Please be aware: the CoTs report was revealed 9/26/2025 for the interval ending 9/23/2025. “Managed Cash” and “Hedge Funds” are used interchangeably.

The Dedication of Merchants report is a weekly publication that exhibits the breakdown of possession within the Futures market. For each contract, there’s a lengthy and a brief, so the web positioning will at all times be zero, however the report exhibits who’s positioned lengthy or quick. Traditionally, Hedge Funds (Managed Cash) dominate the worth motion in each Gold and Silver.

Gold

Present Developments

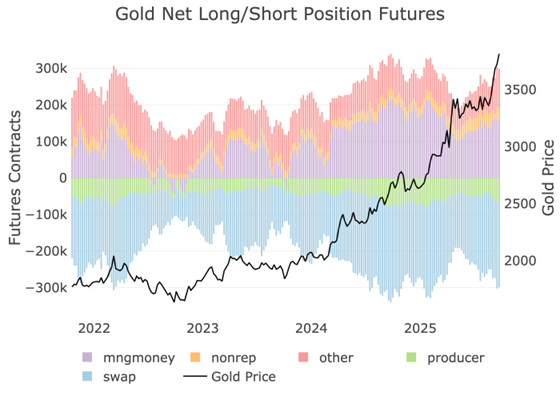

Under exhibits web positioning for the 5 primary teams of futures holders. Internet positioning reached multi-year highs final September and has not but reached that peak but. Whereas open curiosity is on the upper facet, it’s not but on the acute facet.

Determine: 1 Internet Place by Holder

Managed Cash has been in full management of the worth motion for years, driving the spikes in each instructions. The general upward pattern is past the management of Managed Cash however the short-term strikes are very a lot tied to the motion of Managed Cash.

That has modified in 2025 because the Managed Cash group has solely added modestly to their positions as the worth has soared greater. The most recent up-move noticed Managed Cash keep almost flat positioning. In actual fact, whole contracts are barely down whereas gold has climbed $300 within the final 4 weeks.

Determine: 2 Managed Cash Internet Place

Weekly Exercise

Managed Cash has been auspiciously quiet during the last a number of weeks.

Determine: 3

The exercise within the choices market has picked up from the lows in 2023, however it’s nonetheless beneath the current peak in 2020.

Determine: 4 Choices Positions

Silver

Present Developments

Silver had been extremely correlated to the motion in managed cash, however has diverged within the current explosive transfer up.

Determine: 5 Internet Place by Holder

Managed Cash was behind the preliminary transfer up in August. Nevertheless, just like gold, managed cash is not behind the most recent transfer.

Determine: 6 Managed Cash Internet Place

Weekly Exercise

Once more, just like gold, exercise the previous few weeks have been extremely muted.

Determine: 7 Internet Change in Positioning

The choices market is a distinct story nonetheless. There may be clearly one thing happening right here. It’s too early to inform, however somebody is making outsized positions within the choices market.

Determine: 8 Choices Positions

Conclusion

The desk beneath captures what was defined above: in 2025, Managed Cash has been driving each the gold and silver marketplace for years. That has damaged down this 12 months. The final time that occurred was in 2020 when gold had the explosive up-move in Covid adopted by a serious consolidation interval. It’s doable that Managed Cash is sitting on the sidelines ready for his or her time to pounce and quick the present rally.

No matter what might occur sooner or later. This present rally just isn’t being pushed by Managed Cash. This isn’t the norm. So, both:

- One thing has modified available in the market, which could be seen within the Comex market (see earlier article)

- The market has gotten uncontrolled and Managed Cash is biding their time to carry costs again in-line

Primarily based on all of the knowledge, the market doesn’t appear uncontrolled. Each metals face two main milestones within the close to future ($4,000 gold and $50 silver). It’s seemingly we are going to get a solution earlier than later. The info says there’s not a lot to be apprehensive about, however that’s undoubtedly no assure. Keep in your toes.

Determine: 9 Correlation Desk

Name 1-888-GOLD-160 and converse with a Valuable Metals Specialist at present!