FY 2025 (July 1, 2024 – June 30, 2025) was a report 12 months for BullionStar. Whole income reached SGD 761.1 million, an 80% improve in comparison with FY 2024.

Key highlights

- Income: SGD 761.1 million (+79.7% 12 months on 12 months)

- Purchase orders: 55,686 (+44.6%)

- Common order dimension: SGD 13,873 (+26.2%); median order dimension: SGD 1,469 (+46.7%)

- Peak shopping for months: April 2025 (7,659 purchase orders) and June 2025 (5,738 purchase orders)

- Web site visits: 5,283,570 (+42.7%)

Valuable Steel Worth Tendencies

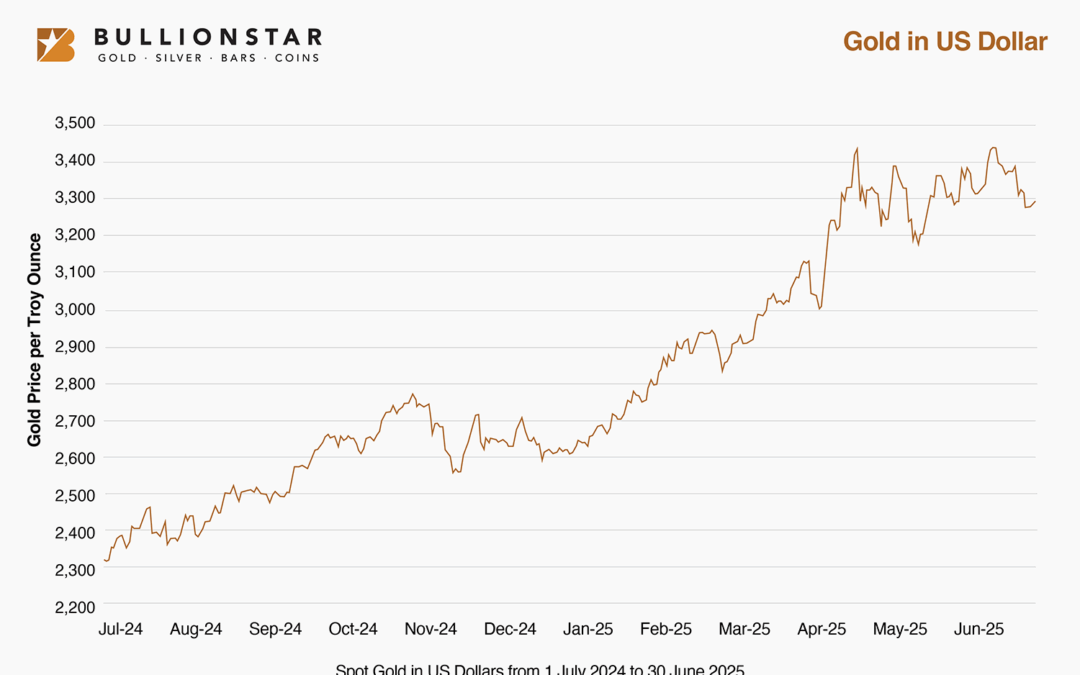

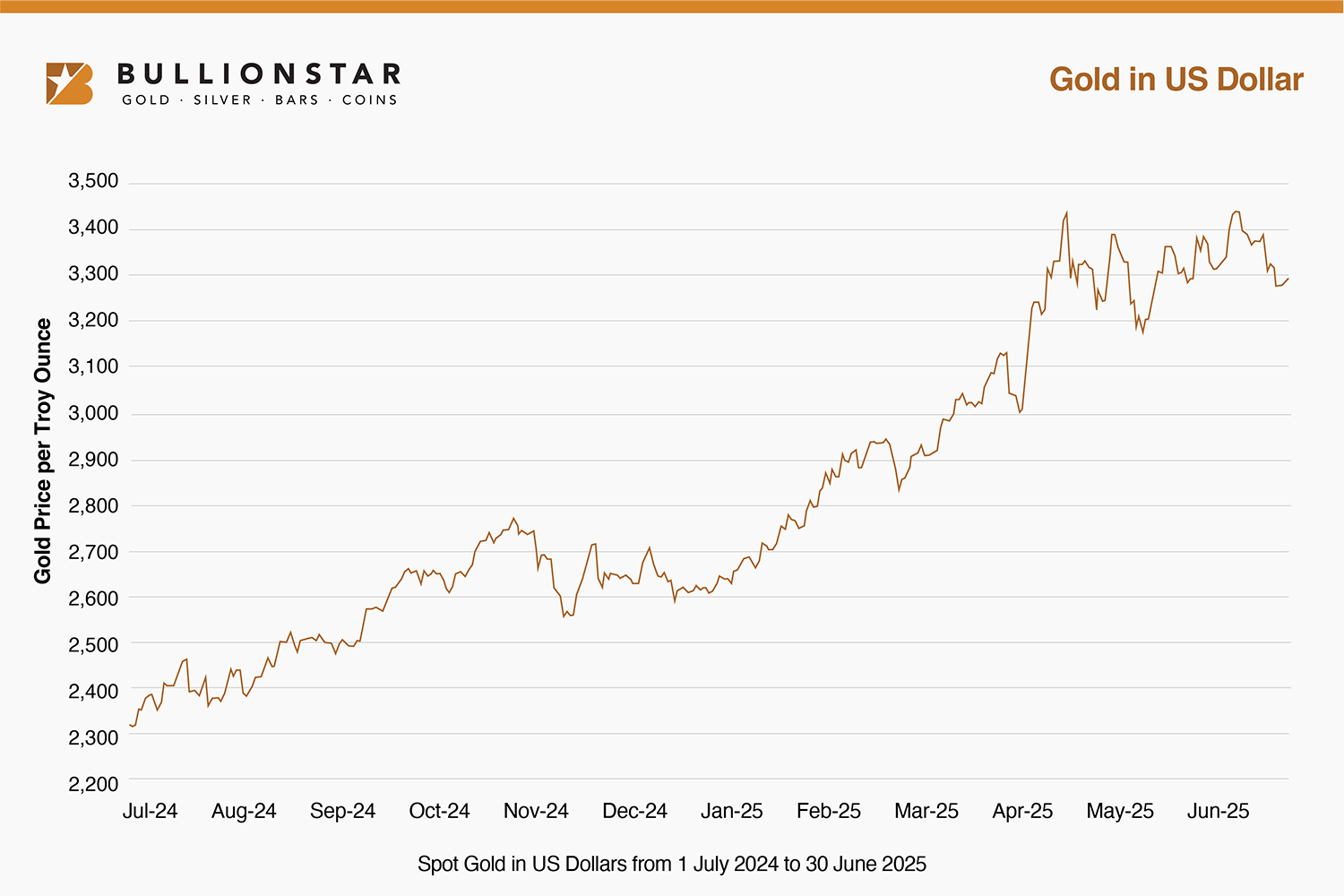

Gold Worth

- Spot Gold: Closed FY 2025 at USD 3,289/oz (June 30, 2025), up from USD 2,329/oz on July 1, 2024 – a 41.3% achieve.

- The final fiscal 12 months skilled an incredible rally in gold costs, with gold hitting 44 new all-time highs.

Silver Worth

- Spot Silver: Closed FY 2025 at USD 35.97/oz (June 30, 2025), up from USD 29.28/oz on July 1, 2024 – a 22.8% achieve.

- In June 2025, silver surged above USD 35/oz and broke by means of a 13-year resistance zone.

- Silver rallied by 9% within the month of June, fuelled by insatiable investor demand and provide shortages.

Document Demand at BullionStar as Clients Flocked to Protected-Haven Property

In April 2025, demand for treasured metals surged following Trump’s tariff bulletins. Income in April greater than doubled in comparison with the prior 12 months and set a report at BullionStar.

Vital buyer demand led to a buy-to-sell ratio above 2:1 for the month – which means prospects have been shopping for greater than double the worth of bullion in comparison with what they have been promoting. Our Bullion Middle in Singapore skilled prospects queuing exterior, desirous to load up on bodily treasured metals.

Valuable Metals Rally on the Again of Trump’s Liberation Day, Central Financial institution Demand, and ETF Flows

On April 2, 2025, United States President Donald Trump introduced a broad vary of tariffs to deal with the commerce deficit and rising debt ranges. The announcement despatched shockwaves by means of world markets, with the S&P 500 dropping 12% within the week following the announcement. Tariff uncertainty fuelled demand for treasured metals as traders sought safe-haven belongings and tried to handle publicity to the US greenback.

