by admin | Oct 1, 2025 | Gold

Spot silver soared above $46.00, lately touching the $45 an oz stage in late September. The highly effective and enduring rally in valuable metals this yr has lifted silver as a lot as 55% in 2025, outpacing the 43% achieve in gold. The push to recent highs in silver...

by admin | Sep 30, 2025 | Gold

Peter Schiff presents the SchiffGold Friday market wrap, the place he delves into the numerous actions within the treasured metals market, significantly gold and silver. Emphasizing the significance of well timed investments, Schiff highlights the dramatic worth will...

by admin | Sep 29, 2025 | Gold

Every day Information Nuggets | Immediately’s prime tales for gold and silver traders September twenty fourth, 2025 Gold Pauses After File Highs Gold eased to $3,762–$3,767/oz this morning, pulling again from Tuesday’s all-time excessive of $3,790....

by admin | Sep 29, 2025 | Gold

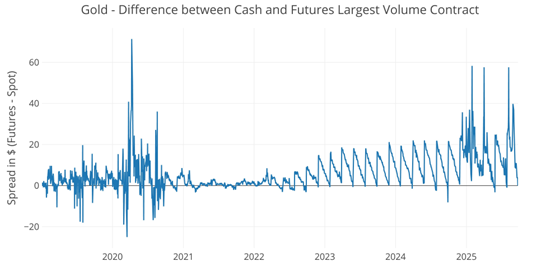

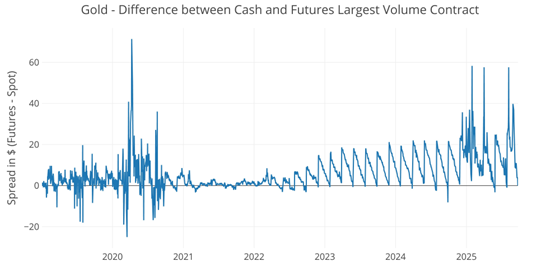

The CME Comex is the Trade the place futures are traded for gold, silver, and different commodities. The CME additionally permits futures consumers to show their contracts into bodily steel via supply. You could find extra element on the CME right here (e.g., vault...

by admin | Sep 28, 2025 | Gold

You’ve in all probability heard Mike Maloney point out the greenback milkshake idea not too long ago — and for good cause. This vivid metaphor captures probably the most vital dynamics in world finance right this moment. Image the U.S. greenback as an enormous straw,...

by admin | Sep 28, 2025 | Gold

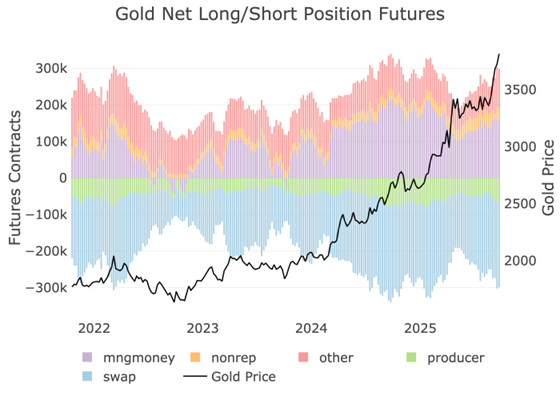

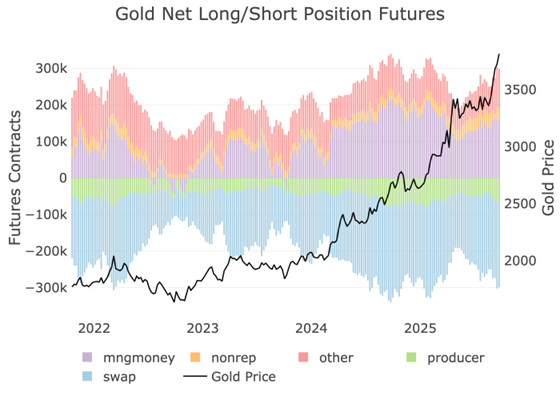

Please be aware: the CoTs report was revealed 9/26/2025 for the interval ending 9/23/2025. “Managed Cash” and “Hedge Funds” are used interchangeably. The Dedication of Merchants report is a weekly publication that exhibits the breakdown of possession within the...