by admin | Dec 6, 2025 | Gold

The 1936-S Bay Bridge Silver Half Greenback is without doubt one of the most beloved basic commemoratives in U.S. coinage. With its daring design, regional satisfaction, and restricted manufacturing, it captures a second in California historical past when the West was...

by admin | Dec 6, 2025 | Gold

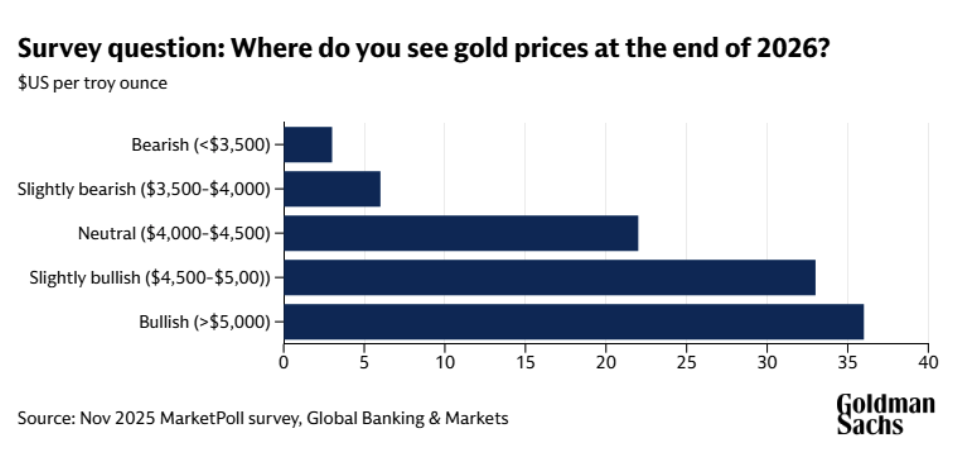

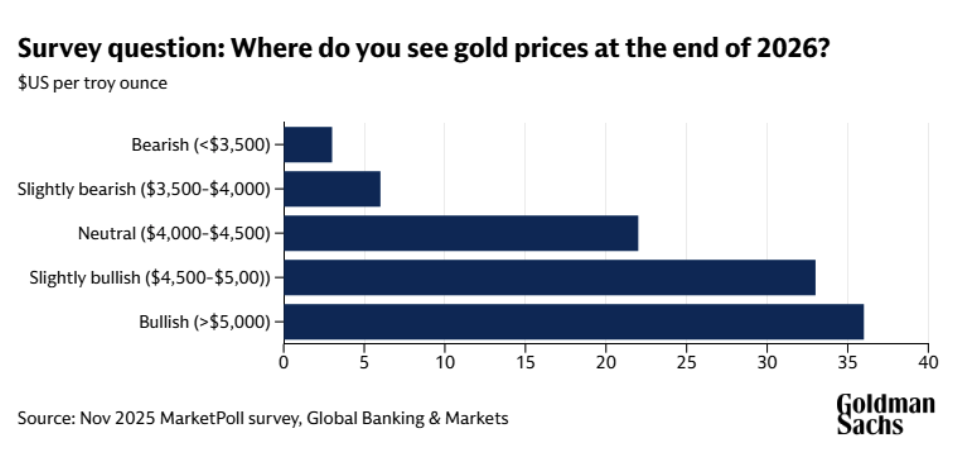

Gold costs have surged to document highs this yr, pushed by highly effective macro forces reshaping the market. As buyers seek for a dependable gold value prediction 2026, one sign is rising above the noise: institutional buyers overwhelmingly count on gold to proceed...

by admin | Dec 5, 2025 | Gold

Gold climbed and shares slumped as personal ADP jobs report revealed accelerating job losses, a confidence survey confirmed a downturn in sentiment and new retail gross sales knowledge disenchanted. Gold hit a 10-day excessive following the information and shares...

by admin | Dec 5, 2025 | Gold

Each day Information Nuggets | At present’s high tales for gold and silver traders December 4th, 2025 Silver Takes a Breather After Historic Run Silver pulled again from its all-time excessive of $58.98, up 100% year-to-date, as merchants locked in income following...

by admin | Dec 4, 2025 | Gold

Most traders don’t lose cash as a result of they picked the flawed inventory or timed the market poorly. They lose cash as a result of they by no means discovered how to decide on investments within the first place. This yr was outlined by volatility, political...

by admin | Dec 2, 2025 | Gold

Day by day Information Nuggets | Right this moment’s prime tales for gold and silver traders December 2nd, 2025 Copper Joins Gold and Silver at File Highs For the primary time in a long time, copper, gold, and silver are all hitting file territory without...