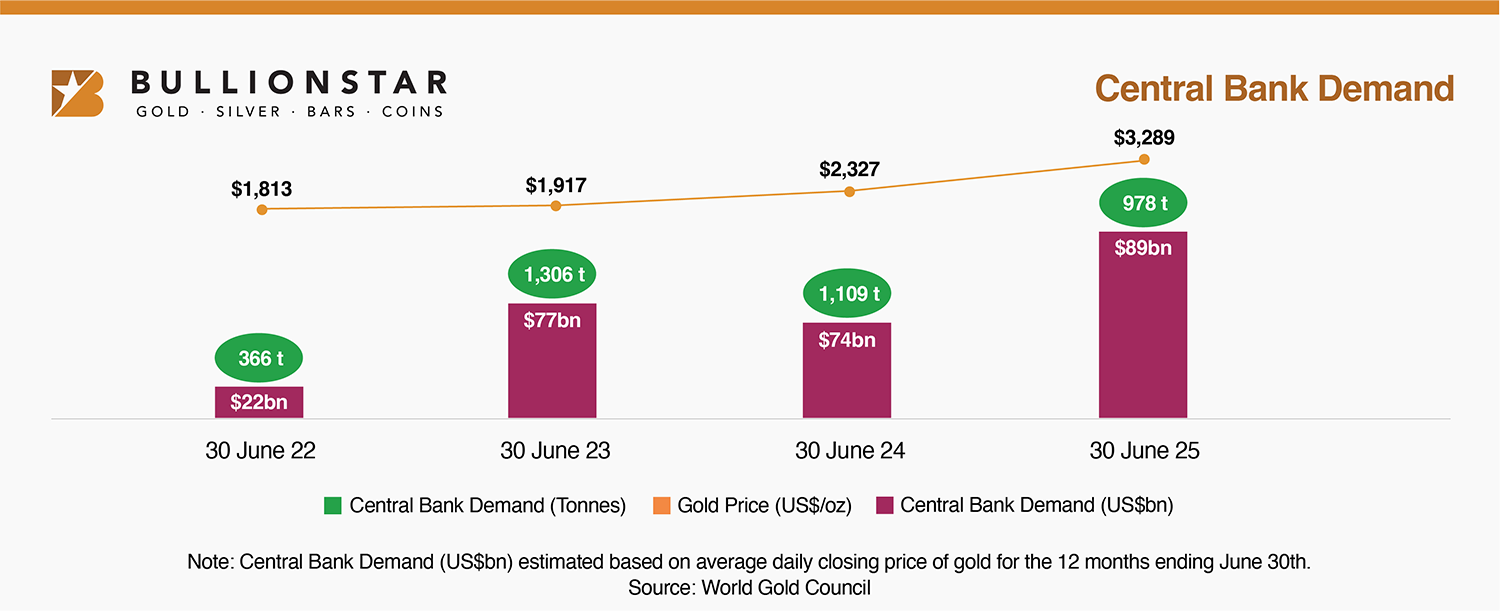

In FY 2025, central banks continued to build up gold at a fast tempo. The estimated US greenback worth of gold bought by central banks elevated roughly 20% within the 12 months ending June 30, 2025. This improve builds on near-record purchases within the prior two years. Nonetheless, as a result of greater gold costs, the tonnes bought declined in comparison with FY 2023 and FY 2024. Regardless of the record-high gold costs, central financial institution demand stays sturdy.

