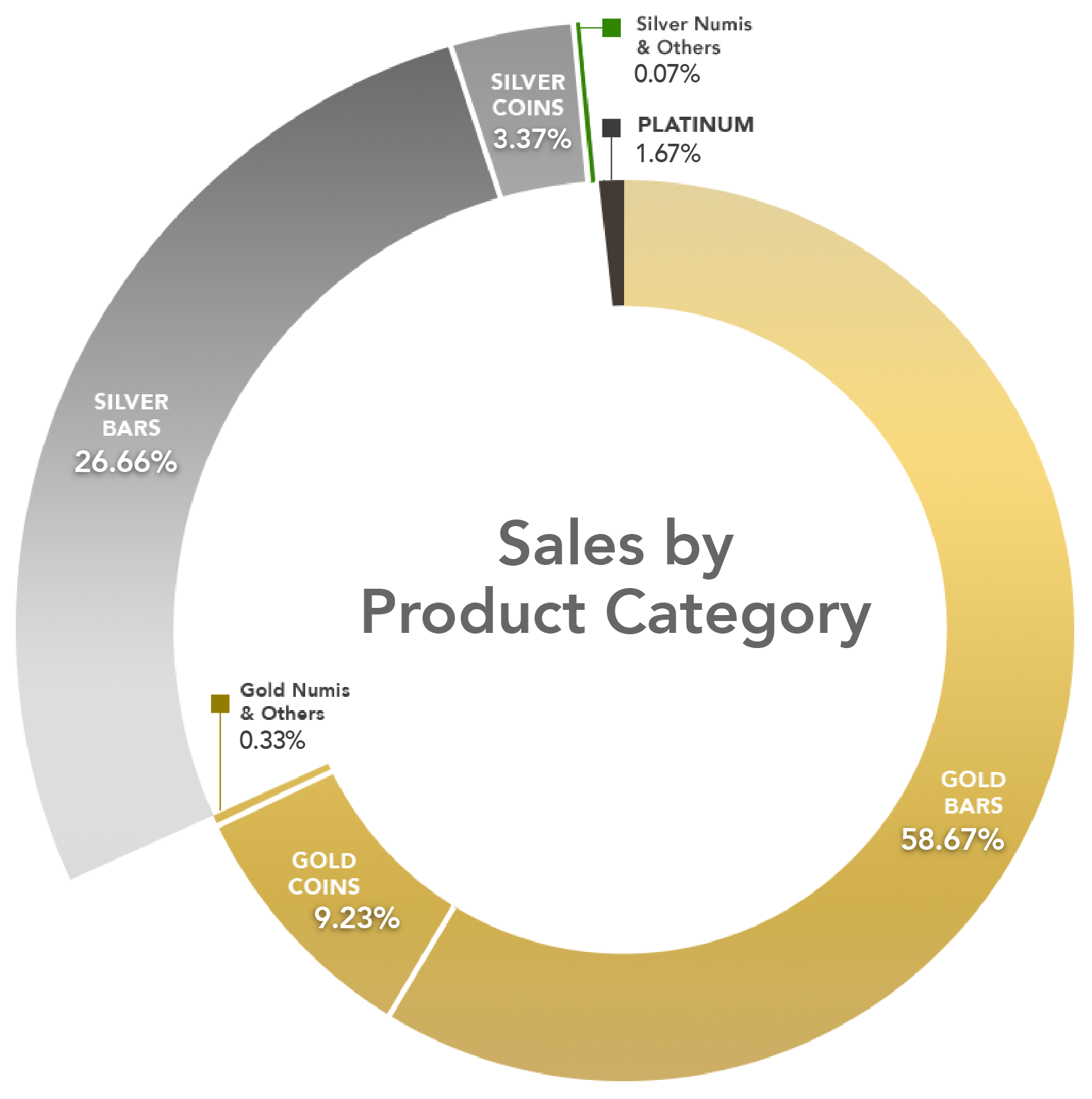

Complete Gross sales Income: SGD 423.5 million

Gross sales per Product Class

- Gold: 68.23%

- Silver: 30.1%

- Different Metals (primarily Platinum): 1.67%

This breakdown intently mirrors the distribution in FY 2023.

Gold Merchandise

Inside Gold Bars:

- 83%: Bigger gold bars.

- 54%: 100g gold bars

- 29%: Good Supply gold bars and 1kg gold bars

- Remaining 17%: Different sizes and merchandise

Inside Gold Cash:

Silver Merchandise

Inside Silver Bars:

- 2%: 1kg silver bars

- 2%: LBMA Good Supply silver bars

- Remaining 13.6%: Different sizes and merchandise

Inside Silver Cash:

- Purchase Orders: 38,515 (up 16.6% from 33,033 in FY 2023)

- Common Order Measurement: SGD 10,994.90 (down from SGD 11,913.37 in FY 2023)

- Median Order Measurement: SGD 1,001.01 (down from SGD 1,177.39 in FY 2023)

As a worldwide bullion seller, BullionStar recorded gross sales from prospects in 102 nations throughout FY 2024. Since our launch in 2012, we’ve served prospects in over 130 nations.

BullionStar.com Visits: 3,703,049 (a 21.5% enhance in comparison with FY 2023), demonstrating elevated shopper curiosity in treasured metals

We launched BullionStar Auctions to offer prospects with alternatives to bid on overstocked bullion and uncommon, collectible gadgets.

Our progressive method has allowed prospects to safe offers on extremely sought-after collectibles at distinctive worth—typically beneath retail costs and at vital reductions.

- Since October 2024:

- Over 63,000 bids positioned

- 700 auctions concluded

Two Foremost Public sale Classes

Bullion Public sale Offers

- Overstocked bullion stock

- Low premiums and vital reductions

- Potential to win at costs beneath spot

Uncommon & Unique Auctions

- Historic cash, uncommon collectibles, and limited-edition releases

- Ultimate for traders and collectors looking for distinctive alternatives

Go to now to browse our unique public sale gadgets. Seize your likelihood to seek out distinctive offers and uncommon treasures—you received’t need to miss this chance!

Earlier Monetary Reviews

BullionStar Financials FY 2023 – 12 months in Evaluation

BullionStar Financials FY 2022 – 12 months in Evaluation

BullionStar Financials FY 2021 – 12 months in Evaluation

BullionStar Financials FY 2020 – 12 months in Evaluation

BullionStar Financials FY 2019 – 12 months in Evaluation

BullionStar Financials FY 2018 – 12 months in Evaluation

BullionStar Financials FY 2017 – 12 months in Evaluation

BullionStar Financials FY 2016 – 12 months in Evaluation

BullionStar Financials FY 2015 – 12 months in Evaluation