The actual property market is liable for wherever from 20% to over 30% of China’s GDP (relying on who you ask). And with the most recent meltdown that started with the implosion of Evergrande, the state of affairs simply retains getting worse, inspiring a slew of presidency interventions past the scope of what could be attainable in a rustic just like the US.

It’s a take a look at of China’s authority, and its means to micromanage what was mismanaged from the beginning. With China’s actual property shares down 20% since Might can the CCP, in all its centralized energy, stop a full meltdown?

China could achieve kicking the can down the street, nevertheless it can’t save the true property market — or economic system — in the long run. Both approach, historical past signifies that the present drawdown seemingly nonetheless has a great distance down to go.

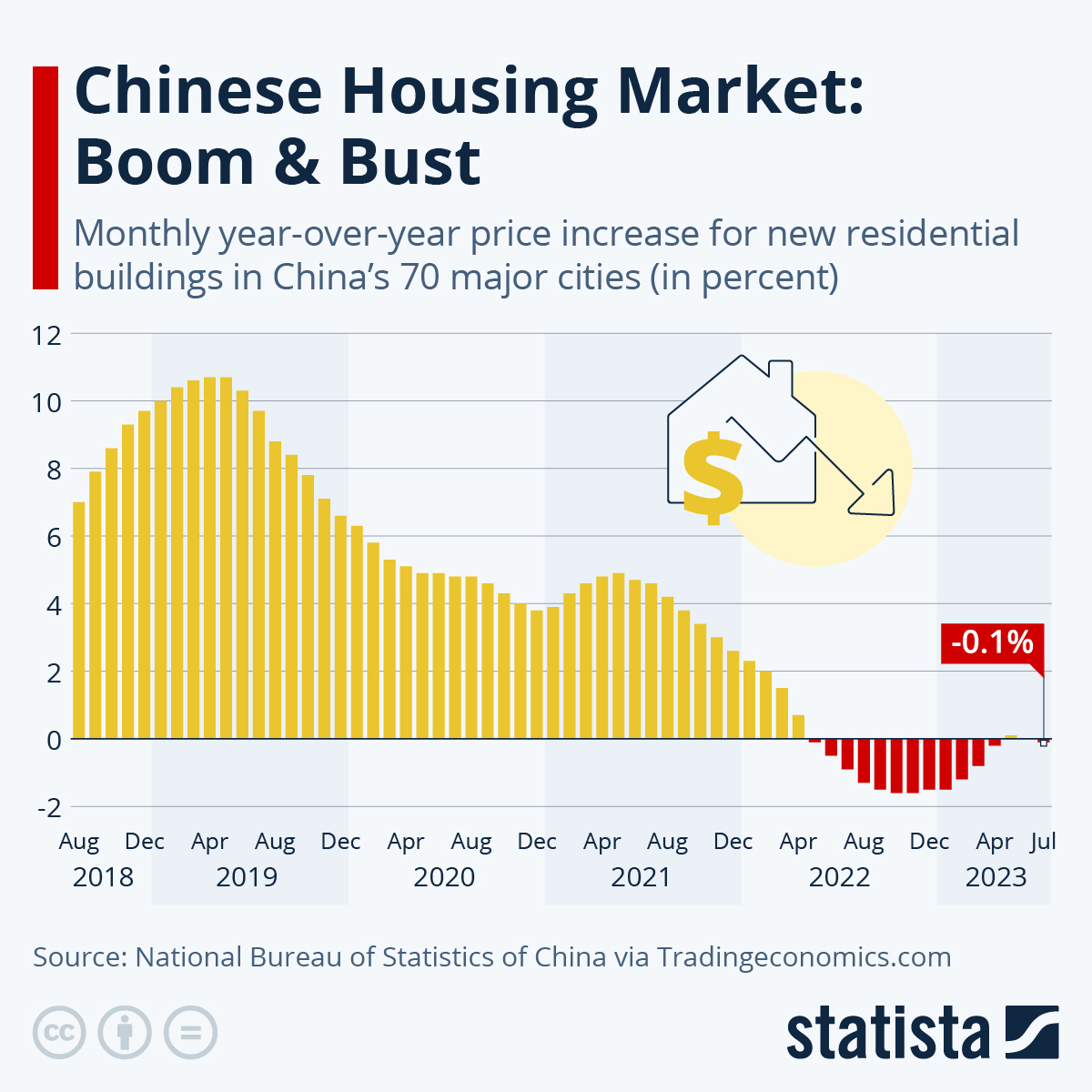

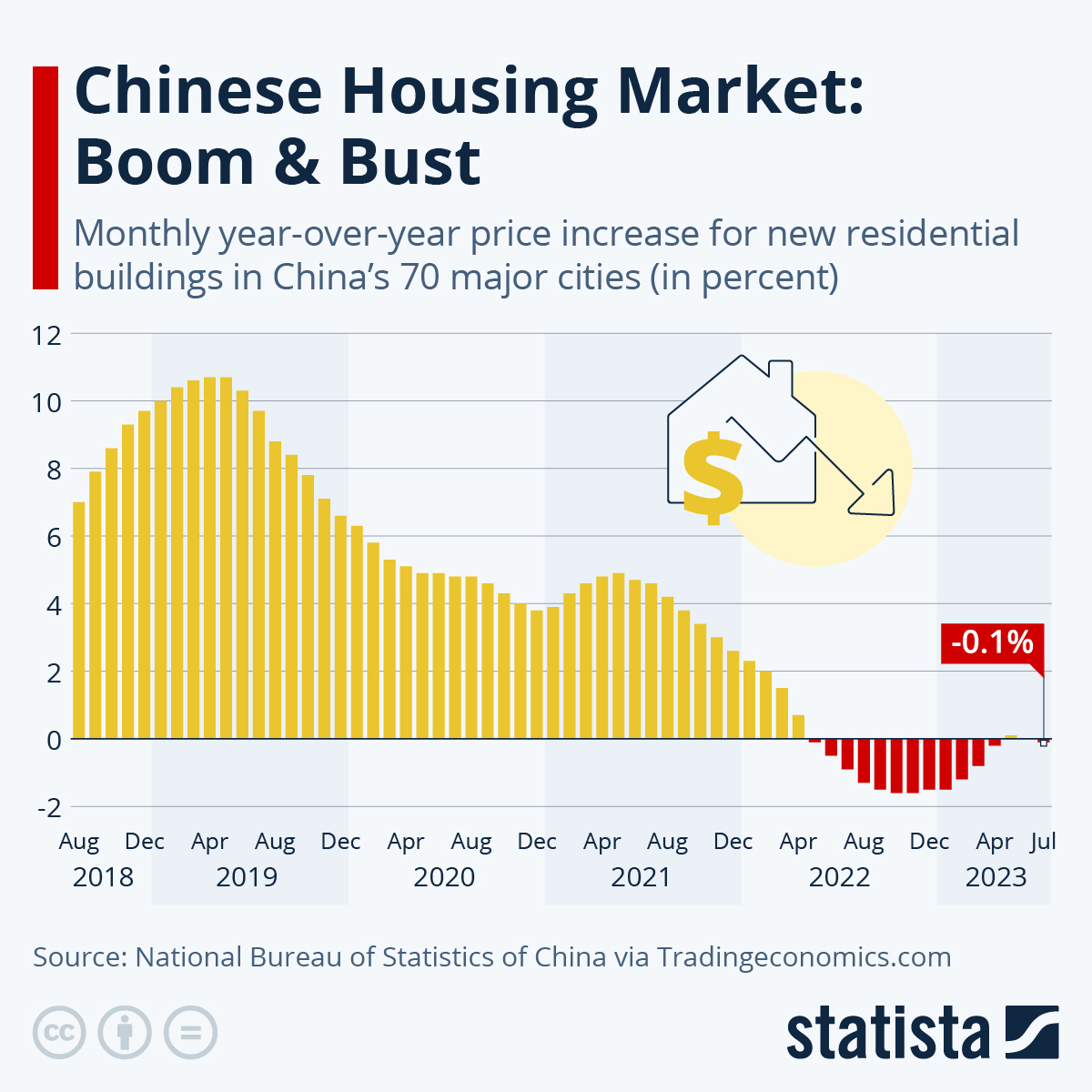

This chart exhibits a run-up to the present route, not lengthy earlier than the liquidation calls started for Evergrande and Nation Backyard and set the most recent RE spiral into movement:

You will see extra infographics at Statista

You will see extra infographics at Statista

The Individuals’s Financial institution of China can immediately inject liquidity right into a struggling sector. However state-owned firms additionally get to purchase properties at government-set costs. The state and central financial institution can even change mortgage charges and fee necessities immediately, in contrast to within the US the place banks react to the federal funds charge set by the Fed. China can also be loosening normal restrictions on who’s allowed to purchase a house, hoping to juice the market and cut back vacancies, however there’s a possible catch-22 inherent to all such historic-level interventions:

In the event that they stoke issues amongst customers and buyers that the disaster is one thing to be deeply fearful about, this could gas a self-fulfilling suggestions loop that worsens investor confidence even additional.

In the meantime, house patrons who match the beforehand stringent standards for purchasing properties really feel duped now that these restrictions have been eased, devaluing their social standing and the work they put into the home-buying course of. With many complexes now having their unsold buildings became public housing, residents who saved up their complete lives to develop into householders in these areas are changing into enraged to find that their complexes will now be sponsored. Not solely does that imply they paid an excessive amount of, however their house’s attractiveness as a longer-term funding might drop.