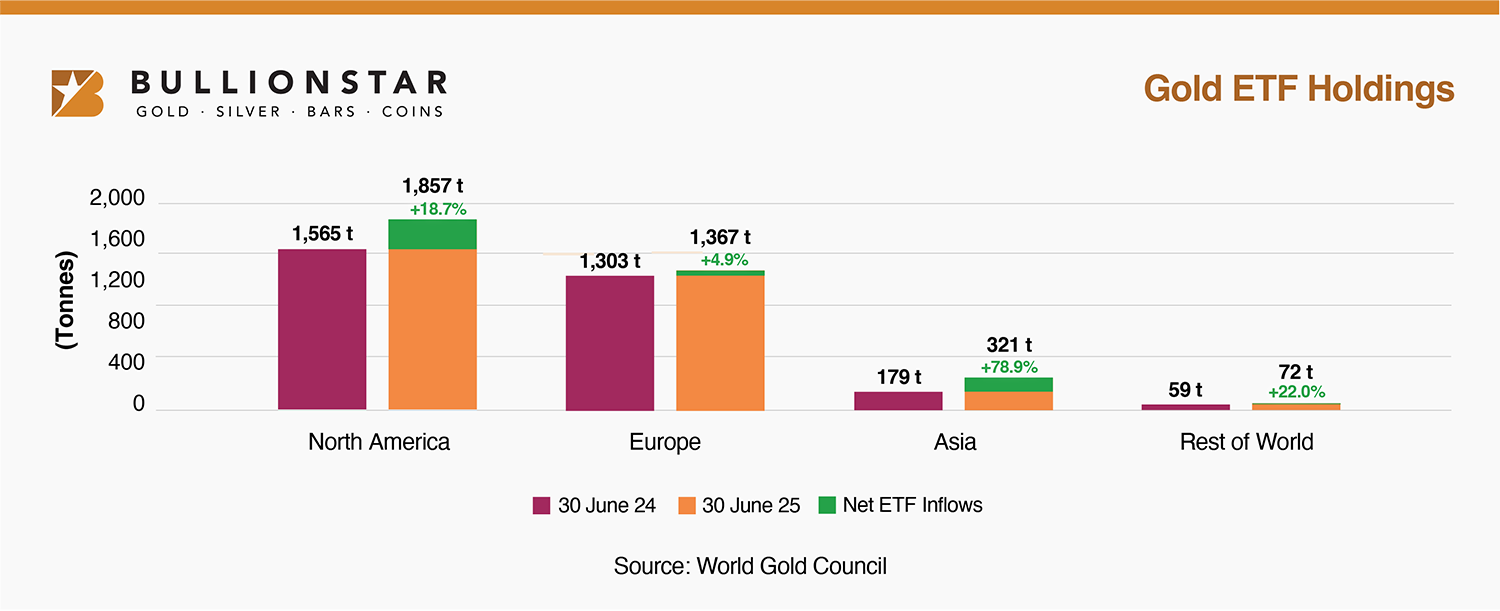

Gold ETFs skilled an acceleration of inflows in FY 2025. Gold ETF holdings elevated by over 500 tonnes, representing a 16% improve within the 12 months ending June 30, 2025. North America and Asia have been the biggest contributors, rising by ~290 tonnes (+19%) and ~140 tonnes (+79%), respectively.

