by admin | Nov 2, 2025 | Gold

There’s a revolution taking place in Wall Road’s steering to traders on find out how to construction their portfolios—and it includes gold. Longstanding traditions are being upended because the U.S. Treasury bond market is dropping favor as a secure haven. As an...

by admin | Nov 1, 2025 | Gold

Day by day Information Nuggets | As we speak’s prime tales for gold and silver traders October 30th, 2025 Trump and Xi Name Timeout on Commerce Struggle After months of escalating tariffs and export controls, Presidents Trump and Xi Jinping met in South Korea and...

by admin | Nov 1, 2025 | Gold

Veteran investor and creator Jim Rogers joined BullionStar’s Claudia Merkert for a wide-ranging dialog discussing record-breaking bullion demand, Asia’s financial ascent, and the enduring position of gold and silver in instances of uncertainty. Talking candidly,...

by admin | Nov 1, 2025 | Gold

A coin born of mud, distance, and shortage Within the late summer time of 1849, the Nice Salt Lake Valley was hungry for a medium of change that wasn’t barked bargains or paper promissories. Mormon Battalion veterans and prospectors had introduced residence glitter...

by admin | Oct 31, 2025 | Gold

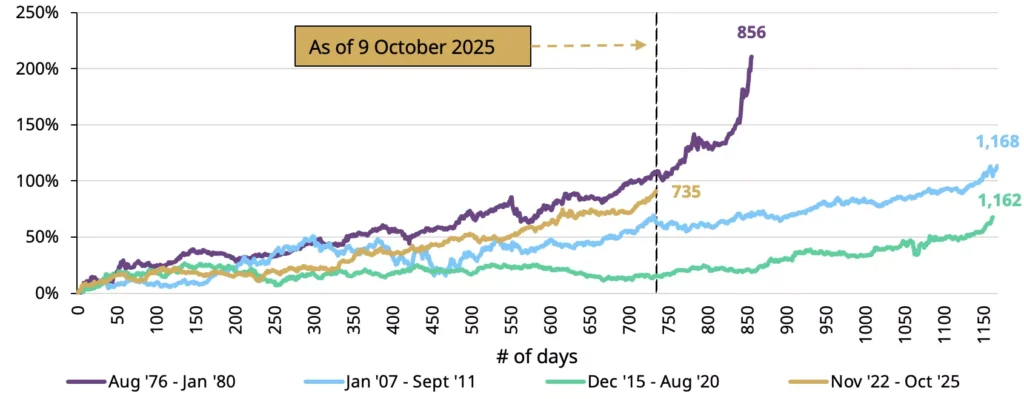

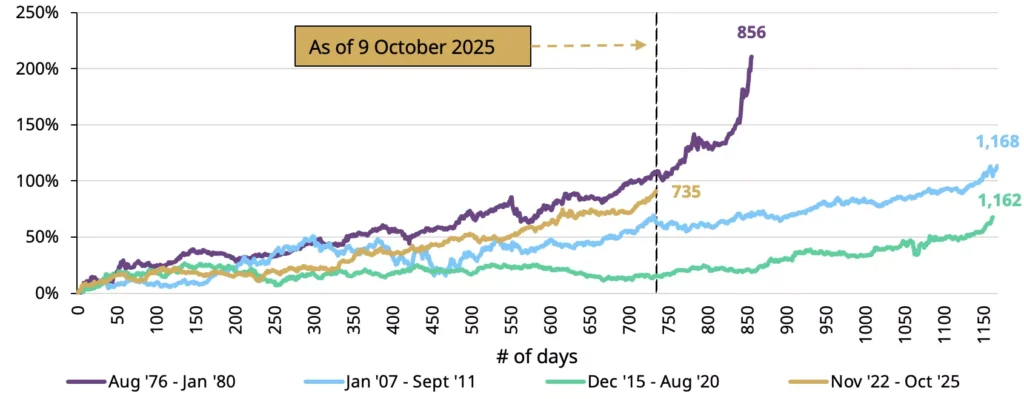

The place We Are within the Cycle In the event you’re questioning whether or not gold’s current all-time highs imply you’ve missed the rally, historical past presents a reassuring reply: gold bull markets are inclined to final far longer than most traders count on....

by admin | Oct 30, 2025 | Gold

Fed Cuts Curiosity Charge in Information DroughtIdentical to a pilot flying a airplane by means of a blizzard in white-out situations, the Federal Reserve is making rate of interest choices blindfolded. Fed officers lack contemporary financial knowledge, due to the...