In line with Goldman Sachs, the present interventions nonetheless aren’t sufficient. A current report requires extra liquidity to the tune of $276 billion (¥2 trillion yuan) to stabilize housing in main mainland cities, with ¥20 trillion yuan price of actual property in want of a savior.

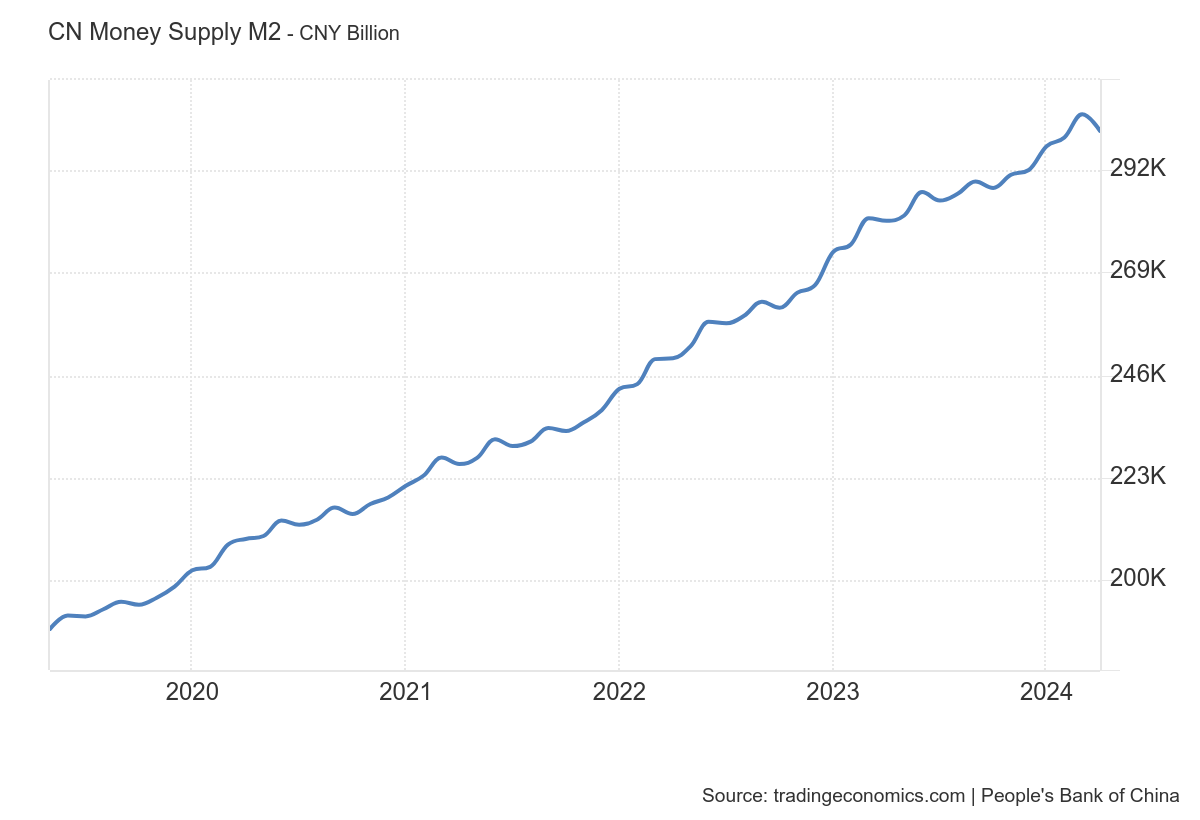

This liquidity could be meant to cease costs from persevering with to plummet and permit over-indebted builders to pay again loans and curiosity. However in a market in want of such an intervention, even as soon as costs cease plummeting, many develop into rightfully hesitant to develop into patrons. The under chart of China’s M2 cash provide exhibits a dip in April 2024. Will probably be attention-grabbing to take one other take care of China’s intervention floods the economic system with $500 billion yuan price of relending packages.

To make issues worse in the long term, declining birthrate and an getting old inhabitants each point out that demand shouldn’t be going to decide again up sufficient to fill the residences and homes constructed throughout China’s decades-long urbanization frenzy. This is a generational drawback that goes past a single crash, liquidation, or chapter — and can’t be correctly fastened with centralized market interventions. Past that, even individuals of their prime home-buying age are extra fearful about future earnings than they used to be, with out the feverish demand for city properties that characterised a lot of China’s rise to a worldwide financial energy.

In a free market, nature determines the winners and losers. However in a command-and-control economic system, the State will get to determine. And when the interventions openly defy financial actuality, as central banks at all times do, everybody finally ends up dropping ultimately. That’s, aside from the central financial institution, the federal government, and their most well-liked cronies, who would be the ones who get the free cash and the bailouts when all of it comes crashing down.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist at present!