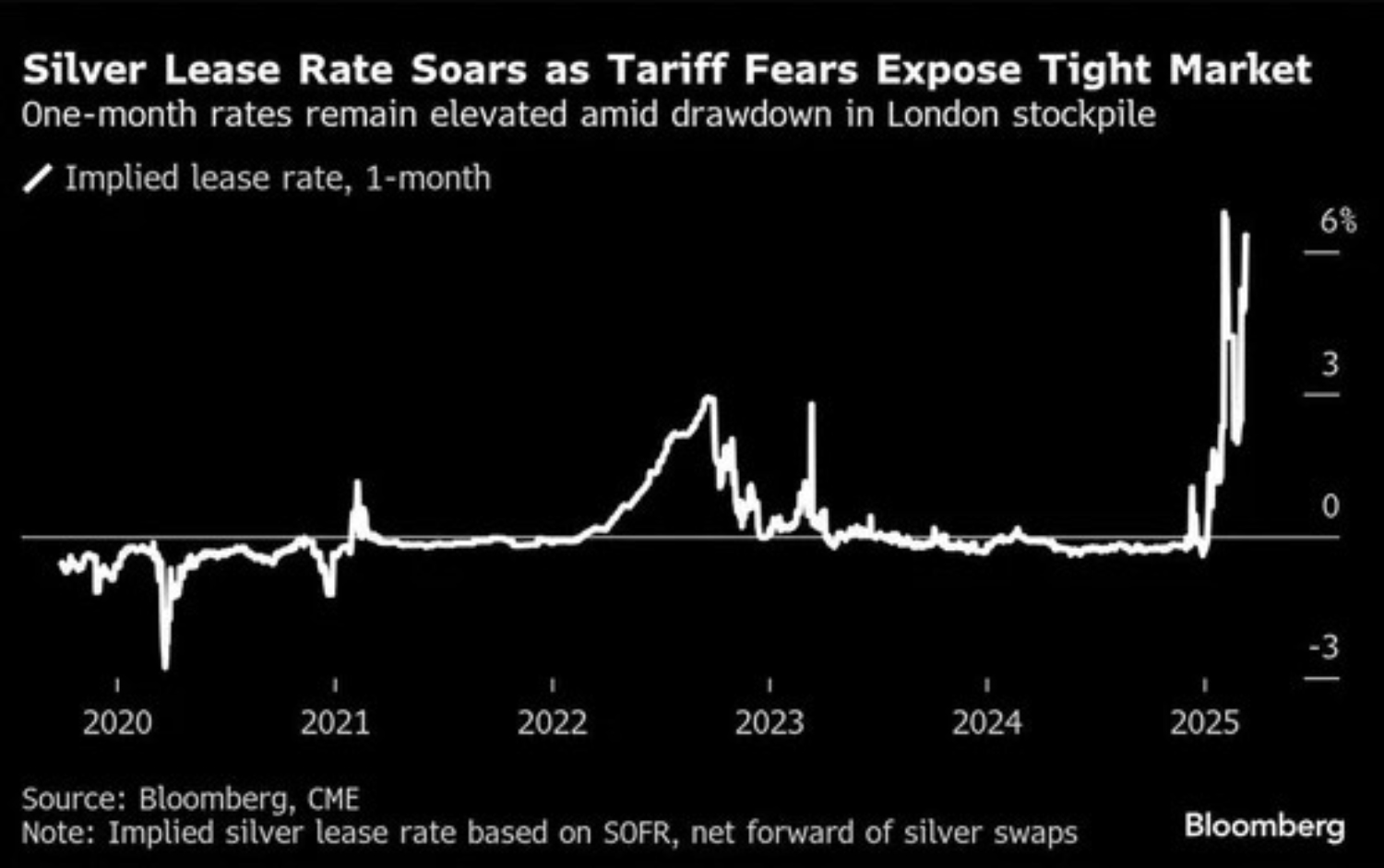

In early 2025, the market skilled important bodily provide shortages, particularly for silver. The implied 1-month silver lease charge in Q1 and Q2 2025 spiked to 4–6% in comparison with its typical charge of some foundation factors.

Which Months Noticed the Most Shopping for Exercise at BullionStar?

April 2025 and June 2025 skilled a surge in exercise.

April 2025:

7,659 purchase orders, pushed by the announcement of Trump’s liberation day tariffs, which accelerated investor demand for bodily treasured metals.

June 2025:

5,738 purchase orders have been positioned, spurred by a structural breakout of silver costs above USD 35/oz, a 13-year resistance zone.

BullionStar Financials FY 2025 – Yr in Overview – Gross sales

Whole Gross sales Income: SGD 761.1 million

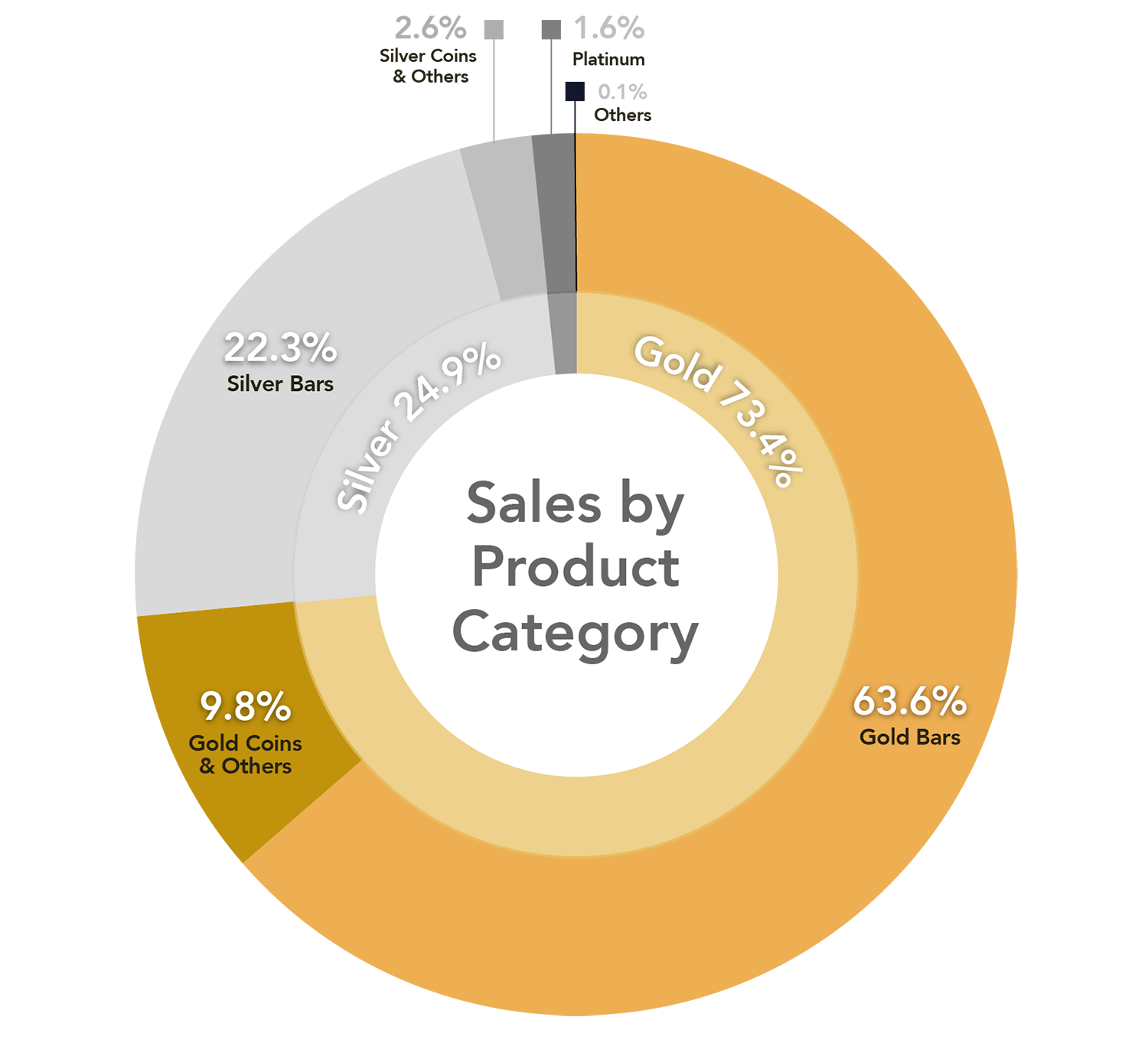

Gross sales per Product Class

- Gold: 73.4%

- Silver: 24.9%

- Platinum & Different: 1.7%

In FY 2024, 68% of gross sales have been gold and 30% have been silver. In FY 2025, there was a noticeable improve in gold gross sales.

Gold Merchandise:

- Gold Bars: 86.6%

- Gold Cash: 13.1%

- Others (Numismatics, Jewelry, and so on.): 0.3%

Inside Gold Bars:

- 100g gold bars: 59.4%

- LBMA Good Supply gold bars and 1kg gold bars: 27.8%

- Different sizes and merchandise: 12.8%

Inside Gold Cash:

- Canadian Gold Maple: 37.7%

- UK Gold Britannia: 21.2%

- Different merchandise: 41.1%

Silver Merchandise:

- Silver Bars: 89.4%

- Silver Cash and Rounds: 10.5%

- Others (Numismatics, and so on.): 0.1%

Inside Silver Bars:

- 1kg silver bars: 77.9%

- LBMA Good Supply silver bars: 9.7%

- Different sizes: 12.4%

Inside Silver Cash:

- Canadian Silver Maple: 16.7%

- UK Silver Britannia: 14.2%

- Different merchandise: 69.1%

Buyer Orders

- Purchase Orders: 55,686 (up 44.6% from FY 2024)

- Common Order Measurement: SGD 13,873 (up 26.2% from FY 2024)

- Median Order Measurement: SGD 1,469 (up 46.7% from FY 2024)

As a world bullion vendor, BullionStar recorded gross sales to prospects in 115 international locations throughout FY 2025. Since our launch in 2012, we’ve got served prospects in 145 international locations.

Web site Visitors

- BullionStar.com Visits: 5,283,570 (up 42.7% from FY 2024), reflecting elevated client curiosity in BullionStar and treasured metals.